A government budget deficit occurs when government expenses exceed revenue. This can be caused by a variety of factors, such as increased spending on social security, healthcare, military spending, or tax cuts. When a budget deficit occurs, the government may borrow money by selling treasury bonds, bills, and other securities, leading to an increase in national debt. This can have implications for savings and investments, as the government borrows from the pool of available funds that could otherwise be invested in other businesses. This is known as the crowding out effect, where government borrowing reduces the funds available for private investment. However, the impact of budget deficits on savings and investments is complex and subject to debate among economists. Some argue that government spending drives economic activity and growth, while others believe that deficits impede private borrowing and lead to higher taxes.

| Characteristics | Values |

|---|---|

| Effect on the economy | A budget deficit can lead to higher borrowing, higher interest payments, and low reinvestment, resulting in lower revenue the following year. |

| Budget deficits affect individuals, businesses, and the overall economy. | |

| Long-term deficits can be detrimental to economic growth and stability. | |

| An increase in the fiscal deficit can boost a sluggish economy by giving individuals more money to buy and invest more. | |

| Budget deficits can be used to expand popular policies, such as welfare programs and public works. | |

| Budget deficits can be caused by unanticipated events and policies, such as increased defense spending. | |

| Budget deficits can be reduced by raising taxes or cutting spending. | |

| Budget deficits can lead to higher taxes, higher inflation, or both. | |

| Budget deficits can crowd out private borrowing and distort interest rates. | |

| Budget deficits can reduce investment and slow economic growth. | |

| Budget deficits can be financed through the sale of government securities, such as Treasury bonds. | |

| Budget deficits can increase the national debt. |

What You'll Learn

Government borrowing reduces the pool of funds for investment in other businesses

Government borrowing can have a significant impact on the funds available for investment in other businesses. When a government borrows money, it enters the financial markets as a borrower, competing with private firms for funds. This can result in a reduction in the pool of funds available for private investment, as lenders have a finite amount of capital to lend.

