Investment valuation is a critical process in finance that determines the fair value of an investment, such as stocks, bonds, or real estate. It involves assessing the current worth of an asset or security based on various factors and methodologies. The goal is to provide an accurate estimate of the investment's value, which is essential for investors to make informed decisions. This process can be complex and often requires a deep understanding of financial markets, economic trends, and the specific characteristics of the investment being valued. By employing different valuation techniques, investors can analyze and compare investments, helping them make strategic choices to optimize their portfolios.

What You'll Learn

- Discounted Cash Flow (DCF) Analysis: Estimating the present value of future cash flows to determine an investment's worth

- Multiples Approach: Using financial ratios like P/E or P/S to value companies based on industry comparables

- Asset-Based Valuation: Valuing investments by assessing the value of their underlying assets

- Relative Valuation: Comparing a company's valuation metrics to those of similar companies in the same industry

- Market Multiple Analysis: Examining market-wide multiples to gauge the overall valuation of an asset class

Discounted Cash Flow (DCF) Analysis: Estimating the present value of future cash flows to determine an investment's worth

Discounted Cash Flow (DCF) analysis is a fundamental method used in investment valuation to estimate the current worth of a company or an investment by considering the time value of money. This approach involves forecasting a company's future cash flows and then discounting them back to the present using an appropriate discount rate. The primary objective is to determine the fair value of an investment by assessing the present value of the expected cash inflows.

The process begins with a comprehensive financial forecast, which includes projecting future revenue, expenses, and cash flows over a specified period. This forecast serves as the basis for calculating the investment's value. The next step is to determine the appropriate discount rate, which is a critical factor in the DCF analysis. The discount rate represents the minimum rate of return an investor could expect from an alternative investment of equal risk. It is typically based on the company's weighted average cost of capital (WACC) or the cost of equity, depending on the type of investment.

Once the discount rate is established, the analyst applies the discounting process to each future cash flow. This involves multiplying each cash flow by the appropriate discount factor, which is derived from the discount rate and the number of periods until the cash flow is received. The result is a series of present values for each cash flow. By summing up these present values, investors can estimate the total present value of the investment's future cash flows.

A key aspect of DCF analysis is sensitivity analysis, which involves assessing the impact of changes in assumptions on the final valuation. This analysis helps investors understand the robustness of the investment's value and identify potential risks and uncertainties. For instance, varying the discount rate or cash flow projections can provide insights into how sensitive the valuation is to different scenarios.

In summary, Discounted Cash Flow analysis is a powerful tool for investment valuation, allowing investors to make informed decisions by evaluating the present value of future cash flows. It requires careful financial forecasting, selection of an appropriate discount rate, and sensitivity analysis to ensure a comprehensive understanding of the investment's worth. This method is widely used across industries to assess the attractiveness of various investment opportunities.

Pyramid Schemes: Why the Appeal?

You may want to see also

Multiples Approach: Using financial ratios like P/E or P/S to value companies based on industry comparables

The multiples approach is a fundamental method in investment valuation, allowing investors to assess the value of a company by comparing it to similar businesses within its industry. This technique is particularly useful when direct comparables are scarce or when a company's unique characteristics make it challenging to apply traditional valuation methods. The core idea is to use financial ratios, such as the Price-to-Earnings (P/E) ratio and the Price-to-Sales (P/S) ratio, to establish a valuation multiple. These ratios provide a standardized way to compare a company's valuation to that of its peers.

In this approach, the P/E ratio is calculated by dividing a company's share price by its earnings per share (EPS). It indicates how much investors are willing to pay for each dollar of the company's earnings. For instance, if Company A has a P/E ratio of 20 and Company B has a P/E ratio of 15, it suggests that investors are willing to pay more for each dollar of earnings for Company A compared to Company B. This comparison can help investors determine if a company is overvalued or undervalued relative to its industry.

Similarly, the P/S ratio is derived by dividing the company's share price by its revenue per share (RPS). This ratio is particularly useful when a company's profitability is not the primary focus, or when comparing companies with different profit margins. For example, if two tech companies have similar revenue but one has a higher profit margin, the P/S ratio can provide a more accurate comparison of their valuations.

To apply the multiples approach, investors start by identifying a set of comparable companies within the same industry. These comparables should have similar business models, market positions, and growth prospects. Once the comparable companies are identified, their financial ratios (P/E and P/S) are calculated and compared to the target company's ratios. By analyzing these multiples, investors can gain insights into the target company's relative valuation and make informed decisions about its investment potential.

