Investing wisely can be a powerful strategy to achieve financial freedom and potentially retire early. The idea of never working again is an enticing prospect for many, but it requires careful planning and a solid understanding of investment principles. This guide will explore the various avenues available for investors, from stocks and bonds to real estate and alternative investments, and provide practical tips on how to build a diversified portfolio that can generate passive income. By learning how to invest effectively, you can work towards a secure financial future and potentially enjoy the freedom of a life without the daily grind of a traditional job.

What You'll Learn

- Choose Your Niche: Identify a profitable field that aligns with your skills and interests

- Build a Portfolio: Diversify your investments to minimize risk and maximize returns

- Automate Your Income: Utilize passive income streams to generate wealth without constant effort

- Leverage Technology: Leverage digital tools and platforms to streamline your investment processes

- Stay Informed: Continuously educate yourself on market trends and investment strategies

Choose Your Niche: Identify a profitable field that aligns with your skills and interests

When embarking on the journey to achieve financial independence through investing, one of the most crucial steps is choosing the right niche or field to focus on. This decision will significantly impact your success and long-term satisfaction. Here's a guide to help you navigate this process:

Assess Your Skills and Interests: Begin by evaluating your strengths, passions, and hobbies. What are you naturally good at? What subjects or activities spark your enthusiasm? For instance, if you have a knack for analyzing financial data and a deep interest in the stock market, this could be a strong starting point. Consider your educational background, work experience, and any unique talents you possess. For example, a background in engineering and a passion for technology could make you an expert in the tech investment sector.

Market Research: Conduct thorough market research to identify profitable fields that align with your skills. Look for industries or sectors that are currently in demand and have growth potential. Analyze trends, study industry reports, and understand the market dynamics. For instance, the renewable energy sector is gaining traction, offering opportunities for investors in sustainable energy projects. Similarly, the healthcare industry, with its constant innovation and aging population, presents various investment avenues.

Identify Gaps and Opportunities: Within your chosen field, look for gaps or areas that are underserved. These gaps often present profitable opportunities. For instance, in the tech industry, there might be a lack of investment in certain niche software solutions. Identifying such opportunities can give you a competitive edge. Additionally, consider the problem-solving aspect; choose a niche where you can offer unique solutions or products that address specific market needs.

Diversify Your Interests: Diversification is a key strategy for long-term success. Instead of focusing solely on one niche, consider having multiple streams of income. This could mean investing in various sectors or even exploring different investment strategies. For example, you might invest in real estate, stocks, and cryptocurrencies, each requiring different skill sets and knowledge. Diversification reduces risk and provides a more stable financial future.

Network and Learn: Engage with professionals in your chosen niche. Attend industry events, join relevant online communities, and seek mentorship. Networking can provide valuable insights and connections. Stay updated with industry news, attend webinars, and consider taking online courses to enhance your knowledge. Continuous learning will ensure you stay ahead of the curve and make informed investment decisions.

Mortgage or Super: Where Should Your Money Go?

You may want to see also

Build a Portfolio: Diversify your investments to minimize risk and maximize returns

To build a robust investment portfolio and achieve financial independence, diversification is key. Here's a detailed guide on how to diversify your investments to minimize risk and maximize returns:

Understand Your Risk Tolerance:

Before constructing your portfolio, it's crucial to understand your risk tolerance. This refers to your ability to withstand fluctuations in the market. Are you comfortable with potential short-term losses for long-term gains? Or do you prefer a more conservative approach with steadier returns? Assess your financial situation, goals, and emotional comfort with risk. This will determine the allocation of your investments across different asset classes.

Asset Allocation:

Diversification involves spreading your investments across various asset classes. Here's a breakdown:

- Stocks: Invest in a mix of domestic and international stocks representing different sectors and industries. Consider a blend of large-cap, mid-cap, and small-cap companies for a balanced approach.

- Bonds: Include government bonds, corporate bonds, and mortgage-backed securities for stability and income. Bonds offer lower risk compared to stocks but provide a crucial element of diversification.

