A personal investment plan is a strategic approach to managing and growing one's financial assets. It involves creating a tailored strategy that aligns with an individual's financial goals, risk tolerance, and time horizon. This plan typically includes setting clear objectives, such as saving for retirement, purchasing a home, or funding a child's education. The process involves assessing one's current financial situation, including income, expenses, and existing investments. From there, a plan is developed to allocate assets across various investment vehicles, such as stocks, bonds, mutual funds, or real estate, based on the individual's risk profile and goals. Regular reviews and adjustments are made to ensure the plan remains on track, allowing for the optimization of returns while managing risk effectively. Understanding how a personal investment plan works is essential for anyone looking to make informed decisions about their financial future.

What You'll Learn

- Investment Goals: Define short-term and long-term financial objectives

- Risk Tolerance: Assess comfort with risk and potential losses

- Asset Allocation: Diversify investments across asset classes

- Time Horizon: Consider investment duration and liquidity needs

- Regular Review: Monitor and adjust plan as needed

Investment Goals: Define short-term and long-term financial objectives

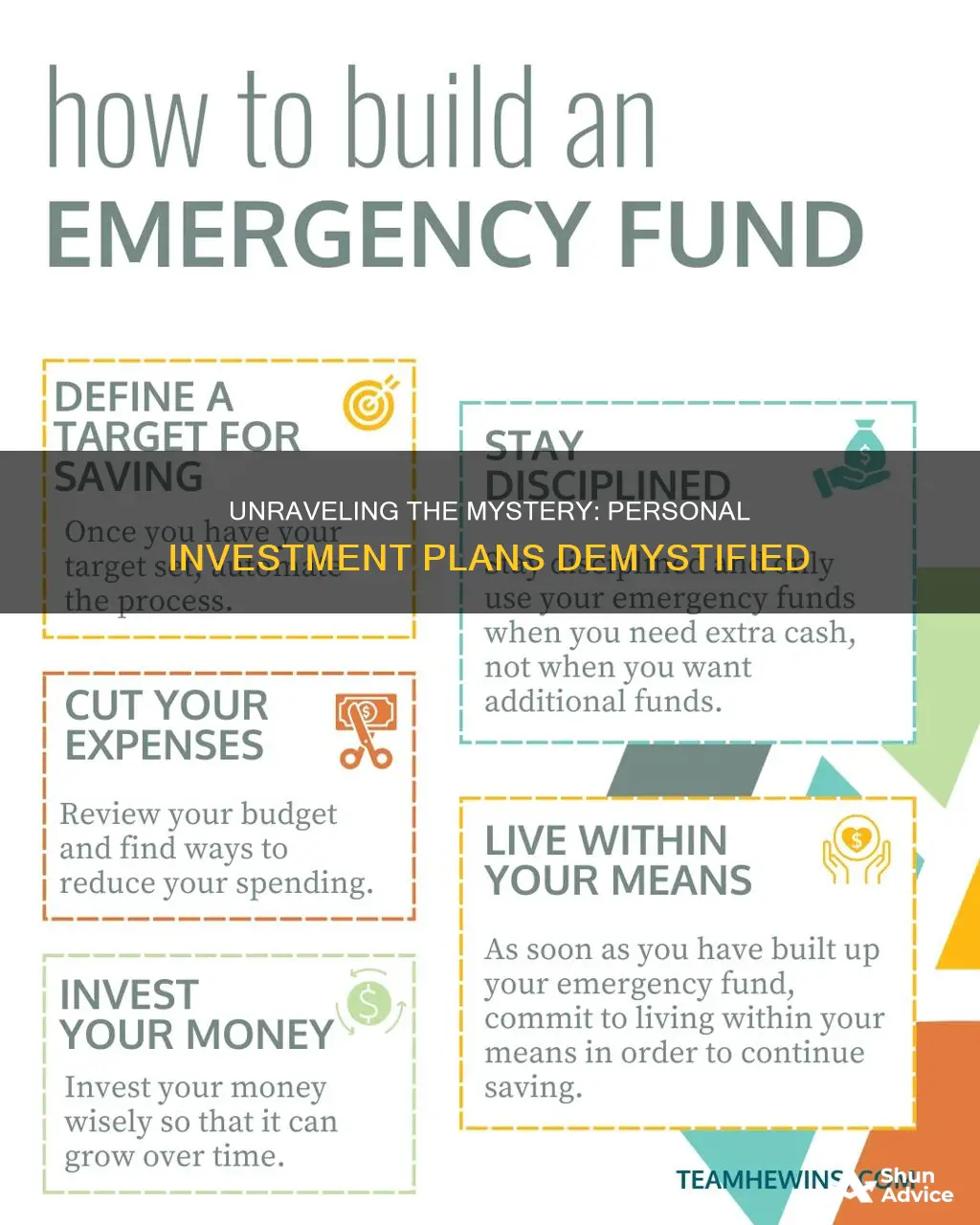

When creating a personal investment plan, it's crucial to define your financial objectives, which can be categorized into short-term and long-term goals. Short-term goals are typically those that you aim to achieve within a few years or less. These objectives are often more immediate and may include building an emergency fund, saving for a down payment on a house, or funding a child's education. For instance, if you're saving for a house deposit, you might aim to have a substantial amount set aside within the next 18 months to two years. Short-term goals are essential as they provide a safety net and help you stay on track with your financial plans.

Long-term financial objectives, on the other hand, are those that require a more extended period to achieve and often involve significant milestones. This could include retirement planning, where you aim to accumulate a substantial nest egg over several decades to ensure financial security in your later years. Another example is investing in a child's education fund, where you plan to save and invest over a long period to ensure they have the financial means for higher education. Long-term goals are more complex and often require a well-diversified investment strategy to manage risk and maximize returns over an extended period.

Defining these investment goals is a critical step in creating a personalized investment plan. It allows you to tailor your strategy to your specific needs and aspirations. For short-term goals, you might opt for more conservative investment options like high-yield savings accounts or short-term bonds to ensure liquidity and minimize risk. In contrast, long-term goals may involve a mix of stocks, bonds, and other assets, with a focus on growth and capital appreciation.

To achieve these objectives, it's essential to regularly review and adjust your investment plan. Life events, such as a change in income, marriage, or the birth of a child, can impact your financial goals. For instance, a new job with a higher salary might allow you to accelerate savings for a house, while a marriage could prompt a reevaluation of your long-term retirement plans. Regularly assessing your progress and making necessary adjustments will help you stay on course and ensure your investment strategy remains aligned with your evolving financial objectives.

