Arrived investing is an innovative approach to investing that allows individuals to invest in real estate projects without directly purchasing property. This method involves investing in a fund or platform that identifies and acquires real estate assets, such as commercial buildings or residential properties, on behalf of investors. By pooling capital from multiple investors, these platforms can secure financing for real estate projects, offering an opportunity to diversify one's investment portfolio and gain exposure to the real estate market. This introduction sets the stage for a discussion on the mechanics and benefits of arrived investing.

What You'll Learn

- Understanding Arrived Investing: A simplified guide to investing in real estate without direct property ownership

- Platform Overview: How arrived.com facilitates investing in real estate projects

- Investment Process: Step-by-step guide to investing, from registration to project selection

- Risk and Rewards: Balancing potential returns with the risks of real estate investing

- Community and Support: Arrived's approach to providing investor education and community engagement

Understanding Arrived Investing: A simplified guide to investing in real estate without direct property ownership

Arrived investing is a relatively new concept in the world of real estate investment, offering an alternative way to participate in the real estate market without the need for direct property ownership. This innovative approach allows investors to gain exposure to the real estate market through fractional ownership of properties, making it an attractive option for those who want to diversify their portfolios or invest in real estate without the complexities and risks associated with traditional property ownership.

At its core, arrived investing involves breaking down a property into multiple shares or fractions, each representing a portion of the entire asset. These shares are then offered to investors, allowing them to own a part of the property. For example, a commercial building might be divided into 100 shares, with each share representing a 1% ownership stake. Investors can purchase one or more shares, effectively becoming partial owners of the property. This fractional ownership model enables individuals to invest in high-value real estate assets that might otherwise be out of reach due to their substantial cost.

The process typically begins with a real estate developer or an investment firm identifying a suitable property. They then engage with investors, offering them the opportunity to purchase shares in the property. Investors can choose to invest in a single property or diversify their portfolio by investing in multiple properties across different locations. This diversification is a key advantage, as it reduces the risk associated with any single property's performance.

One of the most significant benefits of arrived investing is the accessibility it provides. Traditional real estate investment often requires substantial capital and a deep understanding of the market, making it exclusive to a select few. Arrived investing democratizes this process, allowing a broader range of investors to participate. It also eliminates the need for investors to manage the property directly, as the investment firm or developer handles the day-to-day operations, maintenance, and management.

Investors can expect regular returns on their investment in the form of rental income or property appreciation. The investment firm typically handles the distribution of these returns to the shareholders. Additionally, arrived investing provides investors with an opportunity to gain exposure to the real estate market, which is known for its potential to generate steady, long-term returns. This approach offers a more liquid and flexible investment option compared to traditional real estate, where buying or selling properties can be a lengthy and complex process.

Kodak Stock: Buy or Pass?

