Investing can be a daunting concept for beginners, but understanding the basics can be a powerful tool for building wealth. This guide will provide an introduction to the world of investing, covering essential concepts such as asset allocation, diversification, and risk management. We'll explore different investment vehicles, including stocks, bonds, and mutual funds, and explain how they work, their potential risks and rewards, and how to get started with a beginner-friendly approach. By the end of this guide, you'll have a solid foundation to begin your investment journey with confidence.

What You'll Learn

- Understanding the Basics: Learn the core concepts of investing, like stocks, bonds, and mutual funds

- Setting Financial Goals: Define your investment goals and risk tolerance to create a plan

- Choosing Investment Vehicles: Explore different investment options like stocks, bonds, ETFs, and mutual funds

- Risk and Reward: Understand the relationship between risk and potential returns in the stock market

- Diversification and Portfolio Management: Learn how to diversify investments and manage a balanced portfolio for long-term success

Understanding the Basics: Learn the core concepts of investing, like stocks, bonds, and mutual funds

Investing is a powerful tool to grow your wealth over time, but it can seem daunting for beginners. The core concepts of investing include understanding stocks, bonds, and mutual funds, which are the building blocks of the financial markets.

Stocks, also known as shares or equities, represent ownership in a company. When you buy a stock, you become a shareholder and have a claim on a portion of the company's assets and profits. Stocks are typically traded on stock exchanges, and their prices fluctuate based on supply and demand, as well as various economic and company-specific factors. For example, if a tech company releases a groundbreaking product, its stock price may rise as investors anticipate increased demand and higher profits.

Bonds, on the other hand, are a type of debt security. When you invest in a bond, you are essentially lending money to a government or corporation. In return, the borrower promises to pay you back the principal amount (the initial investment) plus interest over a specified period. Bonds are generally considered less risky than stocks, as they provide a steady stream of income through interest payments and the return of the principal at maturity.

Mutual funds are a basket of different securities, such as stocks, bonds, or a combination of both. When you invest in a mutual fund, you own a small portion of each security within the fund. Mutual funds are managed by professional fund managers who decide which securities to include in the fund and when to buy or sell them. This diversification allows investors to gain exposure to a wide range of assets without having to select individual securities.

Understanding these core concepts is essential for beginners to start their investment journey. It's important to remember that investing involves risk, and prices can go up or down. Diversification, which means spreading your investments across different asset classes and companies, is a key strategy to manage risk. Additionally, long-term investing, holding your investments for extended periods, can help smooth out short-term market fluctuations and potentially yield better returns over time.

Retirement Reinvented: A Guide to Investing 1 Crore for a Secure Future

You may want to see also

Setting Financial Goals: Define your investment goals and risk tolerance to create a plan

When starting your investment journey, setting clear financial goals is crucial. These goals will guide your strategy and help you stay focused on your objectives. Begin by asking yourself what you want to achieve through investing. Are you saving for a specific purchase, such as a house or a new car? Or are you aiming for long-term financial security and retirement planning? Defining these goals will help you determine the appropriate investment timeline and the level of risk you're willing to take.

Risk tolerance is a critical aspect of investing. It refers to your ability to withstand fluctuations in the market and your emotional response to potential losses. Some investors are more risk-averse, preferring stable, low-risk investments, while others are comfortable with higher-risk, potentially higher-reward options. Understanding your risk tolerance is essential to creating a sustainable investment strategy. For instance, if you have a low-risk tolerance, you might opt for bonds or savings accounts, which offer more security but potentially lower returns. On the other hand, if you're willing to take on more risk for potentially greater gains, you could consider stocks, real estate, or alternative investments.

To set your risk tolerance, consider your financial situation, investment time horizon, and personal circumstances. Younger investors often have a higher risk tolerance since they have more time to recover from potential market downturns. As you get closer to retirement, your risk tolerance may decrease, favoring more conservative investments. It's also important to regularly review and adjust your risk tolerance as your financial goals and life events change.

Creating a plan based on your defined goals and risk tolerance is the next step. This plan will outline the specific investments you should consider, the amount you should invest, and the timeline for achieving your goals. For example, if your goal is to buy a house in five years, you might allocate a portion of your income to a savings account for a down payment and invest the rest in a mix of stocks and bonds to grow your wealth over time.

Remember, investing is a long-term commitment, and your financial goals should be flexible and adaptable. Regularly review your progress, make adjustments as needed, and stay informed about market trends and economic changes that might impact your investments. By setting clear goals, understanding your risk tolerance, and creating a well-thought-out plan, you'll be on the right path to becoming a successful investor.