In summary, defining short-term and long-term financial objectives is a fundamental aspect of creating a personal investment plan. It enables you to make informed decisions about asset allocation, risk management, and strategy implementation. By regularly reviewing and adapting your plan, you can navigate life's financial challenges and opportunities, ensuring that your investments work towards your desired goals.

Investment Advisor: Helping People Navigate Finances

You may want to see also

Risk Tolerance: Assess comfort with risk and potential losses

When creating a personal investment plan, understanding your risk tolerance is crucial. It involves assessing your comfort level with the potential risks and losses associated with different investment options. Here's a step-by-step guide to help you evaluate your risk tolerance:

- Evaluate Your Financial Goals and Time Horizon: Start by considering your short-term and long-term financial objectives. Are you saving for a house, retirement, or a child's education? The time you have to invest is also essential. Longer investment periods generally allow for more risk due to the potential for compounding returns. For instance, a young investor with a 20-year horizon might be more inclined to take on higher risks compared to someone planning for retirement in the next 5 years.

- Understand Risk Types: Risk tolerance is not just about the fear of losing money; it's about understanding the different types of risks. Market risk refers to the volatility of investment returns, while credit risk is the possibility of an issuer defaulting on debt obligations. Liquidity risk is the potential difficulty in converting an asset into cash without significant loss, and operational risk pertains to losses from poor or failed internal processes, people, and systems.

- Create a Risk Profile: Develop a risk profile that categorizes you as a conservative, moderate, or aggressive investor. Conservative investors prefer low-risk investments and are more sensitive to market fluctuations. Moderate investors aim for a balance between risk and reward, while aggressive investors seek higher returns and are willing to accept greater market volatility. You can use online risk assessment tools or work with a financial advisor to determine your risk profile.

- Diversify Your Portfolio: Diversification is a key strategy to manage risk. It involves spreading your investments across various asset classes, sectors, and geographic regions. By diversifying, you reduce the impact of any single investment's performance on your overall portfolio. For example, if you invest in a mix of stocks, bonds, real estate, and commodities, a decline in one area may be offset by gains in another.

- Regularly Review and Adjust: Risk tolerance is not static and can change over time. Life events, financial goals, and market conditions may influence your risk tolerance. It's essential to periodically review and adjust your investment plan. As you get closer to your financial goals, you might want to shift towards more conservative investments to preserve capital. Conversely, if you have a long investment horizon and can withstand short-term market fluctuations, you may opt for more aggressive strategies.

