How Doewa Investments Work: A BDO Perspective

Doewa investments, a term that might sound unfamiliar to many, represent a unique approach to financial management. This paragraph aims to shed light on the intricacies of Doewa investments, particularly from the perspective of BDO, a renowned financial services firm. Understanding how these investments work is crucial for investors seeking alternative strategies to grow their portfolios. BDO's expertise in the financial industry provides valuable insights into the mechanics of Doewa investments, offering a comprehensive guide for those interested in exploring this investment avenue.

What You'll Learn

- Investment Vehicles: BDO offers various investment options, including stocks, bonds, and mutual funds

- Risk Management: Strategies to mitigate risks associated with investments

- Tax Implications: Understanding tax benefits and deductions for investment activities

- Regulatory Compliance: BDO ensures adherence to financial regulations and industry standards

- Investment Advisory Services: Personalized guidance for navigating investment decisions and market trends

Investment Vehicles: BDO offers various investment options, including stocks, bonds, and mutual funds

BDO, a leading financial services firm, provides a range of investment vehicles to cater to diverse client needs. These investment options are designed to offer growth, income, and risk management, allowing clients to build and manage their wealth effectively. Here's an overview of the investment vehicles BDO offers:

Stocks: Investing in stocks, also known as equity investments, allows clients to become partial owners of companies. When you buy a company's stock, you essentially purchase a fraction of that business. BDO assists clients in selecting stocks from various sectors and industries, enabling them to diversify their portfolios. This investment vehicle offers the potential for significant returns over time, as stock prices can fluctuate based on market conditions and company performance. Clients can choose to invest in individual stocks or opt for mutual funds that hold a basket of stocks, providing instant diversification.

Bonds: Bonds are a type of debt investment where BDO acts as an intermediary, connecting borrowers (usually governments or corporations) with investors. When you invest in a bond, you are essentially lending money to the borrower with the promise of getting it back with interest over a specified period. BDO offers a wide range of bond options, including government bonds, corporate bonds, and municipal bonds, each carrying different levels of risk and return. Bonds provide a steady income stream through regular interest payments and are considered a more conservative investment compared to stocks.

Mutual Funds: Mutual funds are a popular investment vehicle offered by BDO, allowing clients to pool their money with other investors to invest in a diversified portfolio of stocks, bonds, or other securities. This approach enables individuals to access a wide range of investments without having to select and manage each asset individually. Mutual funds are managed by professional fund managers who make investment decisions on behalf of the fund's shareholders. This investment option is suitable for those seeking long-term growth and willing to accept some level of risk. BDO provides various mutual fund options, including index funds, growth funds, and income funds, catering to different investment strategies and goals.

BDO's investment vehicles are designed to cater to various risk appetites and financial objectives. Whether clients are seeking capital appreciation, regular income, or a balanced approach, BDO's range of investment options provides flexibility and customization. It is essential for investors to understand their risk tolerance and financial goals before making investment decisions. BDO's team of financial advisors can offer guidance and help clients navigate the complex world of investments, ensuring they make informed choices aligned with their unique circumstances.

Deeds and Dreams: Navigating the World of Deed Investments

You may want to see also

Risk Management: Strategies to mitigate risks associated with investments

When it comes to managing risks in investments, especially in the context of Doewa investments facilitated by BDO, a comprehensive strategy is essential. Here are some key approaches to consider:

Diversification: One of the fundamental principles of risk management is diversification. This involves spreading your investments across various asset classes, sectors, and geographic regions. By diversifying, you reduce the impact of any single investment's performance on your overall portfolio. For instance, if you invest in a mix of stocks, bonds, real estate, and alternative investments, a downturn in one area might be offset by gains in another.

Risk Assessment and Analysis: Conducting thorough risk assessments is crucial. This process involves identifying potential risks associated with each investment opportunity. For Doewa investments, you should evaluate the specific risks related to the investment vehicle, such as market volatility, liquidity issues, or regulatory changes. BDO can provide valuable insights and guidance in this area, helping you understand the potential risks and how they might affect your investment strategy.

Risk Mitigation Techniques: Several strategies can help mitigate risks. One common approach is to use hedging, which involves taking positions in derivatives or other financial instruments to offset potential losses. For example, you could use options or futures contracts to protect your investment against market downturns. Additionally, regular portfolio rebalancing can ensure that your asset allocation remains aligned with your risk tolerance and investment goals.

Regular Monitoring and Review: Effective risk management requires ongoing monitoring and review. This includes tracking the performance of your investments and staying updated on market trends and news that might impact your holdings. For Doewa investments, you should set up a system to regularly assess the performance and risk exposure of your portfolio. BDO can assist in providing the necessary tools and resources to facilitate this process, ensuring that you make informed decisions.

By implementing these risk management strategies, investors can navigate the complexities of the financial markets with greater confidence. It's important to remember that risk management is an ongoing process, and staying proactive in assessing and mitigating risks is essential for long-term success in investment endeavors.

Sherwin-Williams: Time to Invest?

