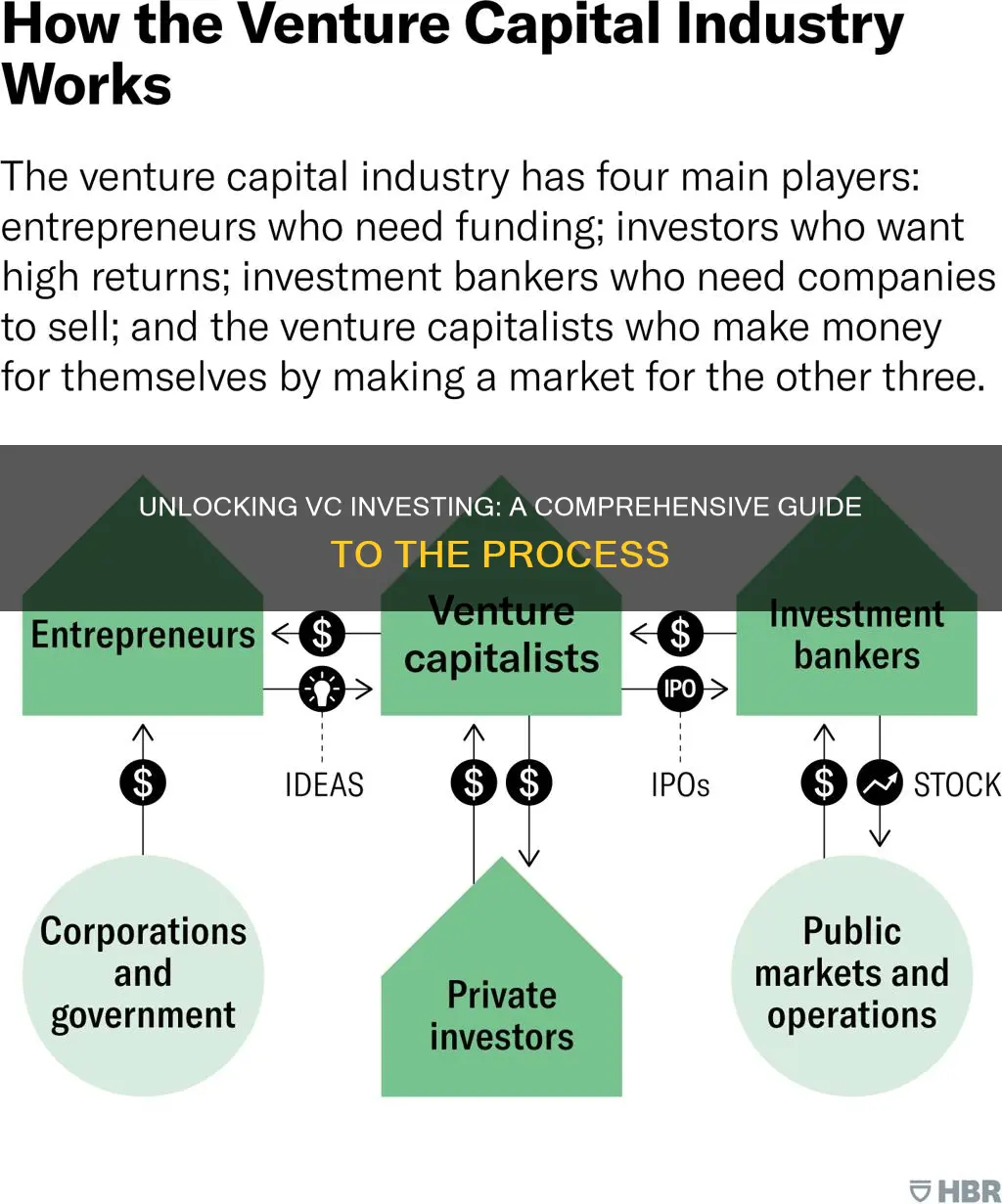

Venture capital (VC) investing is a dynamic and complex process that plays a crucial role in the startup ecosystem. It involves a strategic investment approach where VC firms provide capital to early-stage companies, often in exchange for equity. This process is not merely about financial support; it's a partnership that offers mentorship, strategic guidance, and access to a vast network of resources. Understanding how VC investing works is essential for entrepreneurs seeking funding and for investors looking to navigate this intricate world. This paragraph aims to provide an overview of the key aspects, shedding light on the mechanics of VC deals, the due diligence process, and the potential benefits and risks involved.

