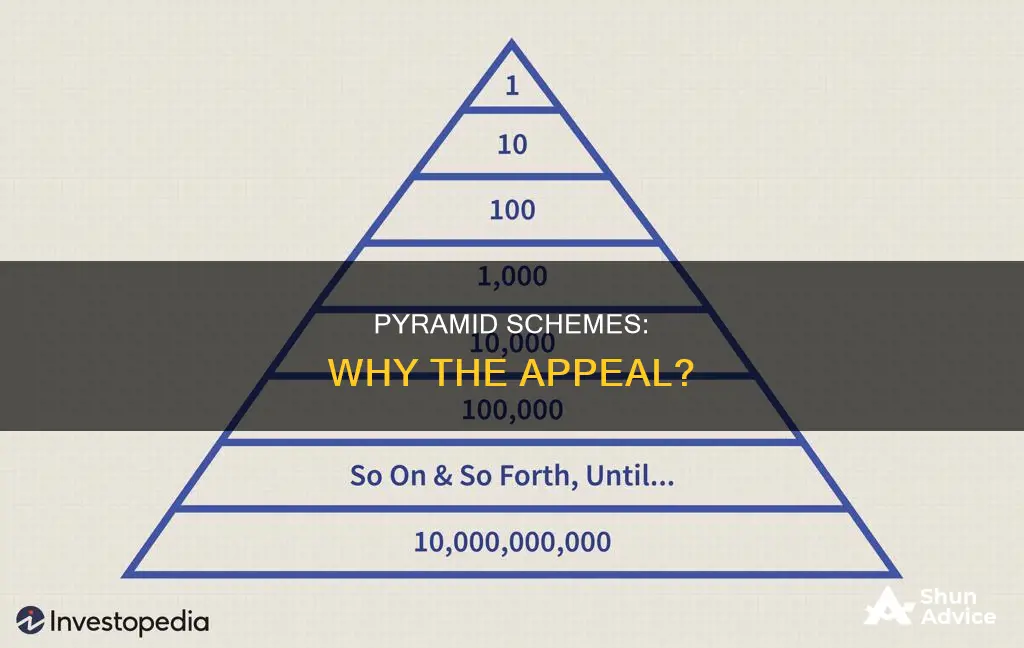

It is important to note that not everyone who invests in a pyramid scheme is stupid. There are many psychological and social factors at play that can cause even intelligent people to fall for these scams. That being said, pyramid schemes are fraudulent investment operations that promise high returns but rely solely on recruiting new participants to sustain themselves. The schemes are called pyramids because they require an ever-increasing number of investors at each level to support the scheme, forming a pyramid-like structure. The small group of initial promoters at the top profits from the investments of the growing base of later investors. Eventually, the scheme becomes unsustainable, and most members are unable to profit, making pyramid schemes illegal in many places.

What You'll Learn

The allure of quick and easy money

Pyramid schemes are fraudulent investment schemes that promise high returns with minimal effort or risk. They prey on people's natural desire for shortcuts and quick fixes to their financial problems, especially when they are facing economic hardship or are seeking ways to improve their financial situation. The promise of "getting rich quick" can be very tempting and cause people to make irrational decisions.

The prospect of earning a substantial amount of money with little effort is enticing, especially for those who are unemployed or struggling financially. Pyramid schemes exploit this vulnerability by presenting themselves as a blessing in disguise, promising a good amount of money with little investment of time or resources. They deceive people into believing that they can achieve financial independence and become their own boss by participating in their scheme.

The promise of quick and easy wealth can cloud rational judgment. People may believe that they are lucky to have stumbled upon such an opportunity and don't want to miss out on the potential gains. They may also trust the judgment of friends or family members who introduce them to the scheme, assuming that those close to them wouldn't involve them in anything illegal or harmful. This trust can lead them to lower their guard and make them more receptive to the scheme's pitch.

