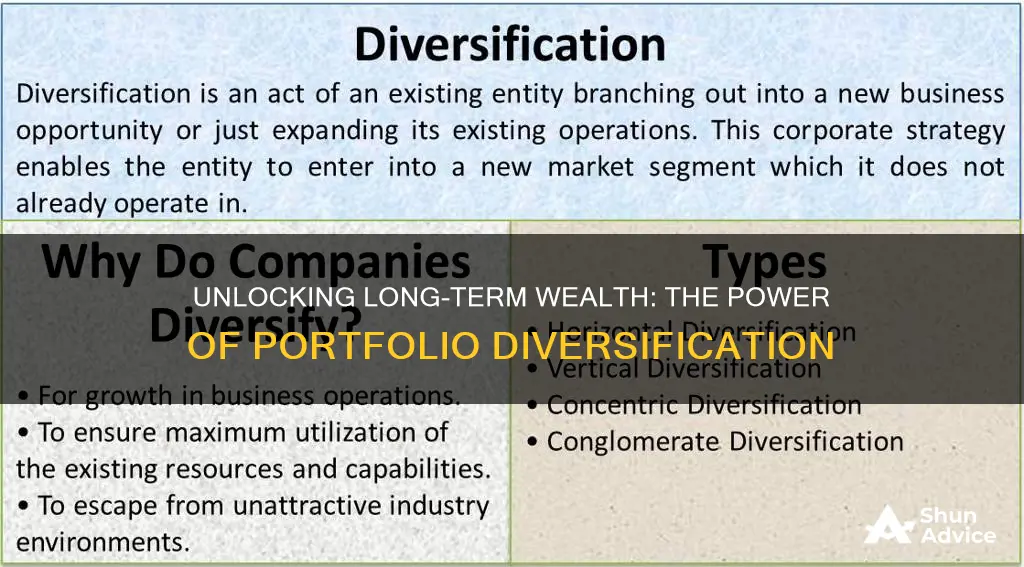

Portfolio diversification is a key strategy for investors aiming to achieve their long-term financial goals. By spreading investments across various asset classes, sectors, and regions, investors can reduce risk and increase the potential for long-term growth. Diversification helps to ensure that an investor's portfolio is not overly exposed to any single investment or market, thereby mitigating the impact of volatility and market downturns. This approach allows investors to maintain a consistent investment strategy over time, which is crucial for achieving long-term financial objectives such as retirement planning, education savings, or wealth accumulation. Effective diversification can provide a more stable and resilient investment journey, making it an essential tool for investors to navigate the complexities of the financial markets and reach their financial milestones.

| Characteristics | Values |

|---|---|

| Reduced Risk | Diversification spreads risk across various assets, reducing the impact of any single investment's performance on the overall portfolio. |

| Long-Term Growth | A well-diversified portfolio can provide a more consistent and steady growth rate over time, which is crucial for long-term investment goals. |

| Risk-Adjusted Returns | By diversifying, investors can achieve higher risk-adjusted returns, meaning better returns relative to the risk taken. |

| Market Volatility Mitigation | Diversification helps smooth out market volatility, as different asset classes perform differently at various points in the economic cycle. |

| Asset Allocation | It involves allocating assets in a way that aligns with an investor's risk tolerance, goals, and time horizon. |

| Historical Evidence | Historical data shows that diversified portfolios have historically outperformed non-diversified ones, especially over extended periods. |

| Flexibility | Diversified portfolios offer flexibility to adjust asset allocations as market conditions and personal circumstances change. |

| Tax Efficiency | Certain diversification strategies can lead to tax advantages, such as tax-efficient asset allocation and tax-loss harvesting. |

| Peace of Mind | Diversification provides a sense of security, knowing that the portfolio is not overly exposed to any single risk factor. |

| Professional Guidance | Investors often benefit from seeking professional advice to create a diversified portfolio tailored to their needs. |

What You'll Learn

- Risk Reduction: Diversification minimizes risk by spreading investments across asset classes

- Long-Term Growth: A diversified portfolio can provide steady, long-term growth over time

- Market Volatility: Diversification helps mitigate the impact of market volatility on investment returns

- Asset Allocation: Proper allocation of assets is key to achieving investment goals

- Risk-Adjusted Returns: Diversification can enhance risk-adjusted returns, making investments more attractive

Risk Reduction: Diversification minimizes risk by spreading investments across asset classes

Diversification is a fundamental strategy in investing that plays a crucial role in risk reduction and the achievement of long-term financial goals. By spreading investments across various asset classes, investors can significantly minimize the impact of market volatility and unexpected events. This approach is based on the principle that different asset classes, such as stocks, bonds, real estate, and commodities, tend to perform differently over time. By allocating capital among these assets, investors can create a balanced portfolio that is less susceptible to the risks associated with any single investment.

