Private investing, also known as angel investing or venture capital, is a form of investment where individuals or firms provide capital to startups and early-stage companies in exchange for equity or ownership. This type of investing is distinct from traditional public markets, where companies offer shares to the general public. Private investors play a crucial role in the startup ecosystem by providing the necessary funding for businesses to grow, innovate, and scale. They often offer not only financial support but also strategic guidance, mentorship, and industry connections. Understanding the mechanics of private investing is essential for entrepreneurs seeking funding and for investors looking to diversify their portfolios with high-growth potential companies.

What You'll Learn

- Understanding Private Equity: How private equity firms invest in and manage companies

- Angel Investing Basics: The process of individual investors funding startups

- Venture Capital Models: Strategies used by VCs to evaluate and invest in startups

- Limited Partnerships: Legal structure for private investment funds

- Exit Strategies: Methods for investors to realize returns from their private investments

Understanding Private Equity: How private equity firms invest in and manage companies

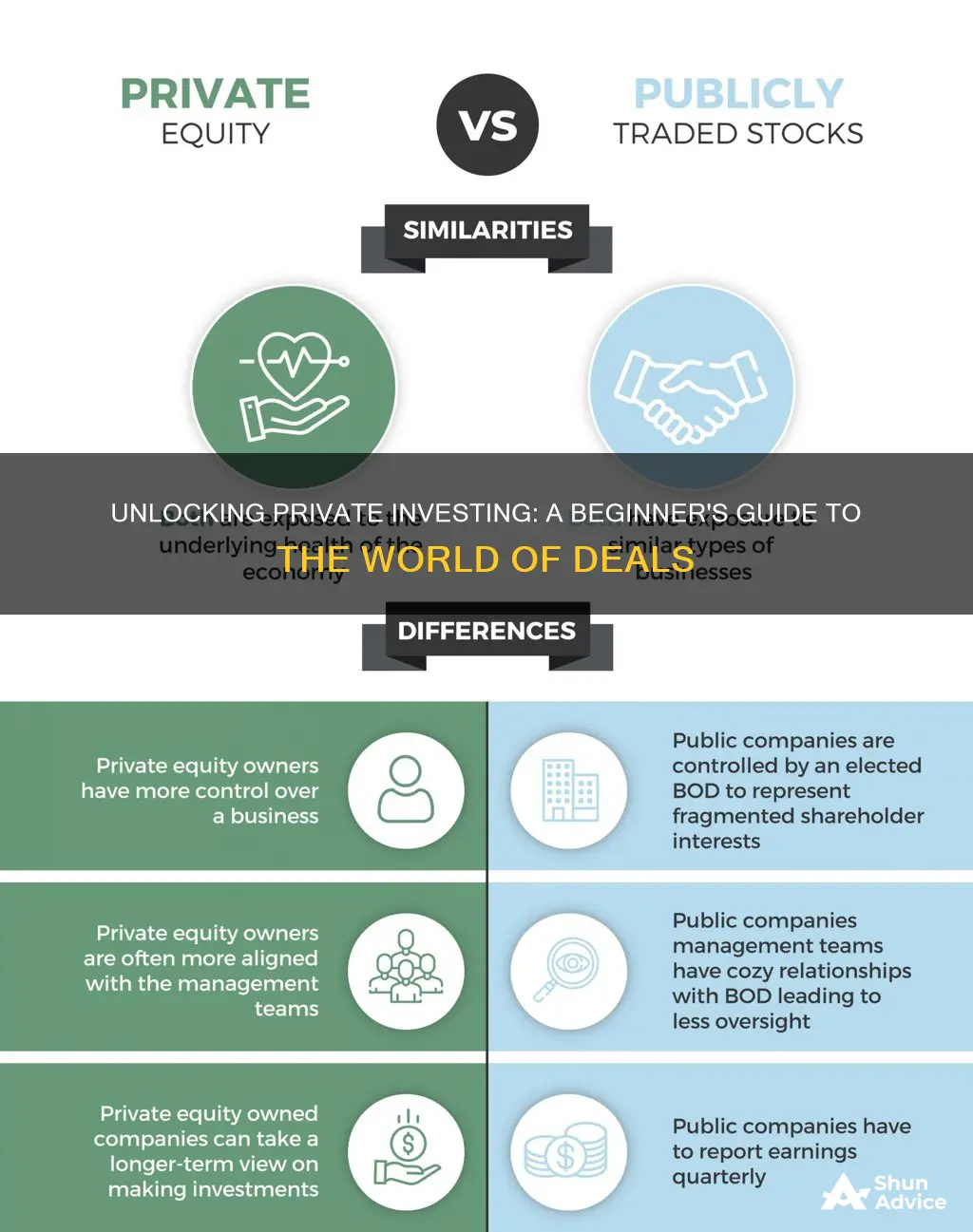

Private equity is a powerful investment strategy that involves acquiring and managing companies, often with the goal of increasing their value and generating significant returns for investors. This process is distinct from traditional public equity investments, where shares are traded on stock exchanges. Private equity firms play a crucial role in this ecosystem by investing in companies that are not publicly listed, providing them with the capital and expertise needed to grow and thrive.

The process begins with a private equity firm identifying and acquiring a company, typically through a leveraged buyout. This involves purchasing the company's assets and taking on debt to finance the acquisition. The firm then becomes the majority shareholder and takes control of the company's operations. The primary objective is to improve the company's performance through strategic initiatives, operational enhancements, and financial optimizations. Private equity firms often focus on specific industries or sectors, allowing them to develop deep expertise and a competitive edge.

One of the key advantages of private equity is the ability to tailor investment strategies to individual companies. Private equity firms conduct thorough due diligence to assess the target company's financial health, market position, and growth potential. They identify areas for improvement, such as cost-cutting measures, operational inefficiencies, or market expansion opportunities. By implementing these strategies, private equity firms aim to increase the company's profitability, market share, and overall value. This hands-on approach often involves active participation in day-to-day management, working closely with the company's existing management team to drive positive change.

Over time, private equity firms may choose to exit their investments through various means, such as selling the company to another buyer or taking it public via an initial public offering (IPO). The success of private equity investments is often measured by the difference between the initial investment and the final sale price, along with the improvements made during the investment period. This strategy requires a long-term perspective and a willingness to take calculated risks, as private equity investments can be highly leveraged and may involve significant financial commitments.

