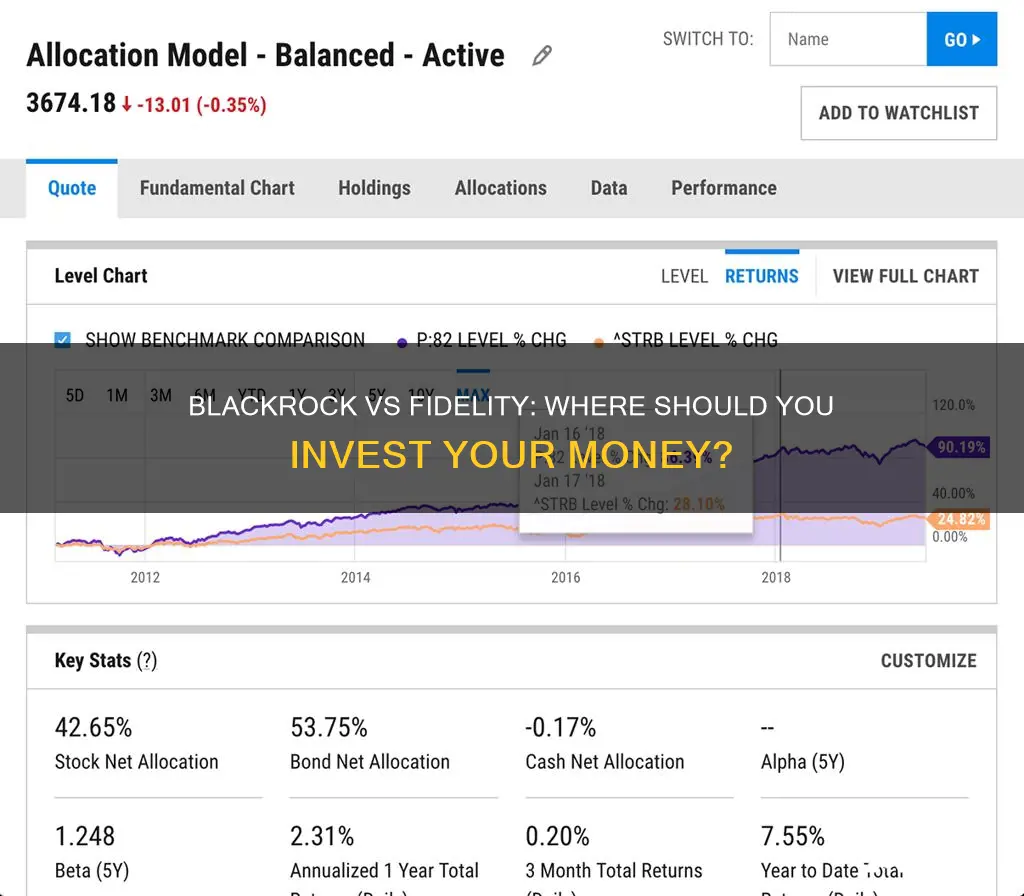

BlackRock and Fidelity are two of the biggest names in the investment world, with both companies offering a range of investment products and services. BlackRock, founded in 1988, is a global investment management corporation with a focus on asset management, risk management, and advisory services. It has a presence in over 30 countries and is known for its use of advanced technology and data analytics in its investment strategies. On the other hand, Fidelity, established in 1946, is a multinational financial services corporation offering investment management, retirement planning, and wealth management services. With a strong focus on customer service, Fidelity provides investors with diverse investment options and comprehensive research tools. When comparing BlackRock and Fidelity, investors should consider factors such as investment strategy, product offerings, fees, and customer service, as both companies have their own unique strengths and features.

What You'll Learn

Investment strategies

BlackRock is a global investment management corporation with a focus on asset management, risk management, and advisory services. The company employs advanced technology and data analytics to inform its investment strategies. BlackRock's Aladdin platform, for instance, combines risk analytics, portfolio management, and trading. The firm also emphasises sustainable investing, incorporating Environmental, Social, and Governance (ESG) criteria into its decisions. BlackRock's investment strategy is characterised by its laser-like focus on risk management, which has served shareholders well during economic downturns.

BlackRock offers a wide range of investment options, including mutual funds, exchange-traded funds (ETFs), separately managed accounts, and alternative investments. The company's investment research team conducts rigorous research and analysis to identify potential investment opportunities and risks.

