The Rule of 72 is a quick and easy method to estimate how long it will take for an investment to double in value. This rule of thumb is based on a simplified formula that measures the effect of compound interest on an investment. By dividing 72 by the expected annual rate of return, investors can determine how many years it will take for their initial investment to duplicate itself. For example, if an investment scheme promises an 8% annual compounded rate of return, it will take approximately nine years (72 / 8 = 9) to double the invested money. The Rule of 72 is most accurate for rates of return between 5% and 10%.

| Characteristics | Values |

|---|---|

| Name of Rule | Rule of 72 |

| Use | To estimate how long it will take to double an investment at a given interest rate |

| Formula | 72 / Expected Rate of Return |

| Formula Application | Divide 72 by the interest rate to see how long it will take to double your money on an investment |

| Calculation Example | If you invest a sum of money at 6% interest per year, how long will it take you to double your investment? t=72/R = 72/6 = 12 years |

| Accuracy | The Rule of 72 is not precise but is a quick way to get a useful ballpark figure |

| Accuracy Range | The calculation is most accurate for rates of return of about 5% to 10% |

| More Precise Formula | For more precise outcomes, divide 69.3 by the rate of return |

| Application | The Rule of 72 can also be used to estimate the rate of return needed for an investment to double given an investment period |

| Application Example | If you wanted to double an investment in 5 years, divide 72 by 5 to learn that you'll need to earn 14.4% interest annually on your investment for 5 years: 14.4 x 5 = 72 |

What You'll Learn

The Rule of 72: a formula to estimate years to double investment

The Rule of 72 is a formula used to estimate the number of years required for an investment to double in value, or alternatively, the annual rate of return on an investment given the number of years it will take to double.

The formula is calculated by dividing 72 by the annual rate of return (or interest rate) to get the number of years it will take for an investment to double. For example, if an investment scheme promises an 8% annual compounded rate of return, it will take approximately 9 years (72 / 8 = 9) to double the money invested.

The Rule of 72 is not entirely precise but is a quick and easy method to get a useful ballpark figure. It is most accurate for rates of return between 5% and 10%. It is also a useful formula for mental calculations and when only a basic calculator is available.

The Rule of 72 can also be used to estimate the rate of return needed for an investment to double given an investment period. For example, if you want to double your money in 5 years, divide 72 by 5 to find that you'll need to earn 14.4% interest annually on your investment: 14.4 x 5 = 72.

The Rule of 72 is a simplified version of the more complex compound interest calculation. It is a useful rule of thumb for estimating the doubling of an investment.

The Rule of 72 dates back to 1494 when Luca Pacioli referenced the rule in his book 'Summa de Arithmetica'.

Investing for Retirement: A Conservative Approach to Financial Security

You may want to see also

Calculating the rate of return needed to double investment

The Rule of 72 is a formula used to estimate the number of years required for an investment to double while considering a given annual rate of return. It can also be used to calculate the annual rate of compounded return from an investment given the number of years it will take to double.

The Rule of 72 is a useful tool for investors to quickly gauge an approximate value for the number of years it will take for their investment to double. It is calculated by dividing 72 by the expected rate of return. For example, if an investment scheme promises an 8% annual compounded rate of return, it will take approximately nine years (72 / 8 = 9) for the invested money to double.

The formula can also be adjusted for higher accuracy. The Rule of 72 is most accurate for interest rates ranging from 6% to 10%. When dealing with rates outside this range, the formula can be adjusted by adding or subtracting 1 from 72 for every 3 points the interest rate diverges from the 8% threshold. For example, for a 5% rate of return, the formula would become 71 (72 - 1) since 5% is 3 percentage points lower than 8%.

Additionally, for daily or continuously compounding interest, using 69.3 in the formula instead of 72 will yield a more accurate result. This is known as the Rule of 69.3, which many investors prefer due to its higher precision.

The Rule of 72 can also be used to estimate the rate of return needed for an investment to double within a certain time frame. For instance, if you want to double your investment in 5 years, you would divide 72 by 5, indicating that you'll need to earn approximately 14.4% interest annually (72 / 5 = 14.4).

Investing Globally: Picking the Right Countries

You may want to see also

Using the Rule of 72 for stocks

The Rule of 72 is a formula used to estimate the number of years required for an investment to double at a given annual rate of return. It is calculated by dividing 72 by the expected rate of return. For example, if an investment scheme promises an 8% annual compounded rate of return, it will take approximately nine years (72 / 8 = 9) to double the money invested.

The Rule of 72 is particularly useful for mental calculations and for investors who are just starting as it is easy to understand and calculate. It is a simplified formula that assumes a single average rate over the life of the investment and applies to compounded interest rates. While it is most accurate for interest rates ranging from 6% to 10%, it can be adjusted for higher or lower rates by adding or subtracting 1 from 72 for every 3-percentage point divergence from the 8% threshold.

For example, if you invest $50,000 in a mutual fund with a 6% average rate of return, the Rule of 72 formula (72/6) indicates that your investment will double in value to $100,000 in approximately 12 years.

The Rule of 72 can also be used to estimate the long-term effects of interest or fees on loans, such as business loans, personal loans, or credit cards. Additionally, it can be applied to predict the growth of anything that increases exponentially, such as population or macroeconomic numbers.

It is important to note that the Rule of 72 is an estimation tool, and the number of years it provides is approximate. For more precise calculations, investors can use compound interest calculators or the precise formula for calculating the exact doubling time.

