Investment is a fundamental concept in finance and economics, representing the act of allocating resources with the expectation of generating an income or profit. It involves committing money or assets to various financial instruments, projects, or ventures with the aim of growing wealth over time. Understanding how investment works is crucial for individuals and businesses alike, as it involves assessing risks, analyzing market trends, and making informed decisions to achieve financial goals. This process often requires careful planning, research, and a strategic approach to navigate the complex world of investments, which can range from stocks and bonds to real estate and alternative assets.

What You'll Learn

Investment Basics: Understanding capital, returns, and risk

Investment is a fundamental concept in finance and economics, representing the act of allocating resources, typically money, with the expectation of generating an income or profit over time. It involves committing funds to various financial instruments, assets, or ventures, aiming to grow wealth and achieve financial goals. Understanding the basics of investment is crucial for anyone looking to manage their money effectively and secure their financial future.

At its core, an investment is a commitment of capital with the primary objective of earning returns. These returns can be in the form of interest, dividends, capital gains, or a combination of these. When you invest, you essentially lend your money to a company, government, or other entity, and in return, you expect to receive a portion of the profits or value appreciation. The key is to strike a balance between the amount of capital you invest and the potential returns you can generate, all while managing the associated risks.

Capital, in the investment context, refers to the money or assets you invest. It can be in the form of cash, stocks, bonds, real estate, or other financial instruments. The amount of capital you invest is a critical decision, as it determines the potential upside and the level of risk you are taking. Generally, the more capital you invest, the higher the potential returns, but also the greater the risk. Diversification is a common strategy to manage risk, where investors spread their capital across various assets to minimize potential losses.

Returns are the gains or profits generated from an investment. They can be realized through various mechanisms. For instance, in the case of stocks, returns can be in the form of dividends paid by the company or capital gains when the stock price increases. Bonds may provide interest payments as returns. Real estate investments can offer rental income and potential property value appreciation. Understanding the different types of returns and how they are calculated is essential for investors to assess the performance of their investments.

Risk is an inherent part of investing and refers to the possibility of losing some or all of the invested capital. It is a critical factor that investors must consider when making investment decisions. There are various types of risk, including market risk, which is the potential for asset prices to fluctuate, and credit risk, which relates to the possibility of default on loan or bond payments. Investors often use risk assessment tools and strategies to manage their exposure and make informed choices. Diversification, as mentioned earlier, is one such strategy to mitigate risk by spreading investments across different asset classes.

In summary, investment basics revolve around understanding capital allocation, returns, and risk. It involves committing capital with the expectation of earning returns, which can be in various forms. Investors must carefully consider the amount of capital to invest, the types of returns they seek, and the associated risks. Effective investment strategies often involve diversification, risk management, and a long-term perspective to navigate the complexities of the financial markets and secure financial success.

Where to Shop the Internet-Famous Brad Blouse

You may want to see also

Types of Investment: Stocks, bonds, real estate, and more

Investment is a fundamental concept in finance, representing the act of allocating resources with the expectation of generating an income or profit. It involves committing money or capital to various assets or ventures with the aim of growing wealth over time. Understanding the different types of investments is crucial for individuals seeking to build their financial portfolios and achieve their financial goals. Here's an overview of some common investment options:

Stocks: Also known as equity investments, stocks represent ownership shares in a company. When you invest in stocks, you become a shareholder, entitling you to a portion of the company's profits and assets. Stocks are typically traded on stock exchanges, and their prices fluctuate based on market conditions, company performance, and investor sentiment. Investing in stocks offers the potential for significant returns but also carries higher risks compared to other asset classes. Diversifying your stock portfolio across various industries and market capitalizations can help manage risk.

Bonds: Bonds are a type of debt investment, where you essentially lend money to a government or corporation. When you buy a bond, you are essentially providing a loan, and in return, the issuer promises to pay you a fixed rate of interest (coupon) at regular intervals until the bond matures. Bonds are generally considered less risky than stocks, especially government bonds, which are backed by the full faith and credit of a government. However, they offer lower potential returns compared to stocks. Bond prices are influenced by interest rate changes, with prices tending to fall when interest rates rise.

