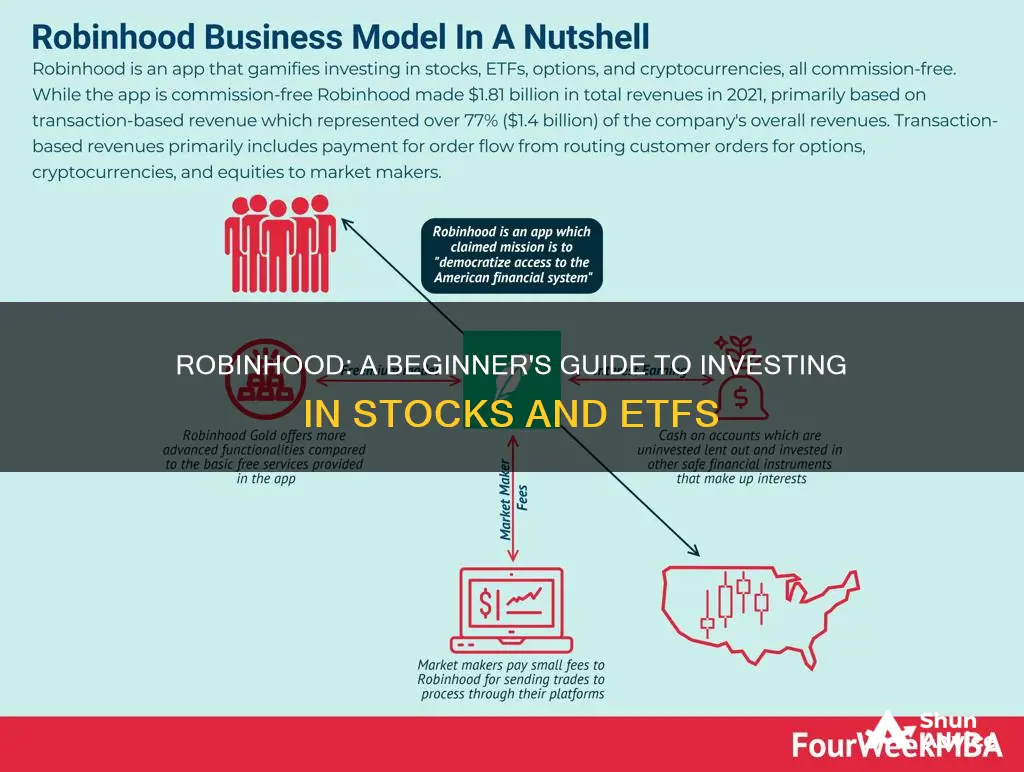

Robinhood is a popular mobile app that allows users to invest in stocks, options, exchange-traded funds (ETFs), and cryptocurrencies. It offers a user-friendly platform that enables individuals to start investing with just a small amount of money, making it accessible to a wide range of investors. The app provides a simple and intuitive interface, where users can easily buy and sell various financial instruments. With Robinhood, you can open an account, deposit funds, and begin investing in just a few steps. The platform also offers educational resources and market insights to help users make informed decisions. Understanding how investing on Robinhood works can be a great first step for anyone looking to enter the world of investing and potentially build their financial portfolio.

What You'll Learn

- Opening an Account: Create a new account, link a bank account, and fund it

- Placing Trades: Use the app to buy/sell stocks, ETFs, and options

- Market Orders and Limits: Choose order types, set price targets, and execute trades

- Fees and Commissions: Understand Robinhood's zero-commission policy and other potential fees

- Research and Education: Access market insights, company profiles, and educational resources

Opening an Account: Create a new account, link a bank account, and fund it

To begin your investing journey on Robinhood, you'll need to open a new account, which is a straightforward process. First, download the Robinhood app on your smartphone or visit their website. You'll be prompted to create an account by entering your email address or phone number. During the sign-up process, you'll be asked to provide some personal information, including your name, date of birth, and Social Security number (or equivalent ID number). This is a standard security measure to comply with regulatory requirements.

Once your account is set up, the next step is to link your bank account. This is essential as it allows you to transfer money into your Robinhood account and start investing. You can link your bank account by providing the necessary details, such as your account number and routing number. Robinhood uses this information to verify your identity and ensure secure transactions. It's important to note that you can link multiple bank accounts to your Robinhood account, providing you with more flexibility for managing your funds.

After linking your bank account, the final step is to fund your Robinhood account. You can do this by transferring money from your linked bank account. Robinhood offers various funding options, including direct deposit, which allows you to set up recurring deposits at regular intervals. Alternatively, you can transfer funds manually by logging into your account and selecting the 'Transfer' or 'Deposit' option. The minimum funding amount is typically low, making it accessible for beginners.