Assessing your risk tolerance is a critical step in creating a personalized investment plan that aligns with your financial goals and comfort level with risk. It enables you to make informed decisions and build a portfolio that suits your needs and preferences. Remember, a well-diversified portfolio, combined with a clear understanding of your risk tolerance, can help you navigate the investment journey with confidence.

Copper's Investment Appeal: A Guide to Buying and Profiting from this Metal

You may want to see also

Asset Allocation: Diversify investments across asset classes

Asset allocation is a fundamental concept in personal investment planning, and it involves distributing your investment portfolio across different asset classes to achieve a balanced and diversified approach. The primary goal is to optimize risk and return by carefully selecting and combining various investment options. Here's a detailed guide on how to approach asset allocation:

Understanding Asset Classes: Asset classes represent different categories of investments, each with its own characteristics and risk profiles. Common asset classes include stocks, bonds, cash, real estate, and commodities. Stocks, for instance, represent ownership in companies and offer the potential for high returns but also carry higher risk. Bonds provide a steady income stream and are generally considered less risky than stocks. Real estate and commodities, such as gold or oil, offer unique investment opportunities but may be more volatile.

Diversification Strategy: Diversification is the cornerstone of asset allocation. It involves spreading your investments across multiple asset classes to reduce the impact of any single investment's performance on your overall portfolio. By diversifying, you minimize the risk associated with individual asset classes and create a more stable investment environment. For example, if you invest solely in stocks, a downturn in the stock market could significantly affect your portfolio. However, by allocating a portion of your investments to bonds, real estate, or commodities, you create a safety net, ensuring that not all your eggs are in one basket.

Risk Assessment: Before constructing your asset allocation strategy, it's crucial to assess your risk tolerance and investment goals. Consider your financial situation, investment horizon, and the level of risk you are comfortable with. Younger investors with longer investment periods might opt for a more aggressive approach, allocating a larger portion of their portfolio to stocks. In contrast, older investors may prefer a more conservative strategy, favoring bonds and fixed-income securities. Regularly reviewing and adjusting your asset allocation based on changing circumstances is essential to stay aligned with your financial objectives.

Creating a Portfolio: When building your investment portfolio, start by setting specific percentages or dollar amounts for each asset class. For instance, you might decide to allocate 60% of your portfolio to stocks, 30% to bonds, and 10% to alternative investments like real estate or commodities. This allocation should be tailored to your risk tolerance and financial goals. It's important to remember that asset allocation is not a one-time decision but an ongoing process. Market conditions and personal circumstances change over time, requiring periodic adjustments to your portfolio.

Regular Review and Rebalancing: Asset allocation is a dynamic process that requires regular monitoring and adjustment. Market trends, economic shifts, and personal life events can impact your investment strategy. Periodically review your portfolio's performance and rebalance it to maintain your desired asset allocation. For example, if stocks have outperformed bonds, you might need to sell some stocks and buy more bonds to restore the original allocation. This process ensures that your portfolio remains aligned with your risk tolerance and investment objectives.

Investment Intentions: Unraveling the Impact on Asset Values

You may want to see also

Time Horizon: Consider investment duration and liquidity needs

When creating a personal investment plan, understanding the concept of time horizon is crucial. It refers to the length of time you are willing to commit your money to an investment strategy. This decision is closely tied to your financial goals and the level of risk you are comfortable with. A longer time horizon often allows for more aggressive investment strategies, as you have more time to weather market fluctuations and benefit from potential long-term growth. For instance, if you are saving for retirement, a 20-year horizon might be appropriate, as you can afford to take on more risk and potentially benefit from compound interest over a more extended period.

On the other hand, if you need to access your funds soon, a shorter time horizon is more suitable. This could be for short-term goals like a vacation or a down payment on a house. In these cases, you might opt for more conservative investments or even a savings account to ensure liquidity and minimize potential losses. The key is to balance the need for growth with the requirement for easy access to funds.

Assessing your time horizon involves considering both the length of your investment period and your liquidity needs. It's about understanding how long you can keep your money invested and how quickly you might need to access it. For example, if you have a 5-year goal for a new car, you might choose investments that offer moderate growth with relatively low risk, ensuring your funds are available when needed.

A longer time horizon often means you can take advantage of compound interest, where your earnings generate additional earnings, leading to exponential growth. This is particularly beneficial for long-term goals like retirement planning. However, it's essential to remember that longer-term investments also carry more risk, and market conditions can change over time.

