Target maturity investment is a strategic approach to financial planning that involves investing in securities with a specific maturity date. This strategy is particularly useful for investors who want to ensure that their investments will mature at a predetermined point in the future, aligning with their financial goals and risk tolerance. By carefully selecting securities with the desired maturity, investors can create a structured plan to reach their financial objectives, such as funding a child's education or saving for retirement. This method allows investors to take advantage of the potential growth of investments while also ensuring a clear timeline for reaching their financial milestones. Understanding how target maturity investment works can be a valuable tool for anyone looking to make informed decisions about their long-term financial strategy.

What You'll Learn

- Target Date Funds: These funds adjust asset allocation based on the investor's age, aiming for a specific retirement date

- Asset Allocation: The fund manager dynamically adjusts the mix of stocks, bonds, and other assets as the target date approaches

- Risk Management: Strategies to manage risk as investors age, gradually shifting towards more conservative investments

- Performance Tracking: Regular reviews to ensure the fund's performance aligns with the target maturity goals

- Tax Efficiency: Optimizing tax strategies to maximize returns and minimize tax impacts as investors near retirement

Target Date Funds: These funds adjust asset allocation based on the investor's age, aiming for a specific retirement date

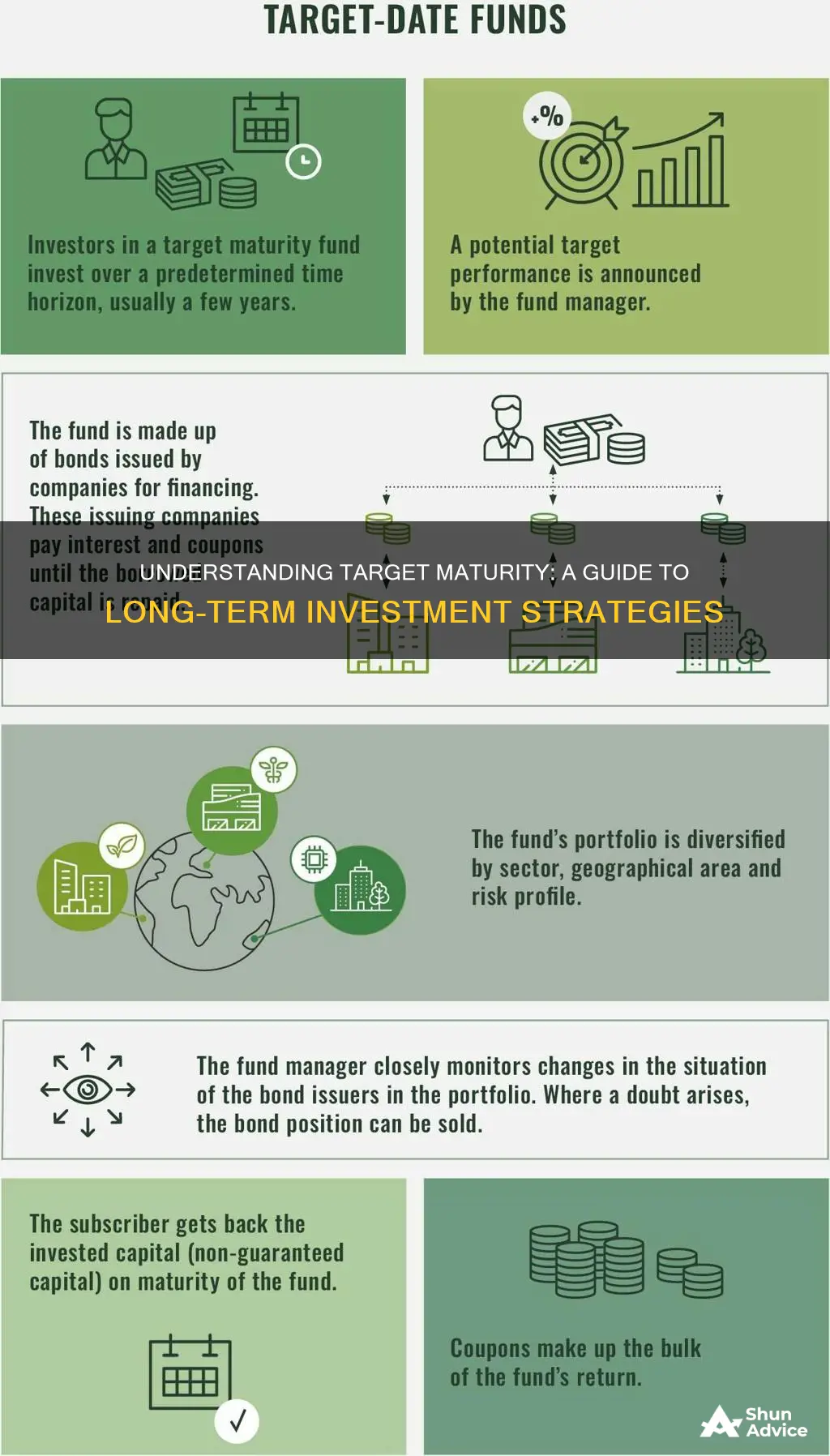

Target Date Funds are a type of mutual fund or exchange-traded fund (ETF) designed to help investors plan for retirement by offering a dynamic investment strategy. These funds are a popular choice for individuals who want a simplified approach to investing, especially when it comes to retirement savings. The core concept behind target date funds is that they adjust their asset allocation over time, gradually shifting from more aggressive investments to more conservative ones as the investor approaches their retirement goal.

The asset allocation in these funds is strategically structured to match the investor's age and the target retirement date. For instance, a 30-year-old investor with a retirement goal set for 30 years from now might have a portfolio that is heavily weighted towards stocks, which are generally considered riskier but offer higher potential returns. As the investor gets closer to retirement, the fund manager gradually reduces the stock allocation and increases the bond allocation, making the portfolio more conservative and less volatile. This process ensures that the fund's performance aligns with the investor's risk tolerance as they age.

The beauty of target date funds lies in their ability to provide a 'one-stop-shop' investment solution. Investors don't need to worry about constantly rebalancing their portfolios or making frequent adjustments as their financial goals change. The fund manager takes care of this, making it an excellent choice for those who prefer a hands-off approach to investing. As the investor ages, the fund's performance becomes more aligned with their risk profile, making it a well-rounded and dynamic investment strategy.