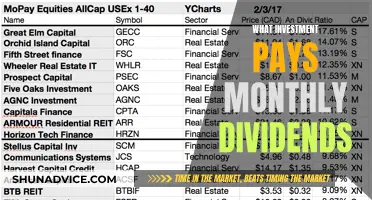

- Real Estate: Consider investing in real estate investment trusts (REITs) or directly purchasing rental properties. Real estate can provide diversification and potential income through rent.

- Alternative Investments: Explore options like commodities, futures, options, and derivatives. These can offer diversification benefits but are generally more complex and carry higher risks.

Diversification Within Asset Classes:

Don't stop at asset allocation. Diversify within each asset class:

- Stocks: Invest in a range of sectors (technology, healthcare, financials, etc.) and company sizes. Avoid putting all your eggs in one basket by holding stocks from different industries.

- Bonds: Diversify across different maturity dates (short-term, medium-term, long-term) and credit ratings (investment-grade, speculative-grade).

- Real Estate: Consider different property types (residential, commercial, industrial) and geographic locations.

Regular Review and Rebalancing:

Your portfolio should be a dynamic plan that requires regular review and adjustment. Market conditions change, and your risk tolerance may evolve over time.

- Annual Reviews: Periodically assess your portfolio's performance and alignment with your goals.

- Rebalancing: Adjust your asset allocations to maintain your desired risk level. If certain investments have outperformed, sell a portion and reinvest in underperforming areas to restore balance.

Remember:

Diversification doesn't guarantee profit or protect against losses in a declining market. However, it significantly reduces the impact of any single investment's performance on your overall portfolio. By carefully selecting investments and regularly reviewing your portfolio, you can build a strong foundation for achieving your financial independence and "never working again."

Investing: Fear or Loathing?

You may want to see also

Automate Your Income: Utilize passive income streams to generate wealth without constant effort

The concept of automating your income and achieving financial freedom through passive income streams is an attractive proposition for many. It offers the tantalizing possibility of generating wealth without the need for constant, active effort. This approach leverages the power of compounding and the efficiency of technology to create a steady flow of income that requires minimal ongoing management. Here's a guide to help you embark on this journey:

Identify Your Niche: The first step is to identify a niche market or a skill that can be monetized passively. This could be anything from renting out property, investing in dividend-paying stocks, creating digital products like e-books or online courses, or even generating income through affiliate marketing. The key is to find something that can be scaled and requires minimal additional effort once set up. For instance, if you're a skilled writer, consider creating an online course or writing e-books on a topic you're passionate about and market them through affiliate links.

Build a Foundation: Once you've identified your niche, it's time to build a solid foundation. This involves creating a product or service that can be sold repeatedly with minimal additional effort. For example, if you're investing in real estate, you might buy a property, fix it up, and then rent it out. The rental income becomes your passive income stream. Similarly, if you're creating digital products, you might write a comprehensive e-book, create a video course, or develop a software tool and then market it through your website or online platforms.

Leverage Technology: Technology plays a pivotal role in automating your income. Utilize online platforms and tools to streamline your processes. For instance, if you're investing in stocks, consider using automated investment platforms that allow you to set up regular contributions or round-up investments. These platforms can be configured to invest in a diversified portfolio, reducing the risk associated with individual stock picks. For digital products, consider using e-commerce platforms that handle payment processing, customer support, and order fulfillment, allowing you to focus on content creation and marketing.

Diversify Your Income Streams: Diversification is a critical strategy to ensure the long-term success of your passive income. Don't put all your eggs in one basket. Instead, create multiple income streams to reduce risk and increase overall earnings. For example, you could combine real estate rentals with dividend-paying stocks, affiliate marketing, and royalties from digital products. Each income stream should ideally require minimal ongoing effort once set up, allowing you to focus on new opportunities or expand existing ones.