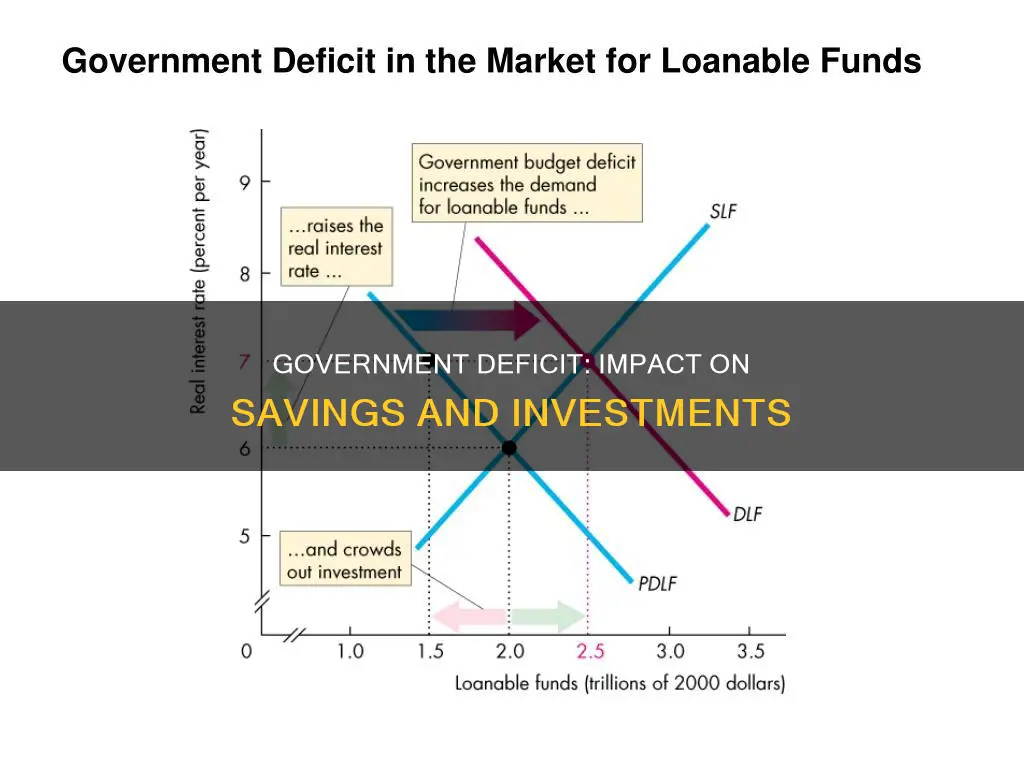

The impact of government borrowing on investment funds is known as the "crowding out" effect. As the government's demand for financial capital increases, it can drive up interest rates and borrowing costs, making it more expensive for private firms to borrow money. This, in turn, can reduce the demand for borrowing from private firms, as their cost of borrowing increases.

The "crowding out" effect suggests that rising public sector spending can drive down private sector spending. To increase its spending, the government needs to raise revenue, which it typically does through higher taxes or by borrowing by selling Treasury securities. Higher taxes can reduce income and spending by individuals and businesses, while increased borrowing by the government can push up interest rates, making borrowing more costly for private firms.

The "crowding out" effect is particularly relevant when the economy is operating at or near full capacity. In this case, an increase in government borrowing can absorb a significant portion of the economy's lending capacity, leaving less capital available for private investment. This can be a concern for companies that rely on financing to fund capital projects, as the increased cost of borrowing may make these projects unprofitable.

It is important to note that the impact of government borrowing on investment funds is not always negative. During periods of slow economic activity, government spending can stimulate the economy and increase spending by consumers and businesses. Additionally, government investment in infrastructure, education, and research and development can have long-term benefits for the economy, despite the short-term impact on investment funds.

In summary, while government borrowing can reduce the pool of funds available for investment in other businesses, the overall impact depends on various factors, including the state of the economy, the level of interest rates, and the nature of government spending.

Unlocking Retirement Wealth: Navigating the World of Retirement Notes

You may want to see also

Deficits can lead to higher interest rates

Secondly, the sale of government securities, such as Treasury bonds, influences interest rates. The interest rate paid on loans to the government becomes the benchmark for other financial instruments. If government bonds pay 2% interest, other financial assets must pay a competitive rate to attract buyers. This dynamic is leveraged by the Federal Reserve to adjust interest rates within monetary policy.

Thirdly, as the government borrows more, interest rates are likely to rise. This increase in interest rates can make borrowing more expensive for ordinary businesses, particularly small enterprises. Consequently, some businesses may defer new projects, expansions, or hiring decisions, which can hamper overall economic growth.

Furthermore, higher interest rates can lead to a phenomenon known as "'crowding out.'" This occurs when the government's increased borrowing and spending reduce the resources typically utilised by private enterprises for investment projects. Instead of adding new output to the economy, government spending replaces private sector output, leading to higher interest rates that offset the stimulative impact of government expenditures.

Finally, an increase in interest rates will result in higher future budget deficits, as domestic investment, which is largely financed by national savings, decreases. This dynamic creates a cycle where higher deficits lead to higher interest rates, exacerbating the issue.

The Market's Resilience: Will Investments Bounce Back?

You may want to see also

Deficits can cause higher taxes

The impact of higher taxes on economic activity is a subject of discussion. Some economists argue that higher taxes can impede private borrowing, spur inflation, and negatively impact economic growth. They suggest that individuals will save more in anticipation of higher taxes, reducing the money available for spending and investment. Additionally, higher taxes can decrease disposable income, affecting consumption and business profitability.

On the other hand, Keynesian economics proposes that deficit spending can stimulate the economy. During economic downturns, governments can increase spending to maintain aggregate demand and prevent prolonged periods of high unemployment. Once the economy recovers, taxes can be raised to repay the accumulated debt. This approach has been used by governments to justify spending with reduced short-term consequences.

The decision to raise taxes is complex and depends on various factors, including the initial tax rate levels, the size of the tax rate change, and the country's specific circumstances. While higher taxes may be necessary to address fiscal deficits, they can also have unintended consequences on economic activity and growth.