One of the key advantages of target date funds is their simplicity. Investors can easily understand the fund's strategy, as it is directly tied to their age and retirement goals. This transparency allows investors to make informed decisions and feel confident in their retirement planning. Additionally, these funds often have lower management fees compared to actively managed funds, making them an attractive option for cost-conscious investors.

In summary, target date funds are a powerful tool for retirement planning, offering a structured and dynamic investment approach. By adjusting asset allocation based on age, these funds provide a convenient way to build wealth over time, ensuring that investors are well-prepared for their retirement goals. This type of investment strategy is particularly beneficial for those who want a simplified, long-term investment plan without the hassle of frequent portfolio adjustments.

Unveiling the Tricks: How Investment Scams Manipulate Victims

You may want to see also

Asset Allocation: The fund manager dynamically adjusts the mix of stocks, bonds, and other assets as the target date approaches

As the target maturity date for a target maturity investment fund approaches, the fund manager employs a strategic approach known as asset allocation to optimize the portfolio's performance and risk profile. This process involves a dynamic adjustment of the fund's holdings in stocks, bonds, and other assets to align with the changing market conditions and the fund's objectives.

The primary goal of asset allocation is to create a balanced portfolio that can withstand various market scenarios while striving to meet the fund's target maturity goals. As the target date nears, the fund manager typically increases the allocation to more conservative assets, such as bonds, to ensure capital preservation and reduce interest rate risk. This shift in asset allocation is a critical aspect of managing risk and providing stability for investors as they approach retirement or the desired maturity date.

Stocks, which are generally more volatile, are often gradually reduced in the portfolio as the target date is imminent. This reduction in stock allocation helps to minimize potential losses during a market downturn and ensures that the fund's value remains stable and aligned with the investor's risk tolerance. The fund manager carefully considers the timing and extent of these adjustments to optimize the fund's performance and provide a smooth transition to the target maturity date.

Bonds, on the other hand, play a crucial role in providing income and stability to the portfolio. As the target date approaches, the fund manager may increase the bond allocation to take advantage of the higher yields and lower volatility associated with fixed-income securities. This strategic allocation helps to generate a steady income stream and reduce the overall risk of the portfolio.