You may want to see also

Tax Implications: Understanding tax benefits and deductions for investment activities

When it comes to investment activities, understanding the tax implications is crucial for maximizing your financial gains and ensuring compliance with tax regulations. Here's an overview of the tax benefits and deductions associated with investment activities, particularly in the context of Doewa investments and BDO (a professional services network):

Tax Deductions for Investment Expenses:

One of the primary tax advantages of engaging in investment activities is the ability to claim deductions for various expenses. These deductions can significantly reduce your taxable income and, consequently, your tax liability. For Doewa investments, you may be eligible to deduct expenses such as brokerage fees, transaction costs, research and analysis tools, and any other costs directly associated with the management and maintenance of your investment portfolio. BDO, as a professional services firm, can provide valuable guidance on identifying and documenting these expenses to ensure you take full advantage of these deductions.

Capital Gains and Losses:

Investment activities often result in capital gains or losses, which have distinct tax treatments. When you sell an investment for a profit, you may be subject to capital gains tax. However, certain conditions and thresholds may apply, allowing for tax-efficient realization of gains. On the other hand, losses can be utilized to offset capital gains, reducing your taxable income. Understanding the tax rules surrounding capital gains and losses is essential to make informed investment decisions and potentially minimize tax obligations. BDO's tax experts can assist in analyzing your investment strategies and providing strategies to optimize tax outcomes.

Tax-Advantaged Accounts:

Certain investment vehicles and accounts offer tax advantages. For instance, retirement accounts like 401(k)s or IRAs often provide tax benefits, allowing investments to grow tax-deferred or tax-free. Understanding the rules and contribution limits of these accounts is crucial for effective tax planning. Additionally, some governments offer tax incentives for specific investment activities, such as venture capital investments or investments in certain industries. BDO can help navigate these tax-advantaged options and ensure you comply with the relevant regulations.

Tax Reporting and Documentation:

Accurate tax reporting is essential to avoid penalties and legal issues. When engaging in investment activities, it is crucial to maintain detailed records of all transactions, including purchase and sale dates, prices, and any associated fees. Proper documentation ensures that you can substantiate your investment expenses and capital gains/losses when filing your tax returns. BDO's professionals can assist in setting up efficient record-keeping systems and provide guidance on tax reporting requirements specific to investment activities.

Consultation with Tax Professionals:

Given the complexity of tax laws and their potential impact on investment activities, consulting with tax professionals is highly recommended. BDO's network of experts can provide tailored advice based on your investment strategy, helping you navigate the tax implications effectively. They can assist in identifying tax-efficient investment opportunities, structuring your investments to optimize tax outcomes, and ensuring compliance with tax regulations.

Home Truths: Unlocking the Retirement Potential of Your Mortgage

You may want to see also

Regulatory Compliance: BDO ensures adherence to financial regulations and industry standards

In the complex world of finance, regulatory compliance is a critical aspect that cannot be overlooked. This is where BDO, a renowned professional services firm, plays a pivotal role in ensuring that financial institutions adhere to the myriad of rules and regulations governing the industry. BDO's expertise in regulatory compliance is a cornerstone of its services, offering a comprehensive approach to navigating the intricate landscape of financial regulations.

The primary objective of BDO's regulatory compliance services is to safeguard financial institutions from the perils of non-compliance. This involves a meticulous process of identifying, assessing, and mitigating risks associated with various financial regulations. These regulations, often mandated by government bodies and international organizations, are designed to maintain the integrity, stability, and transparency of financial markets. For instance, the Know Your Customer (KYC) regulations mandate that financial institutions verify the identity of their clients, a crucial step in preventing money laundering and terrorist financing. BDO assists in implementing robust KYC procedures, ensuring that client data is accurately collected, verified, and stored, thereby reducing the risk of identity fraud.

BDO's approach to regulatory compliance is multifaceted, encompassing a wide range of services. These include conducting thorough risk assessments to identify potential compliance issues, providing tailored advice on regulatory changes, and offering comprehensive training programs to ensure that staff are well-versed in compliance matters. The firm also assists in the development and implementation of internal control systems, which are essential for monitoring and managing compliance risks. By doing so, BDO helps financial institutions establish a strong compliance culture, where adherence to regulations is not just a requirement but a fundamental principle of operations.

Furthermore, BDO's expertise extends to the interpretation and application of complex regulations. Financial institutions often face challenges in understanding the nuances of regulatory requirements, especially when new rules are introduced or existing ones are amended. BDO's team of experts provides clear and concise guidance, ensuring that clients are fully informed and prepared to comply. This proactive approach not only helps in avoiding costly penalties and legal issues but also fosters a culture of ethical conduct and transparency within the organization.

In summary, BDO's regulatory compliance services are a testament to its commitment to the financial industry's well-being. By ensuring adherence to financial regulations and industry standards, BDO empowers financial institutions to operate with confidence, integrity, and compliance. This not only protects the institutions but also contributes to the overall stability and trustworthiness of the financial markets, making BDO an indispensable partner in the journey towards regulatory excellence.