Real Estate: Investing in real estate involves purchasing property, such as residential or commercial buildings, land, or real estate investment trusts (REITs). Real estate investments can provide a steady income stream through rent payments and potential capital appreciation over time. Owning rental properties requires significant upfront capital and ongoing management responsibilities. Alternatively, REITs allow investors to invest in large-scale real estate projects without directly owning the property. This investment type offers diversification benefits and can provide a hedge against inflation.

Mutual Funds and Exchange-Traded Funds (ETFs): These are investment funds that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. Mutual funds are managed by professional fund managers, while ETFs track specific market indices or sectors. Both offer a convenient way to invest in a wide range of assets, providing instant diversification. ETFs trade like stocks and offer lower expense ratios compared to mutual funds. These investment vehicles are popular among investors seeking a hands-off approach to portfolio management.

Alternative Investments: This category includes a wide range of investment options that deviate from traditional stocks, bonds, and real estate. Alternative investments can include commodities (such as gold, silver, or agricultural products), futures and derivatives, private equity, venture capital, and even collectibles like art or antiques. These investments often have lower liquidity and may require substantial capital, making them less accessible to the average investor. However, they can provide unique opportunities for diversification and potential high returns.

Each investment type carries its own set of risks and rewards, and the choice depends on an individual's risk tolerance, investment goals, and time horizon. Diversification is a key strategy to manage risk, ensuring that your investment portfolio is well-balanced across different asset classes.

Home Sweet Investment: Why Buying a House is a Smart Financial Move

You may want to see also

Investment Strategies: Diversification, long-term vs. short-term

Investment is a fundamental concept in finance, representing the act of allocating resources, typically money, with the expectation of generating an income or profit over time. It involves committing funds to various financial instruments, assets, or projects with the aim of growing wealth. Understanding investment strategies is crucial for anyone looking to navigate the complex world of finance and make informed decisions about their financial future.

One of the most widely recognized investment strategies is diversification. This approach involves spreading your investments across various asset classes, sectors, and geographic regions to minimize risk. Diversification is based on the principle that different investments perform differently at various times, and by diversifying, investors can reduce the impact of any single investment's poor performance. For example, an investor might allocate a portion of their portfolio to stocks, bonds, real estate, commodities, and alternative investments like derivatives or cryptocurrencies. This strategy ensures that the entire investment is not exposed to the same risks and can provide a more stable return over time.