Who's Saving, Not Investing: A Money Mindset Shift

You may want to see also

Choosing Investment Vehicles: Explore different investment options like stocks, bonds, ETFs, and mutual funds

When it comes to investing for beginners, understanding the various investment vehicles available is crucial. Each option has its own characteristics, risks, and potential rewards, and choosing the right one depends on your financial goals, risk tolerance, and investment horizon. Here's an overview of some common investment vehicles to help you make an informed decision:

Stocks: Stocks, also known as shares or equities, represent ownership in a company. When you buy a stock, you become a shareholder and have a claim on a portion of the company's assets and profits. Stocks offer the potential for significant returns over time, as their value can increase due to various factors such as company growth, market trends, and economic conditions. However, they also come with higher risk. Stock prices can be volatile, and there's always the possibility of losing some or all of your investment. Diversification is key when investing in stocks; consider spreading your investments across different companies and sectors to manage risk.

Bonds: Bonds are essentially loans made to governments or corporations. When you buy a bond, you are essentially lending money to the issuer in exchange for a fixed rate of interest (coupon) over a specified period. Bonds are generally considered less risky than stocks, as they provide a steady income stream and the principal amount is typically returned at maturity. Government bonds are often seen as a safe haven, while corporate bonds may offer higher yields but with increased risk. Bond prices can fluctuate based on interest rate changes and the creditworthiness of the issuer.

Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They are baskets of securities that track an index, sector, commodity, or other financial metrics. ETFs offer diversification and are generally more cost-effective than actively managed mutual funds. They provide an easy way to invest in a specific market or asset class. For example, an ETF might track the S&P 500 index, allowing you to own a diversified portfolio of 500 large-cap U.S. companies. ETFs are known for their low expense ratios and can be traded throughout the day, providing flexibility.

Mutual Funds: Mutual funds pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other assets. A professional fund manager makes investment decisions on behalf of the group. Mutual funds offer instant diversification, making them less risky than investing in individual stocks. They are suitable for beginners as they provide an easy way to access a wide range of investments. However, they may come with higher management fees compared to ETFs. There are various types of mutual funds, including equity funds, bond funds, and balanced funds, each with its own investment strategy.

When choosing an investment vehicle, consider your investment goals, risk tolerance, and time horizon. Diversification is a key strategy to manage risk, so consider combining different investment options to create a well-rounded portfolio. It's also essential to stay informed about market trends, economic conditions, and the performance of your investments to make timely adjustments as needed. Remember, investing is a long-term journey, and patience is often rewarded.

Contracts for Difference: Unlocking Investment Opportunities

You may want to see also

Risk and Reward: Understand the relationship between risk and potential returns in the stock market

The stock market is a complex and dynamic environment where investors seek to grow their wealth by purchasing shares in companies. At its core, investing involves a fundamental trade-off between risk and reward. Understanding this relationship is crucial for beginners as it forms the basis of their investment strategy and decision-making process.

Risk, in the context of investing, refers to the uncertainty and potential for loss associated with an investment. It encompasses various factors such as market volatility, company-specific risks, economic conditions, and geopolitical events. When you invest in stocks, you are essentially buying a piece of a company, and the performance of that investment is tied to the company's success and the overall market conditions. Higher-risk investments often offer the potential for greater returns, but they also come with a higher chance of loss. For example, investing in small-cap stocks or startups may yield significant gains if the company succeeds, but it also carries a higher risk of the company failing or performing poorly.

On the other hand, reward in investing is the potential for capital appreciation and income generation. When you buy stocks, you expect the value of your investment to increase over time, either through the company's growth or by selling the shares at a higher price. Additionally, investors can earn dividends, which are a portion of the company's profits distributed to shareholders. The relationship between risk and reward is directly proportional; as risk increases, the potential for higher returns also increases. However, this is not a linear relationship, and there is no guarantee that higher-risk investments will always result in greater rewards.

Beginners should approach the stock market with a long-term perspective, understanding that short-term fluctuations are common and can be managed through a well-diversified portfolio. Diversification is a key strategy to manage risk. By investing in a variety of companies and sectors, investors can reduce the impact of any single investment's poor performance on their overall portfolio. This approach ensures that the risk is spread across multiple assets, and the potential rewards are still significant.