In conclusion, deficits can lead to higher taxes, and the impact of this decision on the economy is a matter of ongoing debate among economists and policymakers. The decision to raise taxes should consider the potential benefits and drawbacks to strike a balance between fiscal responsibility and economic growth.

Fidelity Investments: A Comprehensive Guide to Buying and Owning Mutual Funds

You may want to see also

Deficits can lead to low reinvestment

Deficits can have a detrimental impact on reinvestment, leading to a downward spiral of lower revenue and increased borrowing. When a government runs a deficit, it often results in higher levels of borrowing and increased interest payments. This means that there is less money available for reinvestment, which can lead to even lower revenue in the following years.

The impact of deficits on reinvestment can be understood through the lens of the National Saving and Investment Identity, which states that the quantity of financial capital supplied in the market must equal the quantity demanded. When the government spends more than it receives in taxes, it becomes a demander of financial capital, competing with private investment for funds. This can result in a fall in domestic investment as funds are diverted to cover the government's borrowing needs.

Additionally, government borrowing reduces the pool of available funds that could otherwise be invested in businesses. For example, an individual who lends money to the government cannot use the same funds to invest in the stocks or bonds of private companies. This reduction in potential capital stock in the economy can hinder economic growth and stability.

Furthermore, the sale of government securities, such as treasury bonds, to finance deficits can directly impact interest rates. The interest rate paid on government loans becomes the benchmark for other financial instruments, influencing the rates offered by banks and financial institutions. This can further affect the attractiveness of private investments and impact individuals' and businesses' ability to reinvest.

The negative cycle of deficits and low reinvestment can be challenging to break. To address this, governments may need to take corrective actions such as cutting back on certain expenditures or increasing revenue-generating activities. However, these actions may also have short-term negative consequences on the economy, and determining the best course of action is often a subject of debate.

Unemployed and Unretired: Navigating Investment Strategies for a Secure Future

You may want to see also

Deficits can be caused by increased government spending

The impact of government deficits on savings and investments is complex and subject to debate among economists and policy analysts. On the one hand, some argue that deficits can have a negative effect on savings and investments by reducing the pool of funds available for private investment and distorting interest rates. When a government borrows money, it competes with private borrowers for funds, which can result in higher interest rates and reduced investment in the private sector. Additionally, if a government continues to run deficits over an extended period, it may lead to higher levels of borrowing, higher interest payments, and reduced revenue in subsequent years.

On the other hand, some economists argue that government spending can drive economic activity and growth. For example, during periods of economic downturn, a government may intentionally run a deficit to stimulate the economy through increased spending. This is known as countercyclical fiscal policy. In the short term, an increase in the fiscal deficit can give individuals more money to buy and invest, boosting a sluggish economy. However, in the long term, deficits can be detrimental to economic growth and stability if they are not addressed.

The impact of government deficits on savings and investments can also depend on the source of funds for government borrowing. There are three possible sources: households saving more, private firms borrowing less, or borrowing from foreign financial investors. If households save more to lend to the government, it may reduce their ability to invest in other areas. Similarly, if private firms borrow less, it can reduce their investment in their own businesses. Borrowing from foreign financial investors can impact the trade balance, as it increases the inflow of foreign financial capital, which is equal to the trade deficit.

In summary, deficits caused by increased government spending can have both direct and indirect effects on savings and investments. While government spending can stimulate the economy in the short term, it is important to consider the potential long-term consequences on savings and investment behaviour.

Retirement Planning: Where to Invest Your Money

You may want to see also

Frequently asked questions

A government deficit, or budget deficit, occurs when a government's expenses exceed its revenue.

When a government runs a deficit, it borrows money by selling government securities such as Treasury bonds. This reduces the pool of available funds that can be invested in other businesses.

To improve a deficit, a government may cut back on certain expenditures or increase revenue-generating activities. This can result in higher taxes for high-income earners or large corporations, which may affect their ability to invest in new business ventures or hire new employees.

When governments are borrowers in financial markets, there are three possible sources of funds: households saving more, private firms borrowing less, or funds coming from foreign financial investors.

The interest rate paid on loans to the government is a nearly risk-free investment. All other financial instruments must compete with this, so they may need to offer higher interest rates to entice buyers.