This method is widely used in the investment community due to its simplicity and effectiveness in providing a quick assessment of a company's value. It allows investors to leverage the collective knowledge of industry experts and peers, making it a valuable tool in the investment valuation process. However, it's important to note that the multiples approach should be used in conjunction with other valuation techniques and fundamental analysis to ensure a comprehensive understanding of a company's worth.

Merrill Edge Cash Availability: When Can You Invest?

You may want to see also

Asset-Based Valuation: Valuing investments by assessing the value of their underlying assets

Asset-based valuation is a method of assessing the value of an investment by examining the worth of its underlying assets. This approach is particularly useful for investments that are closely tied to tangible or identifiable assets, such as real estate, commodities, or specific intellectual property. The core principle is to determine the fair value of these assets and then use that as a basis for valuing the investment itself. Here's a detailed breakdown of the process:

When performing an asset-based valuation, the first step is to identify and list all the tangible assets associated with the investment. This could include physical properties like land, buildings, machinery, or even specific items like artwork or collectibles. For intangible assets, this might involve intellectual property, patents, trademarks, or proprietary data. The key is to have a comprehensive inventory of all relevant assets.

Next, each asset is evaluated individually to determine its current market value. This requires a thorough understanding of the asset's condition, location, demand, and any unique characteristics that could influence its price. For instance, a real estate investment would involve assessing the property's size, location, recent sales data, and any recent renovations or improvements. The valuation process here is similar to what a professional appraiser would do for a bank loan or insurance purposes.

Once the individual asset values are established, the sum of these values provides an estimate of the investment's overall worth. This method is especially valuable for investors who want a conservative approach, as it focuses on the tangible and measurable aspects of the investment. It also provides a more concrete foundation for decision-making, especially in industries where assets are easily identifiable and valued.

However, it's important to note that asset-based valuation might not capture the full picture, especially for investments in intangible assets or those with a strong market presence. In such cases, other valuation methods, such as market-based or income-based approaches, might be more appropriate. Nonetheless, asset-based valuation remains a valuable tool for investors seeking a more tangible and asset-centric perspective on their investments.

Investing Strategies for Volatile Times

You may want to see also

Relative Valuation: Comparing a company's valuation metrics to those of similar companies in the same industry

Relative valuation is a fundamental concept in investment analysis, allowing investors to assess the value of a company by comparing its financial metrics to those of similar companies within the same industry. This approach is particularly useful when direct comparisons to the company's own historical data are not feasible or meaningful. By analyzing relative metrics, investors can gain insights into a company's performance, growth prospects, and overall attractiveness compared to its peers.

The process begins with identifying a group of comparable companies, often referred to as a peer group or industry comparables. These companies should operate in the same industry, have similar business models, and be exposed to comparable economic and market conditions. The goal is to create a dataset that provides a fair and relevant basis for comparison. For instance, if you are valuing a technology company, you might include other tech firms with similar revenue streams, product offerings, and market positions in your peer group.

Once the peer group is established, various financial ratios and metrics can be calculated and compared. Common valuation metrics used in relative valuation include price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, enterprise value to EBITDA, and return on equity (ROE). These ratios provide a snapshot of how a company's valuation compares to its industry peers. For example, a higher P/E ratio relative to the industry average might suggest that investors are paying a premium for the company's earnings, indicating potential overvaluation.

The analysis doesn't stop at identifying over- or undervaluation. It also involves understanding the reasons behind any deviations from the industry norm. This could be due to various factors such as competitive advantage, market share, brand recognition, or cost structures. For instance, a company with a unique product offering or a strong market position might command a higher valuation due to its ability to generate higher revenues and profits.

Relative valuation is a powerful tool for investors as it provides a framework to assess a company's value in the context of its industry. It helps in making informed investment decisions by identifying companies that are potentially undervalued or overvalued relative to their peers. However, it's important to remember that relative valuation should not be the sole criterion for investment. Other factors, such as absolute financial performance, growth prospects, and management quality, should also be considered to make a well-rounded investment analysis.

Investing: Nice People, Psychopaths?

You may want to see also

Market Multiple Analysis: Examining market-wide multiples to gauge the overall valuation of an asset class

