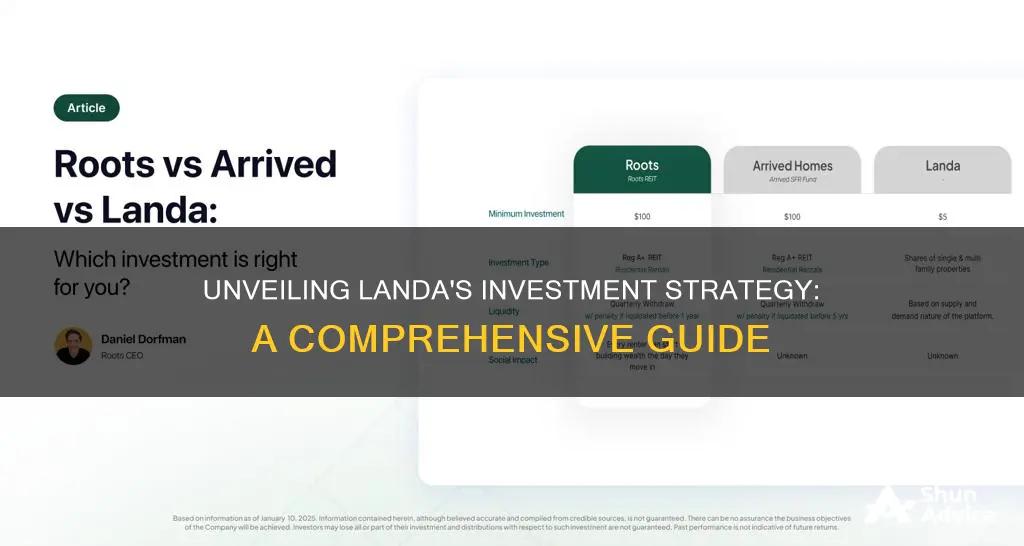

Landa is a revolutionary platform that empowers individuals to invest in the stock market with ease and confidence. It offers a user-friendly interface and a range of investment tools, allowing users to build and manage their portfolios efficiently. With Landa, you can explore various investment strategies, such as long-term growth, value investing, or dividend-focused approaches, all while benefiting from the platform's comprehensive research and educational resources. Landa's intuitive design and robust features make it an ideal choice for both novice and experienced investors, providing a seamless and accessible way to enter the world of investing.

What You'll Learn

- Landa's Investment Strategy: Focuses on early-stage tech startups with high growth potential

- Funding Rounds: Landa participates in seed, series A, and later rounds

- Portfolio Management: Active involvement in portfolio companies' growth and development

- Exit Strategies: Aiming for successful exits through IPOs or acquisitions

- Industry Expertise: Landa leverages deep knowledge of tech sectors to identify promising investments

Landa's Investment Strategy: Focuses on early-stage tech startups with high growth potential

Landa's investment strategy is centered around identifying and supporting early-stage tech startups with significant growth potential. This approach is a key differentiator for Landa, as it allows them to invest in companies at a stage where they can have a substantial impact on their development and future success. The focus on early-stage investments is a calculated move, as it often comes with higher risks but also presents the opportunity for substantial returns if the startups succeed. Landa's team employs a rigorous process to evaluate and select these startups, ensuring that their investments are well-researched and aligned with their strategic goals.

The investment process begins with an extensive market research phase, where Landa's analysts study emerging trends, technologies, and industries. They identify sectors that are likely to experience rapid growth and innovation. This research is crucial in narrowing down the vast number of startups to a manageable pool of potential investments. Landa's team then employs a meticulous due diligence process, assessing each startup's business model, management team, competitive advantage, and growth prospects. This due diligence is a critical step to ensure that Landa's investments are in companies with a strong foundation and a clear path to success.

Once the startups are identified, Landa's investment team engages in active collaboration with the founders and their teams. This collaboration involves providing strategic guidance, mentorship, and access to Landa's extensive network of industry experts and resources. By offering this support, Landa aims to enhance the startups' chances of success and ensure that their investments are well-positioned for growth. This hands-on approach is a unique aspect of Landa's strategy, setting them apart from traditional investors who may take a more passive role.

Landa's investment strategy also emphasizes a long-term perspective. They are willing to take on the risks associated with early-stage investments, believing that the potential rewards can be significant over time. This long-term focus allows Landa to build strong relationships with the startups they invest in, providing ongoing support and guidance as the companies grow and evolve. The goal is to create a mutually beneficial relationship where Landa's expertise and resources contribute to the startups' success, and in return, Landa gains substantial returns on their investments.

In summary, Landa's investment strategy in early-stage tech startups with high growth potential is a well-defined and proactive approach. It involves a comprehensive research process, meticulous due diligence, active collaboration with founders, and a long-term perspective. This strategy enables Landa to identify and support innovative companies, fostering their growth and potentially generating substantial returns for its investors. By focusing on the early stages, Landa aims to capture the significant rewards that can come from backing the next big tech success story.

