Forex investment, or foreign exchange trading, is a dynamic and complex financial market where investors buy and sell currencies in a global network. It involves trading one country's currency for another, aiming to profit from the fluctuations in exchange rates. This investment strategy requires a deep understanding of economic indicators, geopolitical events, and market trends. Investors can speculate on currency pairs, utilizing leverage to amplify potential gains or losses. Forex trading offers 24-hour access to the market, allowing traders to react swiftly to news and events that can significantly impact currency values. Understanding the mechanics of forex investment is crucial for anyone looking to navigate this volatile yet potentially lucrative market.

What You'll Learn

- Market Dynamics: How currency values fluctuate due to economic factors

- Trading Platforms: Tools and software used to execute forex trades

- Leverage and Margin: Borrowing money to increase potential profits or losses

- Risk Management: Strategies to minimize potential losses in forex trading

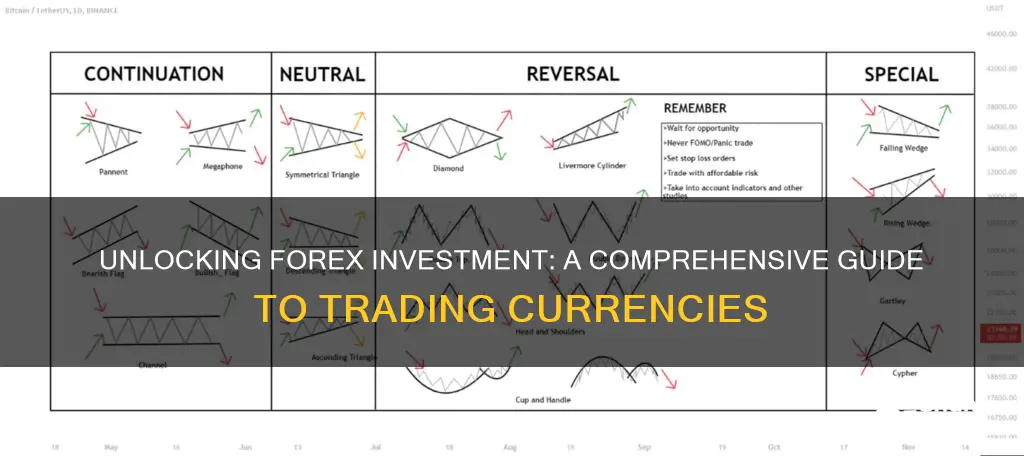

- Technical Analysis: Using charts and indicators to predict price movements

Market Dynamics: How currency values fluctuate due to economic factors

The foreign exchange (forex) market is a dynamic and complex arena where currency values are in a constant state of flux, influenced by a myriad of economic factors. Understanding these market dynamics is crucial for anyone looking to navigate the forex investment landscape. Here's an in-depth look at how economic factors drive currency fluctuations:

Economic Indicators and Currency Values: Economic indicators are statistical data points that provide insights into a country's economic health. These indicators are closely watched by forex traders as they can significantly impact currency values. For instance, a country's inflation rate, interest rates, GDP growth, and employment data are critical factors. When a country's economic indicators show positive trends, it often leads to a stronger currency. For example, if a country's central bank raises interest rates, it can attract foreign investors seeking higher returns, thereby increasing demand for that country's currency. Conversely, negative economic data might prompt investors to sell off the affected currency.

Interest Rates and Currency Strength: Interest rates play a pivotal role in currency fluctuations. Central banks adjust interest rates to control inflation and stimulate economic growth. Higher interest rates make a country's currency more attractive to investors, as it offers higher returns on their investments. This increased demand for the currency can lead to its appreciation against other currencies. For instance, if the European Central Bank (ECB) decides to raise interest rates, the Euro might strengthen against the US Dollar, as investors may prefer the higher yields offered by Eurozone assets.