What You'll Learn

- Fundraising: VCs raise funds from investors to invest in startups

- Deal Flow: They source and evaluate potential investment opportunities

- Due Diligence: VCs conduct thorough research to assess startup viability

- Term Sheets: Legal agreements outline investment terms and conditions

- Exit Strategies: VCs plan for returns through acquisitions or IPOs

Fundraising: VCs raise funds from investors to invest in startups

Venture capital (VC) investing is a complex process that involves a significant amount of due diligence and strategic decision-making. One of the key aspects of this process is fundraising, where venture capitalists (VCs) seek to attract investors to their funds. This is a crucial step, as it provides the capital necessary to invest in startups and drive innovation.

VCs typically raise funds through limited partnerships, where they invite investors to contribute capital in exchange for a share of the fund's profits. These investors, often referred to as limited partners (LPs), can include high-net-worth individuals, institutional investors, and even other VCs. The process begins with a pitch, where VCs present their investment thesis, market analysis, and the potential for high returns. They highlight the fund's investment strategy, the team's expertise, and the potential for significant financial gains. This pitch is a critical step in attracting LPs, as it showcases the fund's potential and the VCs' ability to identify and nurture successful startups.

During the fundraising process, VCs must demonstrate their ability to identify and evaluate investment opportunities. This involves rigorous research, industry analysis, and a deep understanding of market trends. VCs need to show LPs that they have a robust pipeline of potential investments and a proven track record of successful deals. They must also provide transparency regarding the fund's performance, fees, and potential risks. This transparency builds trust and confidence among investors, encouraging them to commit their capital.

The success of fundraising efforts often depends on the VCs' reputation, network, and track record. Established VCs with a history of successful investments can attract more LPs, as they provide a sense of security and assurance. Building a strong network of industry connections and maintaining a positive reputation through successful deals are essential for attracting investors. Additionally, VCs may offer various incentives, such as carry or profit-sharing agreements, to encourage LPs to invest and share the rewards of successful ventures.

In summary, fundraising is a critical phase in the VC investment journey, enabling them to secure the necessary capital to invest in startups. It requires a well-crafted investment thesis, a thorough understanding of market dynamics, and a strong network of industry connections. VCs must demonstrate their ability to identify and nurture successful ventures while providing transparency and confidence to potential investors. Effective fundraising ensures the sustainability and growth of VC funds, enabling them to contribute to the ecosystem of innovation and entrepreneurship.

Cars: A Fast-Depreciating Asset

You may want to see also

Deal Flow: They source and evaluate potential investment opportunities

Deal flow is a critical aspect of venture capital (VC) investing, as it involves the entire process of identifying and assessing potential investment opportunities. VC firms aim to build a robust deal flow to ensure a steady pipeline of promising startups and businesses to invest in. This process is both art and science, requiring a combination of industry knowledge, network, and analytical skills.

The first step in generating deal flow is sourcing potential investment opportunities. VC investors employ various strategies to identify startups and businesses with high growth potential. One common approach is through their personal networks, including alumni connections, industry events, and conferences. These events provide an opportunity to meet entrepreneurs, exchange ideas, and gain insights into emerging trends and technologies. Additionally, VC firms often have dedicated deal-sourcing teams that research and identify potential investments using online databases, industry reports, and market trends. These teams analyze financial data, market positioning, and competitive landscapes to create a comprehensive view of potential deals.

Once a list of potential deals is compiled, the evaluation process begins. This stage is crucial as it determines which opportunities will receive further attention and investment. The evaluation typically involves a thorough analysis of the startup's or business's financial health, market position, and growth prospects. VC investors look for strong leadership teams, innovative products or services, and a clear understanding of the target market. They assess the company's competitive advantage, market fit, and scalability. Due diligence is a critical part of this process, including legal and financial reviews, as well as industry and market research.