You may want to see also

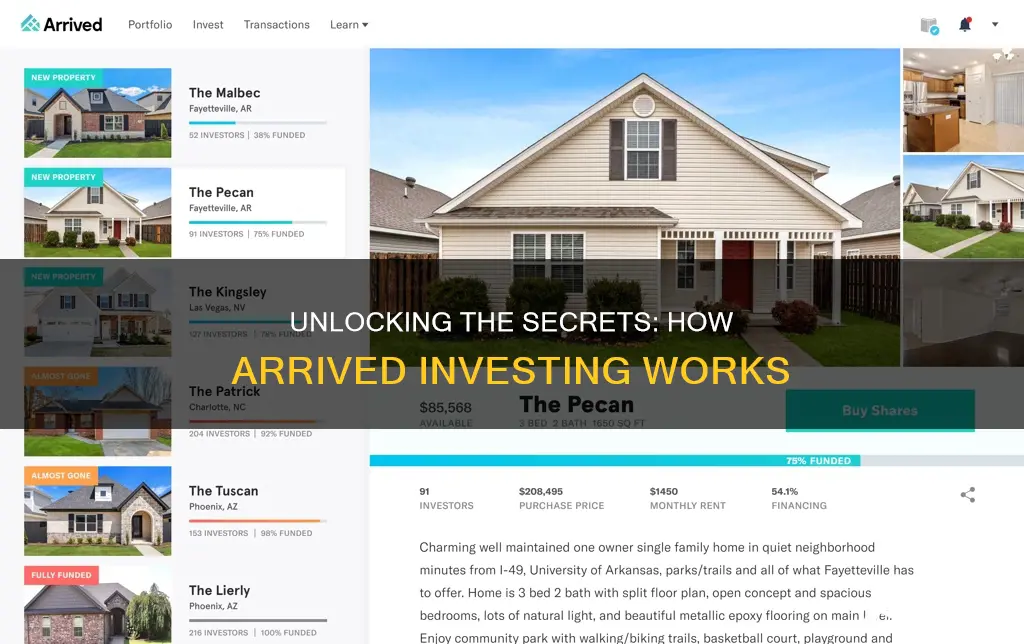

Platform Overview: How arrived.com facilitates investing in real estate projects

Arrived is an online platform that revolutionizes the way individuals can invest in real estate, offering a unique and accessible approach to diversify portfolios with tangible assets. The platform aims to democratize the real estate market, allowing investors to participate in projects that might have been previously out of reach due to high entry costs and complex processes.

At its core, Arrived provides a marketplace where investors can discover and invest in various real estate projects, including residential, commercial, and mixed-use developments. The platform acts as a bridge between real estate developers and investors, streamlining the investment process and making it more efficient. Here's a breakdown of how it works:

Project Discovery and Due Diligence: Arrived features a curated selection of real estate projects, providing detailed information about each venture. Investors can explore projects based on location, type, and investment size. The platform offers comprehensive due diligence materials, including financial projections, market analysis, and legal documents, ensuring investors have all the necessary information to make informed decisions. This transparency is a key differentiator, as it empowers investors to assess risks and potential returns.

Fractional Ownership: One of the innovative aspects of Arrived is its approach to fractional ownership. Instead of investing in an entire property, investors can purchase a fraction of a project, making it possible to invest in real estate with smaller amounts of capital. This strategy allows for a more flexible and diverse investment portfolio, as investors can choose to invest in multiple projects simultaneously. The platform calculates the value of each fraction based on the project's overall value, providing a clear and fair representation of ownership.

Investment Process: Investing on the Arrived platform is straightforward. Users can create an account, review project details, and decide on the amount they wish to invest. The platform facilitates secure transactions, ensuring that funds are transferred safely to the developer. Once invested, investors receive regular updates and financial reports, maintaining transparency throughout the project's lifecycle. This process simplifies the traditional real estate investment journey, eliminating the need for intermediaries and reducing associated costs.

Risk Mitigation and Support: Arrived prioritizes risk management and investor protection. The platform employs a robust due diligence process to identify potential risks and ensure that projects meet certain standards. Additionally, Arrived provides a support system for investors, offering guidance and resources to navigate the real estate investment landscape. This includes educational materials, community forums, and access to a dedicated team of experts who can address investor queries and concerns.

In summary, Arrived.com serves as a comprehensive platform for investing in real estate, offering a user-friendly interface, fractional ownership options, and a robust due diligence process. By simplifying the investment journey, Arrived opens up opportunities for individuals to diversify their portfolios and participate in the real estate market, potentially generating returns that rival traditional investment avenues.

Home Sweet Home: Navigating the Safest Investment Path to Buying a House

You may want to see also

Investment Process: Step-by-step guide to investing, from registration to project selection

The investment process with Arrived Investing involves a structured approach to help investors navigate the world of real estate and generate returns. Here's a step-by-step guide to understanding this process:

Step 1: Registration and Account Setup:

Investors begin by creating an account on the Arrived Investing platform. This involves providing personal details, verifying identity, and setting up secure login credentials. The platform aims to ensure a safe and transparent environment for investors, so a thorough registration process is essential. During this step, investors can also choose their preferred investment strategy, such as direct ownership or crowdfunding, depending on their risk appetite and financial goals.