Additionally, the fund manager may also consider other asset classes, such as real estate investment trusts (REITs) or alternative investments, to further diversify the portfolio and manage risk. By dynamically adjusting the asset mix, the fund manager aims to create a well-rounded investment strategy that caters to the specific needs and goals of investors as they near their target maturity date. This approach ensures that the fund remains aligned with the investors' risk preferences and provides a sense of security during the transition period.

The Great Debate: Paying Off Bills vs. Investing – Which Should You Choose?

You may want to see also

Risk Management: Strategies to manage risk as investors age, gradually shifting towards more conservative investments

As investors age, their risk tolerance often decreases, and managing risk becomes a critical aspect of their investment strategy. This is where the concept of target maturity investment comes into play, offering a structured approach to navigate the complexities of retirement planning. This strategy involves gradually shifting an investor's portfolio towards more conservative investments as they approach their desired retirement date or target maturity. By doing so, investors can ensure that their financial resources are aligned with their changing needs and risk preferences.

One of the primary strategies for risk management in target maturity investment is asset allocation. As investors age, they typically move through different life stages, and their financial goals evolve. For instance, during their working years, investors might focus on building a substantial nest egg by investing in a mix of stocks and bonds. However, as retirement approaches, the strategy shifts towards a more conservative allocation. This could mean increasing the proportion of fixed-income securities, such as bonds, and reducing exposure to volatile assets like stocks. By gradually rebalancing the portfolio, investors can minimize the impact of market fluctuations and ensure a steady stream of income during retirement.

Another crucial aspect of risk management is regular portfolio reevaluation. Investors should periodically assess their target maturity investment strategy to ensure it remains aligned with their goals. This involves reviewing the performance of individual investments, market conditions, and personal circumstances. For example, if an investor's health status changes, they might need to adjust their investment approach to accommodate potential future healthcare costs. Regular reevaluation allows investors to make informed decisions about buying, selling, or holding investments, ensuring that their portfolio is optimized for their current risk tolerance.

Additionally, investors can employ a strategy known as "laddering" to manage risk effectively. Laddering involves spreading investments across different maturity dates or time horizons. For instance, an investor might allocate a portion of their portfolio to short-term bonds, another to intermediate-term bonds, and the remaining to long-term bonds. This approach provides a steady income stream and helps smooth out the impact of market volatility. As the investor ages and approaches the target maturity, they can gradually shift the ladder, moving from longer-term to shorter-term investments, ensuring a more conservative position over time.

Furthermore, diversification is a key principle in risk management. Investors should aim to diversify their portfolios across various asset classes, sectors, and geographic regions. By not putting all their eggs in one basket, investors can reduce the overall risk of their portfolio. As investors age, they might consider increasing the allocation to safer assets like government bonds or high-quality corporate bonds, while still maintaining a small portion of their portfolio in growth-oriented investments to potentially keep up with inflation. This balanced approach ensures that investors can meet their financial objectives while minimizing the risks associated with market downturns.

In summary, managing risk as investors age is a critical aspect of retirement planning, and target maturity investment strategies provide a structured approach to achieve this. By gradually shifting towards more conservative investments, investors can ensure financial security and stability during their retirement years. Asset allocation, regular portfolio reevaluation, laddering, and diversification are essential tools in this process, allowing investors to make informed decisions and adapt to changing circumstances as they navigate the journey towards their target maturity.

Renting vs. Investing: The Financial Dilemma

You may want to see also

Performance Tracking: Regular reviews to ensure the fund's performance aligns with the target maturity goals

Performance tracking is a critical aspect of managing target maturity investments, ensuring that the investment strategy remains on course to meet its defined objectives. This process involves regular and systematic reviews of the investment portfolio's performance against the predetermined target maturity goals. The primary purpose is to identify any deviations from the planned trajectory and take corrective actions promptly.

In the context of target maturity investments, these reviews are essential as they provide a clear picture of how the investment is progressing towards its intended end date. For instance, if an investor has a target maturity fund for a specific project or goal, regular performance tracking will help assess whether the fund is accumulating assets at the desired rate and in the right proportions. This is particularly important for long-term investments, where market conditions and economic factors can significantly impact performance.

During these performance reviews, investors and fund managers should analyze key metrics such as return on investment, risk exposure, and the allocation of assets across different sectors or asset classes. By comparing the current performance with the historical data and the initial investment plan, it becomes easier to identify areas of strength and weakness. For example, if the fund is underperforming compared to its peers or the market index, a review might uncover issues like excessive fees, poor asset allocation, or a lack of diversification.