During the evaluation, VC firms also consider the investment thesis and their specific areas of interest. They may focus on particular industries, stages of company development, or specific market segments. This strategic approach ensures that the investment aligns with the firm's expertise and resources. The evaluation process often involves multiple rounds of discussions and meetings with the startup's team, industry experts, and sometimes even potential customers to gain a comprehensive understanding.

After a thorough evaluation, VC firms decide whether to invest, and if so, negotiate the terms of the deal. This includes discussions on valuation, equity, and the level of involvement the VC firm will have in the company's operations. The deal flow process is an ongoing cycle, as successful investments lead to more deal flow through word-of-mouth and industry recognition. Thus, a robust deal flow is essential for VC firms to maintain a competitive edge and deliver value to their investors.

Retirement Investment Strategies for Those Without Employer Plans

You may want to see also

Due Diligence: VCs conduct thorough research to assess startup viability

Venture capital (VC) investing is a complex process that involves a significant amount of due diligence to ensure the viability and potential of startup companies. Due diligence is a critical step for VCs to evaluate and assess the value and risks associated with an investment opportunity. This process is essential to help VCs make informed decisions and minimize potential losses.

When a VC firm identifies a promising startup, they initiate a due diligence process to gather comprehensive information and insights. This process typically involves a thorough investigation of the company's business model, market position, competitive landscape, financial health, and management team. VCs aim to uncover any potential red flags or risks that could impact the startup's success and their investment.

One key aspect of due diligence is financial analysis. VCs scrutinize the startup's financial statements, cash flow projections, and historical performance. They assess the company's revenue model, cost structure, and ability to generate profits. This includes evaluating the startup's market valuation, comparing it to industry peers, and determining a fair investment value. VCs also consider the startup's funding history, previous investments, and the potential for future growth.

Additionally, VCs conduct market research to understand the industry dynamics and the startup's position within the market. They analyze the target market, customer base, and the competitive advantage the startup offers. This research helps VCs assess the scalability and long-term viability of the business. They also study the regulatory environment, industry trends, and potential disruptions that could impact the startup's operations.

Management evaluation is another crucial part of due diligence. VCs assess the experience, skills, and track record of the startup's founders and key executives. They review the management team's ability to execute the business plan, navigate challenges, and drive growth. VCs also consider the company's corporate governance, decision-making processes, and the clarity of ownership and equity structures.

In summary, due diligence is a comprehensive process that allows VCs to make well-informed investment decisions. It involves financial, market, and management assessments to evaluate the startup's viability, risks, and potential for success. By conducting thorough research, VCs can identify the most promising opportunities and minimize the chances of unsuccessful investments. This due diligence process is a critical aspect of VC investing, ensuring that both the investors and the startups benefit from a thorough evaluation.

Can Slimming Down Your Portfolio Yield Results? Exploring CanSlime Investing

You may want to see also

Term Sheets: Legal agreements outline investment terms and conditions

Term sheets are a crucial component of the venture capital (VC) investment process, serving as a comprehensive legal agreement that outlines the terms and conditions of an investment. When a VC firm decides to invest in a startup, it is essential to have a clear and detailed document that defines the rights, responsibilities, and expectations of both parties involved. This document is the term sheet, which acts as a roadmap for the entire investment journey.

In the context of VC investing, a term sheet typically includes various provisions that cover the key aspects of the investment. Firstly, it specifies the amount of capital the VC firm is willing to invest and the valuation of the startup at that point. This valuation is a critical factor as it determines the ownership stake the startup will give up in exchange for the investment. The term sheet also outlines the voting rights associated with the investment, including the number of shares or ownership percentages the VC firm will hold and the corresponding voting power.

Another crucial element of term sheets is the representation and warranty clauses. These clauses ensure that the startup provides accurate and complete information about its business, financial status, and any potential risks or liabilities. VCs rely on these representations to make informed investment decisions, and any breaches of these warranties can have legal consequences. The term sheet may also include provisions related to intellectual property rights, confidentiality, and the rights of the VC firm to conduct due diligence on the startup's operations.

