Investing 15% of your gross income for retirement is a general rule of thumb that has helped thousands of people build wealth. This equates to $931 a month, assuming a median household income of $74,500. Over 30 years, this could grow to about $2.61 million, assuming an 11% return.

However, the exact amount you can save in the next 15 or 20 years depends on several factors, such as your earnings, health, and any employer contributions.

If you are married, you can fund a spousal IRA, which is reserved for workers with earned income, but taxable income must be more than the contributions made to any IRAs.

It's important to note that investing for retirement is crucial at any age, but your strategy may change over time. Younger investors tend to tolerate more risk but have less income to invest, whereas those near retirement may have more money to invest but less time to recover from losses.

| Characteristics | Values |

|---|---|

| How much to invest for retirement | 15% of gross income into tax-favored retirement accounts |

| Where to invest | 401(k), IRA, 403(b), 529 plan, HSA, pension, etc. |

| When to start investing | As early as possible, but it's never too late to start |

| How often to invest | Monthly or annually |

| How long to invest for | Until retirement, or until you have a large enough nest egg |

| What to do if you can't invest 15% | Invest what you can and look for ways to increase your income |

| What to invest in | Stocks, bonds, annuities, income-producing equities, etc. |

| How to reduce risk | Diversify your investments and seek professional advice |

What You'll Learn

Invest 15% of gross income into tax-favoured retirement accounts

Investing 15% of your gross income into tax-favoured retirement accounts is a good way to ensure you have a comfortable retirement. Here are some reasons why:

You Build a Solid Nest Egg

The median household income in the United States is roughly $74,500. 15% of that would be $11,175 a year, or $931 a month. Over 30 years, that $931 a month could grow to about $2.61 million, assuming an 11% return. Even if you only invested 10%, or the average personal savings rate in the US of 4%, in the long run, skimping on retirement savings could cost you and your nest egg hundreds of thousands of dollars (or even millions).

You Have Room in Your Budget for Other Financial Goals

You might be wondering why not save more than 15%? Well, you'll need money for other important financial goals, like saving for your children's college funds and paying off your house. Investing 15% leaves enough room in your budget to put money in an Education Savings Account (ESA) or 529 plan and make extra mortgage payments. Once your kids have left the nest and you have a paid-off house, then you can really ramp up your investing.

Social Security Won't Replace Your Income

As of May 2024, the average Social Security benefit for retired workers was $1,867 a month, which is only $22,404 a year. The federal poverty level for a family of two is $20,440. So, Social Security won't be enough to live on. Also, will Social Security still be around when you retire? Nobody knows for sure. If it isn't, you'll definitely want to have your own nest egg to live on.

You've Got Some Big Expenses Coming in Retirement

While some costs may drop in retirement, you'll still have to pay property taxes, insurance, utilities and other monthly expenses. Plus, you'll have one major expense: healthcare. A 65-year-old couple will need about $315,000 for healthcare costs in retirement, and that doesn't include long-term care costs, which can run an average of around $108,400 a year in a nursing home or $54,000 for assisted living.

How to Invest 15% for Retirement

First, hold off on investing until you're debt-free and have 3-6 months of expenses saved in an emergency fund. Then, remember this simple formula: Match beats Roth beats traditional.

