Roth IRA investing is a powerful tool for individuals looking to save for retirement and build wealth over time. In this video, we'll explore how Roth IRAs work and the benefits they offer. From understanding the tax advantages to learning how to contribute and invest, this guide will provide a comprehensive overview of Roth IRA investing. Whether you're a beginner or looking to optimize your retirement savings, this video will help you navigate the world of Roth IRAs and make informed decisions about your financial future.

What You'll Learn

- Roth IRA Basics: Contributions, Tax-Free Growth, and Distribution Rules

- Roth IRA Contributions: Limits, Income Phase-Out, and Tax Implications

- Tax-Free Growth: How Roth IRAs Allow Investments to Grow Tax-Free

- Roth IRA Distribution: Penalties, Required Minimum Distributions (RMDs), and Flexibility

- Roth IRA Conversion: Strategies, Tax Implications, and Benefits

Roth IRA Basics: Contributions, Tax-Free Growth, and Distribution Rules

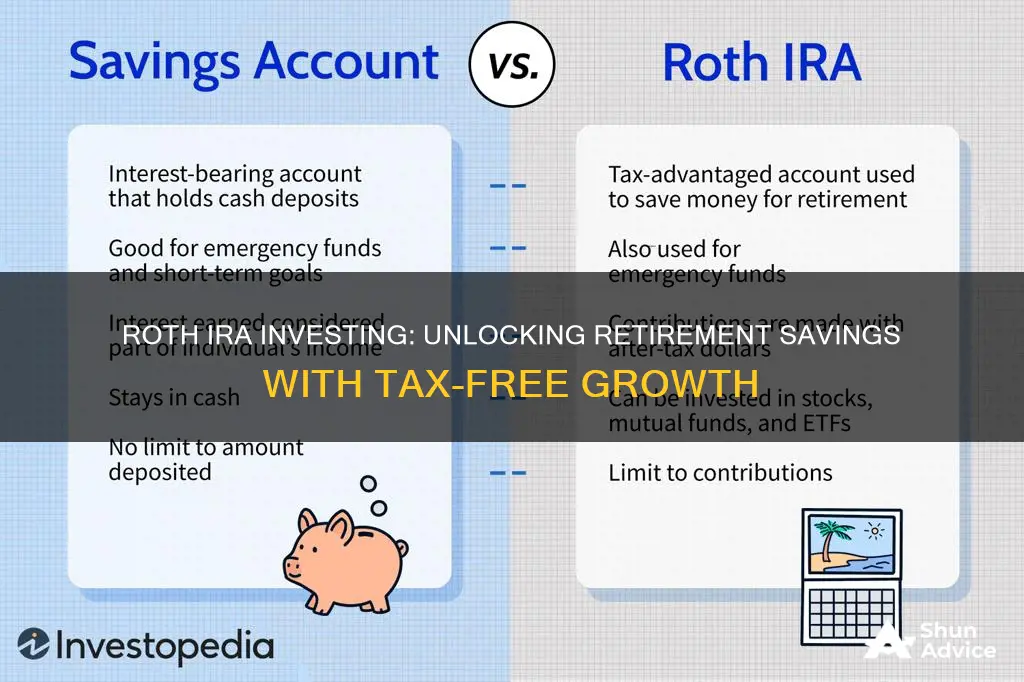

Understanding the fundamentals of a Roth IRA is essential for anyone looking to build a secure financial future. This type of retirement account offers a unique way to save for your later years, providing tax-free growth and a tax-free distribution of earnings. Here's a breakdown of the key aspects:

Contributions: The first step in Roth IRA investing is deciding how much you want to contribute. Unlike traditional IRAs, Roth IRAs do not allow tax deductions for contributions. This means you contribute after-tax dollars, which can be a significant advantage in the long run. The contribution limits for 2023 are $15,500 for individuals and $27,000 for those over 50. It's important to note that you can only contribute up to the limit if your income falls below certain thresholds.

Tax-Free Growth: One of the most attractive features of a Roth IRA is the potential for tax-free growth. Any earnings or capital gains generated within the account grow tax-free. This is because you've already paid taxes on the contributions, allowing your investments to flourish without further tax implications. Over time, this can result in substantial tax savings, as you won't owe taxes on the gains when you withdraw them in retirement.

Distribution Rules: Roth IRA distributions are subject to specific rules. You can withdraw your contributions at any time, tax- and penalty-free. This flexibility is a significant benefit, especially if you need access to your funds before retirement. However, withdrawals of earnings are generally tax-free and penalty-free after age 59½. It's crucial to understand that if you withdraw earnings before this age, you may incur a 10% early withdrawal penalty, unless you qualify for an exception. Additionally, required minimum distributions (RMDs) must begin by April 1 of the year after you reach 72, similar to traditional IRAs.

When considering a Roth IRA, it's essential to weigh the potential benefits against your current financial situation. While contributions are not tax-deductible, the tax-free growth and distribution advantages can be substantial. Consulting a financial advisor can help you determine if a Roth IRA is the right choice for your retirement strategy.