In summary, the time horizon is a critical component of your personal investment plan, influencing the types of investments you make and the level of risk you assume. It's about finding the right balance between growth potential and the need for quick access to funds, ensuring your financial goals are met while managing risk effectively.

Investor Influx: Impacting Markets

You may want to see also

Regular Review: Monitor and adjust plan as needed

Regular reviews are an essential part of managing your personal investment plan effectively. This process involves monitoring your investments and making adjustments to ensure they align with your financial goals and risk tolerance. Here's a detailed guide on why and how to conduct these reviews:

Understanding the Need for Regular Review:

Regularly reviewing your investment plan is crucial for several reasons. Firstly, it allows you to stay informed about the performance of your investments. Markets and economic conditions are dynamic, and what was a suitable investment strategy yesterday might not be optimal today. By reviewing your plan regularly, you can identify any underperforming assets or strategies and take timely action. Secondly, life events and personal circumstances can change, impacting your financial goals. For instance, a new job, a marriage, or the birth of a child might alter your risk appetite and investment timeline. Regular reviews help you adapt your plan to these life changes. Lastly, market volatility can lead to unexpected fluctuations in investment values. A review process enables you to manage risk by rebalancing your portfolio to maintain your desired asset allocation.

Steps to Conduct a Regular Review:

- Set a Schedule: Determine a frequency that suits your needs, such as quarterly or annually. Consistency is key to effective monitoring.

- Gather Information: Collect relevant data, including investment performance reports, market trends, and any news or events that might impact your investments.

- Compare with Goals: Evaluate your investments against your original plan and financial objectives. Assess if your current asset allocation is still appropriate.

- Risk Assessment: Review your risk tolerance and the risk levels of your investments. Consider market volatility and any recent changes in your personal risk profile.

- Reallocation and Adjustments: Based on your review, make necessary changes to your investment strategy. This could involve rebalancing your portfolio by buying or selling assets to maintain your desired allocation.

- Tax Implications: Be mindful of tax consequences when making adjustments. Certain trades or reallocations might have tax implications, so consult a financial advisor if needed.

Benefits of Regular Monitoring:

- Early Detection of Issues: Regular reviews can help identify potential problems early on, allowing for prompt action to mitigate losses.

- Adaptability: By staying updated, you can adapt your investment strategy to changing market conditions and personal circumstances.

- Long-Term Success: Consistent monitoring ensures your investment plan remains aligned with your goals, increasing the likelihood of long-term success.

In summary, regular reviews are a critical component of personal investment management. They empower you to take control of your financial future by making informed decisions and adapting to various life and market scenarios. Remember, investing is a long-term journey, and staying vigilant through regular reviews will contribute to a more secure and prosperous financial future.

College: A Risky Bet?

You may want to see also

Frequently asked questions

A personal investment plan is a strategy or roadmap designed to help individuals manage and grow their money over time. It involves setting financial goals, assessing risk tolerance, and creating a tailored investment approach to achieve those goals.

Creating a personal investment plan involves several steps. First, define your financial objectives, such as saving for retirement, buying a house, or funding your child's education. Then, evaluate your current financial situation, including income, expenses, and existing savings. Next, determine your risk tolerance by considering your investment goals, time horizon, and ability to withstand market fluctuations. Finally, research and select investment options like stocks, bonds, mutual funds, or real estate, and consider working with a financial advisor to build a diversified portfolio aligned with your goals.

A well-structured personal investment plan offers numerous advantages. It provides a clear direction and helps individuals stay focused on their financial goals. By assessing risk tolerance, the plan ensures that investments are aligned with the individual's ability to handle potential losses. It also allows for diversification, reducing risk through a mix of asset classes. Regular review and adjustment of the plan can help individuals adapt to changing market conditions and life circumstances, ensuring their investments remain on track.

The frequency of reviewing and adjusting your investment plan depends on various factors. It is generally recommended to review your plan at least annually to assess progress, rebalance your portfolio if necessary, and make any required changes to stay on track. Life events, such as marriage, the birth of a child, or a significant career change, may also trigger a review to ensure your investments are still suitable for your current situation. Additionally, market conditions and economic trends should be monitored regularly to make informed decisions.

You can certainly take control of your investments and create a personal investment plan independently. Many online resources, educational materials, and investment platforms are available to guide you through the process. However, investing can be complex, and seeking professional advice from a financial advisor or investment manager can provide valuable insights and ensure your plan is tailored to your specific needs. They can offer guidance on tax strategies, risk management, and help you navigate market complexities.