Regular reviews also allow for proactive decision-making. If the performance is not meeting the target maturity goals, adjustments can be made to the investment strategy. This could involve rebalancing the portfolio, reallocating assets, or even making changes to the investment approach itself. For instance, if the fund is expected to mature in a high-interest environment, the strategy might be to invest in shorter-term securities to capture more favorable returns.

In summary, performance tracking is a vital tool for maintaining the integrity of target maturity investments. It enables investors to make informed decisions, adapt to changing market conditions, and ensure that the investment strategy remains aligned with the intended goals. By conducting these regular reviews, investors can optimize their portfolios and increase the likelihood of achieving their target maturity objectives.

Beyond the Desk: Investment Bankers' Extracurricular Engagements

You may want to see also

Tax Efficiency: Optimizing tax strategies to maximize returns and minimize tax impacts as investors near retirement

As investors approach retirement, tax efficiency becomes a critical factor in optimizing their financial strategies. The goal is to maximize returns while minimizing the tax impact on their hard-earned savings. This is where the concept of target maturity investment can be a valuable tool.

Target maturity investments are structured products designed to provide a specific return at a predetermined maturity date, often aligned with retirement goals. These investments are structured as a series of financial instruments, such as bonds or fixed-income securities, that are carefully selected and managed to meet a particular objective. The key advantage is that investors can lock in a guaranteed return, ensuring a steady income stream during retirement. By choosing investments with a target maturity, investors can strategically plan their tax efficiency.

One strategy to optimize tax efficiency is to consider the tax treatment of different investment types. For example, tax-free municipal bonds can be an attractive option for investors in higher tax brackets. These bonds offer tax-exempt income, allowing investors to keep more of their returns. Additionally, investors can utilize tax-efficient exchange-traded funds (ETFs) that track specific market sectors or indices. ETFs often have lower expense ratios and can provide diversification, which can help reduce tax implications through efficient portfolio management.

Another approach is to review and adjust investment allocations as retirement nears. Investors can strategically shift their portfolio towards tax-efficient assets. For instance, selling investments with higher capital gains and buying those with lower tax implications can result in significant savings. Additionally, investors can consider tax-loss harvesting, where they sell investments at a loss to offset capital gains, thus reducing their taxable income. This strategy requires careful planning and a comprehensive understanding of tax laws to ensure compliance.

Furthermore, investors should stay informed about tax law changes and seek professional advice. Tax regulations can vary over time, and staying updated is essential. Consulting a financial advisor or tax specialist can provide personalized guidance, ensuring that investment strategies align with tax-efficient practices. They can help identify suitable investment vehicles, optimize portfolio allocations, and provide strategies to minimize tax burdens during retirement.

In summary, as investors near retirement, tax efficiency is a critical aspect of their financial planning. Target maturity investments offer a structured approach to achieving financial goals while providing tax advantages. By understanding the tax implications of different investment types, investors can make informed decisions to maximize returns and minimize tax impacts, ensuring a more secure and comfortable retirement.

Beanie Babies: A Collectible Craze

You may want to see also

Frequently asked questions

Target maturity investment is a strategy where an investor aims to have a specific security or portfolio reach a predetermined maturity date with a known value. This approach is often used in fixed-income markets, where the goal is to match the investor's financial needs at a future point in time.

In traditional bond investments, investors typically buy bonds and hold them until maturity, receiving regular interest payments. With target maturity, the strategy is more proactive, as investors may adjust their portfolio composition over time to ensure it aligns with their future cash flow requirements. This can involve buying and selling securities to maintain the desired maturity profile.

One advantage is the ability to plan and manage cash flow more effectively. By investing with a target maturity in mind, investors can ensure they have the necessary funds available when needed, especially for specific financial goals like retirement or a child's education. It also allows for a more dynamic approach to portfolio management.

The maturity curve refers to the change in the value of an investment or portfolio over time as individual securities mature or reach their target maturity. For example, in a bond portfolio, the curve might show how the value of each bond changes as it approaches maturity, helping investors understand the overall behavior of the investment.

Regular reviews are essential to ensure your investments stay on track. Market conditions, interest rate changes, and your personal financial situation may require adjustments. It is recommended to review your target maturity investments at least annually or whenever there are significant life events or changes in your financial goals.