Understanding private equity is essential for investors and entrepreneurs alike. It offers a unique approach to investing, providing companies with the resources and guidance needed to achieve growth and success. Private equity firms bring a wealth of experience, industry connections, and strategic insights, contributing to the overall success of their portfolio companies. This investment strategy continues to play a significant role in the global economy, shaping industries and driving innovation through the acquisition and transformation of businesses.

Retirement Investing: Knowing When to Play it Safe

You may want to see also

Angel Investing Basics: The process of individual investors funding startups

Angel investing is a form of private investment where individual investors, known as angels, provide capital to startups and early-stage companies in exchange for equity or ownership in the business. This process allows entrepreneurs to access the funding they need to launch and grow their ventures, while angels get the opportunity to invest in potentially high-growth companies and benefit from their success. Here's an overview of the basics:

Understanding the Role of Angels: Angel investors are typically high-net-worth individuals who invest their own capital directly into businesses. They often have industry expertise and provide mentorship and guidance to the startups they back. Angels may invest individually or as part of an angel network or syndicate, where multiple investors pool their resources to invest in a single company. This approach allows for larger investments and a more diverse portfolio.

The Investment Process: When a startup seeks funding, it approaches individual angel investors or their networks. Angels review business plans, conduct due diligence, and assess the company's potential for growth and profitability. They consider various factors such as the team's expertise, market opportunity, competitive advantage, and financial projections. Due diligence may include verifying the business's legal and financial status, analyzing its competitors, and understanding the industry trends.

Term Sheets and Agreements: If an angel investor decides to invest, they will negotiate the terms of the investment, which are documented in a term sheet. This document outlines the amount invested, the type of equity or ownership granted, voting rights, and any special provisions or protections for the angel. The startup and the investor then draft a formal investment agreement, which is a legally binding contract. This agreement specifies the rights and obligations of both parties and the terms of the investment.

Valuation and Equity: Startups often seek funding in exchange for a percentage of ownership, which is determined through valuation. Angels consider various valuation methods, such as comparable company analysis, discounted cash flow, or market multiples. The agreed-upon valuation sets the price for the startup's equity, and the angel investor receives a corresponding number of shares or ownership stakes.

Post-Investment Support: Angel investors often provide more than just financial support. They may offer strategic advice, industry connections, and mentorship to help the startup succeed. Angels can assist with business development, operational improvements, and strategic decision-making. This support is valuable for entrepreneurs, as it can significantly impact the company's growth and ability to attract further investments.