Investment Bankers and Traders: Collaborating on Projects

You may want to see also

Funding Rounds: Landa participates in seed, series A, and later rounds

Landa, a company focused on revolutionizing the construction industry through modular construction, has raised significant funding to support its growth and development. The company's investment strategy involves participating in various funding rounds, each serving a specific purpose in its journey towards success.

The seed funding round is often the initial phase where Landa seeks to establish its concept and gain traction. This round targets early-stage investors who believe in the potential of modular construction and are willing to take a risk on a novel idea. Landa's pitch during this stage likely emphasizes its unique value proposition, market opportunity, and the team's expertise in the field. By securing seed funding, Landa can develop its technology, conduct research and development, and build a prototype, which are crucial steps in gaining investor confidence.

As Landa progresses, it moves on to Series A funding, which is typically sought when the company has made significant strides and is ready to scale its operations. This round focuses on expanding the business, refining the product, and establishing a solid market presence. Investors at this stage are more experienced and seek a higher return on their investment. Landa's strategy here might involve demonstrating its ability to execute, showcasing early customer success stories, and providing a clear roadmap for future growth. The Series A funding enables Landa to hire key talent, enhance its technology, and expand its operations to new markets.

Landa's investment strategy also includes participating in later-stage funding rounds, such as Series B and beyond. These rounds are aimed at further scaling the business, entering new territories, and solidifying its position in the market. Later-stage investors often bring industry connections, strategic partnerships, and additional capital to support Landa's expansion plans. Landa's focus here is on demonstrating its market leadership, consistent revenue growth, and a strong team capable of executing its vision. These funding rounds allow Landa to refine its business model, optimize operations, and ultimately drive significant growth.

In summary, Landa's approach to investing involves a strategic progression through various funding rounds. Each round serves a unique purpose, from establishing the concept and gaining traction in the seed stage to scaling operations and expanding into new markets in later rounds. By carefully selecting the right investors and demonstrating its ability to execute, Landa can secure the necessary funding to drive its modular construction vision forward.

Will Buchanan: Navigating the Investment Landscape

You may want to see also

Portfolio Management: Active involvement in portfolio companies' growth and development

Landa, a prominent investment firm, takes a unique approach to portfolio management, emphasizing active involvement in the growth and development of its portfolio companies. This strategy sets them apart from traditional investors, who often adopt a more passive role. The firm's philosophy revolves around the belief that active engagement can significantly impact the success and long-term value of their investments.

When Landa invests in a company, they don't merely provide financial support and move on. Instead, they actively participate in the company's journey, offering a range of services and resources to foster growth. This includes strategic guidance, industry expertise, and access to a vast network of professionals. Landa's team often becomes an integral part of the portfolio company's management, working closely with the existing team to identify and implement growth initiatives.

One of the key aspects of Landa's approach is their focus on long-term value creation. They aim to build strong relationships with portfolio companies, understanding their unique challenges and opportunities. By immersing themselves in the company's operations, Landa can provide tailored solutions, whether it's refining business strategies, optimizing operations, or identifying new market opportunities. This level of involvement allows them to become trusted partners, contributing to the company's success and resilience.

Landa's active portfolio management also involves a comprehensive approach to risk management. They employ sophisticated tools and techniques to identify and mitigate potential risks, ensuring the stability and growth of their investments. This includes regular performance reviews, market analysis, and strategic planning sessions with the portfolio company's leadership. By proactively addressing risks, Landa can help the company navigate challenges and maintain a strong market position.

Furthermore, Landa's commitment to active involvement extends beyond financial and operational support. They often facilitate connections with industry peers, mentors, and potential partners, creating a supportive ecosystem for the portfolio company's growth. This network can provide valuable insights, mentorship, and even potential acquisition opportunities, further enhancing the company's prospects. Landa's approach transforms investment into a collaborative and transformative process, where their active participation contributes to the portfolio company's success and long-term sustainability.

Greenlight Investing: Unlocking the Power of Sustainable Investment Strategies

You may want to see also

Exit Strategies: Aiming for successful exits through IPOs or acquisitions

When it comes to exit strategies for your investments, two common approaches are Initial Public Offerings (IPOs) and acquisitions. Both methods can provide significant returns on your investment, but they require careful planning and execution. Here's a breakdown of how to aim for successful exits through these avenues:

IPOs:

An Initial Public Offering (IPO) is a powerful way to exit your investment and realize gains. It involves taking your privately held company public by listing it on a stock exchange. Here's a step-by-step guide:

- Company Preparation: Ensure your company meets the legal and financial requirements for an IPO. This includes having a solid business model, strong financial performance, and a clear understanding of your market. Conduct a thorough audit and prepare financial statements to meet regulatory standards.

- Underwriter Selection: Choose reputable investment banks or underwriters to assist with the process. They will help determine the offering price, prepare the necessary documentation, and market the IPO to potential investors.

- Roadshow and Marketing: Organize a roadshow to promote the IPO to institutional investors and the public. This involves presenting your company's story, financial projections, and growth potential. Effective marketing can generate buzz and attract investors.

- Pricing and Allocation: Set a competitive offering price based on market analysis and valuation. Allocate shares to institutional investors and the general public, ensuring a balanced distribution.