Inflation and Purchasing Power: Inflation is another critical factor affecting currency values. When a country experiences high inflation, the purchasing power of its currency decreases. This means that a unit of currency can buy fewer goods and services over time. As a result, investors may seek currencies of countries with lower inflation rates, leading to a potential depreciation of the high-inflation currency. For instance, if Country A has a consistently high inflation rate, investors might prefer holding currencies from countries with stable or low inflation, causing the currency of Country A to weaken.

Economic Policies and Trade Balance: Government economic policies and a country's trade balance can also influence currency values. Trade policies, such as tariffs or subsidies, can impact a country's exports and imports, affecting its trade balance. A country with a consistent trade surplus (exporting more than it imports) often sees its currency strengthen, as foreign demand for its goods and services increases. Conversely, a trade deficit may lead to currency depreciation. For example, if a country imposes tariffs on imports, it might boost local industries, improving the trade balance and potentially strengthening the national currency.

Global Economic Events and Uncertainty: Major global economic events and geopolitical factors can cause significant currency fluctuations. Unforeseen events like political instability, natural disasters, or changes in government policies can create uncertainty in the market. During such times, investors often seek safe-haven currencies, such as the Japanese Yen or Swiss Franc, which are typically considered low-risk assets. This increased demand for safe-haven currencies can lead to their appreciation, while riskier currencies may depreciate.

Young Investors: Emulate Warren Buffett's Strategy

You may want to see also

Trading Platforms: Tools and software used to execute forex trades

Trading platforms are essential tools for forex traders, providing a gateway to the global currency markets. These platforms offer a range of features and functionalities that facilitate the buying and selling of currencies, enabling traders to execute trades efficiently and effectively. When choosing a trading platform, traders should consider factors such as user-friendliness, available features, and the availability of research and analysis tools.

One of the key components of a trading platform is the order execution system. This system allows traders to place buy or sell orders for currencies, specifying the amount, price, and type of order. Common order types include market orders, which are executed immediately at the current market price, and limit orders, which are executed at a specified price or better. Stop-loss orders are also crucial, as they automatically sell a currency when it reaches a certain price, helping to limit potential losses.

Trading platforms often provide a comprehensive suite of technical analysis tools. These tools enable traders to analyze price charts, identify trends, and make informed trading decisions. Key technical indicators include moving averages, which smooth out price data and help identify trends, and relative strength index (RSI), which measures the speed and change of price movements to assess overbought or oversold conditions. Platform users can also access a variety of charting tools, such as candlestick charts and volume indicators, to gain deeper insights into market dynamics.

In addition to technical analysis, many trading platforms offer fundamental analysis tools. These tools provide economic data, news feeds, and research reports that help traders make informed decisions based on macroeconomic factors. Real-time currency quotes, interest rate announcements, and economic calendars are common features, allowing traders to stay updated on market-moving events. Some platforms also offer automated news alerts, ensuring traders never miss critical information.

Security and risk management are also integral to trading platforms. Traders can set up stop-loss and take-profit orders to automatically close positions when specific price levels are reached, helping to manage risk. Additionally, platforms often provide security features such as two-factor authentication and encryption to protect user data and funds. It is crucial for traders to choose platforms that offer robust security measures to safeguard their investments.

Lastly, the user interface and customization options are essential considerations. A user-friendly platform with an intuitive interface can significantly enhance the trading experience. Traders should look for platforms that offer customizable charts, indicators, and layouts to suit their individual trading styles and preferences. The ability to personalize the trading environment can lead to more efficient and effective trading strategies.

The Borrower's Dilemma: Navigating Investment Opportunities

You may want to see also

Leverage and Margin: Borrowing money to increase potential profits or losses

When it comes to forex investment, leverage and margin are fundamental concepts that can significantly impact your trading strategy and outcomes. These terms refer to the practice of borrowing money from a broker to increase the potential profits or losses in your forex trades. Understanding how leverage and margin work is crucial for managing risk and maximizing gains in the highly volatile forex market.

