The debate surrounding the impact of minimum wage on long-term investments for low-income earners is a complex and multifaceted issue. While some argue that higher wages can boost economic growth and reduce poverty, others contend that increased labor costs may hinder job creation and investment in capital-intensive industries. This discussion is crucial as it explores the potential trade-offs between short-term economic gains and long-term financial stability for those earning the minimum wage. Understanding these dynamics is essential for policymakers and economists alike as they strive to create sustainable and inclusive economic policies.

What You'll Learn

- Economic Disincentives: Higher wages may reduce long-term savings and investment due to disincentivizing work

- Skill Development: Minimum wage may not encourage skill development, impacting future earning potential

- Income Inequality: Widening income gap can hinder social mobility and long-term financial stability

- Employment Flexibility: Stricter minimum wage laws may limit job flexibility, affecting long-term career prospects

- Inflationary Pressures: Increased wages can lead to higher inflation, eroding purchasing power over time

Economic Disincentives: Higher wages may reduce long-term savings and investment due to disincentivizing work

The concept of minimum wage and its impact on long-term savings and investments is a complex economic debate. While some argue that higher wages can boost the economy and improve the standard of living, others suggest that it may have unintended consequences, particularly in the realm of long-term savings and investments. One of the primary economic disincentives associated with higher minimum wages is the potential reduction in long-term savings and investment. When the minimum wage is increased, it often leads to higher labor costs for businesses, especially in low-wage sectors. As a result, some employers might choose to cut back on hiring or even reduce the number of hours their employees work to offset these increased costs. This can directly impact individuals' income and, consequently, their ability to save and invest for the future.

For many low-income earners, a higher minimum wage could mean an immediate increase in their disposable income, which might encourage them to spend more rather than save. While this short-term boost in consumption can stimulate the economy, it may not necessarily translate into long-term savings and investments. In fact, the very nature of minimum wage increases could inadvertently discourage individuals from making long-term financial plans. This is because the higher wage might not provide enough financial stability to justify long-term investments, such as purchasing a home, starting a business, or contributing to retirement funds. As a result, individuals might opt for more immediate gratification, further reducing their capacity for long-term savings.

The disincentive to work is another critical aspect to consider. When minimum wages are set too high, some argue that it can create a disincentive for individuals to seek employment or work additional hours. This is particularly true for low-skilled or entry-level jobs, where the increased wage might not justify the effort or skill required. As a consequence, individuals might prefer to rely on government assistance or other forms of support rather than seeking employment. This behavior can lead to a reduction in the overall workforce participation rate, which, in turn, may negatively impact economic growth and development.

Moreover, the potential for higher minimum wages to lead to inflation is a significant concern. When businesses face increased labor costs, they might pass these costs on to consumers in the form of higher prices. This can result in a decrease in purchasing power, especially for low-income earners who are more sensitive to price changes. As inflation rises, the real value of savings and investments decreases, further discouraging long-term financial planning. This economic disincentive can create a vicious cycle, where higher wages lead to reduced savings and investments, which, in turn, may hinder economic growth and individual financial stability.

In conclusion, while the argument for higher minimum wages is often centered around improving the lives of low-income earners, it is essential to consider the potential economic disincentives. The reduction in long-term savings and investments, the disincentive to work, and the possibility of increased inflation are all factors that can significantly impact the overall economy and individuals' financial well-being. Balancing the need for fair wages with the long-term sustainability of the economy is a challenging task that requires careful consideration and comprehensive economic policies.

Long-Term Trading: Balancing Risk and Reward in Securities

You may want to see also

Skill Development: Minimum wage may not encourage skill development, impacting future earning potential

The concept of minimum wage has long been a subject of debate, especially when it comes to its potential impact on long-term investments and skill development. While the primary intention behind setting a minimum wage is to ensure a fair standard of living for workers, there are arguments suggesting that it might inadvertently discourage skill development, which could have long-lasting effects on an individual's earning potential.

One of the key points to consider is that minimum wage often sets a fixed threshold for entry-level jobs, which may not incentivize employers to invest in training and skill enhancement. When the wage is set at a basic level, it becomes a cost-saving measure for businesses, especially in sectors with high turnover rates. As a result, employees might not receive the necessary support or opportunities to acquire new skills, which could limit their career progression. For instance, in industries where technology and automation are rapidly advancing, a minimum wage might not provide enough financial incentive for employers to offer specialized training, potentially leaving workers behind in terms of skill development.