The primary benefit of diversification is its ability to reduce unsystematic risk, which is the risk that is specific to a particular investment or industry. When an investor holds a diverse range of assets, the performance of one investment is less likely to significantly affect the overall portfolio. For example, if an investor owns stocks from multiple sectors, a decline in one sector's performance due to industry-specific news or events will have a diluted impact on the entire portfolio. This strategy ensures that the overall investment strategy remains stable and resilient, even when individual holdings experience fluctuations.

In practice, diversification can be achieved through various methods. One common approach is to invest in a mix of asset classes, such as a combination of stocks, bonds, and alternative investments. For instance, a long-term investor might allocate a portion of their portfolio to large-cap stocks, a segment of the market known for its stability, while also investing in small-cap stocks, which offer higher growth potential but come with increased risk. Additionally, investors can further diversify by considering international markets, real estate investment trusts (REITs), and commodities, each bringing unique characteristics and risk profiles to the portfolio.

Another strategy is to employ asset allocation techniques, where investors decide on the percentage of their portfolio to be invested in different asset classes based on their risk tolerance and investment goals. A well-diversified portfolio often includes a mix of aggressive and conservative investments, ensuring that the overall risk is managed effectively. This approach allows investors to stay invested in the market while minimizing the potential negative impact of any single asset or market segment.

By embracing diversification, investors can build a robust and resilient investment strategy. This strategy enables them to navigate market fluctuations with greater confidence, knowing that their portfolio is less dependent on the performance of any single investment. Over time, this approach can contribute to the achievement of long-term investment plans, providing a more stable and secure financial future.

Maximizing Affiliate Investments: Strategies for Long-Term Success

You may want to see also

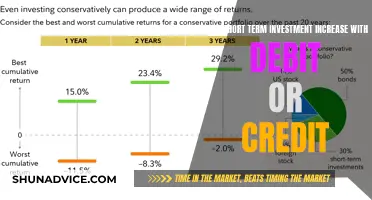

Long-Term Growth: A diversified portfolio can provide steady, long-term growth over time

A diversified portfolio is a powerful tool for achieving long-term investment goals, offering a steady and robust path to financial growth. This strategy involves allocating your investments across various asset classes, sectors, and geographic regions, rather than concentrating your capital in a single area. By doing so, investors can significantly reduce the risk associated with their holdings, as different asset classes tend to perform differently over time. For instance, stocks might experience a downturn while bonds or commodities show resilience, ensuring that your overall portfolio remains stable even during market fluctuations.

The beauty of diversification lies in its ability to provide a consistent and reliable return over the long haul. By spreading your investments, you're not only minimizing the impact of any single negative event but also taking advantage of the fact that different asset classes often have varying growth rates and cycles. This means that even if one sector underperforms, others may compensate, leading to a more stable and predictable return over time. For instance, a well-diversified portfolio might include a mix of large-cap stocks, small-cap growth stocks, international equities, and various fixed-income securities, each contributing to the overall growth and stability of the portfolio.

Over the long term, this approach can lead to substantial wealth accumulation. By consistently investing in a diversified range of assets, investors can benefit from the power of compounding, where the returns on their investments generate additional returns, further growing their capital. This is particularly effective when combined with a long-term investment horizon, as it allows investors to ride out short-term market volatility and focus on the underlying value of their holdings. As a result, a diversified portfolio can provide a reliable source of income and capital appreciation, making it an essential strategy for those aiming to secure their financial future.

Additionally, diversification can help investors manage risk more effectively. By not putting all their eggs in one basket, investors can avoid the potential devastating effects of a single-stock or sector failure. This is especially important for long-term investors, as it allows them to maintain their investment strategy even during challenging market conditions. For instance, during a recession, a well-diversified portfolio might include assets that are less sensitive to economic downturns, ensuring that the investor can weather the storm and continue to grow their wealth over the long term.

In summary, portfolio diversification is a key strategy for achieving long-term investment success. It provides a steady, reliable growth path by spreading investments across various asset classes and sectors, reducing risk and ensuring consistent returns. This approach empowers investors to build wealth over time, providing financial security and the potential for substantial long-term gains. By embracing diversification, investors can navigate the complexities of the financial markets with confidence, knowing their portfolio is well-positioned to meet their long-term financial objectives.

