Free cash flow is an important metric for investors to assess a company's financial health and profitability. It represents the cash a company generates after accounting for operational and capital asset expenses. Private equity investors, in particular, would be interested in a company's free cash flow to determine its ability to pay dividends or repurchase shares. This is calculated as the cash from operations minus capital expenditures and any debt repayments. A positive free cash flow indicates the company's ability to meet its financial obligations and fund growth initiatives, making it an attractive investment opportunity.

What You'll Learn

Free cash flow to equity (FCFE)

FCFE is the amount of cash a business generates that is available to be distributed to shareholders. It is a measure of equity capital usage and is used to determine a company's value.

FCFE is calculated using the following formula:

FCFE = Cash from Operating Activities – Capital Expenditures + Net Debt Issued (Repaid)

FCFE is composed of net income, capital expenditures, working capital, and debt. Net income is located on the company's income statement, while capital expenditures can be found in the cash flow statement under the "cash flows from investing" section. Working capital is also found on the cash flow statement under the "cash flows from operations" section and represents the difference between the company's most current assets and liabilities.

FCFE is used to determine if dividend payments and stock repurchases are paid for with free cash flow to equity or some other form of financing. Investors want to see dividend payments and share repurchases that are fully paid by FCFE.

FCFE is an important metric for investors focusing on dividend or buyback potential, as it directly relates to the cash that could be distributed to shareholders. It provides a nuanced view of a company's ability to generate cash specifically for its equity holders, taking into account its debt obligations and operational investment requirements.

FCFE is also known as levered free cash flow (LFCF) as it includes the impact of debt, whereas free cash flow to the firm (FCFF) does not.

FD Investments in India: Worthwhile or Not?

You may want to see also

Dividends and stock buybacks

Many investors prefer cash-dividend-paying companies because dividends can significantly affect an investment's return. Dividends have contributed to nearly one-third of total returns for U.S. stocks since 1926, according to Standard & Poors. Conversely, capital gains—or gains from price appreciation—accounted for two-thirds of total returns.

Companies pay out dividends from after-tax profits. Once received, shareholders must include them in their annual income taxes. Start-ups and other high-growth companies, such as those in the technology sector, rarely offer dividends. These companies often report losses in their early years, and profits are usually reinvested to foster growth. Large, established companies with predictable streams of revenue and profits typically have the best track record for dividend payments and offer the best payouts.

A stock buyback, also known as a share repurchase, occurs when a public company buys shares of its own stock. Share repurchases usually increase per-share measures of profitability like earnings-per-share (EPS) and cash-flow-per-share, and improve performance measures like return on equity. These improved metrics generally drive the share price higher over time, resulting in shareholder capital gains. Shareholder gains are realized when the holder sells the shares back to the company, triggering a tax event.

A company can fund its buyback by taking on debt, using cash on hand, or with its cash flow from operations. Timing is critical for a buyback to be effective. Buying back shares may be regarded as a sign of management’s confidence in a company's prospects. However, if the shares subsequently slide for any reason, that confidence was misplaced.

Buybacks may not always take place as a way to compensate shareholders. A company might also initiate a buyback when it wants to increase its share price, consolidate ownership, or reduce the cost of capital. It's important to note that shareholders are not required to sell their shares when a buyback is initiated. If they keep their stocks, their percentage of ownership in the issuing company will increase as other investors sell theirs.

Both dividends and buybacks can help increase the overall rate of return on shares. However, there is much debate surrounding which method of returning capital to shareholders is better for investors and the companies involved over the long term.

Equity Research and Investment Management: Two Sides of Finance

You may want to see also

Calculating FCFE

Free Cash Flow to Equity (FCFE) is a measure of how much cash is available to the equity shareholders of a company after all expenses, reinvestment, and debt are paid. It is calculated as:

FCFE = Cash from Operating Activities – Capital Expenditures + Net Debt Issued (Repaid)

FCFE can be calculated in a few different ways, depending on the information available. Here are some of the most common methods:

FCFE = Net Income + Depreciation & Amortization + Changes in Working Capital + Capital Expenditures + Net Borrowings

Net Income is after the payment of Interest expense and can be found on the Income Statement or Cash Flow Statement if it was prepared using the indirect method.