Moreover, the argument that minimum wage could hinder long-term investments in education and training is compelling. Individuals who are paid the minimum wage might struggle to afford further education or certification programs, which are essential for acquiring specialized skills. This financial barrier could lead to a cycle where workers remain at the minimum wage level, unable to access the very skills that could help them advance to higher-paying positions. In contrast, those who have the means to invest in their education might gain a competitive edge, potentially increasing their earning potential over time.

To address this issue, some propose that a more nuanced approach to wage setting could be beneficial. Instead of a fixed minimum wage, a sliding scale based on skill level and experience could be implemented. This would encourage employers to invest in their workforce, knowing that higher-skilled employees could command higher wages. Additionally, governments could play a role by offering incentives or subsidies to businesses that provide comprehensive training programs, ensuring that workers have the opportunity to develop their skills and potentially earn higher wages over time.

In conclusion, while minimum wage policies aim to protect workers, the potential negative impact on skill development and long-term earning potential cannot be overlooked. By encouraging a more flexible and skill-based wage structure, along with government support for training initiatives, it may be possible to strike a balance that benefits both employers and employees, fostering a more skilled and productive workforce. This approach could ultimately contribute to a more sustainable and prosperous economy.

Understanding Short-Term Investments: Operating Activities or Not?

You may want to see also

Income Inequality: Widening income gap can hinder social mobility and long-term financial stability

The widening income gap is a pressing issue that has significant implications for social mobility and long-term financial stability. As the gap between the rich and the poor continues to grow, it creates a cycle of disadvantage for those at the lower end of the income spectrum, making it increasingly difficult for them to climb the social ladder and achieve financial security. This phenomenon is particularly evident in the context of minimum wage policies, which often fail to keep up with the rising cost of living and can inadvertently set low-income earners back in their long-term financial goals.

One of the primary consequences of a widening income gap is the erosion of social mobility. When income inequality is high, those born into lower-income families face greater challenges in improving their economic status. This is because limited access to quality education, healthcare, and other essential resources can hinder their ability to develop the skills and opportunities needed to advance in life. As a result, they may find themselves trapped in a cycle of poverty, struggling to break free from the constraints of their initial socioeconomic status.

