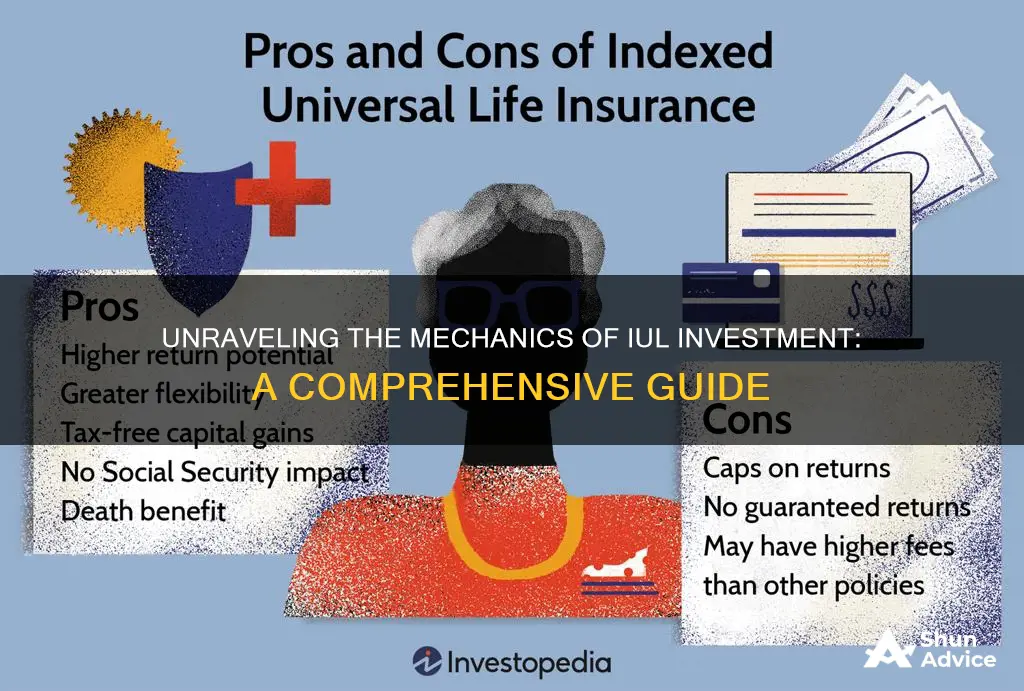

Understanding how Individual Ultimate Life (IUL) investment works is essential for anyone looking to grow their wealth through a combination of life insurance and investment opportunities. IUL is a type of permanent life insurance that offers a unique blend of insurance protection and investment potential. It allows policyholders to build cash value over time, which can be used to pay premiums, take loans, or withdraw funds. The investment component of IUL is designed to help grow your money through a variety of investment options, often with the guidance of a financial advisor. This investment strategy can provide a secure foundation for long-term financial goals while also offering the potential for significant returns.

What You'll Learn

- Tax-Deferred Growth: IUls offer tax-deferred growth, allowing compound interest to build over time

- Flexible Withdrawals: Investors can withdraw funds with penalties, providing liquidity

- Diversification Benefits: IUls offer diversification across various asset classes, reducing risk

- Management Fees: IUls charge management fees, which can impact long-term returns

- Performance-Based Fees: Some IUls have performance-based fees, incentivizing strong investment performance

Tax-Deferred Growth: IUls offer tax-deferred growth, allowing compound interest to build over time

Understanding how tax-deferred growth works in Individual Unit Linked (IUL) insurance products can be a game-changer for investors seeking long-term wealth accumulation. IULs are a type of investment vehicle that combines the benefits of life insurance with the potential for tax-efficient growth. Here's a breakdown of how this mechanism works:

When you invest in an IUL, a portion of your premium goes towards purchasing a policy that provides death benefit coverage. The remaining amount is invested in an underlying investment account. This investment account is designed to offer tax-deferred growth, which is a key advantage over traditional investment accounts. In a conventional investment account, any gains made on your investments are typically taxable in the year they occur. However, with IULs, the investment gains are not taxed until they are withdrawn or the policy is surrendered. This tax-deferred nature allows compound interest to work in your favor over time.

Compound interest is the process where interest is earned not only on the initial investment but also on the accumulated interest from previous periods. In the context of IULs, as your investment grows, the interest earned is reinvested, and subsequent interest is calculated on this growing base. This compounding effect can significantly boost your returns over the long term. For instance, if you invest $10,000 and it grows at an annual rate of 5%, after 10 years, you would have approximately $25,937, considering the power of compounding.