Leverage allows traders to control a larger position in the market with a smaller amount of capital. It is essentially a loan provided by the broker, enabling traders to open larger positions and potentially amplify their profits. For example, if a trader has a $1,000 account and uses a 1:100 leverage ratio, they can control a position worth $100,000. This means that a $1 price movement in the currency pair would result in a $1,000 profit or loss, which is a substantial return on investment. However, it's important to note that leverage can also magnify losses, as traders can lose more than their initial investment if the market moves against their position.

Margin is closely related to leverage and refers to the amount of money a trader must deposit in their account to secure a leveraged position. Brokers typically set a margin requirement, which is a percentage of the total trade value. For instance, if a broker requires 2% margin, and you want to trade a currency pair with a $10,000 value, you would need to deposit $200 as margin. This margin requirement ensures that traders have a financial stake in the trade and provides a buffer against potential losses. It's a way for brokers to manage risk and protect themselves from traders who may not be able to cover potential losses.

The use of leverage and margin can be a double-edged sword. On one hand, it allows traders to participate in larger positions and potentially earn higher returns. On the other hand, it increases the risk of significant losses if the market moves against the trader's position. Effective risk management is crucial when utilizing leverage and margin. Traders should set stop-loss orders to limit potential losses and regularly review their positions to ensure they are aligned with their risk tolerance.

In the forex market, where currency values fluctuate constantly, leverage and margin play a vital role in shaping trading strategies. Traders can take advantage of both upward and downward price movements, but they must also be prepared for the potential risks involved. It is essential to educate oneself about the mechanics of leverage and margin, as well as the specific margin requirements and policies of different forex brokers.

In summary, leverage and margin are powerful tools in forex investment, offering the potential to increase profits but also carrying the risk of substantial losses. Traders should approach these concepts with caution, understanding the risks and implementing appropriate risk management strategies to navigate the forex market effectively.

Faux Fur: Sustainable Luxury

You may want to see also

Risk Management: Strategies to minimize potential losses in forex trading

Risk management is a critical aspect of forex trading, as it can significantly impact your success and longevity in the market. Effective risk management strategies are essential to minimize potential losses and protect your capital. Here are some key approaches to consider:

- Determine Your Risk Tolerance: Understanding your risk tolerance is the first step. It involves assessing how much risk you are willing to take on in relation to your financial goals and trading style. Some traders may prefer a more conservative approach, taking smaller profits but with less risk, while others might opt for a higher-risk strategy to potentially gain larger profits. Knowing your tolerance will guide your decision-making process.

- Set Stop-Loss Orders: A stop-loss order is a powerful tool to limit potential losses. It automatically sells your position when the market reaches a certain price, which you set in advance. By setting stop-loss orders, you can ensure that your losses are contained, even if the market moves against your position. It's important to place these orders at a level that is reasonable and aligned with your risk management plan.

- Utilize Take-Profit Orders: Take-profit orders are the opposite of stop-loss orders. They automatically close your position when the market reaches a predetermined price, locking in your profits. This strategy helps to secure gains and limit potential downside risk. Combining take-profit and stop-loss orders can provide a comprehensive risk management approach.

- Diversify Your Portfolio: Diversification is a fundamental principle of risk management. Instead of investing all your capital in a single currency pair, consider spreading your trades across different pairs and timeframes. This way, if one trade goes against you, the others may compensate for the loss. Diversification also involves trading various asset classes, such as forex, stocks, and commodities, to further reduce risk.

- Practice Money Management: Proper money management is crucial for risk control. It involves determining the appropriate position size for each trade based on your risk tolerance and account equity. A common rule of thumb is to risk only a small percentage of your trading capital on each position. For example, if you have a $10,000 account, you might decide to risk no more than 1-2% per trade, which would be $100-$200. This ensures that even if you experience a series of losing trades, your account balance remains healthy.