Microsoft: A Smart Investment Choice

You may want to see also

The Rule of 72 and inflation

The Rule of 72 is a formula that can be used to estimate how long it will take for an investment to double in value. It can also be used to estimate the impact of inflation on the value of money.

The Rule of 72 formula is: Years to Double = 72 / Rate of Return on Investment (or interest rate).

For example, if an investment earns an annual interest rate of 4%, it would take approximately 72/4 = 18 years to double in value.

The Rule of 72 can also be used to estimate the impact of inflation on the value of money. For example, if inflation is currently at 3%, dividing 72 by 3 gives 24 years as the time it will take for the purchasing power of money to be reduced by half.

It is important to note that the Rule of 72 is an estimate and is most accurate for interest rates between 6% and 10%. The actual mathematical formula is more complex and is based on the time value of money.

The Rule of 72 is a useful tool for investors as it provides a quick way to estimate the potential growth of their investments over time. It also helps investors understand the impact of inflation on their savings.

The Rule of 72 is not a perfect solution and should not be relied upon as the sole basis for investment decisions. It is important to consider other factors and seek professional financial advice when making investment choices.

Nokia's Resurgence: Why Investors are Buying

You may want to see also

Limitations of the Rule of 72

The Rule of 72 is a simplified formula that estimates the number of years it will take for an investment to double in value, based on its rate of return. While it is a useful tool for mental calculations, it does have several limitations that should be considered:

- The Rule of 72 is an approximation and may only be partially accurate. The actual mathematical formula for calculating the doubling time of an investment is more complex and involves logarithms.

- It assumes a constant interest rate, which may not be the case in reality. Interest rates can fluctuate over time, impacting the accuracy of the Rule of 72 calculation.

- It does not take into account inflation or taxes, which can significantly affect the value of an investment over time. Inflation reduces the purchasing power of money, while taxes reduce the net returns.

- The accuracy of the Rule of 72 depends on the interest rate used. It is most accurate for interest rates between 5% and 10%. The further the interest rate is from this range, the less precise the result will be.

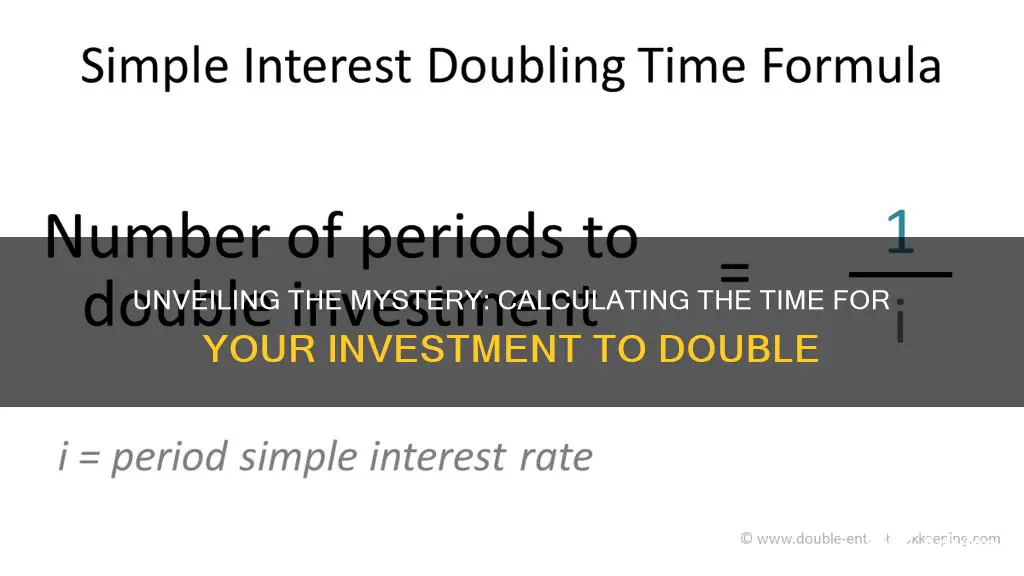

- The Rule of 72 is based on the concept of compound interest, which assumes that interest is calculated on both the initial principal and the accumulated interest. It does not apply to simple interest calculations, where interest is only calculated on the initial principal.

- The frequency of compounding can also impact the accuracy of the Rule of 72. If interest is compounded more frequently, the investment will grow faster, and it will take less time to double than calculated by the Rule of 72.

Due to these limitations, it is important to use the Rule of 72 in conjunction with other financial planning tools and calculations to get a more accurate picture of an investment's potential growth.

The Debt-Investment Dilemma: Navigating the Path to Financial Freedom

You may want to see also

Frequently asked questions

The Rule of 72 is a formula used to estimate how long an investment will take to double based on a given annual rate of return. It is calculated by dividing 72 by the expected rate of return. For example, if you expect a 6% annual rate of return, your investment will double in 12 years (72/6 = 12).

The Rule of 72 is a simplified formula that provides a quick estimate. It is most accurate for rates of return between 5% and 10%. For greater accuracy, you can adjust the formula by adding or subtracting 1 from 72 for every 3% the interest rate diverges from 8%. Alternatively, you can divide 69.3 by the rate of return, which is more precise but less easy to do in your head.

Yes, the Rule of 72 can be applied to any investment, including stocks. However, it is important to note that stocks do not have a fixed rate of return, so the Rule of 72 will give you an estimate of the average annual return needed to double your money in a certain amount of time.