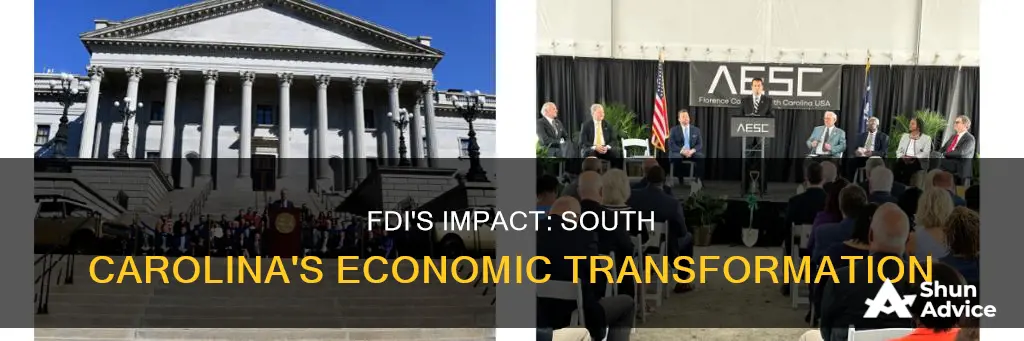

Foreign Direct Investment (FDI) has played a significant role in shaping South Carolina's economy, presenting both opportunities and challenges. On the positive side, FDI has brought substantial economic growth, job creation, and technological advancements to the state. Many foreign companies have established a presence in South Carolina, contributing to the state's manufacturing, automotive, and technology sectors. These investments have led to the expansion of local businesses, improved infrastructure, and increased exports, boosting the state's economy. However, there are concerns regarding the potential negative impacts of FDI. Critics argue that it can lead to job displacement, environmental degradation, and the exploitation of local resources. Additionally, the influx of foreign companies may result in cultural and economic disparities, impacting local communities and businesses. Balancing the benefits and drawbacks of FDI is crucial for South Carolina's sustainable development and long-term prosperity.

| Characteristics | Values |

|---|---|

| Economic Growth and Job Creation | Foreign direct investment (FDI) has significantly contributed to South Carolina's economic growth, particularly in manufacturing, automotive, and aerospace sectors. It has led to the creation of numerous jobs, reducing unemployment rates. |

| Infrastructure Development | FDI has played a role in improving the state's infrastructure, including transportation and utilities, which has enhanced connectivity and supported business operations. |

| Technology Transfer and Innovation | Foreign investors bring advanced technologies and expertise, fostering innovation and knowledge transfer. This has helped local businesses and industries modernize and compete globally. |

| Export Growth | South Carolina's exports have increased due to FDI, with foreign-owned companies contributing to the state's export-oriented industries. |

| Attracting Additional Investment | Successful FDI projects can attract further investment, creating a positive cycle of economic development. |

| Potential Environmental Concerns | Some FDI projects have faced criticism for environmental impacts, requiring careful regulation and management. |

| Impact on Local Businesses | Local businesses may face competition from foreign-owned companies, potentially affecting market dynamics and local entrepreneurship. |

| Regional Disparities | FDI might have varying effects on different regions within South Carolina, with some areas benefiting more than others. |

| Policy and Regulatory Considerations | The state's policies and regulations influence the attractiveness of FDI, requiring a balanced approach to maximize benefits. |

| Long-term Sustainability | Ensuring the long-term sustainability of FDI projects is crucial for the state's economic stability. |

What You'll Learn

- Economic Growth: FDI has boosted South Carolina's GDP and created jobs

- Infrastructure: Foreign investors have funded transportation and utility improvements

- Export Expansion: Increased exports to foreign markets due to FDI

- Labor Market: FDI can lead to higher wages and better working conditions

- Environmental Impact: Some FDI projects may have negative environmental consequences

Economic Growth: FDI has boosted South Carolina's GDP and created jobs

Foreign direct investment (FDI) has played a significant role in South Carolina's economic growth and development, particularly in the areas of job creation and GDP growth. The state has attracted a substantial amount of FDI over the years, which has had a positive impact on its economy.

One of the key benefits of FDI in South Carolina is the creation of jobs. When foreign companies invest in the state, they often establish new facilities or expand existing ones, leading to the hiring of local workers. This influx of jobs can help reduce unemployment rates and provide employment opportunities for South Carolinians. For example, the expansion of a foreign auto manufacturer in the state resulted in the creation of hundreds of jobs, including positions for skilled workers, engineers, and support staff. These jobs not only provide income for individuals but also contribute to the overall economic activity and tax revenue of the state.

FDI has also contributed to the growth of South Carolina's GDP. As foreign companies invest, they bring capital, technology, and expertise, which can lead to increased production, higher output, and improved efficiency in local industries. This can result in a boost to the state's economic output, measured by its GDP. For instance, the presence of a major foreign pharmaceutical company in the state has led to the development of new manufacturing facilities, resulting in a significant increase in GDP and the creation of high-skilled jobs.