Understanding Shocks: Impact on Investment Strategies

You may want to see also

Investment Advisory Services: Personalized guidance for navigating investment decisions and market trends

In the complex world of finance, making informed investment decisions can be a challenging task for individuals and businesses alike. This is where investment advisory services come into play, offering a crucial role in guiding clients through the intricate landscape of the financial markets. These services provide personalized guidance, tailored to each client's unique financial goals, risk tolerance, and investment preferences.

Investment advisory professionals are equipped with the knowledge and expertise to analyze market trends, assess investment opportunities, and provide strategic recommendations. They employ a range of tools and techniques, including financial modeling, risk assessment frameworks, and market research, to offer insights that can help clients make well-informed choices. The primary objective is to optimize investment portfolios, ensuring they align with the client's objectives while managing risk effectively.

The process typically begins with a comprehensive consultation, where advisors gain a deep understanding of the client's financial situation, goals, and risk profile. This includes reviewing existing investments, assessing tax implications, and discussing the client's tolerance for market volatility. By gathering this information, advisors can create a customized investment plan, taking into account the client's unique circumstances. This personalized approach ensures that the investment strategy is tailored to the individual's needs, providing a more effective and satisfying experience.

Market trends and economic forecasts are also integral to the advisory process. Advisors stay abreast of global economic developments, industry-specific trends, and regulatory changes that could impact investments. By analyzing this information, they can provide timely advice on when to buy, hold, or sell assets, helping clients navigate market fluctuations and capitalize on emerging opportunities. This proactive approach is particularly valuable in today's dynamic and often volatile financial environment.

Furthermore, investment advisory services offer ongoing support and monitoring. They regularly review and rebalance investment portfolios to ensure they remain aligned with the client's goals and risk tolerance. This includes making adjustments based on market performance, economic shifts, and changes in the client's financial situation. By providing continuous guidance, advisors can help clients stay the course during market ups and downs, fostering a long-term commitment to their investment strategy.

In summary, investment advisory services play a vital role in empowering individuals and businesses to make sound investment decisions. Through personalized guidance, market analysis, and ongoing support, these services provide the necessary tools to navigate the complexities of the financial markets. By working closely with clients, investment advisors can help them build and maintain successful investment portfolios, ultimately contributing to their financial well-being and success.

Retirement Planning: A Team Effort for Long-Term Success

You may want to see also

Frequently asked questions

Dowa Investments, also known as Dow Theory, is a technical analysis approach that focuses on market trends and price movements. Within the BDO (Bank of the Philippines) context, it involves studying historical price data and market behavior to predict future trends. This method helps investors make informed decisions by identifying potential support and resistance levels, which can guide buy and sell signals.

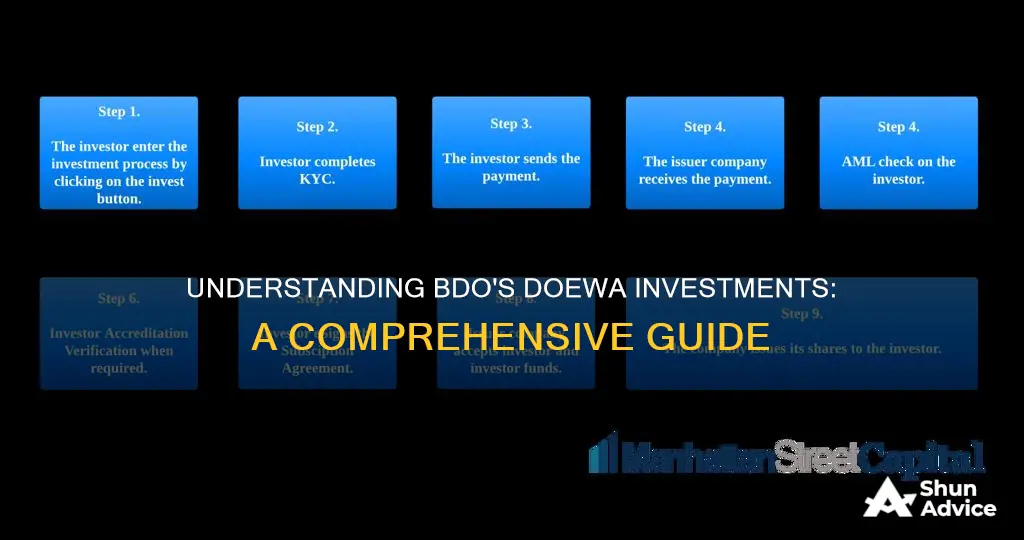

To begin investing in Dowa Investments via BDO, you can follow these steps: First, open a securities account with BDO, allowing you to trade stocks and other financial instruments. Next, educate yourself on Dow Theory principles and technical analysis tools. Then, analyze historical price charts of the desired investment, identifying trends and potential turning points. Finally, execute trades based on your analysis, utilizing stop-loss orders to manage risk.

Dowa Investments can offer several advantages, such as the ability to identify potential market trends early on, which may lead to profitable trades. It also provides a structured approach to technical analysis, helping investors make more informed decisions. However, there are risks involved, including the possibility of false signals and the need for constant market monitoring. Investors should also be cautious of over-relying on technical indicators without considering fundamental factors.