EPZ Investments: Why People Take the Risk

You may want to see also

Manipulative techniques

Pyramid schemes are a type of fraudulent investment scheme that relies on recruiting new participants to sustain the operation. The operators of these schemes often use manipulative techniques to exploit human psychology and convince people to join. Here are some of the common manipulative tactics employed by pyramid scheme operators:

- Love Bombing: Pyramid scheme operators often use excessive flattery and attention to make potential recruits feel important and valued. This tactic helps to lower their guard and makes them more receptive to the scheme.

- Emotional Manipulation: Operators may prey on people's emotions, such as their fear of missing out (FOMO) or their desire for financial independence. They create a sense of urgency and scarcity, emphasizing that the opportunity is once-in-a-lifetime. This taps into people's fear of missing out on a potentially life-changing chance.

- Peer Pressure: Pyramid schemes often target individuals within close-knit communities or social circles. When a trusted member of the community is involved, others are more likely to follow suit, assuming that it must be legitimate if their friends or acquaintances are participating.

- Social Proof: Seeing friends or acquaintances apparently succeeding in the scheme reinforces the idea that it is a legitimate opportunity. People tend to rely on social proof, thinking, "If they're making money, it must be real." This herd mentality can lead them to overlook warning signs.

- Cognitive Dissonance: Once individuals have invested time or money into the scheme, they may experience cognitive dissonance, holding contradictory beliefs. To resolve this discomfort, they may rationalize their involvement, convincing themselves of the scheme's legitimacy. Admitting they've made a mistake becomes psychologically challenging.

- Lack of Financial Literacy: Pyramid scheme promoters make deceptive claims that prey on individuals with limited financial knowledge. These individuals may not recognize the red flags and, instead, focus on the enticing promises of quick wealth.

- Overconfidence: Some people believe they are too smart to be scammed and have a keen eye for detecting scams. This overconfidence can lead them to dismiss warning signs and assume they are immune to fraud.

Gov't Spending: Young vs. Old

You may want to see also

Lack of financial literacy

The intricacies of investments and financial schemes can be challenging to navigate for those without a strong financial background. Pyramid schemes often present themselves as lucrative opportunities, promising high returns with minimal effort. Without adequate financial literacy, individuals may not realize that these schemes are unsustainable and illegal in many jurisdictions.

Financial literacy empowers individuals to make informed decisions about their money. It involves understanding various financial concepts, such as risk assessment, diversification, and return on investment. Individuals with a solid financial education can better evaluate investment opportunities and identify potential scams. They are more likely to recognize the red flags associated with pyramid schemes, such as an excessive focus on recruitment rather than product sales.

Additionally, financial literacy helps individuals understand the importance of conducting due diligence before investing. This includes researching the company, understanding the products or services being offered, and assessing the legitimacy of the opportunity. Individuals with a strong financial background are more likely to approach investment opportunities with a critical eye, scrutinizing the claims made by promoters and seeking out independent sources of information.

Moreover, financial literacy can help individuals spot unrealistic promises and understand the risks associated with get-rich-quick schemes. Pyramid schemes often prey on individuals facing financial difficulties or seeking quick solutions to their economic situation. With a solid financial education, individuals can better assess the feasibility of investment opportunities and make more informed decisions about their money.

In conclusion, lack of financial literacy is a critical factor that contributes to the allure of pyramid schemes. Educating individuals about financial concepts, investment strategies, and the warning signs of scams can empower them to make wiser decisions and protect themselves from financial fraud. Financial literacy equips individuals with the knowledge and skepticism necessary to navigate the complex world of investments and avoid falling victim to deceptive schemes.

Billionaires' Investment Secrets

You may want to see also

Trust and relationships

Trust plays a crucial role in human interactions, and pyramid schemes often exploit this trust by targeting individuals within close-knit communities or social circles. When a friend, family member, or trusted acquaintance introduces the scheme, people tend to let their guard down. They believe that someone they know wouldn't intentionally involve them in a scam, making them more receptive to the pitch. Pyramid schemes thrive on this trust and the relationships between people. They rely on members recruiting new participants to sustain the operation and generate profits.