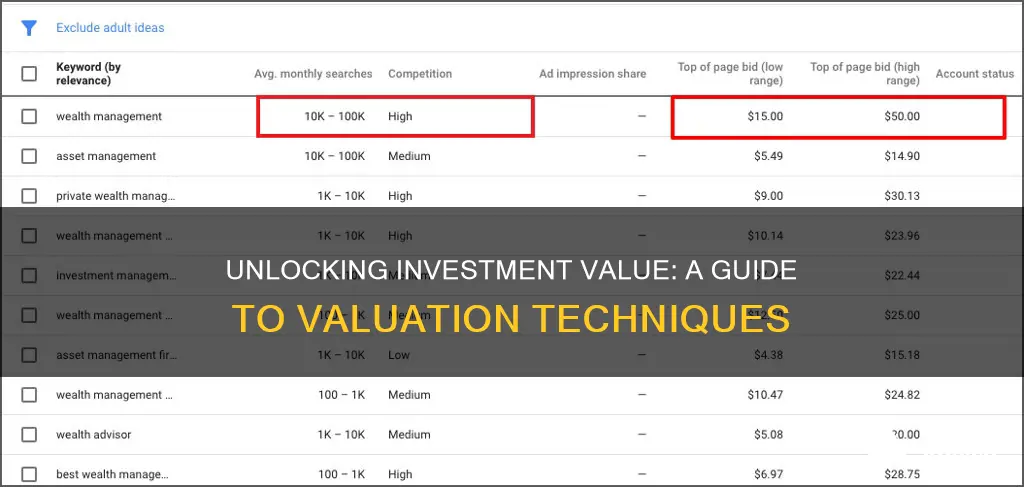

Market Multiple Analysis is a powerful tool for investors to assess the overall health and value of an asset class within a market. This method involves examining various financial metrics, often referred to as multiples, which are derived from market data and applied across an entire sector or market. The primary goal is to provide a comprehensive view of the valuation of assets, allowing investors to make informed decisions.

In this analysis, investors look at key financial ratios and metrics that are used to value individual companies within an asset class. These multiples can include price-to-earnings (P/E) ratios, price-to-book (P/B) ratios, enterprise value multiples, and others. By calculating these multiples for a large number of companies within the same sector or market, investors can identify patterns and trends. For instance, they might compare the average P/E ratio of technology companies over a specific period to gauge if the current market valuation is high or low relative to historical norms.

The process begins with gathering financial data for a large sample of companies within the target asset class. This data typically includes historical financial statements, such as income statements, balance sheets, and cash flow statements. Investors then calculate the relevant multiples for each company, ensuring consistency in the calculation methods. Once the data is compiled, investors can perform statistical analysis to determine the average, median, and other key metrics for the multiples across the entire sample.

One of the critical aspects of market multiple analysis is identifying outliers and anomalies. Outliers may indicate companies with unique characteristics or those that are temporarily undervalued or overvalued. Investors should also consider the qualitative factors that could influence the multiples, such as industry trends, regulatory changes, and macroeconomic factors. By combining quantitative analysis with qualitative insights, investors can make more accurate valuations.

Additionally, market multiple analysis is particularly useful for comparing different asset classes or sectors. Investors can create a benchmark by calculating the average multiples for a broad market index or a specific sector. This benchmark allows for easy comparison of individual companies or asset classes against the market as a whole. For instance, if the average P/E ratio for the S&P 500 index is 20, an investor can determine if a particular stock's P/E ratio is relatively high or low compared to the market's valuation.

In summary, market multiple analysis is a comprehensive approach to investment valuation, providing insights into the overall valuation of an asset class. By examining market-wide multiples, investors can identify trends, compare valuations, and make informed decisions. This method is a valuable tool for both individual investors and institutional investors, enabling them to navigate the complex world of investment valuation with a more strategic and data-driven approach.

Home Truths: Unraveling the Risks of Property Investment

You may want to see also

Frequently asked questions

Investment valuation is the process of determining the fair value of an investment or a company. It involves analyzing various financial and non-financial factors to estimate the worth of an asset or a business. The goal is to provide an accurate and reliable estimate of the value, which can be used for decision-making, pricing, or financial reporting purposes.

Investors use different valuation techniques and models to assess the value of an investment. Common methods include comparative analysis, where the investor compares the target company's financial metrics with similar companies in the same industry. Other approaches include discounted cash flow (DCF) analysis, which estimates the present value of future cash flows, and market-based methods like comparable company analysis or precedent transactions. These techniques help investors understand the investment's potential and make informed choices.

Investment valuation takes into account numerous factors, including financial metrics such as revenue, earnings, cash flow, and financial ratios. Non-financial factors like brand value, market position, competitive advantage, and management quality are also crucial. Additionally, industry trends, economic conditions, regulatory environment, and market sentiment play a significant role in the valuation process. A comprehensive analysis of these factors provides a more accurate assessment of the investment's value.

Investment valuation is essential for several reasons. Firstly, it helps investors make informed decisions by providing a clear understanding of the investment's worth. Accurate valuation ensures that investors pay a fair price for an asset, reducing the risk of overpaying. Secondly, it assists in comparing different investment opportunities and evaluating their potential returns. Moreover, valuation is crucial for financial reporting, regulatory compliance, and determining the overall financial health of a company.