The impact of FDI on South Carolina's economy is further evident in the form of increased tax revenue. Foreign companies operating in the state generate income and sales taxes, which contribute to the state's fiscal health. This additional revenue can be utilized by the government to invest in infrastructure, education, and other public services, further enhancing the state's attractiveness for future investments.

Moreover, FDI can foster innovation and technological advancement in South Carolina. Foreign companies often bring cutting-edge technologies and research capabilities, which can benefit local industries and drive economic growth. This transfer of knowledge and technology can lead to the development of new products, improved processes, and enhanced productivity, ultimately contributing to the state's long-term economic prosperity.

In summary, foreign direct investment has been a driving force behind South Carolina's economic growth, creating jobs and boosting the state's GDP. The positive impact of FDI extends beyond economic indicators, as it also contributes to the overall development and well-being of the state's population. By attracting foreign investment, South Carolina has positioned itself as an attractive destination for businesses, leading to a more robust and resilient economy.

AI for Investing: Strategies for Success

You may want to see also

Infrastructure: Foreign investors have funded transportation and utility improvements

Foreign direct investment (FDI) has played a significant role in South Carolina's infrastructure development, particularly in the transportation and utility sectors. The state has attracted substantial foreign capital, which has contributed to the modernization and expansion of its transportation networks and utility systems.

One of the key areas of FDI in South Carolina's infrastructure is the transportation sector. Foreign investors have funded the construction and improvement of roads, highways, and bridges, connecting various regions of the state. For instance, the expansion of Interstate 59 and the development of the Palmetto Expressway have improved connectivity and reduced travel times between major cities like Columbia, Charleston, and Greenville. These projects have not only facilitated the movement of goods and people but also enhanced the state's attractiveness for businesses, potentially leading to further economic growth.

In addition to roads, foreign investment has also focused on improving South Carolina's rail network. The state's rail infrastructure has been upgraded with the help of foreign capital, allowing for more efficient transportation of cargo and passengers. The expansion of the Norfolk Southern Railway and the construction of new rail lines have improved connectivity with neighboring states and international markets, benefiting both local businesses and the overall economy.

The utility sector has also seen significant foreign investment, leading to improvements in water, electricity, and telecommunications services. Foreign companies have invested in the construction of new power plants, the expansion of transmission lines, and the modernization of the state's electrical grid. These investments have increased the reliability and efficiency of power supply, ensuring that South Carolina's growing population and industries have access to stable and affordable electricity. Moreover, foreign investors have contributed to the development of advanced water treatment facilities, improving water quality and ensuring a sustainable supply for both residential and industrial use.

The impact of foreign investment in infrastructure has been twofold. Firstly, it has led to the creation of numerous jobs, providing employment opportunities for South Carolinians. These projects have required a significant workforce, from construction workers to engineers and technicians, contributing to the state's economic growth and reducing unemployment rates. Secondly, the improved infrastructure has attracted more businesses, fostering economic development and potentially increasing the state's tax revenue. The enhanced transportation and utility networks have made South Carolina an even more attractive location for companies to establish their operations, further boosting the local economy.

A Beginner's Guide to Investing in VTSAX with Vanguard

You may want to see also

Export Expansion: Increased exports to foreign markets due to FDI

Foreign Direct Investment (FDI) has played a significant role in South Carolina's economic landscape, particularly in the expansion of its export sector. The state has experienced a notable increase in exports to foreign markets, which can be attributed to the influx of FDI. This growth in exports has had a positive impact on the local economy, creating new job opportunities and fostering economic development.

One of the key benefits of FDI in South Carolina is the establishment of international trade relationships. When foreign companies invest in the state, they often bring with them a network of global connections and markets. This enables South Carolina-based businesses to access these international networks, facilitating the export of their goods and services. For instance, a foreign investor might set up a manufacturing plant in South Carolina, producing goods that can then be exported to their home country or other international markets. This not only increases the state's export volume but also diversifies its export destinations, reducing reliance on a single market.

The expansion of exports has a ripple effect on the local economy. As more goods and services are exported, South Carolina's businesses benefit from increased revenue and market presence. This, in turn, leads to the creation of new jobs, as companies invest in their export operations to meet growing demand. The state's unemployment rate may decrease, and a more robust job market can attract a younger, more skilled workforce. Furthermore, the increased economic activity can stimulate further investment, creating a positive feedback loop that benefits the entire state.

FDI also contributes to the development of infrastructure and supply chains, which are essential for efficient export operations. Foreign investors often bring advanced technologies and management practices, improving the overall productivity and competitiveness of South Carolina's businesses. This can lead to a more streamlined and cost-effective export process, making South Carolina an attractive destination for international trade.

In summary, Foreign Direct Investment has been instrumental in South Carolina's export expansion, providing access to global markets and fostering economic growth. The state's businesses have been able to increase their export volume and diversify their markets, leading to job creation and a more robust economy. This positive impact of FDI on South Carolina's export sector highlights the potential for further economic development through strategic foreign investment.