In summary, for beginners, grasping the concept of risk and reward is essential. It involves recognizing that higher-risk investments can lead to greater potential returns but also come with increased uncertainty. By educating themselves, diversifying their portfolios, and adopting a long-term investment strategy, beginners can navigate the stock market with a better understanding of the risks and rewards involved, ultimately working towards achieving their financial goals.

Mutual of America: Worth the Investment?

You may want to see also

Diversification and Portfolio Management: Learn how to diversify investments and manage a balanced portfolio for long-term success

Investing is a powerful tool to grow your wealth over time, but it can also be a complex process, especially for beginners. One of the fundamental principles to master is diversification, which is the practice of spreading your investments across various asset classes, sectors, and geographic regions. This strategy is crucial to managing risk and maximizing returns. Here's a guide to understanding diversification and portfolio management for long-term success.

Diversification aims to reduce the impact of any single investment's performance on your overall portfolio. By allocating your capital across different assets, you can smooth out the volatility and potential losses associated with individual investments. For instance, if you invest solely in stocks, a downturn in the stock market could significantly affect your portfolio. However, by diversifying into bonds, real estate, or commodities, you create a more balanced approach. This way, if one asset class underperforms, others may compensate, leading to more stable returns.

To start diversifying, consider the following asset classes:

- Stocks: Equities represent ownership in a company and offer the potential for high returns but also come with higher risk.

- Bonds: These are debt instruments issued by governments or corporations, providing a steady income stream and considered less risky than stocks.

- Real Estate: Investing in property can offer both capital appreciation and rental income, but it requires a significant amount of capital.

- Mutual Funds or ETFs: These are investment funds that hold a basket of securities, allowing investors to diversify their portfolios with a single purchase.

Portfolio management is the art of organizing and structuring your investments to achieve your financial goals. It involves regular review and adjustment of your asset allocation to ensure it aligns with your risk tolerance, time horizon, and objectives. Here are some key steps to effective portfolio management:

- Define Your Goals: Determine your investment goals, whether it's saving for retirement, a child's education, or a specific financial target.

- Assess Risk Tolerance: Understand your risk tolerance, which is your ability to withstand market fluctuations without emotional distress. This will guide your asset allocation.

- Create a Diversified Portfolio: Allocate your investments across different asset classes based on your risk tolerance and goals. Regularly review and rebalance your portfolio to maintain this allocation.

- Monitor and Adjust: Keep track of your investments' performance and make adjustments as needed. This may include buying more of underperforming assets or selling those that have exceeded your target returns.

- Stay Informed: Continuously educate yourself about the markets and economic trends. This knowledge will help you make informed decisions and adapt your portfolio strategy.

In summary, diversification is a key strategy to manage risk and optimize returns in investing. By allocating your investments across various asset classes, you can create a balanced portfolio that withstands market volatility. Portfolio management involves regular review and adjustment to ensure your investments align with your financial goals and risk tolerance. Remember, investing is a long-term journey, and a well-diversified portfolio can be your best ally in achieving financial success.

Beyond the Desk: Investment Bankers' Extracurricular Engagements

You may want to see also

Frequently asked questions

Investing is the act of allocating money with the expectation of generating an income or profit. It involves purchasing assets such as stocks, bonds, or real estate, which can appreciate in value over time. Investing is a powerful tool to grow your wealth, achieve financial goals, and secure your financial future.