Step 2: Due Diligence and Research:

Once registered, investors have access to a comprehensive database of real estate projects. Arrived Investing provides detailed information about each property, including its location, market value, rental history, and potential for growth. Investors must conduct thorough research, analyzing factors like neighborhood trends, local market conditions, and the project's financial projections. This step is crucial to make informed decisions and assess the potential risks and rewards.

Step 3: Project Selection:

After gathering information, investors can start narrowing down their choices. This involves evaluating multiple projects based on various criteria. Investors might consider factors such as property type (residential, commercial, or mixed-use), location-specific advantages, rental yield potential, and the project's alignment with their investment strategy. Arrived Investing may also provide tools or filters to help investors streamline their search and identify projects that match their preferences.

Step 4: Investment Execution:

Once a project is selected, investors can proceed with the investment. Arrived Investing typically offers two main investment models: direct ownership and crowdfunding. In direct ownership, investors purchase a fractional or whole interest in a property, becoming a direct owner. Crowdfunding allows investors to contribute smaller amounts, pooling their capital with other investors to fund a project. The platform will guide investors through the investment process, including payment methods and documentation.

Step 5: Ongoing Management and Returns:

After the investment is made, Arrived Investing provides ongoing support and management. This includes regular updates on the property's performance, maintenance, and any significant developments. Investors can track their portfolio's value and expected returns over time. The platform may also offer additional services, such as property management or exit strategies, to assist investors in maximizing their gains.

Arrived Investing aims to democratize real estate investment by providing an accessible and transparent platform. This step-by-step process ensures that investors can make informed decisions, manage their investments effectively, and potentially benefit from the real estate market's growth. It is essential to stay updated with the platform's guidelines and seek professional advice for personalized investment strategies.

The Future of Finance: Unlocking the Transformative Power of Investment

You may want to see also

Risk and Rewards: Balancing potential returns with the risks of real estate investing

Real estate investing, particularly through platforms like Arrived, offers an enticing opportunity to diversify portfolios and generate passive income. However, it's crucial to understand the risks and rewards associated with this investment avenue. Here's a breakdown of how to balance potential returns with the inherent risks:

Understanding the Risks:

- Market Volatility: Real estate values can fluctuate based on economic conditions, location-specific factors, and supply and demand. A downturn in the market could lead to decreased property values and potential losses.

- Liquidity Risk: Real estate is generally illiquid, meaning it can take time and effort to sell a property. This can be a challenge if you need quick access to your investment capital.

- Management and Maintenance: Owning real estate requires ongoing maintenance, repairs, and management. These expenses can eat into potential returns, especially if unexpected issues arise.

- Lease Risks: If you invest in rental properties, tenant turnover, late payments, and legal issues can impact your income stream.

Maximizing Rewards:

- Diversification: Diversifying your real estate portfolio across different property types (residential, commercial, industrial) and locations can help mitigate market risk.

- Professional Management: Consider using property management companies to handle tenant screening, rent collection, and maintenance. This can free up your time and potentially increase returns.

- Long-Term Perspective: Real estate investing is often a long-term game. Be prepared for potential short-term fluctuations and focus on the long-term appreciation of property values.

- Leverage: Arrived and similar platforms often allow investors to leverage their capital, meaning they can invest with borrowed funds. This can amplify returns but also increases risk.

Arrived Investing Strategy:

Arrived offers a unique approach by allowing investors to invest in fractional shares of real estate securities. This provides access to a diversified portfolio without the full financial burden of owning a property. Here's how to navigate the risks and rewards:

- Research and Due Diligence: Carefully research the properties and projects Arrived offers. Understand the location, market conditions, and potential risks associated with each investment.

- Diversification: Spread your investments across different properties and asset classes to minimize risk.