Automate and Optimize: The ultimate goal is to automate your income to the extent that it requires minimal ongoing management. This involves setting up systems and processes that run on autopilot. For instance, you can use content delivery networks (CDNs) to automatically serve your digital products, ensuring fast loading times and a seamless user experience. Additionally, consider using analytics tools to track the performance of your income streams and make data-driven decisions to optimize your earnings.

By following these steps, you can begin to build a robust passive income portfolio, bringing you closer to the dream of financial freedom and the ability to work on your terms. Remember, the key to success is often found in the initial effort required to set up these streams, but the long-term benefits can be life-changing.

Smart Ways to Invest Your $100,000 Savings

You may want to see also

Leverage Technology: Leverage digital tools and platforms to streamline your investment processes

In today's digital age, technology has become an indispensable tool for investors seeking to optimize their financial strategies and potentially achieve the dream of financial freedom. By leveraging digital tools and platforms, investors can streamline their investment processes, make more informed decisions, and ultimately work towards the goal of investing and never having to work again. Here's how technology can be a powerful ally in this pursuit:

- Online Investment Platforms: The rise of online investment platforms has revolutionized the way people invest. These platforms, often referred to as robo-advisors, provide an accessible and user-friendly interface for investors to manage their portfolios. With just a few clicks, you can open an account, set up a risk profile assessment, and start investing in a diversified portfolio of assets. These platforms often offer low fees, making them an attractive option for cost-conscious investors. They also provide automated rebalancing and tax-loss harvesting features, ensuring your investments stay on track without constant manual intervention.

- Mobile Apps for Real-Time Updates: Technology has made it possible to stay connected to your investments 24/7. Numerous mobile apps allow investors to monitor their portfolios in real-time. These apps provide instant notifications for price movements, news alerts, and market updates. With this level of accessibility, investors can make timely decisions, such as buying or selling assets, even when they are on the go. The convenience of having all your investment data at your fingertips empowers you to react quickly to market changes, which is crucial for long-term success.

- Algorithmic Trading and Automation: For more advanced investors, algorithmic trading and automation are game-changers. These technologies enable investors to execute trades at high speeds, taking advantage of market opportunities that may arise in milliseconds. Algorithmic trading strategies can be backtested and optimized using historical data, ensuring that your trading approach is data-driven. Automation also reduces the emotional aspect of trading, as it eliminates the need for manual decision-making during volatile market conditions. This level of sophistication can be a powerful tool for those aiming to generate substantial returns with minimal effort.

- Data-Driven Investment Strategies: Technology has made it easier to access and analyze vast amounts of financial data. Investors can now leverage data analytics and machine learning algorithms to identify patterns, trends, and correlations in the market. By utilizing these tools, investors can make more informed decisions, such as predicting market shifts or identifying undervalued assets. Data-driven investing also allows for the creation of customized portfolios tailored to individual risk tolerances and financial goals. This approach minimizes the reliance on traditional investment advice, giving investors more control over their financial future.

- Online Education and Resources: The internet provides a wealth of educational resources for investors, ensuring that knowledge is power. Online courses, webinars, and tutorials can help investors enhance their financial literacy and stay updated on the latest investment trends. Many platforms offer free or low-cost educational materials, making it accessible to investors of all experience levels. Continuous learning ensures that investors can adapt to changing market conditions and make informed choices, which is essential for long-term success in the investment journey.

By embracing technology and utilizing these digital tools, investors can significantly streamline their processes, reduce the time and effort required, and potentially achieve the goal of investing and never having to work again. However, it's important to remember that technology should be used as a tool to support your investment strategy, and human oversight and decision-making are still vital for navigating the complexities of the financial markets.

Commodities: Invest Now or Later?