- Listing and Trading: Once the IPO is priced, your company will be listed on the stock exchange, and trading will commence. This marks the official exit for early investors, allowing them to sell their shares and potentially realize substantial returns.

Acquisitions:

Acquiring another company can be a strategic way to exit your investment, especially if you have a complementary business or want to expand your market presence. Here's how to approach acquisitions:

- Target Identification: Research and identify companies that align with your investment goals. Look for businesses with strong growth potential, innovative products, or a solid customer base. Due diligence is crucial to assess the target company's financial health, market position, and potential risks.

- Negotiation and Deal Structuring: Engage in negotiations with the target company's management and owners. Determine the acquisition price, which may involve a premium over the current market value. Decide on the deal structure, whether it's an all-cash offer, a share swap, or a combination of both.

- Due Diligence and Legal Process: Conduct a comprehensive due diligence process to evaluate the target company's assets, liabilities, and potential legal issues. This step ensures a smooth transaction and protects your interests. Legal advisors and accountants can assist with the necessary paperwork and compliance.

- Post-Acquisition Integration: After the acquisition, carefully plan the integration process. This involves combining operations, managing cultural differences, and ensuring the acquired business becomes a profitable part of your portfolio. Effective integration can lead to synergies and increased value.

Both IPOs and acquisitions require a well-defined strategy, market research, and a deep understanding of your investment's value proposition. It's essential to time your exit strategically, considering market conditions and the company's growth trajectory. Successful exits can provide significant financial gains and open up new investment opportunities.

The Equipment Conundrum: Is Buying Gear Really an Investment?

You may want to see also

Industry Expertise: Landa leverages deep knowledge of tech sectors to identify promising investments

Landa's investment strategy is underpinned by its team's extensive industry expertise and deep understanding of the tech sectors it operates in. This knowledge is a powerful tool that enables Landa to identify and evaluate investment opportunities with precision and confidence. The firm's research and analysis capabilities are among the most robust in the industry, allowing them to uncover hidden gems and make informed decisions.

The team at Landa has a collective experience spanning multiple decades, with members having worked in various tech sectors, including software development, hardware manufacturing, and emerging fields like artificial intelligence and blockchain. This diverse background provides a comprehensive understanding of the tech landscape, enabling them to identify trends, assess risks, and recognize potential. For instance, Landa's analysts might have a background in computer science, data analytics, or engineering, which equips them with the skills to evaluate complex technologies and their market potential.

Their industry expertise is further enhanced by a network of relationships with industry leaders, startups, and investors. Landa's team frequently attends conferences, workshops, and industry events, keeping them updated on the latest innovations and market shifts. This proactive approach ensures that Landa is always at the forefront of emerging technologies and business models, allowing them to make timely investment decisions.

Landa's investment process involves a rigorous due diligence process, where they scrutinize every aspect of a potential investment, from the technology itself to the team's capabilities and the market's reception. Their industry knowledge enables them to ask the right questions, identify potential pitfalls, and assess the long-term viability of an investment. For instance, when evaluating a software-as-a-service (SaaS) startup, Landa's analysts might consider the competitive landscape, the uniqueness of the product, and the team's ability to execute their vision.

Moreover, Landa's industry expertise allows them to provide valuable insights to their portfolio companies. They offer strategic guidance, helping startups navigate the challenges of scaling, product development, and market penetration. This support is a key differentiator, as it fosters stronger, more resilient businesses that are better positioned for success in the long term.

Unraveling Fidelity Investments: A Comprehensive Guide to Their Inner Workings

You may want to see also

Frequently asked questions

Landa is an innovative investment platform that utilizes blockchain technology to facilitate secure and transparent peer-to-peer lending. It connects borrowers seeking loans with investors looking for attractive returns. The platform acts as a decentralized marketplace, allowing users to invest in various lending opportunities and earn interest on their investments.

Getting started is straightforward. First, you need to create an account on the Landa platform and complete the necessary verification process. Once your account is set up, you can explore the available investment options, which include different lending pools or projects. You can choose to invest in these pools by purchasing the native Landa tokens or by providing liquidity to the platform.

Investing on Landa offers several advantages. Firstly, it provides access to a diverse range of investment opportunities, allowing investors to diversify their portfolios. The platform's blockchain-based system ensures transparency and security, as all transactions are recorded and verifiable. Additionally, Landa aims to offer competitive interest rates, providing investors with the potential for attractive returns on their investments.

Landa prioritizes security and employs various measures to protect user funds. The platform utilizes smart contracts, which are self-executing contracts with predefined rules, to automate and secure lending processes. These contracts ensure that funds are released only when specific conditions are met, reducing the risk of fraud. Landa also implements a multi-signature wallet system, requiring multiple approvals for transactions, adding an extra layer of security.

Landa provides investors with the flexibility to withdraw their investments at any time, subject to certain conditions. The platform typically offers liquidity pools, allowing investors to redeem their funds with minimal impact on the lending projects. However, there may be associated fees for early withdrawals or certain types of transactions. It is recommended to review the platform's fee structure and terms to understand the costs involved.