France's Foreign Investment Expropriation: A Historical Overview

You may want to see also

Labor Market: FDI can lead to higher wages and better working conditions

Foreign Direct Investment (FDI) has had a significant impact on South Carolina's labor market, particularly in terms of wage growth and improved working conditions. When foreign companies invest in the state, they often bring with them new technologies, management practices, and a demand for skilled labor. This influx of investment can lead to several positive outcomes for the local workforce.

One of the most direct effects is the creation of new job opportunities. FDI projects often result in the establishment of new businesses or the expansion of existing ones, requiring a larger workforce. This can lead to a reduction in unemployment rates and provide South Carolinians with a wider range of employment options. As these new businesses become established, they may also attract additional investment, further stimulating job creation and economic growth.

The presence of foreign investors can also drive up wages in the region. As companies compete for a limited labor pool, they may be forced to offer higher salaries and improved benefits packages to attract and retain employees. This is especially true for skilled workers, as foreign companies often seek to employ local talent with specialized skills that are in high demand. Over time, this can lead to a more competitive labor market, benefiting workers through increased earning potential and better job security.

Moreover, FDI can contribute to the improvement of working conditions. Foreign investors often bring international standards and best practices, which can enhance workplace safety, employee training, and overall job satisfaction. These companies may also implement more efficient management systems, leading to better organization and communication within the workplace. As a result, employees may experience reduced stress levels, improved job satisfaction, and a more positive work environment.

In summary, Foreign Direct Investment has the potential to significantly enhance South Carolina's labor market. It can lead to higher wages, better job opportunities, and improved working conditions for the state's workforce. The positive effects of FDI on the labor market can contribute to a more prosperous and competitive South Carolina economy, benefiting both businesses and employees alike.

Jewelry Crafting: Investment Casting's Role and Relevance

You may want to see also

Environmental Impact: Some FDI projects may have negative environmental consequences

Foreign direct investment (FDI) can have both positive and negative impacts on the environment, and South Carolina, like many other regions, has experienced a range of environmental consequences associated with FDI projects. While some investments can bring economic benefits and job creation, they may also lead to environmental degradation if not properly managed and regulated.

One of the primary environmental concerns is the potential for FDI projects to contribute to pollution and habitat destruction. Industrial activities, such as manufacturing or resource extraction, can result in air and water pollution if not controlled. For instance, the establishment of a new manufacturing plant might lead to increased emissions of pollutants, including greenhouse gases and toxic chemicals, which can have detrimental effects on local ecosystems and human health. These emissions can contribute to air quality issues, leading to respiratory problems for residents and potential long-term environmental damage.

Additionally, FDI projects often require significant land use, which can result in deforestation and habitat loss. The construction of infrastructure, industrial facilities, or even renewable energy projects can disrupt natural habitats and displace wildlife. This is particularly concerning in areas with sensitive ecosystems, such as wetlands or coastal regions, where the loss of natural buffers can exacerbate the impacts of storms and flooding. The displacement of wildlife and disruption of ecological balance can have far-reaching consequences, affecting not only the local biodiversity but also the overall health of the ecosystem.

Furthermore, the extraction of natural resources for FDI projects can have severe environmental implications. Mining, drilling, or logging operations can lead to soil erosion, deforestation, and the contamination of water sources. These activities can permanently alter the landscape and render the land unsuitable for future use. The release of toxic substances during resource extraction can also pollute nearby water bodies, affecting aquatic life and the overall water quality in the region.

To mitigate these negative environmental impacts, it is crucial for South Carolina and other regions to implement robust environmental regulations and impact assessment processes. This includes requiring thorough environmental impact assessments before approving FDI projects, ensuring that companies adhere to strict pollution control measures, and promoting sustainable practices. By balancing economic growth with environmental protection, South Carolina can harness the benefits of FDI while minimizing its potential harm to the natural environment.

Positive Cash Flows: A Smart Investment Strategy?

You may want to see also

Frequently asked questions

Foreign direct investment has played a significant role in South Carolina's economic development, particularly in the automotive, aerospace, and manufacturing sectors. FDI has brought substantial job creation, with many foreign companies establishing manufacturing plants and research facilities, leading to a boost in employment and a reduction in the state's unemployment rate. For example, BMW's South Carolina plant has become a major employer, attracting a substantial number of foreign workers and contributing to the state's economic growth.

While FDI has overall been beneficial, there are some potential drawbacks. One concern is the environmental impact of certain manufacturing processes, especially in the automotive and chemical industries. Foreign companies may bring different environmental standards, and ensuring compliance with South Carolina's regulations can be challenging. Additionally, the influx of foreign workers might lead to temporary labor market disruptions, affecting local wages and employment conditions.

Foreign direct investment and domestic investment have both contributed to South Carolina's economic growth, but they serve different purposes. FDI often brings advanced technology, expertise, and access to global markets, which can enhance the state's productivity and competitiveness. Domestic investment, on the other hand, may focus more on local market needs and can help develop specific industries within South Carolina. A balanced approach, encouraging both types of investment, could lead to a more robust and diverse economy.