- Risk Tolerance: Assess your risk tolerance and invest accordingly. More aggressive investors might be comfortable with higher-risk, higher-reward opportunities.

- Regular Review: Monitor your investments regularly and adjust your portfolio as needed based on market conditions and performance.

Real estate investing through Arrived or similar platforms can be a rewarding venture, but it's essential to be aware of the risks involved. By understanding the market, diversifying your portfolio, and managing your expectations, you can strive to achieve a balance between potential returns and the inherent risks of this asset class.

Investment Intentions: Navigating the Personal Journey of Financial Commitment

You may want to see also

Community and Support: Arrived's approach to providing investor education and community engagement

Arrived Investing is a unique platform that aims to democratize access to real estate investments, offering an innovative approach to investor education and community engagement. This platform is designed to empower individuals to invest in real estate, a traditionally complex and exclusive market, by providing a user-friendly interface and comprehensive educational resources.

One of the key aspects of Arrived's strategy is to create a supportive community for investors. They understand that investing in real estate can be daunting for beginners, and thus, they foster an environment that encourages learning and collaboration. The platform facilitates this through various means:

- Educational Resources: Arrived offers an extensive library of articles, videos, and tutorials covering various topics related to real estate investing. These resources are designed to educate investors at all levels, from beginners to experienced professionals. Topics range from the fundamentals of real estate, such as market analysis and property valuation, to more advanced subjects like tax strategies and portfolio management.

- Community Forums: The platform features dedicated forums where investors can interact, share experiences, and seek advice. These forums are moderated to ensure a safe and constructive environment for open discussions. Here, investors can connect with like-minded individuals, share insights, and learn from each other's successes and challenges.

- Webinars and Workshops: Arrived regularly hosts webinars and workshops led by industry experts and successful investors. These events provide practical knowledge and insights into real estate investing strategies, market trends, and investment opportunities. Participants can ask questions and engage in discussions, making it an interactive learning experience.

Additionally, Arrived Investing encourages community engagement by providing tools and features that facilitate networking and collaboration. This includes a social feed where investors can share their investment journeys, success stories, and insights, fostering a sense of community and inspiration. The platform also offers a mentorship program, connecting experienced investors with newcomers, further enhancing the educational aspect of the community.

By combining educational resources, community forums, and interactive events, Arrived Investing aims to build a robust support system for its users. This approach not only helps investors make informed decisions but also creates a network of like-minded individuals who can provide ongoing support and guidance. As a result, Arrived empowers investors to navigate the real estate market with confidence and success.

The Power of Will Investment: Unlocking Long-Term Financial Freedom

You may want to see also

Frequently asked questions

Arrived Investing is a real estate investment platform that allows investors to invest in fractional shares of commercial properties. It provides an opportunity to diversify one's portfolio by investing in a range of assets, including office buildings, retail spaces, and multifamily properties, without the need for large sums of capital.

Arrived Investing operates by tokenizing real estate assets, meaning they are divided into smaller, tradable units called tokens. Investors can purchase these tokens, which represent ownership in the underlying property. The platform then manages the investment, including property acquisition, management, and potential revenue generation. Investors benefit from rental income, property appreciation, and the ability to buy and sell tokens on the secondary market.

This platform offers several advantages. Firstly, it provides access to a diverse range of real estate investments, allowing investors to diversify their portfolios across different property types and geographic locations. Secondly, the fractional ownership model enables smaller investors to participate in high-value properties that would otherwise be out of reach. Additionally, Arrived's technology-driven approach simplifies the investment process, making it more accessible to a broader range of investors.

Getting started is straightforward. Investors can create an account on the Arrived Investing website, complete the verification process, and fund their account. Once funded, they can browse the available investment opportunities, select the properties they want to invest in, and purchase the corresponding tokens. The platform provides a user-friendly interface for managing investments and offers educational resources to help investors understand the real estate market and investment strategies.