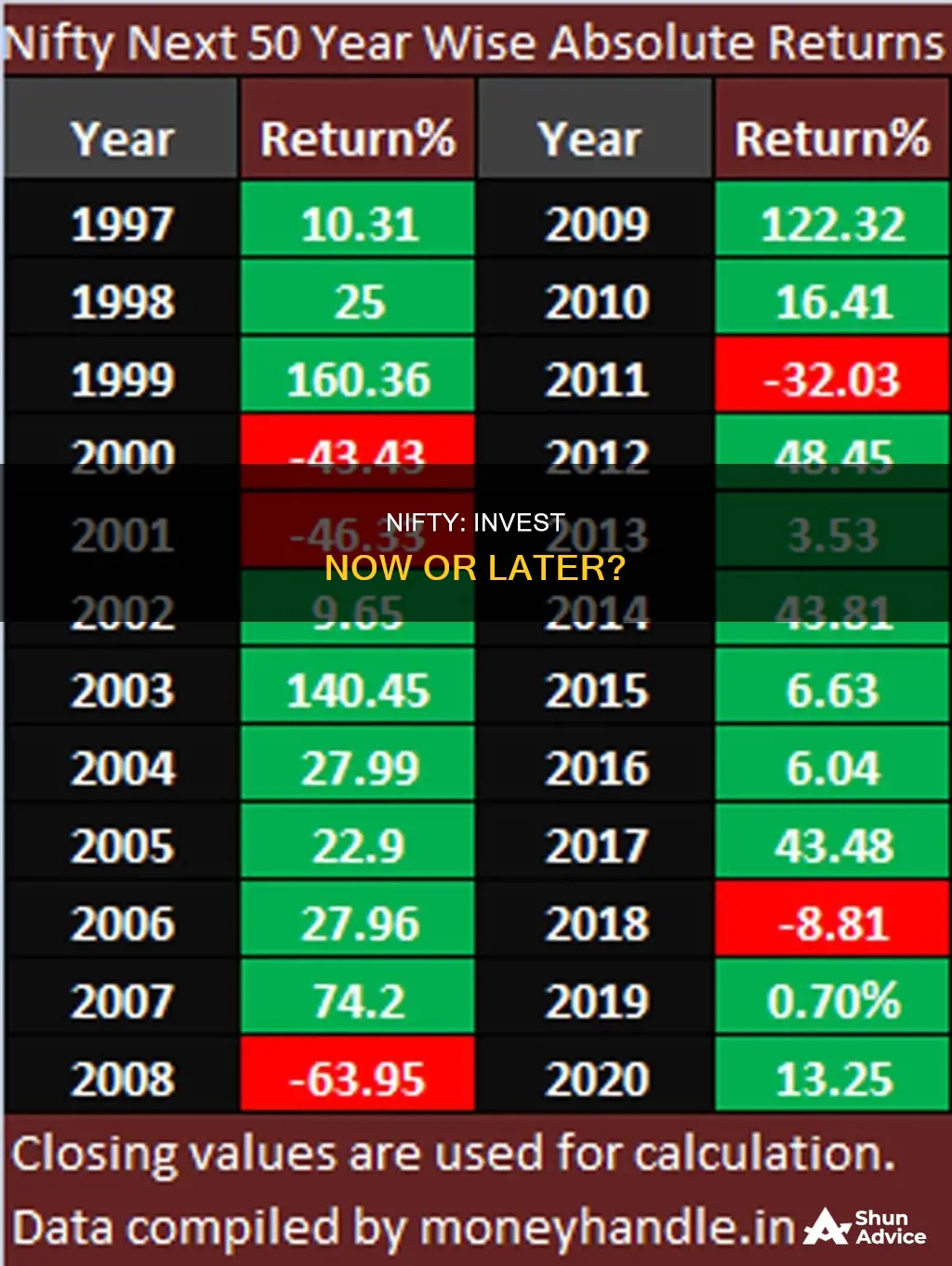

There are mixed views on whether now is the right time to invest in Nifty. Some investors are concerned that the ripple effect of high inflation and a global recession may adversely affect Indian markets. They worry that the Indian market may correct significantly and are unsure if now is the right time to invest in Nifty 50 index funds. However, others argue that it is always a good time to invest in the market, and that investors risk losing out by trying to time the market.

| Characteristics | Values |

|---|---|

| Current market conditions | High inflation, global recession, Indian market at peak |

| Investor concerns | Market correction, adverse impact of high inflation on Indian markets |

| Market correction prediction | Impossible to predict, market may or may not correct |

| Impact of waiting for market correction | Reduced returns, missing out on market rise |

| Recommended approach | Long-term horizon, avoid timing the market |

| Nifty50 Index performance | Deep red due to Fed rate hikes, pessimism, Adani fiasco, geopolitical tensions |

| Investor response | Withdrawal from stock market, interest in index funds |

| Expert opinion | Anytime is a good time to invest, invest in a staggered manner |

What You'll Learn

NIFTY 50 Index Funds: pros and cons

Pros:

- Diversification: Nifty 50 Index Funds provide investors with a diversified portfolio of India's top 50 companies across various sectors, reducing the risk associated with investing in individual stocks.