When funding your account, it's a good practice to start with a small amount to get comfortable with the process. You can gradually increase the amount as you become more familiar with investing. Robinhood provides a user-friendly interface, making it easy to monitor your account balance and transaction history. Additionally, they offer educational resources and tutorials to help new investors understand the platform and make informed decisions.

Remember, opening an account on Robinhood is a simple process, and the platform is designed to be intuitive and user-friendly. By following these steps, you'll be well on your way to becoming a Robinhood investor, with the ability to explore various investment opportunities and potentially build your financial portfolio.

Chanel Bags: Fashionable Investment or Money Pit?

You may want to see also

Placing Trades: Use the app to buy/sell stocks, ETFs, and options

To place trades on the Robinhood app, you'll need to follow a few simple steps. First, open the app and log in to your account. Once you're in, you'll see a dashboard with a list of your current positions and a search bar at the top. This search bar is your gateway to the vast array of investments available on the platform.

To initiate a trade, tap the search bar and type in the name of the security you want to buy or sell. This could be a stock, an exchange-traded fund (ETF), or even an option. For example, if you want to buy shares of Apple Inc. (AAPL), simply type "AAPL" into the search bar. The app will display a list of relevant results, including the stock itself, any associated ETFs, and options contracts.

When you've found the specific investment you're interested in, tap on it to view more details. Here, you'll see information such as the current price, the change in price over time, and a summary of the company's performance. You can also access financial data, news, and analyst ratings to make informed decisions.

On the investment's details page, you'll see options to either buy or sell the security. To buy, enter the number of shares or the amount you wish to invest. You can also set a limit order, which allows you to specify the maximum price you're willing to pay. This feature can be useful for buying stocks when you believe their price will rise. Similarly, for selling, you can set a limit order to ensure you get the best possible price.

After confirming your trade details, tap the "Place Order" button. You'll then be prompted to review your order and confirm the transaction. Once confirmed, your trade will be executed, and you'll see the updated balance in your account. Remember, it's essential to monitor your portfolio regularly and stay informed about market trends to make timely adjustments to your investment strategy.

Navigating Ethical Boundaries: Exploring Investment Firms' Halal Status

You may want to see also

Market Orders and Limits: Choose order types, set price targets, and execute trades

When it comes to investing on Robinhood, understanding the different order types and how to set price targets is crucial for executing trades effectively. Robinhood offers two primary order types: Market Orders and Limit Orders, each with its own advantages and use cases.

Market Orders:

A Market Order is an instruction to buy or sell a security at the current market price. This type of order is executed immediately, ensuring that your trade is filled at the best available price in the market at that moment. Market orders are ideal for investors who want to take advantage of immediate price movements and don't mind the potential impact of market volatility. For example, if you want to buy 100 shares of Apple stock, a market order will ensure you get the current market price, which may vary depending on supply and demand. This order type is straightforward and suitable for active traders who want to react quickly to market changes.

Limit Orders:

Limit orders provide more control over the price at which you buy or sell a security. With a limit order, you set a specific price target, and the trade will only be executed if the market reaches or crosses that price point. This strategy is beneficial for investors who want to buy or sell at a particular price or better. For instance, you might set a limit order to buy 100 shares of Tesla at $500 per share. If the stock price reaches or falls below $500, the order will be executed. Limit orders are excellent for long-term investors who want to buy stocks at a lower price or sell when the market is expected to rise. This approach helps avoid potential losses due to market fluctuations.

Setting price targets is a critical aspect of using limit orders effectively. You can choose to set a 'buy' or 'sell' limit order, each with its own considerations. When setting a buy limit, you should consider the current market price and any potential price adjustments. Similarly, for a sell limit order, you need to decide on a price that reflects your investment strategy and risk tolerance. Robinhood's platform provides real-time market data, allowing you to make informed decisions about these price targets.

In summary, Robinhood's order types offer investors flexibility and control over their trades. Market orders provide immediate execution at the current market price, while limit orders enable investors to set specific price targets. Understanding these order types and their applications is essential for anyone looking to navigate the stock market successfully through Robinhood. By choosing the right order type and setting appropriate price targets, investors can make informed decisions and potentially optimize their investment outcomes.

Musk's Next Move: Will Dogecoin Be the Beneficiary of His Investment Magic?

You may want to see also

Fees and Commissions: Understand Robinhood's zero-commission policy and other potential fees

Robinhood has revolutionized the investing world by offering a user-friendly platform with a unique approach to fees and commissions. One of its most notable features is its zero-commission policy, which has attracted many new investors. When you invest through Robinhood, you won't pay any commissions on stock, options, or ETF trades. This is a significant advantage over traditional brokerage firms, which often charge a flat fee or a percentage of the trade value. Robinhood's model allows users to invest without the burden of these additional costs, making it an attractive choice for those looking to start building their portfolios.