The tax-deferred nature of IULs is particularly beneficial for long-term goals, such as retirement planning. By allowing compound interest to work its magic over an extended period, IULs can help build substantial savings. Additionally, the death benefit provided by the life insurance component ensures that your beneficiaries receive a payout, providing financial security for your loved ones.

In summary, IULs offer a unique approach to investing by combining insurance and tax-efficient growth. The tax-deferred nature of these products enables compound interest to accumulate, potentially resulting in significant long-term gains. This feature makes IULs an attractive option for investors who want to maximize their savings while also ensuring financial protection for their families.

Unlocking Offshore Investment: A Comprehensive Guide to Global Opportunities

You may want to see also

Flexible Withdrawals: Investors can withdraw funds with penalties, providing liquidity

When it comes to Individual Unsecured Life (IUL) investments, one of the key features that sets them apart is the flexibility they offer in terms of withdrawals. Unlike traditional fixed-term investments, IUL policies allow investors to access their funds without the need for a full surrender of the policy. This flexibility is particularly beneficial for investors who may require liquidity for various reasons, such as unexpected expenses or other financial needs.

With IUL investments, investors can typically withdraw a portion of their accumulated cash value without facing significant penalties. This is a significant advantage over other investment vehicles, where early withdrawals often result in substantial fees or penalties. The ability to withdraw funds with penalties provides investors with a sense of control and the freedom to manage their finances according to their changing circumstances.

The process of withdrawing funds from an IUL policy is relatively straightforward. Investors can request a withdrawal, and the insurance company will typically assess the policy's value and the amount being withdrawn. The insurance company may apply a penalty, which is usually a surrender charge, to the withdrawn amount. These charges are designed to compensate the insurance company for the loss of potential future benefits and the administrative costs associated with processing the withdrawal.

The penalties associated with withdrawals from IUL policies are generally lower compared to other investment products, making them more attractive for those seeking liquidity. The specific penalty structure can vary depending on the insurance company and the age of the policy. Younger policies may have higher surrender charges, while older policies might have lower or even no surrender charges, allowing investors to access their funds without significant penalties.

In summary, the flexibility of withdrawals with penalties is a unique aspect of IUL investments. It empowers investors to make financial decisions based on their needs while still benefiting from the long-term growth potential of the investment. This feature, combined with the potential for tax-advantaged growth and the security of life insurance, makes IUL a compelling option for investors seeking a balanced approach to wealth accumulation and preservation.

Retirement Planning: Navigating the Investment Landscape

You may want to see also

Diversification Benefits: IUls offer diversification across various asset classes, reducing risk

When it comes to investing, diversification is a key strategy to manage risk and potentially enhance returns. IUls, or Index Universal Life policies, are a unique financial product that can provide investors with a way to diversify their portfolios across various asset classes. This approach is particularly beneficial for those seeking to spread their investments and reduce the impact of market volatility.

The concept of diversification is simple yet powerful. By allocating investments across different asset classes such as stocks, bonds, real estate, and commodities, investors can minimize the risk associated with any single asset. IUls facilitate this diversification by allowing investors to invest in a wide range of assets within a single policy. For instance, an IUl policy might offer the option to invest in a mix of stocks, bonds, and alternative investments, providing a comprehensive approach to asset allocation.

One of the key advantages of IUls is the ability to tailor the investment strategy to individual needs. Investors can choose the specific asset classes they want to include, allowing for a personalized diversification plan. This level of customization ensures that the investment strategy aligns with the investor's risk tolerance and financial goals. For example, a conservative investor might opt for a higher allocation of bonds and lower-risk investments, while a more aggressive investor could focus on a mix of stocks and alternative investments.

By diversifying across various asset classes, IUls can help reduce the overall risk of an investment portfolio. This is particularly important during market downturns, where certain asset classes may perform poorly while others may offer a safety net. For instance, during a stock market decline, bond investments can provide a stable source of income and help offset potential losses in equity investments. Similarly, alternative investments like real estate or commodities can offer a hedge against market volatility.

In summary, IUls provide investors with a powerful tool to diversify their portfolios and manage risk. By offering exposure to various asset classes, these policies enable investors to create a well-rounded investment strategy. This approach can potentially enhance returns while also providing a level of risk mitigation, making it an attractive option for those seeking a comprehensive investment solution. Understanding the diversification benefits of IUls can be a crucial step in building a robust and resilient investment portfolio.

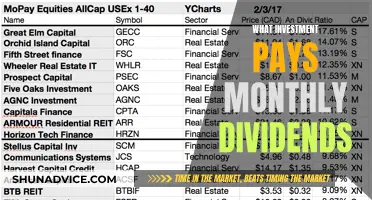

Investing in Your Future: Exploring the Dividends of OpenStudy

You may want to see also

Management Fees: IUls charge management fees, which can impact long-term returns

Understanding the mechanics of Indexed Universal Life (IUL) investments is crucial for anyone considering this type of financial product. One of the key aspects to be aware of is the role of management fees, which can significantly impact the overall performance of your IUL investment over time.