Fidelity Investments, on the other hand, is a multinational financial services corporation offering investment management, retirement planning, and wealth management services. Fidelity is known for its customer-centric approach, providing investors with access to diverse investment options, comprehensive research tools, and personalised guidance. The company offers both active and passive management options, with a strong emphasis on sector-specific funds in technology, healthcare, and energy.

Fidelity's active management approach involves in-house fund managers using detailed research to aim to outperform the market. For passive investors, Fidelity offers a broad selection of index funds and ETFs, some with zero expense ratios. The company's online trading platform and mobile app offer intuitive interfaces, real-time market data, and advanced trading tools.

Fidelity is particularly well-known for its retirement planning services, including 401(k) plans, IRAs, and annuities. The company also provides wealth management services, such as portfolio management, financial planning, and estate planning, tailored to high-net-worth individuals and families.

Both BlackRock and Fidelity offer a diverse array of investment products and services, catering to a wide range of investor needs. When choosing between the two, it is essential to consider factors such as investment strategy, product offerings, fees, and customer service.

Managed Funds: Choosing and Investing in a Smart Way

You may want to see also

Fee structures

When comparing BlackRock and Fidelity's fee structures, it is evident that both firms offer a range of investment products and services, but the specific fees can vary depending on the type of investment and the client's individual circumstances. Here is a more detailed look at their fee structures:

BlackRock's Fee Structure

BlackRock's fees can vary depending on the type of investment product chosen. For example, their mutual funds and ETFs have expense ratios that cover management and operational costs, with their iShares ETFs known for having competitive expense ratios. However, managed accounts and alternative investments may attract higher fees, including performance and advisory fees.

BlackRock's Wrap Fee Schedule for various strategies starts at 2.50% for the first $500,000 and decreases as the balance increases. For instance, their SMA Program: Fixed-Income Investment Strategy fee starts at 0.35% for the first $1 million. Therefore, it is essential to carefully review BlackRock's fee structure before investing, as the fees can depend on the specific investment strategy chosen.

Fidelity's Fee Structure

Fidelity is known for offering low-cost investment options, particularly when it comes to index funds and ETFs, with some funds having zero expense ratios. They provide $0 commissions on U.S. stock, ETF, and options trades executed online. However, other fees may apply, such as $32.95 for broker-assisted trades and up to $49.95 for mutual fund trades.

Fidelity's fees for advisory services can vary depending on the level of service and the amount invested. For example, their Wealth Management service requires a minimum investment of $250,000, with fees ranging from 0.5% to 1.5%. In contrast, their Private Wealth Management service starts at $2 million, with fees ranging from 0.2% to 1.04%.

When comparing the fee structures of BlackRock and Fidelity, it is clear that both firms have different approaches. BlackRock's fees seem to be more dependent on the specific investment strategy chosen, with varying expense ratios and advisory fees. On the other hand, Fidelity offers a range of low-cost options, with some funds having zero expense ratios, but they also have additional fees for certain trades and services. Therefore, investors should carefully review the fee structures of both firms and consider their individual needs and investment strategies before making a decision.

ISA Funds: A Guide to Smart Investing

You may want to see also

Customer service

When it comes to customer service, Fidelity is known for its exceptional support. It offers 24/7 phone support, live chat, and a vast network of physical branches. Fidelity financial advisors are dedicated to building strong client relationships and providing comprehensive educational resources to ensure that investors have access to the information and assistance they require.

On the other hand, BlackRock's customer service is primarily geared towards institutional clients and high-net-worth individuals. While the company offers a wealth of online resources, including research reports and market insights, the level of personalized customer service for retail investors might not be as extensive as Fidelity's.

Fidelity's focus on customer satisfaction is evident through its commitment to enhancing the customer experience and eliminating trading commissions on key products. The firm prioritizes client support and education, making it a popular choice among retail investors.

BlackRock, as the world's largest asset management firm, serves a diverse global clientele, including individuals, institutions, and governments. While BlackRock prioritizes client satisfaction and offers personalized investment solutions, its customer service may be more tailored to high-value clients.

Overall, when comparing the customer service of BlackRock and Fidelity, Fidelity appears to have an edge due to its comprehensive support, accessibility, and emphasis on client relationships and education.