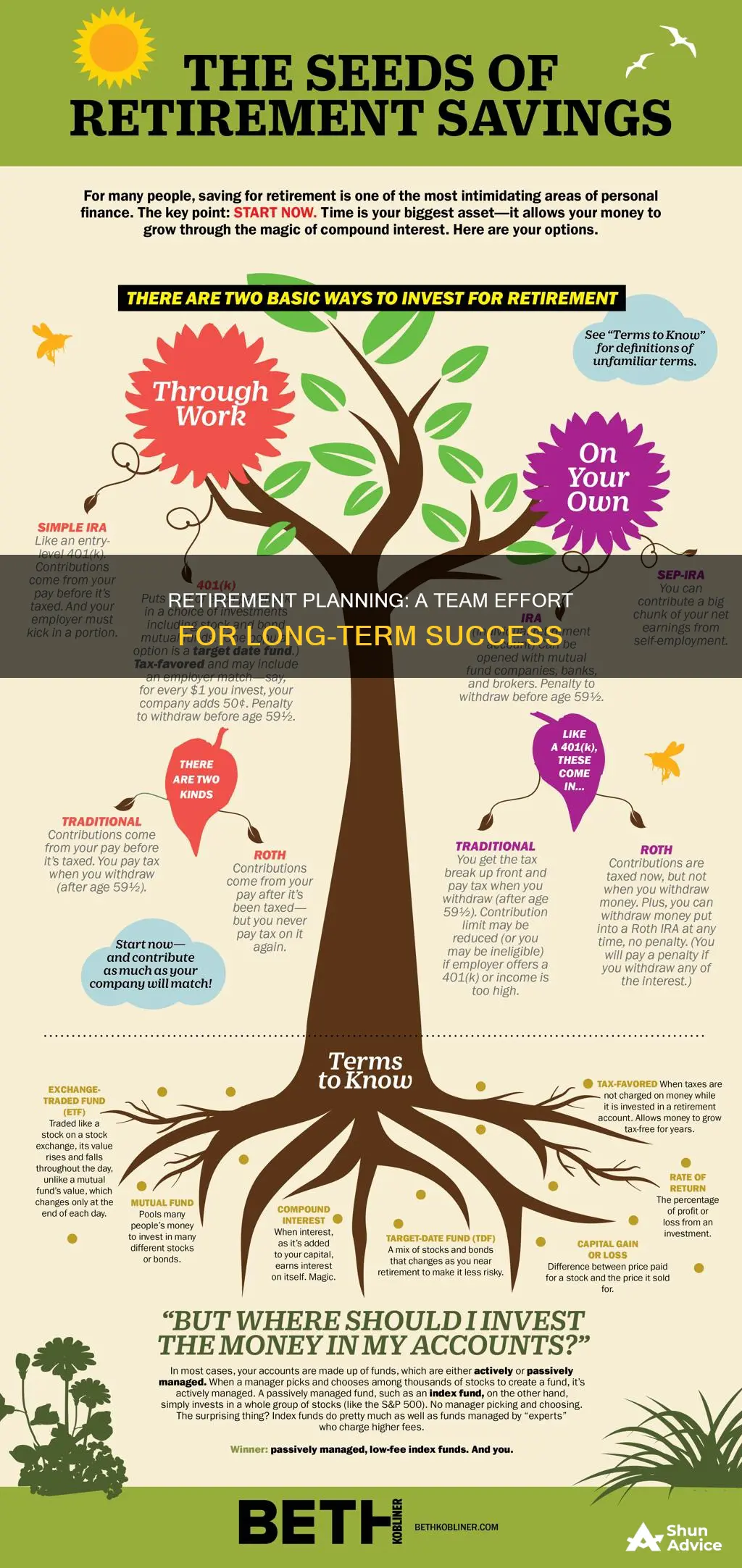

- Invest up to the match in your 401(k), 403(b) or TSP. The first place to start investing is through your workplace retirement plan, especially if they offer a company match. That's free money!

- Fully fund a Roth IRA. With a Roth option, you contribute after-tax dollars, so your money grows tax-free and you don't pay taxes on it when you take it out at retirement.

- Go back to your workplace retirement plan until you hit 15%. If you still haven't reached 15%, go back to your traditional 401(k) or similar and keep increasing your contribution.

Set up your account for automatic withdrawals, as a percentage of your salary, so your money goes straight from your paycheck to your retirement account.

Finding Your Ideal Investment Advisor

You may want to see also

Save 15% of income for retirement

Saving 15% of your income for retirement is a general rule of thumb that has helped thousands of people build wealth. Here are some reasons why saving 15% of your income for retirement is a good idea:

- Building a Solid Nest Egg: The median household income in the United States is roughly $74,500. 15% of that would be $11,175 a year, or $931 a month. Over 30 years, that $931 a month could grow to about $2.61 million, assuming an 11% return. This will provide financial security and help you retire with dignity.

- Leaves Room in Your Budget for Other Financial Goals: Saving 15% of your income allows you to allocate money for other important financial goals, such as saving for your children's education or paying off your mortgage early. It's important to balance retirement savings with other financial priorities.