Management fees are charges levied by the insurance company or the investment manager for providing services and managing the policy. These fees are typically a percentage of the policy's value and are deducted from the policy's cash value. The impact of these fees can be substantial, especially when considering the long-term nature of IUL investments. Over time, the accumulation of these fees can eat into the potential returns, reducing the overall growth of your investment. It's important to carefully review the fee structure of any IUL product you are considering, as different providers may have varying fee schedules.

The structure of management fees in IULs is often complex and can vary widely. Some policies may charge a fixed annual fee, while others might have a combination of per-year and per-contract fees. Additionally, certain policies might offer different fee structures based on the policy's performance or the investment options chosen. For instance, some IULs may have lower management fees during the accumulation phase but higher fees once the policy enters the guaranteed period.

When evaluating IUL investments, it's essential to compare the management fees across different providers. Lower fees can result in higher long-term returns, as they leave more room for investment growth. However, it's also important to consider the quality of service and the investment options provided, as these factors can influence the overall performance of your IUL policy.

In summary, management fees are a critical consideration when investing in IULs. These fees can impact the long-term returns of your investment, and understanding their structure and potential effects is vital for making informed financial decisions. By carefully reviewing fee schedules and comparing providers, investors can ensure they are getting the best value for their IUL investment.

Gamestop Investors: Who's In?

You may want to see also

Performance-Based Fees: Some IUls have performance-based fees, incentivizing strong investment performance

When it comes to Index-Linked Unit Trusts (IUls), one of the key features that sets them apart is the potential for performance-based fees. This is a unique aspect of IUl investments that can significantly impact the overall returns for investors. Performance-based fees are a mechanism used by some IUls to align the interests of the fund manager and the investors. Here's how it works:

In traditional investment funds, the fund manager is typically compensated through a fixed management fee, which is a percentage of the fund's assets. However, with performance-based fees, the structure changes. Instead of a fixed fee, a certain percentage of the investment's gains or growth is retained by the fund manager as a reward for their successful management. This fee is only charged when the investment outperforms a predefined benchmark or target. For example, an IUl might set a performance target of outperforming the S&P 500 index by 2% annually. If the fund achieves this, the manager receives a performance fee, which could be a fixed percentage of the excess return.

The incentive here is clear: the fund manager has a direct interest in the investment's performance. They are motivated to make strategic decisions and manage the portfolio actively to achieve the set target. This can lead to more aggressive investment strategies and a focus on capital appreciation, potentially benefiting investors who seek higher returns. However, it's important to note that this fee structure also means that investors bear the risk of underperformance. If the investment doesn't meet the performance target, the manager might not receive any performance-based fees, and the investors could miss out on the potential upside.

Performance-based fees are not a standard feature of all IUls, and their inclusion depends on the fund's objectives and the manager's strategy. Investors should carefully review the fund's prospectus and understand the fee structure before investing. This type of fee arrangement adds an extra layer of complexity to IUl investments, and investors need to be well-informed to make the most of this unique feature. It's a way for fund managers to demonstrate their skills and take on more risk, which can ultimately benefit investors if the investment strategy proves successful.

ICO Investment: Why the Risk?

You may want to see also

Frequently asked questions

An Index-Linked Unit (ILU) is a type of investment vehicle that is designed to track the performance of a specific market index. It is a form of exchange-traded fund (ETF) that aims to mirror the returns of a particular index, such as a stock market index or a commodity index. ILUs provide investors with a way to gain exposure to a broad market or a specific sector, offering diversification and the potential for capital growth.

ILU investments generate returns by replicating the performance of the underlying index. When the index value rises, the ILU's net asset value (NAV) increases, and investors can benefit from capital appreciation. Conversely, if the index falls, the ILU's NAV decreases, reflecting the losses in the index. The investment management company behind the ILU ensures that the fund's holdings are adjusted to match the index's composition, thus providing investors with a cost-effective way to invest in a diversified portfolio.

Investing in ILUs offers several advantages. Firstly, they provide diversification, allowing investors to gain exposure to a wide range of assets or sectors within a single investment. This can help reduce risk compared to investing in individual securities. Secondly, ILUs often have lower management fees and expenses compared to actively managed funds, making them a cost-effective option. Additionally, since ILUs track an index, they offer transparency and simplicity, as investors can easily understand the fund's performance in relation to the benchmark index.