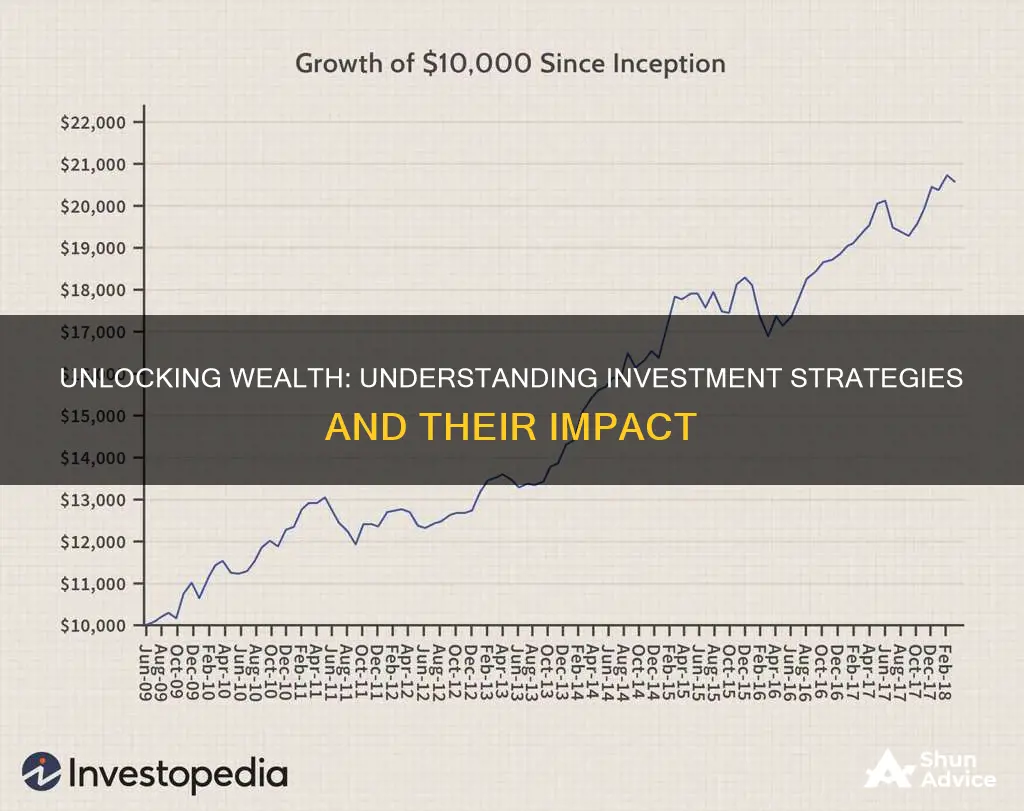

Long-term and short-term investment strategies represent two distinct approaches to managing investments. Long-term investing focuses on holding investments for an extended period, often years or even decades. This strategy is based on the idea that markets tend to trend upwards over the long term, and short-term fluctuations are less significant in the grand scheme of an investment's life. Long-term investors typically aim to buy and hold assets, allowing them to benefit from compound interest and the potential for significant growth over time. This approach is often associated with index funds or exchange-traded funds (ETFs) that track a specific market index, providing broad exposure to the market's performance.

In contrast, short-term investing involves a more active approach, where investors frequently buy and sell assets to capitalize on short-term market movements or price fluctuations. This strategy requires a more dynamic and responsive investment approach, as short-term traders aim to profit from market inefficiencies or news-driven events. Short-term investments often involve higher transaction costs and may require more research and monitoring to identify profitable opportunities. This strategy can be riskier due to the increased volatility and the potential for quick losses if market conditions change unexpectedly.

In summary, investment strategies play a pivotal role in financial planning and wealth management. Diversification is a powerful tool to manage risk by spreading investments across various asset classes, while long-term and short-term strategies cater to different investor goals and risk tolerances. Understanding these concepts is essential for anyone looking to build a robust investment portfolio and navigate the ever-changing financial markets with confidence.

American Fender: Musical Instrument or Investment Opportunity?

You may want to see also

Market Dynamics: Supply and demand, price fluctuations

Understanding market dynamics is crucial for comprehending how investment works and how it influences various economic activities. At the heart of these dynamics are two fundamental forces: supply and demand. These forces are the driving factors that determine the prices of goods and services in a market.

Supply and Demand:

Supply refers to the amount of a product or service that producers are willing and able to offer for sale at various prices in a given period. Demand, on the other hand, represents the quantity of a product or service that consumers are willing and able to purchase at different prices during the same period. The relationship between supply and demand is often depicted by the supply and demand curve, which illustrates how the quantity supplied changes in response to price changes and vice versa. When demand exceeds supply, prices tend to rise, and when supply surpasses demand, prices tend to fall. This dynamic is a key principle in economics and is essential for investors to grasp.

Price Fluctuations:

Price fluctuations are a direct result of the interplay between supply and demand. When there is a high demand for a product or service and a limited supply, prices tend to increase. This can occur during periods of economic growth when consumer spending is high, or due to supply chain disruptions that reduce the availability of goods. Conversely, when supply exceeds demand, prices tend to decrease. This might happen during economic downturns when consumers are more price-sensitive or when there is an oversupply in the market due to increased production or reduced demand for certain products.