Minimum Wage Wages: Long-Term Investment Barriers for Low-Income Earners

You may want to see also

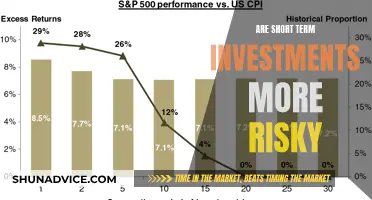

Market Volatility: Diversification helps mitigate the impact of market volatility on investment returns

Market volatility is an inherent characteristic of financial markets, presenting investors with both opportunities and risks. It refers to the rapid and significant fluctuations in asset prices, often driven by various factors such as economic news, geopolitical events, or changes in investor sentiment. While volatility can create short-term challenges, it also underscores the importance of a strategic approach to investment, and that's where portfolio diversification comes into play.

Diversification is a fundamental principle in investing, which involves spreading your investments across various asset classes, sectors, and geographic regions. The primary goal is to reduce the overall risk of the portfolio by not concentrating assets in a single area. When applied to the context of market volatility, diversification becomes a powerful tool to navigate the turbulent waters of the financial markets. By allocating investments in a diverse range of assets, investors can significantly reduce the impact of market swings on their returns.

For instance, consider a portfolio that includes a mix of stocks, bonds, real estate, and commodities. During a period of market volatility, certain asset classes might experience significant declines, while others could show resilience. A well-diversified portfolio would benefit from this balance, as the losses in one asset class could be offset by the gains in another. This strategy ensures that the overall performance of the portfolio remains relatively stable, even when individual investments face challenges.

The key idea behind diversification is to lower the volatility of the investment returns. By holding a variety of assets, investors can smooth out the ups and downs of the market. This approach is particularly crucial for long-term investors, as it allows them to stay committed to their investment strategy during turbulent times. Instead of panicking and making impulsive decisions, a diversified portfolio enables investors to weather the storm, benefiting from the long-term growth potential of the markets.

In summary, market volatility is an inevitable aspect of investing, but diversification provides a robust strategy to manage its effects. By allocating investments across different asset classes and sectors, investors can minimize the impact of market fluctuations on their returns. This approach fosters a more stable and consistent investment journey, which is essential for achieving long-term financial goals. Diversification is a powerful tool that empowers investors to make informed decisions and build a resilient portfolio capable of withstanding the challenges of market volatility.

Unraveling Short-Term Investment Accounting: A Comprehensive Guide

You may want to see also

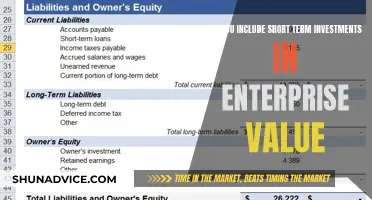

Asset Allocation: Proper allocation of assets is key to achieving investment goals

Asset allocation is a fundamental concept in investing that involves distributing your investment portfolio across various asset classes such as stocks, bonds, cash, and alternative investments. This strategic approach is crucial for achieving long-term investment goals as it helps manage risk and optimize returns. Proper asset allocation ensures that your investments are aligned with your financial objectives, risk tolerance, and time horizon.

The primary goal of asset allocation is to create a balanced portfolio that can withstand market fluctuations and provide consistent growth over time. By diversifying your investments, you reduce the impact of any single asset's performance on your overall portfolio. For instance, if one stock underperforms, a well-diversified portfolio can be supported by other asset classes, minimizing potential losses. This strategy is particularly important for long-term investors who aim to build wealth steadily and securely.

When allocating assets, investors should consider their individual circumstances. Factors such as age, income, financial goals, and risk tolerance play a significant role in determining the appropriate asset mix. Younger investors, for example, might opt for a higher allocation of stocks, which historically offer higher returns over the long term, while older investors may prefer a more conservative approach with a larger portion of bonds and fixed-income securities. Regular reviews of asset allocation are essential to ensure that it remains suitable for your evolving financial situation.

A common approach to asset allocation is the 60/40 model, where 60% of the portfolio is allocated to stocks and 40% to bonds. This allocation provides a balance between growth and stability. However, investors should remember that asset allocation is not set in stone and can be adjusted based on market conditions and personal preferences. During periods of market volatility, investors might rebalance their portfolios to restore the desired asset allocation.