- Regularly Review and Adjust: Risk management is an ongoing process. Regularly review your trades and performance to identify areas for improvement. Analyze what went well and what could have been handled differently. Adjust your risk management strategies accordingly, especially as market conditions change. Stay informed about economic events and news that may impact your trades, and be prepared to adapt your risk exposure.

Unveiling the Secrets to Buying Investment Jewelry

You may want to see also

Technical Analysis: Using charts and indicators to predict price movements

Technical analysis is a powerful tool in the forex market, offering traders a structured approach to predicting price movements and making informed investment decisions. It involves the use of historical market data, primarily price and volume, to identify patterns and trends that can be used to forecast future price behavior. This method is particularly useful for short-term traders and investors who aim to capitalize on intraday price fluctuations.

At its core, technical analysis relies on the belief that market prices tend to follow patterns and trends, which can be identified and analyzed through various charting techniques. Traders use charts, often in the form of candlestick or bar charts, to visualize price movements over specific periods. These charts provide a clear representation of the market's supply and demand dynamics, allowing traders to identify key support and resistance levels, as well as potential trend reversals.

One of the fundamental concepts in technical analysis is the use of indicators. These are mathematical calculations based on historical price and volume data, designed to smooth out price fluctuations and reveal underlying trends. Common indicators include Moving Averages (MA), which provide a simple average of prices over a specified period, and Relative Strength Index (RSI), which measures the speed and change of price movements to assess overbought or oversold conditions. Traders can also use more advanced indicators like the Moving Average Convergence Divergence (MACD) to generate buy or sell signals.

The process of applying technical analysis involves several steps. Firstly, traders select a specific currency pair and a time frame that aligns with their trading strategy. They then plot the chosen indicators on the chart to identify potential support and resistance levels, as well as to confirm the strength of a trend. For example, a trader might use a 200-day MA to identify long-term trends and a 50-day MA for short-term signals. By analyzing these indicators, traders can make predictions about future price movements and decide on the timing and direction of their trades.

In summary, technical analysis is a systematic approach to forex investment, enabling traders to make data-driven decisions. It empowers traders to identify patterns, manage risk, and execute trades based on the probabilities suggested by the market's historical behavior. While it is not an exact science, technical analysis provides a structured framework that can enhance a trader's ability to navigate the volatile forex market.

Tesla's Next Move: Diving into Dogecoin?

You may want to see also

Frequently asked questions

Forex investment, or foreign exchange investment, involves trading currencies in the global foreign exchange market. It is a decentralized market where currencies are bought and sold based on their exchange rates. Investors aim to profit from the fluctuations in these rates by speculating on whether a currency will appreciate or depreciate against another.

Getting into forex investment typically involves opening an account with a forex broker. These brokers provide trading platforms that allow investors to access the market and execute trades. You'll need to choose a trading strategy, decide on the amount of leverage you're comfortable with, and manage your risk exposure. It's essential to educate yourself about the market, learn trading techniques, and consider seeking advice from financial professionals.

Several factors can impact forex investment decisions:

- Economic Indicators: Data such as GDP growth, inflation rates, and employment reports from various countries can significantly affect currency values.

- Political Events: Elections, policy changes, and political stability in a country can influence investor sentiment and currency prices.

- Interest Rates: Central banks' decisions on interest rates can impact a country's currency value and attract investors seeking higher returns.

- Market Sentiment: Investor confidence and market trends can drive currency movements, often influenced by news, social media, and global events.

Forex investment carries several risks:

- Market Volatility: Currency exchange rates can fluctuate rapidly, leading to potential losses if not managed properly.

- Leverage Risk: Using leverage can amplify gains but also increases the potential for significant losses if the market moves against your position.

- Liquidity Risk: Forex markets are generally liquid, but certain currency pairs or during specific times, liquidity can decrease, making it challenging to enter or exit trades.

- Time Zone Differences: The forex market operates 24/5, but trading hours vary across different time zones, which may impact trading opportunities and market accessibility.