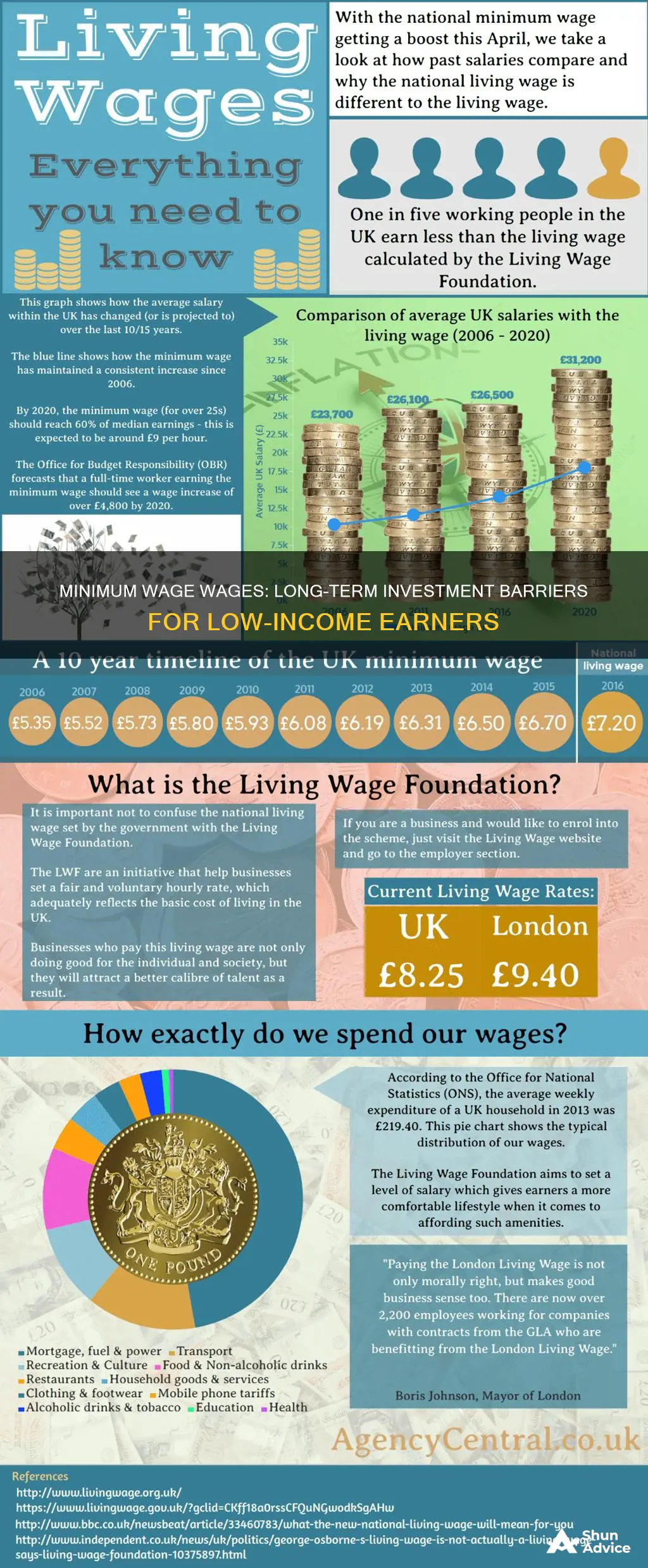

Minimum wage policies play a crucial role in this context. While the intention behind setting a minimum wage is to ensure a basic standard of living, the reality is that it often falls short of providing a living wage, especially in regions with high living costs. When the minimum wage is set too low, it can lead to a situation where workers are unable to cover their basic expenses, let alone save or invest for the future. This is particularly detrimental to long-term financial stability, as it limits the ability of low-income earners to build wealth, secure housing, or invest in their children's education.

The impact of low wages extends beyond individual financial struggles. It can also contribute to broader social and economic issues. For instance, low-income earners may be forced to rely on public assistance programs, straining social welfare systems and potentially leading to increased government spending. Moreover, the lack of financial stability can result in higher rates of poverty, unemployment, and even crime, as individuals and families struggle to make ends meet.

Addressing income inequality and its impact on social mobility requires a multi-faceted approach. This includes implementing policies that gradually increase the minimum wage to a level that provides a decent standard of living, ensuring fair compensation for workers. Additionally, investing in education, healthcare, and social programs can help level the playing field for low-income earners, enabling them to acquire the skills and resources necessary to improve their long-term financial prospects. By taking these steps, societies can work towards reducing the widening income gap and fostering a more equitable and prosperous future for all.

Navigating Short-Term Acquisitions: Strategies for Success

You may want to see also

Employment Flexibility: Stricter minimum wage laws may limit job flexibility, affecting long-term career prospects

The concept of employment flexibility is a critical aspect of the modern workforce, especially when considering the long-term career prospects of individuals. Stricter minimum wage laws, while well-intentioned, can inadvertently impact this flexibility, potentially setting earners back in their pursuit of long-term investments and career growth. This is particularly relevant in an economy where adaptability and a diverse skill set are highly valued.

When minimum wage is set at a higher level, it can lead to a reduction in the number of entry-level jobs available, especially in small businesses and startups. These are often the breeding grounds for innovation and career development, offering a wide range of opportunities for individuals to gain experience and skills. With fewer entry-level positions, young professionals might find it harder to break into the job market, potentially delaying their career progression. This delay could result in a loss of momentum in skill development, making it more challenging to adapt to the ever-changing demands of the job market.

Furthermore, stricter minimum wage laws might encourage employers to become more cautious about hiring new employees, especially part-time or temporary workers. This could lead to a reduction in the availability of flexible work arrangements, which are often crucial for individuals balancing work and personal commitments. For instance, a student or a parent might prefer a part-time job with flexible hours to accommodate their educational or family responsibilities. However, if employers are mandated to pay a higher minimum wage, they may opt for fewer, more permanent employees to manage costs, thus limiting the flexibility that is essential for many workers.

The impact of these laws on employment flexibility can also be seen in the long-term career prospects of individuals. In a competitive job market, employers often seek candidates with a proven track record of adaptability and a willingness to take on diverse roles. Stricter minimum wage policies might discourage employers from providing on-the-job training or cross-training, as they may perceive it as a financial burden. This lack of exposure to different roles and responsibilities could hinder an individual's ability to develop a broad skill set, which is highly desirable in today's job market. As a result, employees might find themselves limited to a narrow range of positions, potentially stunting their career growth and long-term investment in their professional development.