However, it's important to understand that while Robinhood doesn't charge traditional trading commissions, there are still some fees associated with certain activities. One such fee is the "payment for order flow" (PFOF) fee, which is a small amount paid by Robinhood to market makers for routing trades to them. This fee is a common practice in the industry and is used to ensure that users can execute their trades efficiently. Robinhood is transparent about this fee and provides detailed information about it on their website, allowing investors to make informed decisions.

In addition to PFOF, Robinhood may also charge fees for certain activities, such as withdrawing funds or using margin. For example, if you choose to withdraw your funds from your Robinhood account, there might be a small fee associated with the process. Similarly, if you opt for margin trading, which allows you to borrow money to invest, there could be interest charges and fees involved. These fees are designed to cover the costs associated with providing these services and are typically disclosed in Robinhood's fee schedule.

It's worth noting that Robinhood's fee structure is designed to be straightforward and transparent. They provide a clear breakdown of their fees on their website, ensuring that users can understand the costs associated with their activities. This transparency is a key aspect of Robinhood's appeal, as it allows investors to make informed choices without hidden surprises. By understanding these potential fees, investors can better manage their portfolios and make the most of Robinhood's zero-commission policy.

In summary, Robinhood's zero-commission policy is a significant advantage for investors, but it's essential to be aware of other potential fees. The payment for order flow (PFOF) fee is a standard industry practice, and Robinhood's transparency regarding this fee is commendable. Additionally, fees for activities like withdrawals and margin trading should be considered. By educating themselves about these fees, investors can make the most of Robinhood's platform and navigate the world of investing with confidence.

Unlocking Impact: Understanding Program-Related Investments

You may want to see also

Research and Education: Access market insights, company profiles, and educational resources

When it comes to investing on Robinhood, understanding the market and making informed decisions is crucial. Robinhood provides a user-friendly platform that offers a range of research and educational tools to help investors navigate the financial markets. Here's an overview of how you can access market insights, company profiles, and educational resources on Robinhood:

Market Insights and News: Robinhood offers a comprehensive news feed that provides real-time market updates, financial news, and industry trends. You can customize your news feed to receive alerts and notifications for specific stocks, sectors, or market events. This feature allows investors to stay informed about market movements, economic indicators, and global events that may impact their investments. By keeping an eye on these insights, you can make more timely and strategic investment choices.

Company Research: The platform provides detailed company profiles, allowing users to explore various aspects of a business. You can access financial information, such as revenue, profit margins, and historical stock performance. Additionally, Robinhood offers insights into a company's management team, board of directors, and corporate governance. This research enables investors to assess the fundamentals of a company, understand its competitive advantage, and make informed decisions regarding buying or selling stocks.

Educational Resources: Robinhood is committed to educating its users about investing and financial literacy. They offer a dedicated learning center with articles, tutorials, and videos covering various topics. These resources include guides on how to read financial statements, understanding market trends, and strategies for different investment styles. The educational section also provides tips on risk management, tax implications, and the basics of stock market investing. By utilizing these resources, investors can enhance their knowledge and develop a more comprehensive understanding of the investment process.

Furthermore, Robinhood's platform often features market commentary and analysis from its team of financial experts. These insights can provide a deeper understanding of market dynamics and help investors identify potential opportunities or risks. The platform may also offer research reports on specific industries or companies, providing in-depth analysis and recommendations.

In summary, Robinhood's research and education features empower investors by providing access to market insights, company profiles, and educational content. These tools enable users to make more informed investment decisions, assess company fundamentals, and stay updated on market trends. By utilizing these resources, investors can enhance their financial knowledge and potentially improve their overall investment outcomes.

Unraveling Edward Jones Investments: A Comprehensive Guide to Their Work

You may want to see also

Frequently asked questions

Getting started on Robinhood is straightforward. First, download the Robinhood app or visit their website and sign up for an account. You'll need to provide some personal information and verify your identity. Once your account is set up, you can link your bank account or card to fund your investments.

Robinhood offers a wide range of investments, including stocks, ETFs (exchange-traded funds), options, and cryptocurrencies. You can buy individual stocks of well-known companies or invest in baskets of securities through ETFs. The platform also allows you to trade options, which are contracts that give you the right to buy or sell an asset at a specific price by a certain date.

Placing an order is simple. Open the app or website, select the 'Trade' tab, choose the investment you want to buy or sell, enter the quantity, and confirm your order. You can also set up recurring investments by scheduling regular purchases at fixed intervals.

Robinhood has a unique business model where it does not charge traditional trading commissions. Instead, they earn revenue through payment for order flow, which means they receive a small fee from market makers for routing trades to them. Additionally, there might be fees for certain activities like wire transfers or account closures.

Robinhood provides a user-friendly interface to monitor your investments. You can view your portfolio, see a list of all your positions, and track the performance of your investments over time. The platform also offers real-time market data and news to help you make informed decisions. You can also set price alerts and create watchlists to stay updated on specific stocks or assets.