- Low expense ratio: As passive investment instruments, Nifty 50 Index Funds have lower expense ratios than actively managed funds, resulting in higher returns for investors.

- Transparency: The composition of the Nifty 50 index is publicly available and transparent, making it easy for investors to track the performance of the underlying companies.

- Tax efficiency: Nifty 50 index funds are relatively tax-efficient compared to actively managed funds due to their lower turnover and, therefore, lower capital gains.

- Risk management: The funds are diversified across various sectors and companies, reducing the impact of any single company's poor performance on the overall portfolio.

- Performance tracking: Investors can easily track the performance of Nifty 50 index funds by comparing their returns to the Nifty 50 index, enabling informed investment decisions.

- Liquidity: Nifty 50 index funds are traded on the stock exchange, providing investors with the flexibility to buy and sell them easily.

- Long-term growth opportunities: Nifty 50 Index Funds offer investors potentially long-term growth opportunities.

Cons:

- Market risks: As with any stock or mutual fund investment, Nifty 50 Index Funds are subject to market risks and volatility. Investors should carefully consider their risk appetite before investing.

- Exit load: Some funds may have an exit load, impacting returns if investors redeem their investment before a specified period.

- Performance uncertainty: While Nifty 50 Index Funds aim to replicate the performance of the Nifty 50 index, there is no guarantee that they will always match or outperform the index.

- Limited fund manager role: As passive investment instruments, the fund manager's role in Nifty 50 Index Funds is limited, with investment decisions based solely on the underlying index's composition and performance. This may be a disadvantage for investors seeking more active fund management.

Rich People: Where's the Money?

You may want to see also

The impact of geopolitical tensions on the stock market

There are a variety of factors that can influence the stock market, and geopolitical tensions are one of them. Geopolitical tensions can impact the stock market in numerous ways and can cause fluctuations in stock prices and market trends. Here are some key points outlining the impact of geopolitical tensions on the stock market:

Impact on Investor Sentiment

Geopolitical tensions can significantly influence investor sentiment and confidence. When tensions arise, investors may become uncertain about the stability of the market and the potential impact on their investments. This uncertainty can lead to a risk-averse attitude, causing investors to pull their money out of the market or hold off on new investments until the situation becomes clearer.

Market Volatility

Geopolitical tensions often lead to increased market volatility. Uncertainty regarding the outcome of a geopolitical event and its potential impact on a country's economy can cause sudden shifts in stock prices. Volatility can be particularly pronounced in the stock markets of countries directly involved in the tensions or those with close economic ties to the affected regions.

Sector-Specific Effects

Different sectors of the stock market can be affected differently by geopolitical tensions. For example, defence-related stocks may experience a boost during times of heightened geopolitical risk, while industries such as travel, tourism, and consumer discretionary sectors may suffer.

Flight to Safe-Haven Assets

During times of geopolitical uncertainty, investors often seek safe-haven assets such as gold, government bonds, or currencies like the US dollar or Swiss franc. This shift in investment behaviour can lead to a temporary increase in the value of these assets.

Impact on Global Trade and Supply Chains

Geopolitical tensions can disrupt global trade and supply chains, especially if they involve economic sanctions, embargoes, or military conflicts. This can affect the revenue and profitability of companies with international operations, particularly those heavily reliant on imports or exports.

Long-Term Impact on Economic Growth

Prolonged or severe geopolitical tensions can impact a country's economic growth and development. This, in turn, can influence the overall performance of the stock market in the long run.

As for the question of whether it is the right time to invest in Nifty, it is important to remember that market timing is challenging and unpredictable. While geopolitical tensions can influence market performance, other economic factors and intrinsic company values also play a significant role. A long-term investment horizon and a well-diversified portfolio that aligns with your risk profile are generally recommended investment strategies.

Rich People: The Only Investors?

You may want to see also

How to avoid timing the market

Market timing is a controversial topic in the field of investment. While some claim it is impossible, others claim they can do it for you. However, the truth may lie somewhere in the middle.

Market timing is difficult and not easily achievable. Markets move in cycles, and while some cycles are more easily predictable than others, market timing is challenging because many different investors are using their own strategies and trading on their own time. This can cause delays in markets or confusion when an otherwise clear move might present itself.

- Maintain reasonable expectations: Timing the market is not a way to beat the market. A more realistic goal for timing the market is to protect your investments from big market declines.

- Don't try to time the market yourself: Timing the market requires an ironclad discipline that can be carried out through thick and thin. Consider hiring a professional to make trades for you using strictly mechanical trend-following systems.

- Proper asset allocation and diversification: Ensure your timed portfolio holds the same asset classes as your buy-and-hold portfolio. Don't invest in gold or other commodity funds, and don't put more than 10% of your portfolio into any single fund.

- Timing should not be your only defensive strategy: Your portfolio should include bond funds too. Together, these approaches can keep losses relatively manageable.