Investing in Lone Star Funds: A Comprehensive Guide

You may want to see also

Risk management

BlackRock, a global investment management corporation, is renowned for its expertise in risk management. The company employs sophisticated risk models and analytics to effectively manage investment risks. BlackRock's investment strategy is underpinned by its advanced technology and data analytics capabilities. Its Aladdin platform is central to this, offering unparalleled risk management and data analytics capabilities. During the 2007-2009 financial crisis, BlackRock's risk-management theory of fund management allowed its iShares MBS Fund to escape the crisis relatively unscathed. This laser-like focus on risk serves shareholders particularly well during economic downturns.

Fidelity Investments, on the other hand, is known for its strong customer-centric approach and comprehensive financial services. While it does offer risk management tools, there is less of a focus on institutional-level risk management compared to BlackRock. Fidelity's active management option relies on in-house fund managers using detailed research to outperform the market, and it is known for its sector-specific funds in technology, healthcare, and energy.

In summary, both BlackRock and Fidelity Investments have robust risk management capabilities, but BlackRock's sophisticated risk models and technology-driven approach may give it an edge when it comes to managing investment risks. Fidelity's risk management approach is part of its broader suite of customer-centric services, which include extensive educational resources and innovative trading tools.

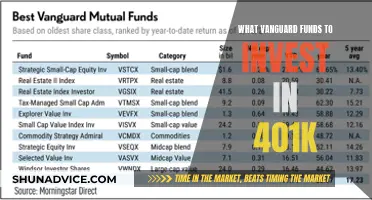

Best 401k Funds to Invest in for Maximum Returns

You may want to see also

Investment research

When comparing BlackRock and Fidelity Investments, investors should consider their differing investment strategies, fee structures, and customer services. Both firms are giants in the financial industry, but they offer unique strengths that cater to different investor needs.

BlackRock, the world's largest asset management firm, is known for its integration of advanced technology and data analytics in its investment strategy. Its Aladdin platform combines risk analytics, portfolio management, and trading. BlackRock also emphasizes sustainable investing, incorporating Environmental, Social, and Governance (ESG) criteria into its decisions. The firm's financial services cater to a global clientele, including individuals, institutions, and governments, offering a wide range of services with a strong emphasis on investment strategy and portfolio management.

Fidelity Investments, on the other hand, offers a mix of active and passive management options, with a strong emphasis on sector-specific funds in technology, healthcare, and energy. Active management at Fidelity relies on in-house fund managers using detailed research to outperform the market. For passive investors, Fidelity provides a broad selection of index funds and ETFs, some with zero expense ratios. Fidelity is also known for its customer-centric approach, extensive educational resources, and innovative trading tools, making it a favorite among retail investors.

Both BlackRock and Fidelity have their strengths in investment research and tools. BlackRock's advanced technology and data analytics provide robust risk management and investment insights, while Fidelity offers comprehensive research tools and market insights to help investors make informed decisions.

A Smart Guide to Nifty 50 Index Fund Investment

You may want to see also

Frequently asked questions

BlackRock is a global investment management corporation with a focus on asset management, risk management, and advisory services. It uses advanced technology and data analytics to inform its investment strategies. On the other hand, Fidelity is a multinational financial services corporation that offers investment management, retirement planning, and wealth management services. Fidelity is particularly known for its customer-centric approach and comprehensive educational resources.

BlackRock's investment strategy is driven by technology and data analytics. Its Aladdin platform combines risk analytics, portfolio management, and trading. BlackRock also emphasizes sustainable investing, incorporating Environmental, Social, and Governance (ESG) criteria. Meanwhile, Fidelity offers a mix of active and passive management options, with a focus on sector-specific funds in technology, healthcare, and energy.

BlackRock's fees depend on the type of investment product. Their Wrap Fee Schedule starts at 2.50% for the first $500,000. Mutual funds and ETFs have varying expense ratios, with iShares ETFs known for their competitiveness. Managed accounts and alternative investments may have higher fees. Fidelity, on the other hand, offers low-cost investment options, with some index funds and ETFs carrying zero expense ratios. They also offer $0 commissions on U.S. stock, ETF, and options trades executed online.

BlackRock's strengths include its global presence, commitment to innovation and sustainability, robust risk management practices, and investment research. However, BlackRock may have higher fees for managed accounts and alternative investments, and may offer less emphasis on customer education. Fidelity's strengths include a wide range of investment options, robust research and analysis, innovative technology, retirement solutions, and exceptional customer service. A potential drawback of Fidelity is that its actively managed funds can have higher fees.

The choice between BlackRock and Fidelity depends on your individual needs and preferences. Consider factors such as investment strategy, product offerings, fees, customer service, and technological capabilities. Evaluate these aspects carefully before making a decision.