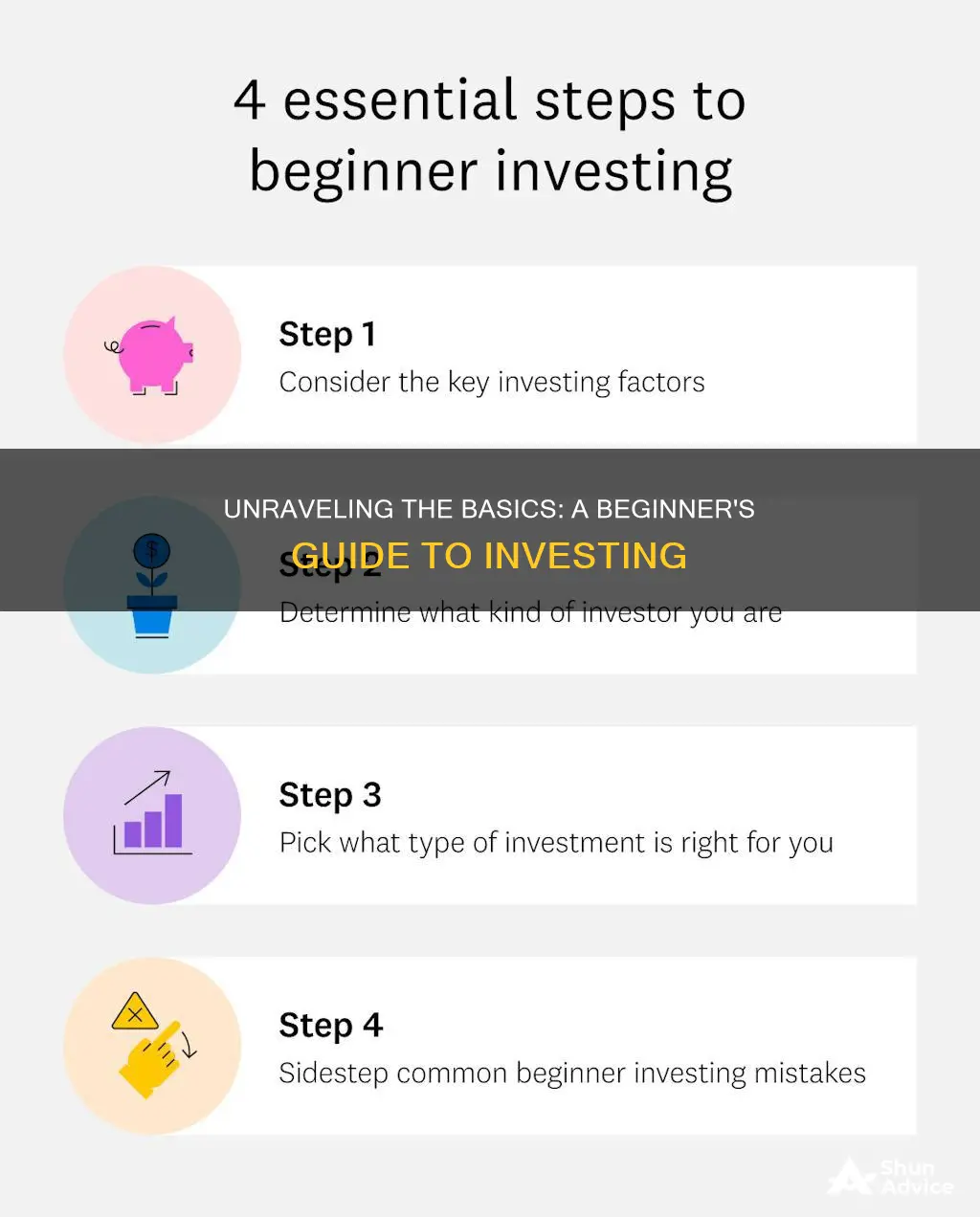

Starting your investment journey can seem daunting, but it's easier than you might think. Here's a simple guide: First, define your financial goals and risk tolerance. Then, open a brokerage account with a reputable online or full-service broker. Research and choose investments that align with your goals and risk profile. Consider starting with a diversified portfolio, such as index funds or exchange-traded funds (ETFs), which offer broad market exposure.

For beginners, there are several investment options to consider:

- Stocks: Ownership shares in companies, allowing you to benefit from their growth.

- Bonds: Lender's loan to a company or government, offering regular interest payments.

- Mutual Funds: Pools of money from many investors to invest in a diversified portfolio.

- ETFs: Similar to mutual funds but trade like stocks, offering diversification.

- Real Estate: Investing in properties can provide rental income and potential capital appreciation.

Risk management is crucial for beginners to protect their capital and achieve long-term success. Here are some strategies:

- Diversification: Spread your investments across different asset classes and sectors to reduce risk.

- Asset Allocation: Determine your risk tolerance and allocate your portfolio accordingly (e.g., more stocks for growth, bonds for stability).

- Regular Review: Periodically assess your investments and adjust your portfolio as needed to stay aligned with your goals.

- Emergency Fund: Maintain a separate savings account for unexpected expenses to avoid selling investments prematurely.

Understanding tax considerations is essential for investors. Here's a brief overview:

- Capital Gains Taxes: Taxes applied when you sell investments for a profit. The rate depends on your income and holding period.

- Dividend Taxes: Taxes on dividends received from stocks or mutual funds.

- Tax-Advantaged Accounts: Consider investing in tax-efficient accounts like IRAs or 401(k)s, which offer tax benefits to help grow your savings.

- Consult a Tax Professional: For complex tax situations, it's advisable to seek advice from a qualified tax advisor.