- Social Security Won't Replace Your Income: Social Security benefits will only replace about 40% of pre-retirement earnings for people earning less than $100,000 a year, and 33% for higher earners. Therefore, it's crucial to supplement this income with additional savings or investments to maintain your standard of living during retirement.

- Covering Big Expenses in Retirement: Retirement comes with significant expenses, including healthcare, property taxes, insurance, utilities, and long-term care costs. By saving 15% of your income, you can build a nest egg that is large enough to cover these costs and maintain your financial security during retirement.

- Start Early: The power of compound interest means that the earlier you start saving, the more your money will grow over time. Even if you're in your 30s or 40s, it's not too late to make retirement savings a priority.

- Maximize Employer Matching: If your employer offers a 401(k) or similar retirement plan with matching contributions, take full advantage of it. This is essentially free money that will boost your retirement savings.

- Utilize Tax-Advantaged Accounts: Contribute to tax-advantaged retirement accounts such as a 401(k), IRA (Individual Retirement Account), or Roth IRA. These accounts offer tax benefits that will help your savings grow faster.

- Automate Your Savings: Set up automatic contributions from your paycheck or bank account to your retirement savings. This way, you save effortlessly without having to remember to transfer funds manually each time.

- Reduce Expenses and Increase Income: Look for ways to cut back on unnecessary expenses and redirect that money towards your retirement savings. Additionally, consider taking on a side hustle or finding other sources of income to boost your savings rate.

- Seek Professional Advice: Consult a financial advisor or planner who can provide personalized guidance based on your unique circumstances. They can help you create a comprehensive retirement plan and ensure you're on track to meet your financial goals.

American Airlines: Invest or Avoid?

You may want to see also

Invest in a 401(k) plan

A 401(k) plan is a company-sponsored retirement account that allows employees to contribute a percentage of their income. It is a tax-advantaged savings plan, named after a section of the US Internal Revenue Code. Employees can contribute pre-tax or after-tax income, depending on the type of 401(k) plan.

Traditional 401(k)

Employee contributions to a traditional 401(k) are made with pre-tax income, reducing taxable income. However, withdrawals in retirement are taxed as ordinary income.

Roth 401(k)

With a Roth 401(k), contributions are made with after-tax income. There is no upfront tax break, but withdrawals in retirement are tax-free.

How to Start a 401(k)

To start a 401(k), contact your employer to see if they offer this benefit and whether they will match your contributions. If they do offer a 401(k), they will provide you with the necessary paperwork to sign up. You will then need to choose your investments from the options provided by your employer.

Contribution Limits

The contribution limit for 401(k) plans changes periodically to account for inflation. For 2024, the annual limit on employee contributions is $23,000 for workers under 50. Workers aged 50 and over can make a catch-up contribution of $7,500.

Why Invest in a 401(k)

A 401(k) is a popular way to save for retirement, with tax advantages and the potential for employer-matching contributions. By contributing to a 401(k), you can benefit from compounding returns and the potential for growth over time. Additionally, automatic contributions from your paycheck make it easier to save for retirement.

The Ultimate Guide to Investing in Metal Pay: Strategies, Tips, and Tricks

You may want to see also

Invest in a Roth IRA

Investing in a Roth IRA is a great way to save for retirement, especially if you are just starting out or starting over. Here are some reasons why you should consider a Roth IRA:

Tax Benefits

With a Roth IRA, you contribute after-tax dollars, meaning you pay taxes on the money going into the account. This allows for tax-free growth of your contributions and any investment earnings. When you withdraw the money during retirement, you can do so tax-free and penalty-free, provided you are at least 59½ years old and have had the account for at least five years. This can be advantageous if you expect to be in a higher tax bracket in retirement since you won't have to pay taxes on the withdrawals.

Flexibility

Roth IRAs offer flexibility in terms of investment options and contribution age. You can choose from a variety of investments, including stocks, bonds, mutual funds, and more. Additionally, there are no age restrictions on contributions, as long as you have qualifying earned income.

Spousal Roth IRA

If your spouse is not working or has little income, you can still contribute to a spousal Roth IRA on their behalf, known as a spousal Roth IRA. This allows you to maximize your family's retirement savings.