Investment Strategies: Navigating the Ideal Percentage of Your Paycheck to Invest

You may want to see also

Roth IRA Contributions: Limits, Income Phase-Out, and Tax Implications

Understanding the rules and limits surrounding Roth IRA contributions is crucial for anyone looking to maximize their retirement savings. The Roth IRA is a powerful tool for long-term wealth accumulation, offering tax-free growth and withdrawals in retirement. However, it's essential to be aware of the income phase-out and contribution limits to ensure you're taking full advantage of this tax-advantaged account.

For the 2023 tax year, the contribution limit for a Roth IRA is $19,500, which is the same as the traditional IRA limit. This limit applies to individuals, and if you and your spouse both have IRAs, the combined contribution cannot exceed this amount. It's important to note that this limit is adjusted annually for inflation, so it's worth checking the IRS website for the most up-to-date figures.

One of the key advantages of a Roth IRA is that contributions are made with after-tax dollars, meaning you don't get an immediate tax deduction like you would with a traditional IRA. However, the real benefit comes in retirement when qualified distributions are tax-free and penalty-free. This is a significant advantage, especially for those who expect to be in a higher tax bracket during retirement.

The income phase-out for Roth IRA contributions is a critical consideration. For the 2023 tax year, if your income is between $138,000 and $163,000 (for single filers), your Roth IRA contribution is phased out. If you are married filing jointly, the phase-out range is between $204,000 and $228,000. During this phase-out range, your contribution limit will gradually decrease until it reaches zero. It's important to plan your contributions carefully to avoid exceeding these limits, as it could result in penalties.

When making contributions, it's essential to consider your overall financial situation and retirement goals. If you're close to the phase-out range, you might want to consider making contributions to a traditional IRA, which has different contribution limits and tax implications. Additionally, if you're already contributing the maximum to your Roth IRA, you can explore other tax-efficient investment options to further enhance your retirement savings strategy.

Retirement and Beyond: Exploring the World of Alternative Investments

You may want to see also

Tax-Free Growth: How Roth IRAs Allow Investments to Grow Tax-Free

The Roth IRA is a powerful tool for investors seeking tax-free growth on their retirement savings. Unlike traditional IRAs, where contributions are tax-deductible but withdrawals are taxed, Roth IRAs offer a unique advantage: investments grow tax-free. This means that any earnings or capital gains generated within a Roth IRA account are not subject to taxation when withdrawn during retirement.

When you invest in a Roth IRA, you contribute after-tax dollars, meaning you've already paid income tax on the money. This allows you to take advantage of tax-free growth over time. As your investments appreciate, the gains are not taxed, and you can withdraw the earnings tax-free in retirement. This is a significant benefit, especially for those who want to ensure their retirement savings grow without the burden of ongoing taxes.

The key to understanding tax-free growth in a Roth IRA is the concept of post-tax contributions. By investing after-tax dollars, you're essentially bypassing the tax man's grasp on your returns. This strategy enables your investments to flourish without the drag of annual taxes, allowing your retirement savings to grow more efficiently.

One of the most appealing aspects of Roth IRA investing is the potential for long-term wealth accumulation. Since the investments are not taxed, they can grow exponentially over the years. This tax-free growth can be particularly beneficial for those planning for a comfortable retirement, as it provides a substantial nest egg that remains intact for decades.

In summary, Roth IRA investing offers a strategic approach to tax-free growth. By contributing after-tax dollars, investors can watch their money flourish without the worry of annual taxes. This feature makes Roth IRAs an attractive option for those seeking to maximize their retirement savings and enjoy the benefits of tax-free growth. Understanding this concept is essential for anyone looking to make the most of their retirement investments.

Shark Tank: Payback Time?

You may want to see also

Roth IRA Distribution: Penalties, Required Minimum Distributions (RMDs), and Flexibility

Understanding the distribution rules of a Roth IRA is crucial for investors to ensure they make the most of their retirement savings. Unlike traditional IRAs, Roth IRAs offer unique advantages, but they also come with specific guidelines that can impact how and when you access your funds.

Penalties for Early Withdrawals: One of the key benefits of a Roth IRA is that contributions are made with after-tax dollars, meaning you don't get a tax deduction for them upfront. However, this also means that the money in your Roth IRA is not taxable income when you withdraw it in retirement. The penalty for withdrawing funds from a Roth IRA before reaching the age of 59½ is that the earnings on those contributions are subject to income tax and a 10% early withdrawal penalty, unless you qualify for an exception. This penalty is a significant deterrent to early withdrawals, encouraging investors to let their investments grow tax-free over time.

Required Minimum Distributions (RMDs): Unlike traditional IRAs, Roth IRAs do not require RMDs until the account owner reaches age 72. This is a significant advantage, as it allows your investments to continue growing tax-free for a longer period. RMDs are mandatory withdrawals that must be taken from traditional IRAs and, in some cases, Roth IRAs, starting in the year the account holder turns 72 (or reaches age 70½ if they were born before July 1, 1949). For Roth IRAs, RMDs are not required because the contributions were made with after-tax dollars, and the earnings are not taxable upon withdrawal. This flexibility in RMDs gives Roth IRA holders more control over their retirement finances.