Angel investing is a high-risk, high-reward venture, and it requires thorough research, due diligence, and a clear understanding of the startup's potential. Individual investors should carefully evaluate their investment criteria, risk tolerance, and the time commitment required to ensure a successful and rewarding experience.

Unlock Wealth: Whole Life Insurance as a Powerful Investment Strategy

You may want to see also

Venture Capital Models: Strategies used by VCs to evaluate and invest in startups

Venture capital (VC) firms employ various models and strategies to evaluate and invest in startups, which are crucial for their success in the highly competitive private investment landscape. These models help VCs make informed decisions, manage risks, and maximize returns on their investments. Here's an overview of some common strategies used by venture capitalists:

Industry and Market Analysis: VCs start by conducting an in-depth analysis of the industry and market in which the startup operates. This includes studying market trends, competitive landscapes, customer behavior, and regulatory environments. By understanding the industry dynamics, VCs can assess the startup's potential for growth, identify unique value propositions, and evaluate the addressable market size. They look for disruptive technologies, innovative business models, or untapped customer segments that can drive success.

Financial Modeling and Due Diligence: Financial modeling is a critical aspect of the investment process. VCs build financial models to forecast the startup's revenue, expenses, cash flows, and profitability over time. This involves analyzing historical financial data, industry benchmarks, and market research to create realistic projections. Due diligence is also conducted to verify the accuracy of the startup's financial statements, assess its legal and operational risks, and evaluate the quality of its management team. VCs may also review customer contracts, intellectual property, and potential liabilities.

Company and Team Assessment: VCs evaluate the startup's business model, product or service, and go-to-market strategy. They assess the uniqueness and scalability of the offering, the competitive advantage, and the potential for market penetration. Additionally, VCs scrutinize the startup's management team, including the founders' experience, skills, and track record. They look for a strong leadership team with complementary strengths, a clear vision, and the ability to execute their strategy. The team's ability to adapt, innovate, and navigate challenges is also a key consideration.

Risk Assessment and Mitigation: VC firms employ risk assessment frameworks to identify and quantify various risks associated with the investment. This includes market risk, competitive risk, operational risk, and financial risk. VCs analyze the startup's ability to manage these risks and develop contingency plans. They may also consider the startup's resilience to economic cycles and industry disruptions. Risk mitigation strategies can include diversification across multiple startups, sectors, and stages of investment.

Exit Strategies and Value Creation: VCs focus on the potential exit strategies for their investments, which can include initial public offerings (IPOs), mergers and acquisitions (M&A), or trade sales. They assess the startup's growth trajectory, market position, and the likelihood of achieving a successful exit. VCs also evaluate the value-creation opportunities, such as strategic partnerships, product enhancements, or market expansion, that can increase the startup's value over time.

VCs often use a combination of these strategies to make informed investment decisions. The process involves rigorous research, analysis, and due diligence, ensuring that the startup aligns with the VC's investment thesis and has the potential to deliver significant returns. These models and strategies are essential tools for VCs to navigate the complex world of private investing and build a successful portfolio of startups.

The Timeless Debate: Do Investment Bankers Still Wear Suits?

You may want to see also

Limited Partnerships: Legal structure for private investment funds

Limited partnerships are a legal structure commonly used for private investment funds, offering a unique blend of ownership and management. This structure is particularly appealing to investors seeking a more hands-off approach while still maintaining a level of control and protection. Here's a detailed breakdown of how limited partnerships function in the context of private investing:

In a limited partnership, the fund is structured as a legal entity, typically a partnership, with two distinct categories of partners: the general partner(s) and the limited partner(s). The general partner(s) manage the investment fund and are responsible for making investment decisions, while the limited partners provide the capital and typically have limited involvement in day-to-day operations. This division of roles is a key advantage, as it allows for a more efficient management structure and a clear delineation of responsibilities.

The limited partners' investment is protected by the 'limited liability' principle, which means their personal assets are generally shielded from the fund's debts and liabilities. This is a significant benefit for investors, as it provides a level of security and reduces personal risk. In contrast, general partners often have unlimited liability, meaning their personal assets can be at risk if the fund incurs significant losses.

One of the critical aspects of limited partnerships is the distribution of profits and losses. Profits are typically shared according to a predetermined ratio, which is agreed upon by the partners at the outset. This ratio can vary, but it often reflects the level of involvement and risk taken by each partner. For instance, the general partner might receive a higher percentage of profits due to their active management role, while limited partners benefit from the fund's success without the associated risks.