You may want to see also

Stay Informed: Continuously educate yourself on market trends and investment strategies

Staying informed is a cornerstone of achieving financial independence through investing. The markets are dynamic and ever-changing, and keeping up with the latest trends and strategies is essential for making sound investment decisions. Here's a guide on how to stay informed and educate yourself to potentially achieve the goal of investing and never working again:

- Diversify Your Information Sources: The financial world is vast, and there are numerous resources available to educate yourself. Diversifying your information sources is key. Start by reading reputable financial newspapers and magazines. Publications like the Wall Street Journal, Financial Times, or Barron's offer in-depth articles and insights into market trends, economic news, and investment strategies. These sources provide a comprehensive understanding of the market and its various sectors. Additionally, consider following financial news websites and blogs that cater to your specific investment interests. For example, if you're interested in technology stocks, sites like TechCrunch or The Verge can offer valuable insights.

- Utilize Online Resources: The internet is a treasure trove of educational content. Numerous websites, online courses, and webinars are available to teach you about investing. Websites like Investopedia, Coursera, and Udemy offer comprehensive courses on various investment topics, from stock market basics to advanced trading strategies. These resources often provide interactive learning experiences, making it easier to grasp complex concepts. Online forums and communities can also be valuable. Platforms like Reddit's r/investing or WallStreetBets allow you to engage with fellow investors, share ideas, and learn from their experiences.

- Follow Market Experts and Analysts: Keeping an eye on market experts and analysts can provide valuable insights. These professionals often have extensive knowledge and experience in the financial industry. Follow their analysis and recommendations, but always exercise critical thinking. Experts may offer different opinions, and it's essential to form your own views based on research and understanding. Many financial advisors and analysts share their insights on social media platforms, blogs, or through their companies' websites. You can also attend webinars or conferences where they present their ideas and strategies.

- Stay Updated on Economic Indicators: Economic indicators are essential data points that provide a snapshot of a country's or region's economic health. These indicators include GDP growth, inflation rates, unemployment rates, and interest rates. Understanding these metrics is crucial as they influence market trends and investment decisions. Government and central bank websites are excellent sources for this information. For example, the US Bureau of Economic Analysis and the Federal Reserve Bank of New York provide regular updates and reports on economic indicators. Staying informed about these indicators will help you anticipate market movements and make more informed investment choices.

- Practice Continuous Learning: Investing is a skill that requires continuous learning and adaptation. Market conditions and investment strategies evolve over time, so it's essential to stay updated. Set aside regular time for learning, whether it's reading books, articles, or taking online courses. Consider subscribing to financial newsletters or podcasts that provide daily or weekly market updates and analysis. This way, you'll stay informed about the latest news and trends without spending hours researching. Continuous learning will also help you identify new investment opportunities and adjust your strategies accordingly.

By staying informed and continuously educating yourself, you'll develop a deeper understanding of the markets and gain the confidence to make informed investment decisions. This knowledge is a powerful tool in your journey towards financial independence, allowing you to potentially invest and never work again. Remember, the markets are a dynamic and ever-evolving landscape, and staying ahead of the curve is a key strategy for success.

SoFi's Automated Investing: A Beginner's Guide to Hands-Off Wealth Building

You may want to see also

Frequently asked questions

Financial independence through investing is the idea of generating a steady income stream from your investments, allowing you to live off the returns without needing to actively work for money. This is often associated with the term "financial freedom" or "early retirement." It involves building a robust investment portfolio that can provide a reliable and growing income over time.

To begin your journey towards financial independence, you should first define your investment goals and risk tolerance. Research and understand different investment options such as stocks, bonds, real estate, or mutual funds. Consider consulting a financial advisor to create a personalized plan. Start by investing a small percentage of your income regularly, and as you gain experience and knowledge, you can adjust your strategy to build a diversified portfolio.

One of the most significant pitfalls is not having a long-term investment strategy. Short-term market fluctuations should not dictate your decisions. Another mistake is investing solely based on emotions or tips without proper research. Diversification is key, so avoid putting all your eggs in one basket. Additionally, be cautious of high-risk, high-reward investments that promise quick riches, as they often come with substantial risks. It's essential to educate yourself, stay disciplined, and regularly review and rebalance your portfolio.