- Consider managing half your portfolio with timing and the other half without it: This can give you peace of mind and reduce the risk of losing everything.

In conclusion, while it is tempting to try and time the market, it is a risky strategy that rarely pays off. A better approach is to invest for the long term and avoid trying to time the market altogether.

Where to Invest Your Money

You may want to see also

The importance of long-term horizons in equity investments

When considering investing in the NIFTY 50 index, it is important to remember that it is impossible to predict if and when markets will correct. While investors might be concerned about the impact of high inflation and a potential global recession on the Indian market, trying to time the market rarely works in their favour.

This is where the importance of long-term horizons in equity investments comes into play.

The Power of Compounding

Long-term investment horizons, typically spanning a decade or more, allow investors to benefit from the power of compounding. The longer the investment horizon, the more time investments have to grow and generate higher returns.

Risk and Reward

Long-term horizons also enable investors to adopt a more aggressive approach to their portfolios. While short-term investors tend to opt for conservative, stable assets, those with a long-term view can afford to take on more risk in exchange for greater potential rewards. This is particularly relevant for equity investments, which are generally considered riskier than bonds.

Diversification and Strategy

Longer time horizons provide access to a wider range of investment strategies and allow for greater diversification across asset classes. This diversification is a key advantage, as it helps to mitigate risk and improve overall portfolio performance.

Historical Performance

Historically, private equity investments with long-term horizons have generated higher returns than public equities. This is due in part to the illiquidity associated with private equity, which allows fund managers to pursue more innovative and value-added investment strategies.

Peace of Mind

Finally, long-term horizons provide peace of mind by reducing the stress associated with short-term market fluctuations. Investors with a long-term view can avoid the constant worry of timing the market and focus on their long-term investment goals.

In conclusion, while it is impossible to predict market corrections, investors with a long-term horizon in equity investments, such as the NIFTY 50 index, can benefit from the power of compounding, take on more risk for greater potential rewards, and diversify their portfolios with innovative strategies. Historically, long-term private equity investments have outperformed public equities, and they provide investors with the peace of mind that comes with a reduced focus on short-term market fluctuations.

Investing in People: The Church's Role

You may want to see also

Index funds vs. actively managed mutual funds

While it is impossible to predict if and when markets will correct, it is always a good time to invest in the market. However, investors might be concerned about the impact of high inflation and a possible global recession on the Indian markets.

Index funds and actively managed mutual funds are two types of investment vehicles that offer different approaches to investing in the market. Here is a comparison between the two:

Management Style

Index funds are passively managed, meaning they aim to mirror the performance of a specific market index or benchmark, such as the NIFTY 50. The holdings of an index fund automatically track the index, so if a stock is in the index, it will be in the fund. There is no need for human oversight or active management, resulting in lower costs.

On the other hand, actively managed mutual funds involve a fund manager or management team that actively selects investments and makes all investment decisions. They strive to outperform the market and earn higher returns by strategically picking investments.

Investment Objective

The sole objective of an index fund is to match the performance of the underlying benchmark index. For example, if the S&P 500 goes up or down, an S&P 500 index fund will also zig or zag accordingly.

Actively managed mutual funds, on the other hand, aim to beat market averages and provide higher returns. They rely on the expertise of fund managers to hand-select stocks or bonds that they believe will boost overall performance.

Costs

Index funds are known for their low investment costs compared to actively managed funds. Actively managed funds have higher fees because of the costs associated with active management, such as investment manager salaries, bonuses, employee benefits, and marketing materials. These fees are bundled into the mutual fund expense ratio, which is deducted from the investor's annual returns, reducing their overall returns.

Performance

The performance of index funds is relatively predictable since it mirrors the performance of the underlying index. Actively managed mutual funds, however, may provide higher returns in the short term, especially when the overall market is down. But it is important to note that history has shown it is challenging to consistently beat passive market returns year after year. According to the S&P Indices versus Active (SPIVA) scorecard, only 6.6% of funds outperformed the S&P 500 in the last 15 years.

Risk

Index funds align directly with the risks involved with the specific stock or bond market they track. Actively managed funds add the risk that the portfolio manager may underperform its benchmark. Additionally, the active management style of hand-picking stocks may result in more taxable capital gains due to more frequent trading.

Suitability

Index funds are often recommended for beginners due to their lower costs, diversification, and passive approach. They are also suitable for long-term investors as they can provide solid returns over time. Actively managed funds may be more suitable for experienced investors who have the time and knowledge to carefully research and understand the higher risks involved.

College: A Risky Bet?

You may want to see also

Frequently asked questions

It is always a good time to invest in the market. However, investors might be concerned about the adverse effects of high inflation and a global recession on Indian markets. It is impossible to predict if markets will correct, and the odds are stacked against an investor when it comes to timing the market. Therefore, it is better to invest for the long term.

If you invest at the current level, your money is likely to give you inflation-beating returns in the long run.

The best thing to do is to avoid timing the market and instead focus on your asset allocation and rebalance your portfolio based on the performance of different asset classes.

If you are scared of a market correction, you can invest your lump sum in a staggered manner over 6-12 months.