Investors closely monitor these price fluctuations as they directly impact the profitability of investments. For instance, in the stock market, a company's share price is influenced by supply and demand factors. If a company's products are in high demand and the supply is stable, the stock price may rise. Conversely, if there is a decrease in demand or an increase in supply, the stock price might fall. Similarly, in the real estate market, property prices are influenced by the balance between the number of buyers and sellers. A limited supply of available properties and high demand from buyers can drive prices up.

Understanding these market dynamics is essential for investors to make informed decisions. By analyzing supply and demand trends, investors can anticipate price movements and adjust their investment strategies accordingly. This knowledge enables them to identify potential opportunities and risks associated with various investments, ensuring a more proactive and successful approach to the world of finance.

Investing Insights: Understanding Buying Power and Its Impact on Your Portfolio

You may want to see also

Investment Risks: Market risk, credit risk, liquidity risk

When considering investments, it's crucial to understand the various risks associated with them. These risks can significantly impact the potential returns and the overall success of an investment strategy. Here, we delve into three key types of investment risks: market risk, credit risk, and liquidity risk.

Market Risk: This is the risk associated with fluctuations in the value of an investment due to changes in the market. It encompasses the potential for an investment to lose value as a result of external factors such as economic conditions, political events, or shifts in investor sentiment. For instance, during a recession, stock prices may decline, and bond prices might fall as interest rates rise. Market risk is inherent in all investments, especially in the stock market, where prices can be volatile and unpredictable. Investors often use diversification strategies to mitigate this risk by spreading their investments across different asset classes, sectors, and geographic regions.

Credit Risk: Credit risk refers to the possibility that a borrower or issuer will fail to meet its financial obligations, leading to a loss for the investor. This risk is particularly relevant in debt investments, such as bonds, where the issuer promises to repay the principal amount and interest according to the terms of the bond. If the issuer defaults or becomes insolvent, investors may lose a portion or all of their investment. Credit risk is often assessed through credit ratings, which provide an indication of the creditworthiness of the borrower. Investors should carefully consider the credit ratings and the financial health of the issuer to make informed decisions.

Liquidity Risk: This type of risk arises when an investor is unable to sell an asset quickly and at a fair price in the market. Liquidity is crucial as it determines how easily an investment can be converted into cash without incurring significant losses. Highly liquid assets, such as stocks and bonds of well-known companies, can be sold relatively quickly and at prices close to their market value. In contrast, illiquid investments, like certain real estate or private equity, may take longer to sell and could result in losses due to the need for specialized buyers. Investors should assess the liquidity of their investments to ensure they can access their funds when needed without incurring substantial costs.

Understanding and managing these investment risks are essential for investors to make informed decisions and build a robust investment portfolio. By recognizing the potential pitfalls, investors can employ strategies to minimize losses and maximize returns. It is also advisable to regularly review and rebalance investments to adapt to changing market conditions and ensure the portfolio aligns with one's risk tolerance and financial goals.

Pelosi's Portfolio: What's She Buying?

You may want to see also

Frequently asked questions

Investment refers to the act of allocating resources, typically money, with the expectation of generating an income or profit over time. It involves committing funds to various financial instruments, assets, or ventures to achieve financial growth and security.

Investment operates through a process of capital allocation and risk management. Investors identify opportunities to invest in assets like stocks, bonds, real estate, or businesses. These investments are then managed and monitored to ensure they appreciate in value or provide regular returns. The goal is to grow the initial investment over the long term while mitigating potential risks.

Investing offers several advantages. Firstly, it provides an opportunity to build wealth over time through the potential for capital appreciation and regular income. Secondly, it allows individuals to diversify their portfolios, reducing risk by spreading investments across different asset classes. Investing also enables people to achieve financial goals, such as retirement planning, education funding, or purchasing assets.

There are numerous investment strategies employed by individuals and institutions. Some popular approaches include value investing, which involves buying undervalued assets; growth investing, focusing on companies with high growth potential; and dividend investing, targeting companies that pay regular dividends. Other strategies include index investing, following a specific market index, and active management, where investors actively select and manage individual securities.