Limited partnerships also offer tax advantages. In many jurisdictions, limited partnerships are treated as 'pass-through' entities for tax purposes, meaning the fund itself is not taxed. Instead, the profits and losses are passed through to the partners, who then declare them on their personal tax returns. This structure can result in more favorable tax treatment for investors, especially in high-tax jurisdictions.

In summary, limited partnerships provide a structured and legally protected environment for private investment funds. This structure allows for a clear separation of management and ownership, with limited partners benefiting from the fund's success while minimizing personal risk. The tax advantages and efficient management structure make limited partnerships an attractive option for investors looking to participate in private equity or venture capital opportunities.

Investing While in Debt: Why You Shouldn't Press Pause on Your Financial Future

You may want to see also

Exit Strategies: Methods for investors to realize returns from their private investments

Exit strategies are crucial components of any investment plan, especially in the realm of private investing, where the potential for high returns often comes with a higher degree of risk and uncertainty. These strategies outline the methods and timelines for investors to realize their gains and move on to new opportunities. Here are some common exit strategies employed by private investors:

- Initial Public Offering (IPO): One of the most traditional and widely recognized exit strategies is an IPO. This involves taking a privately held company public by listing it on a stock exchange. By doing so, investors can sell their shares to the public, providing liquidity and potentially realizing substantial gains. IPOs offer a structured way to exit, as they provide a clear timeline and a regulated market for trading. However, it's a complex process that requires significant preparation, including meeting regulatory requirements and ensuring the company's financial health is in order.

- Trade Sale: In this strategy, investors sell their private company to another company or an acquirer. Trade sales can be a faster way to exit, especially if the acquiring company is in a similar industry and sees value in the target company's assets, technology, or market position. This method often involves negotiations and due diligence to ensure a fair valuation. Investors may also negotiate earn-outs, which are additional payments based on the company's performance post-acquisition.

- Management Buyout (MBO): Here, the management team of the private company purchases the business from external investors. MBOs allow the existing management to retain control and continue growing the business. This strategy can be attractive as it provides a clear understanding of the company's future direction and potential. Investors can realize returns by selling their shares to the management team or through a secondary sale to other investors.

- Secondary Market Transactions: Private investors can also exit their investments through secondary market transactions, where they sell their shares to other investors who are already holding a stake in the company. This can be done through private equity firms or through online platforms that facilitate such trades. Secondary market transactions provide liquidity without the need for a full-scale exit process, making it a more flexible strategy.

- Rollover or Recapitalization: This strategy involves restructuring the company's capital structure, often by replacing debt with equity or vice versa. It can be used to exit investors by providing them with an opportunity to sell their shares to new investors or to the company itself. Rollovers and recapitalizations are common in private equity firms and can offer investors a chance to diversify their portfolios.

Each exit strategy has its own set of advantages and considerations, and the choice depends on various factors, including the company's industry, growth prospects, and the investor's risk tolerance. A well-defined exit strategy ensures that investors can make the most of their private investments and adapt to changing market conditions.

Stratton Oakmont: Victims and Vanishers

You may want to see also

Frequently asked questions

Private investing refers to the act of investing in privately held companies or assets that are not publicly traded on stock exchanges. This can include early-stage startups, real estate, private equity, and other alternative investment opportunities.

Private investing involves buying and selling assets or companies that are not listed on public stock markets. It often requires a more personalized approach and may involve direct negotiations with companies or other investors. In contrast, public investing is done through publicly traded companies, which are regulated and offer a more liquid investment option.

Private investing is often accessible to accredited investors, high-net-worth individuals, or institutional investors. These investors have the financial resources and knowledge to assess the risks and potential rewards of private deals. They may include venture capitalists, angel investors, private equity firms, and wealthy individuals seeking alternative investment strategies.

Private investing offers several advantages, such as the potential for higher returns due to the early-stage nature of many private companies. It provides access to unique investment opportunities that may not be available to the general public. Private investors can also have more control over their investments and may benefit from tax advantages, depending on the jurisdiction and investment structure.

Getting into private investing often requires a network and connections within the investment community. One can start by attending industry events, joining investment clubs, or seeking advice from experienced investors. Due diligence is crucial, so investors should thoroughly research companies, conduct thorough financial analysis, and consider legal and regulatory requirements associated with private investments.