Furthermore, term sheets often cover the terms of the investment's exit strategy. This includes the conditions under which the VC firm can sell or transfer its shares, the valuation at which the investment will be realized, and the distribution of proceeds among the startup's stakeholders. Exit strategies can vary, with common options including initial public offerings (IPOs), mergers and acquisitions (M&A), or secondary sales.

In summary, term sheets are essential legal agreements that provide a structured framework for VC investments. They ensure that both the VC firm and the startup are on the same page regarding the investment's terms, rights, and expectations. By clearly outlining these aspects, term sheets facilitate a smooth investment process, protect the interests of all parties, and contribute to the overall success of the startup's growth and eventual exit.

Tech Investing: Mastering the Financial Tool

You may want to see also

Exit Strategies: VCs plan for returns through acquisitions or IPOs

Exit strategies are a critical component of venture capital (VC) investing, as they outline the path to realizing the returns that VCs aim to generate from their investments. When VCs invest in startups, they typically do so with the expectation of significant financial gains, and these gains are often realized through the successful exit of the investment. There are two primary exit strategies that VCs commonly employ: acquisitions and initial public offerings (IPOs).

Acquisitions involve the purchase of a startup by a larger, more established company. This strategy is attractive to VCs because it provides a relatively quick and often lucrative return on their investment. When a startup is acquired, the acquirer typically pays a substantial amount of money to the VC firm, which in turn distributes the proceeds to its investors based on their shareholdings. The key factor in a successful acquisition exit is identifying a strategic buyer who can leverage the acquired company's assets and technology to create value. VCs often seek to maximize the value of the startup before an acquisition by ensuring the company is well-positioned in the market and has a strong product-market fit.

IPOs, on the other hand, involve taking a company public and selling shares to the public through an initial offering. This strategy allows VCs to sell their shares to the general public, providing an opportunity for substantial returns. IPOs can be a complex and risky process, but they offer the potential for significant financial gains. VCs carefully select the timing and terms of an IPO to maximize their returns. They may also work with investment banks to ensure the company's valuation is fair and that the offering is well-received by investors. A successful IPO can create a positive feedback loop, as the company's increased visibility and credibility can attract more customers and investors, further enhancing its value.

In both acquisition and IPO exit strategies, VCs must carefully consider the timing and conditions of the exit. They need to assess the company's growth prospects, market conditions, and the overall health of the industry. VCs often aim to time their exits to coincide with periods of high market demand or when the company has reached a significant milestone, such as a major product launch or expansion into new markets. Additionally, VCs may employ a combination of these strategies, investing in a startup with the dual goal of an acquisition and an IPO, allowing for a more diversified and potentially higher return.

Exit strategies are a delicate balance of art and science, requiring VCs to make informed decisions based on extensive research, market analysis, and a deep understanding of the startup ecosystem. The success of these strategies can significantly impact the overall performance of a VC fund, influencing its reputation and future investment opportunities. Therefore, VCs must carefully plan and execute these exits to ensure they deliver the expected returns to their investors while also contributing to the growth and success of the startups they support.

Investment Strategies: How to Choose?

You may want to see also

Frequently asked questions

Venture capital is a form of private equity investment that focuses on funding early-stage, high-growth startups and small businesses. It involves providing capital to these companies in exchange for equity, with the aim of generating significant returns through their success and eventual exit.

VC investors employ a rigorous process to identify and assess potential investments. This includes thorough market research, analyzing financial projections, assessing the team's capabilities, and conducting due diligence to understand the company's technology, competitive landscape, and potential risks. They often use a network of sources, industry connections, and deal flow to find promising startups.

The process usually begins with a pitch deck submission from the startup. If selected, the firm will conduct an initial screening and due diligence phase. This may involve meetings with the founders, industry experts, and legal teams. If impressed, they will make an investment offer, which includes the amount, valuation, and terms. Upon acceptance, the VC firm becomes a shareholder and provides support for growth.

VC investors aim to generate returns through a combination of strategies. They typically hold their investments for several years, allowing the startups to grow and mature. Returns can be realized through an initial public offering (IPO) or a merger and acquisition (M&A) deal, where the VC firm sells its shares at a higher price. Additionally, some VCs may also generate returns through dividends, interest, or other financial gains during the investment period.