In conclusion, while the intention behind stricter minimum wage laws is to improve the financial well-being of workers, it is essential to consider the potential trade-offs, particularly in terms of employment flexibility. This flexibility is vital for individuals to explore diverse career paths, gain valuable experience, and adapt to the evolving demands of the job market. A balanced approach, one that encourages fair compensation while also fostering a flexible and dynamic work environment, is key to ensuring that earners can progress and invest in their long-term careers.

Understanding Liquid Assets: Short-Term Investments Explained

You may want to see also

Inflationary Pressures: Increased wages can lead to higher inflation, eroding purchasing power over time

The concept of minimum wage and its impact on long-term investments is a complex issue, and one of the key considerations is the potential for increased inflation. When minimum wages are raised, it can have a direct effect on the cost of living, particularly for low-income earners. As wages rise, businesses often face higher operational costs, which may lead to a ripple effect throughout the economy.

One of the primary mechanisms through which this occurs is the relationship between wages and prices. When minimum wages increase, it directly impacts the earnings of those in low-wage jobs. As a result, these individuals may have more disposable income, which can lead to increased demand for goods and services. This higher demand can drive up prices, especially for essential items, as businesses aim to cover their increased labor costs. Over time, this can contribute to a general rise in the price level, commonly known as inflation.

Inflation, in turn, erodes the purchasing power of individuals. As prices increase, the money that was once worth a certain amount now buys less. This is particularly detrimental to long-term investments, as the real value of savings and investments decreases. For example, if an individual invests in a long-term savings plan or a property, and inflation outpaces the growth of their investment, the actual value of their investment may diminish over time. This can discourage people from making long-term financial commitments, as the potential returns may not keep up with the rising costs of living.

Furthermore, the impact of increased wages on inflation can have a knock-on effect on the overall economy. As businesses struggle to manage higher labor costs, they may reduce hiring or even consider automation to cut expenses. This could potentially lead to a slowdown in economic growth and job creation, which are essential for long-term prosperity. The delicate balance between wage growth and inflation must be carefully managed to ensure that the economy remains stable and supportive of long-term investments.

In summary, while raising minimum wages can provide immediate benefits to low-income earners, it also carries the risk of increased inflation. This inflationary pressure can significantly impact long-term investments, reducing their value and discouraging individuals from making crucial financial decisions. Striking the right balance between wage growth and inflation management is essential for fostering a healthy economy and encouraging long-term investment strategies.

Unlocking Long-Term Wealth: Strategies for Profitable Investment Growth

You may want to see also

Frequently asked questions

The minimum wage is a crucial topic in discussions about economic fairness and worker rights. While it aims to provide a basic standard of living, its impact on long-term financial goals for earners is complex. On one hand, a higher minimum wage can reduce poverty and increase disposable income, allowing individuals to save more. However, it may also lead to higher costs for businesses, potentially resulting in reduced hiring or even job losses, especially in low-margin industries. This can set earners back in terms of long-term financial stability and career progression.

Yes, a significantly increased minimum wage might have unintended consequences. For instance, if the wage floor rises too high, it could discourage low-income individuals from investing in their education or starting small businesses. Higher wages might make it less attractive to take on entry-level jobs, which are often stepping stones to better opportunities. This could potentially lead to a skills gap and limit the ability of individuals to progress in their careers, thus impacting their long-term earning potential.

A living wage, which is designed to cover the basic costs of living in a particular region, can provide more financial security for earners. It ensures that workers can afford essential needs like housing, food, and healthcare, reducing the reliance on public assistance programs. This increased financial stability can enable individuals to plan for the long term, invest in their future, and make more significant financial decisions without the constant worry of making ends meet.

The relationship between minimum wage and productivity is not straightforward. While some studies suggest that higher wages can lead to increased productivity as workers feel more valued and motivated, others argue that it may not always be the case. If the wage increase is not accompanied by improved working conditions or job security, workers might focus more on immediate income rather than long-term productivity gains. Additionally, businesses might need time to adjust and adapt, which could temporarily impact overall productivity.

Policymakers play a crucial role in balancing the needs of workers and businesses. One approach is to implement a gradual wage increase, allowing businesses time to adapt and potentially invest in automation or training. This can help maintain job security and encourage long-term investments in the workforce. Additionally, providing support and resources for small businesses can ensure that they can absorb the increased labor costs without significant negative impacts on employment. Regular reviews and adjustments based on economic data can also help strike a balance between worker benefits and business sustainability.