The success of a pyramid scheme depends on its ability to recruit more and more investors. Each new member is expected to pay a fixed amount of money and, in turn, recruit additional investors. This creates a chain where numerous people invest their money, forming the base of the pyramid. The initial promoters at the top of the pyramid require this large base of investors to support the scheme and provide profits to earlier investors.

Pyramid schemes often target closely-knit groups, such as religious or social organizations, sports teams, and college students, to increase the pressure to participate. The involvement of a trusted acquaintance can make it challenging for potential investors to recognize the scheme's fraudulent nature. They may believe that if someone they know is participating, it must be legitimate. This trust and sense of community can lead people to lower their guard and make them more susceptible to the scheme's influence.

Additionally, pyramid schemes often use manipulative techniques, such as love bombing (excessive flattery and attention), emotional manipulation, and peer pressure, to keep participants engaged and committed. These tactics create a sense of belonging and camaraderie within the group, making it even harder for individuals to question the legitimacy of the scheme or the intentions of those they trust.

To protect oneself from falling victim to such schemes, it is essential to recognize the role of trust and relationships in their appeal. Be cautious when opportunities are presented by friends, family, or acquaintances, and remember that even they can be misled or unintentionally involved in fraudulent activities. Conduct thorough research, seek independent advice, and be wary of high-pressure tactics or promises that seem too good to be true.

Stable Interest Rates: Investors' Confidence Boost?

You may want to see also

Fear of missing out

The fear of missing out on a promising financial opportunity can be especially strong when it is presented by a trusted friend, family member, or acquaintance. Pyramid schemes often exploit this trust by targeting individuals within close-knit communities or social circles. When an opportunity is introduced by someone you know, it can be hard to believe that they would intentionally involve you in a scam. This dynamic leads people to lower their guard and be more receptive to the scheme's pitch.

The fear of missing out is further amplified by the allure of quick and easy wealth promised by pyramid schemes. The promise of "getting rich quick" with minimal effort or risk can cloud rational judgment, especially for individuals facing financial difficulties or seeking ways to improve their economic situation. The idea of achieving financial independence and being one's own boss can create a strong emotional attachment to the scheme, making it harder for individuals to recognise and acknowledge the warning signs of a scam.

Additionally, the social proof provided by seeing friends or acquaintances apparently succeeding in the scheme can reinforce the idea that it is a legitimate opportunity. The herd mentality can lead people to follow the crowd, assuming that "if they're making money, it must be real." This can cause individuals to overlook red flags and ignore their better judgment, as they don't want to miss out on the potential gains that others seem to be enjoying.

To address the fear of missing out, it is essential to recognise that pyramid schemes always fail. The success of a pyramid scheme depends on the ability to recruit more and more investors, and since there is only a limited number of people in any given community, all pyramid schemes will inevitably collapse. Understanding this inherent flaw in the pyramid scheme model can help individuals resist the fear of missing out and make more informed and rational decisions.

College: Investing in a Brighter Future

You may want to see also

Frequently asked questions

Stupid people don't invest in pyramids, but they may be tricked into doing so by deceptive promoters. Pyramid schemes are illegal in many places and are designed to scam people out of their money. They promise high returns but rely on constantly recruiting new investors to sustain the operation, which is unsustainable.

Pyramid schemes promise high financial returns in a short period but require individuals to recruit more and more people into the scheme. The focus is on recruiting, not selling legitimate products or services. The money received from new recruits is used to pay off earlier investors, with those at the top of the pyramid profiting the most. Eventually, the scheme collapses when no new recruits can be found, and most members lose money.

Pyramid schemes are bad because they are illegal, fraudulent, and designed to deceive people. They waste people's time and money and always fail, leaving most investors with a loss. The only people who benefit are the creators of the scheme and those at the very top.

There are several signs that can help you spot a pyramid scheme:

- They ask you to invest a fixed amount of money upfront.

- You are required to recruit a certain number of new members.

- The company is not focused on selling products or services.

- They promise to double or triple your investment in a short time.