Depreciation & Amortization: Add back all non-cash charges, which can usually be found on the Income Statement or Cash Flow Statement.

Changes in Working Capital: This includes inventory, receivables, and payables, and can be found on the Cash Flow Statement.

Capital Expenditures: This is the cash impact of purchases of property, plant, and equipment, and can be found on the Cash Flow Statement.

Net Borrowings: This includes both short-term and long-term debt, and is calculated as Debt Issued - Debt Repaid.

FCFE = EBIT – Interest – Taxes + Depreciation & Amortization + Changes in Working Capital + Capital Expenditures + Net Borrowings

FCFE = Cash from Operations (CFO) – Capex + Net Borrowing

CFO is calculated as Net Income + Depreciation & Amortization – Change in Net Working Capital.

FCFE = EBITDA – Interest – Taxes – Change in Net Working Capital – Capex + Net Borrowing

Example Calculations

Example 1: Net Income to FCFE

Suppose a company has a net income of $10mm, given a 10% net income margin assumption and $100mm in revenue.

Net Income = $10 million

Depreciation & Amortization = $5 million

Increase in Net Working Capital = $2 million

Capital Expenditures = $3 million

Net Borrowing = Debt Borrowing – Debt Paydown = $5 million

FCFE = $10 million + $5 million – $3 million – $2 million + $5 million = $5 million

Example 2: CFO to FCFE

In this example, we start with a CFO of $13mm.

CFO = Net Income + Depreciation & Amortization – Change in Net Working Capital = $10 million + $5 million – $2 million = $13 million

FCFE = CFO – Capex + Net Borrowing = $13 million – $3 million – $5 million = $5 million

Example 3: EBITDA to FCFE

In this example, we start with EBITDA and need to deduct the impact of debt financing.

FCFE = EBITDA – Interest – Taxes – Change in NWC – Capex + Net Borrowing

FCFE = $5 million

Insurance in India: An Investment or a Safety Net?

You may want to see also

FCFE and company value

Free cash flow to equity (FCFE) is a measure of how much cash is available to the equity shareholders of a company after all expenses, reinvestment, and debt are paid. It is calculated as Cash from Operations less Capital Expenditures plus net debt issued.

FCFE is often used by analysts to determine a company's value. It is a measure of equity capital usage and is composed of net income, capital expenditures, working capital, and debt.

FCFE is calculated as follows:

FCFE = Cash from Operating Activities – Capital Expenditures + Net Debt Issued (Repaid)

FCFE is used to determine if dividend payments and stock repurchases are paid for with free cash flow to equity or some other form of financing. Investors want to see that dividend payments and share repurchases are fully paid by FCFE.

If FCFE is less than the dividend payment and the cost to buy back shares, the company may be funding these payments through debt, existing capital, or issuing new securities. This is not a positive sign for investors, even if interest rates are low.

On the other hand, if the company's dividend payment funds are significantly less than the FCFE, the firm may be using the excess cash to increase its cash level or invest in marketable securities.

FCFE is also used to calculate the value of equity using the Gordon growth model:

V_equity = FCFE / (r-g)

Where Vequity is the value of the stock today, FCFE is the expected FCFE for the next year, r is the cost of equity of the firm, and g is the growth rate in FCFE for the firm.

In summary, FCFE is an important metric for analysts to determine a company's value, especially when the company does not pay dividends. It provides insights into the company's financial health and helps investors make informed decisions about their investments.

Partnerships: Equity Investment or Strategic Alliance?

You may want to see also

FCFE and debt

Free cash flow to equity (FCFE) is a measure of how much cash is available to a company's equity shareholders after all expenses, reinvestment, and debt are paid. It is calculated as cash from operations less capital expenditures plus net debt issued.