In summary, asset allocation is a critical component of portfolio management, enabling investors to navigate the complexities of the financial markets while working towards their long-term investment objectives. By carefully considering various asset classes and regularly reviewing your allocation, you can build a robust investment strategy that adapts to your changing needs and market dynamics. This approach ensures that your investments are well-diversified, reducing risk and maximizing the potential for long-term success.

Unraveling ETFs: Are They Short-Term Investments?

You may want to see also

Risk-Adjusted Returns: Diversification can enhance risk-adjusted returns, making investments more attractive

Diversification is a powerful strategy in investing that can significantly contribute to achieving long-term financial goals. One of the key benefits of diversification is its ability to enhance risk-adjusted returns, making investments more appealing and sustainable over time. This concept is particularly important for investors who aim to balance risk and reward, ensuring their portfolios perform well despite market volatility.

When investors diversify their portfolios, they spread their capital across various assets, sectors, and geographic regions. This approach reduces the impact of any single investment's performance on the overall portfolio. By holding a diverse range of assets, investors can mitigate the risks associated with individual stock or market sector underperformance. For instance, if one sector experiences a downturn, a well-diversified portfolio can provide support from other sectors, thus stabilizing the overall investment returns.

Risk-adjusted returns are a critical metric for investors, as they measure the performance of an investment portfolio relative to the risk taken. Diversification allows investors to achieve higher risk-adjusted returns by optimizing the allocation of their investments. By carefully selecting assets with varying risk profiles and expected returns, investors can construct a portfolio that aligns with their risk tolerance and long-term objectives. This strategic allocation ensures that the portfolio's performance is not solely dependent on the success of a few high-risk investments but rather on the collective performance of a well-rounded set of assets.

The power of diversification in enhancing risk-adjusted returns becomes evident during market fluctuations. In a diversified portfolio, the impact of market downturns is often mitigated, as different asset classes may react differently to economic changes. For example, during a recession, stocks might underperform, but a well-diversified portfolio could include bonds, real estate, or commodities that may hold their value or even appreciate, thus providing a hedge against market volatility. This strategic allocation ensures that the portfolio's overall performance remains stable, even in challenging economic conditions.

In summary, diversification is a critical tool for investors seeking to achieve long-term success. By spreading investments across various assets, investors can enhance risk-adjusted returns, making their portfolios more resilient and attractive. This strategy allows investors to navigate market uncertainties with confidence, knowing that their diversified approach provides a buffer against potential losses and contributes to the overall growth of their investments over time.

Long-Term Investments: Financing or Investing? Unlocking the Strategy

You may want to see also

Frequently asked questions

Portfolio diversification is a strategy that involves spreading your investments across various asset classes, sectors, and geographic regions. By diversifying, investors aim to reduce the risk associated with individual asset performance. Over the long term, this approach can lead to several advantages. Firstly, it helps to smooth out the volatility of returns, as different assets may perform differently at various points in time. This means that even if one investment underperforms, others may compensate, resulting in a more stable overall return. Secondly, diversification allows investors to access a broader range of opportunities, potentially increasing the overall return on investment. By holding a mix of assets, investors can benefit from the growth potential of different markets and industries, which can be particularly valuable during economic cycles.

Risk reduction is a key benefit of diversification. When you diversify your portfolio, you are essentially minimizing the impact of any single investment's poor performance on your overall financial health. Here's how it works: if you invest solely in one asset or sector, and that asset experiences a significant downturn, your entire investment could be at risk. However, by diversifying, you expose yourself to multiple assets, and if one investment takes a hit, others may remain stable or even perform well. This strategy helps to limit the potential losses and provides a more consistent risk profile over time. For instance, if you diversify across stocks, bonds, and real estate, a decline in stock prices might be offset by the performance of bonds and property, ensuring your portfolio's value remains relatively stable.

Maintaining a diversified investment portfolio over the long term offers several strategic advantages. Firstly, it enables investors to benefit from the power of compounding. By investing in a range of assets, investors can take advantage of the potential for long-term growth, allowing their investments to grow exponentially over time. Secondly, diversification helps to manage risk effectively. As mentioned earlier, it reduces the impact of individual asset volatility, providing a more stable investment journey. This stability can be crucial for long-term financial goals, such as retirement planning or funding education. Additionally, a well-diversified portfolio can provide investors with the flexibility to adapt to changing market conditions. If certain sectors or asset classes underperform, the overall impact on the portfolio can be mitigated by the positive contributions of other investments, ensuring a more consistent and reliable investment strategy.