No Minimum Distributions

Unlike traditional IRAs, Roth IRAs do not require you to take minimum distributions starting at a certain age. This gives you more control over your retirement savings and allows you to continue growing your investments tax-free.

Estate Planning

With a Roth IRA, you can pass on your retirement savings to your heirs tax-free. They won't incur any additional income taxes on the inherited account, making it a valuable tool for estate planning.

How to Get Started

To open a Roth IRA, you can follow these steps:

- Determine your eligibility: Roth IRAs have income limits, so check if your modified adjusted gross income (MAGI) falls within the eligible range.

- Choose a provider: Compare different brokerage firms, banks, or investment companies that offer Roth IRAs and consider factors such as investment options, fees, and customer service.

- Fund the account: You can fund your Roth IRA with regular contributions, spousal contributions, rollover contributions, or conversions from existing retirement accounts.

- Make investment choices: Decide how you want to invest your Roth IRA funds, considering your risk tolerance and investment preferences. You can choose from a variety of investment options, including stocks, bonds, mutual funds, and more.

- Monitor and adjust: Once you've set up your Roth IRA, remember to regularly review and adjust your investments as needed to align with your retirement goals.

Faux Fur: Sustainable Luxury

You may want to see also

Invest in a traditional IRA

Investing in a traditional IRA is a great way to save for retirement, especially if you're looking to invest 15% of your gross income. Here's everything you need to know about traditional IRAs and how they can help you achieve your retirement goals:

A traditional IRA (Individual Retirement Account) is a tax-advantaged account that allows your earnings to grow tax-deferred. This means that you only pay taxes on your investment gains when you make withdrawals in retirement. Traditional IRAs offer a great opportunity to reduce your taxable income while saving for the future.

Benefits of a Traditional IRA:

- Tax-deductible contributions: If you're not covered by a retirement plan at work, you can deduct your IRA contributions from your income tax. The annual contribution limit for 2024 is $7,000, or $8,000 if you're 50 or older.

- No maximum income limit: Anyone can invest in a traditional IRA, regardless of their income.

- Tax-deferred growth: Any gains you would normally pay taxes on in a standard brokerage account are deferred until retirement.

- Early withdrawal options: You can use traditional IRA funds for qualified expenses, such as college costs or purchasing your first home, without paying an early distribution penalty. However, you will owe taxes on these withdrawals.

How to Open a Traditional IRA:

To open a traditional IRA, you need to decide if you want to be a hands-on or hands-off investor. Hands-on investors can choose their own investments through an online broker, while hands-off investors can opt for a robo-advisor, which uses automated technology to choose investments based on your goals.

Contribution Limits and Eligibility:

The great news about traditional IRAs is that everyone can open and contribute to one. However, the ability to deduct contributions and reap the full tax benefits has income limits. If you or your spouse has a retirement plan at work, your income must be below a certain threshold to deduct the full contribution. For 2024, the income limit for single or head of household is $77,000-$87,000, and for married filing jointly, it's $123,000-$143,000.

Traditional IRA vs. Roth IRA:

The main difference between a traditional IRA and a Roth IRA lies in when taxes are applied. With a traditional IRA, contributions are tax-deductible, while withdrawals in retirement are taxed. On the other hand, Roth IRAs offer no tax benefit when contributing, but qualified withdrawals during retirement are tax-free. You can have both types of IRAs, but the total annual contribution across all your IRA accounts cannot exceed the annual limit.

Retirement Reinvented: Navigating Post-Career Investment Strategies

You may want to see also

Frequently asked questions

It is recommended that you invest 15% of your gross income for retirement. This will help you build a solid nest egg and leave room in your budget for other financial goals.

There are various investment options available, including 401(k) plans, IRAs (Individual Retirement Accounts), and employer-sponsored plans such as pensions.

Younger investors can typically tolerate more risk but have less income to invest, while those near retirement have more money to invest but less time to recover from losses. It is important to adjust your asset allocation accordingly.

If you are behind on retirement savings, consider maximising tax-advantaged accounts, finding ways to increase your income, and reducing unnecessary expenses. Additionally, consider working with a financial advisor to create a comprehensive plan.