FCFE is composed of net income, capital expenditures, working capital, and debt. Net income is located on the company's income statement, while capital expenditures can be found within the cash flows from the investing section on the cash flow statement. Working capital is also found on the cash flow statement, in the cash flows from operations section. Net borrowings can be found on the cash flow statement in the cash flows from the financing section.

FCFE is often used by analysts to determine a company's value, and it can be used to calculate the net present value (NPV) of equity. The formula for calculating FCFE is:

FCFE = Cash from Operating Activities – Capital Expenditures + Net Debt Issued (Repaid)

FCFE is a type of free cash flow (FCF), which is a measure of a company's profitability. FCF represents the cash that a company generates after accounting for cash outflows to support its operations and maintain its capital assets. It is the company's available cash repaid to creditors and as dividends and interest to investors.

FCF is often used as a measure of a company's financial health, as it can reveal problems in the financial fundamentals before they become apparent on a company's income statement. A company with consistently low or negative FCF might be forced into costly rounds of fundraising to remain solvent.

There are two types of free cash flow: free cash flow to firm (FCFF) and FCFE. FCFF, or unlevered free cash flow, excludes the impact of interest expense and net debt issuance (repayments), while FCFE, or levered free cash flow, includes these factors. The discount rate and numerator of valuation multiples depend on the type of cash flow used.

Oil Commodity Investment in India: A Beginner's Guide

You may want to see also

Frequently asked questions

Free cash flow (FCF) is a measure of a company's profitability and financial health. It represents the cash that a company generates after accounting for cash outflows to support its operations and maintain its capital assets.

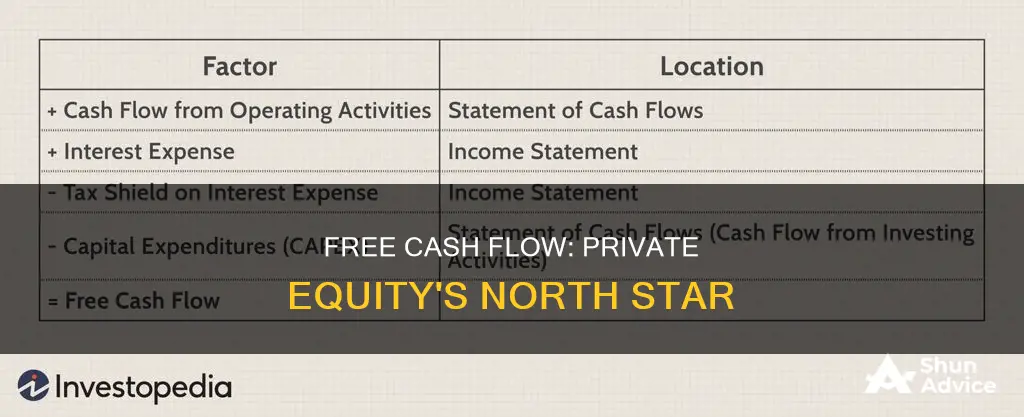

FCF can be calculated using two main approaches: the first approach uses cash flow from operating activities as a starting point and makes adjustments for interest expense, tax shield on interest expense, and capital expenditures. The second approach uses earnings before interest and taxes (EBIT) as a starting point and adjusts for income taxes, non-cash expenses, changes in working capital, and capital expenditures.

Free cash flow is important for private equity investments because it represents the actual amount of cash a company has at its disposal. Private equity investors may be interested in a company's FCF to understand its ability to generate cash and its financial health.

Free cash flow to equity (FCFE) is a metric that measures the amount of cash available to be distributed to shareholders after all expenses, reinvestments, and debt repayments. It is an important levered metric for understanding shareholder value and potential returns through dividends or share buybacks.

The price-to-free cash flow (P/FCF) ratio is an equity valuation metric that compares a company's per-share market price to its free cash flow. A lower P/FCF ratio indicates that a company may be undervalued, while a higher ratio suggests overvaluation. This metric can help investors identify potential investment opportunities or risks.