Flexibility in Distribution: Roth IRA distributions offer a high degree of flexibility. You can withdraw your contributions at any time, tax- and penalty-free, as long as you are over 59½. This is a significant advantage over traditional IRAs, where withdrawals of contributions are generally taxable. Additionally, Roth IRA earnings can be withdrawn tax- and penalty-free after age 59½, provided the account has been open for at least five years. This flexibility allows investors to access their retirement savings when needed, whether for a down payment on a house, education expenses, or other financial goals.

In summary, Roth IRA distribution rules provide a structured yet flexible approach to retirement savings. The absence of penalties for early withdrawals and the lack of RMDs until age 72 encourage long-term investment strategies. Understanding these rules is essential for investors to maximize the benefits of their Roth IRA, ensuring they have the financial flexibility to achieve their retirement goals.

Unraveling the Mystery: How Limited Partnerships Boost Your Investment Portfolio

You may want to see also

Roth IRA Conversion: Strategies, Tax Implications, and Benefits

Understanding Roth IRA Conversion can be a game-changer for your retirement savings. It involves converting traditional IRA or 401(k) assets into a Roth IRA, offering tax-free growth and withdrawals in retirement. Here's a breakdown of the process, its benefits, and some strategic considerations.

The Conversion Process:

When you convert a traditional IRA or 401(k) to a Roth IRA, you're essentially moving your pre-tax contributions (and their earnings) into a Roth account. This means you'll pay taxes on the converted amount upfront, but the earnings and qualified withdrawals in retirement will be tax-free. The key is to understand the tax implications and choose the right strategy for your financial situation.

Tax Implications:

The tax treatment of Roth IRA conversions is a critical aspect. When you convert, you'll owe income tax on the converted amount, which includes both the contributions and any earnings. The tax rate applied will depend on your overall income for the year and your tax bracket. It's essential to consider this upfront cost, as it can be significant, especially if you're in a higher tax bracket. However, the long-term benefit of tax-free growth and withdrawals in retirement can outweigh this initial expense.

Strategies for Conversion:

- Annual Conversion: This involves converting a portion of your traditional IRA or 401(k) to a Roth IRA each year. It's a gradual approach, allowing you to manage the tax burden over time. You can convert a fixed percentage or a specific amount annually, ensuring you stay within IRS limits.

- Lump-Sum Conversion: Here, you convert the entire balance of your traditional account into a Roth IRA at once. This strategy can be appealing if you want to take advantage of the potential tax benefits immediately. However, it requires a substantial upfront tax payment, which can be challenging for some individuals.

- Backdoor Roth IRA: This strategy is for those who exceed the income limits for direct Roth IRA contributions. You can convert a traditional IRA to a Roth and then withdraw the converted amount within 60 days to avoid taxation. This method allows you to get around income-based restrictions.

Benefits of Roth IRA Conversion:

- Tax-Free Growth: One of the most significant advantages is the potential for tax-free growth and withdrawals in retirement. Unlike traditional IRAs, Roth IRAs grow tax-free, and qualified distributions are also tax-free.

- Flexibility in Retirement: Roth IRA distributions are not subject to required minimum distributions (RMDs) after age 72, giving you more control over when and how you access your savings.

- Legacy Planning: Roth IRAs can be passed down to beneficiaries tax-free, providing a valuable inheritance for your loved ones.

Considerations:

Before converting, carefully assess your financial situation and tax outlook. Consult a financial advisor to determine the best strategy, especially if you're close to retirement age. Understanding the tax laws and your personal financial goals is crucial to making an informed decision.

Unlocking Wealth: Understanding Trust Deed Investments and Their Benefits

You may want to see also

Frequently asked questions

A Roth IRA (Individual Retirement Account) is a tax-advantaged retirement savings plan that allows individuals to invest and potentially grow their money tax-free. With a Roth IRA, you contribute after-tax dollars, meaning you've already paid income tax on the money you put in. The key benefit is that qualified withdrawals, including earnings, are tax-free and penalty-free in retirement.

Setting up a Roth IRA involves several steps. First, you'll need to choose a financial institution or custodian that offers Roth IRA services. Research and compare different providers to find one that suits your needs and investment goals. Once you've selected a custodian, you'll open an account, fund it with after-tax dollars, and then choose your investment options, such as stocks, bonds, mutual funds, or exchange-traded funds (ETFs).

Roth IRAs offer significant tax advantages. Since you contribute after-tax dollars, you can deduct your contributions in the year you make them, providing an immediate tax benefit. Additionally, earnings on your investments grow tax-free, and qualified withdrawals in retirement are also tax-free. This means your savings can grow faster, and you'll have more funds available for retirement without incurring additional tax liabilities.

Yes, there are income limits for contributing to a Roth IRA, which determine whether you're eligible to make tax-deductible contributions or whether you can contribute at all. For the 2023 tax year, if your filing status is single or head of household, you must have modified adjusted gross income (MAGI) below $130,000 to be able to contribute the full amount. If your MAGI exceeds this limit, you may be able to make partial contributions or consider a backdoor Roth IRA strategy.