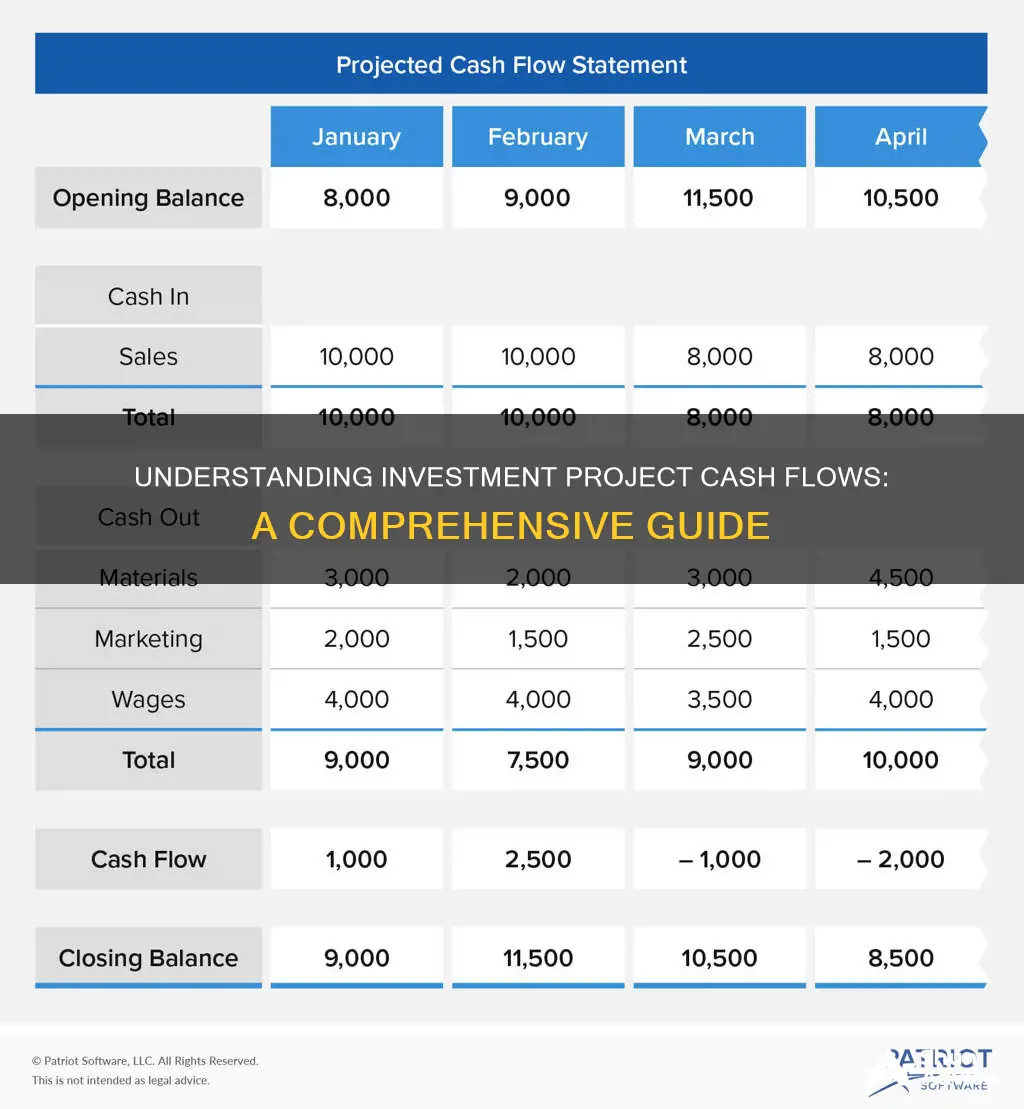

Understanding the cash flow associated with an investment project is crucial for evaluating a company's liquidity, flexibility, and overall financial performance. Cash flow analysis entails examining the money flowing into and out of a company, with positive cash flow indicating an increase in liquid assets, enabling the company to cover obligations, reinvest in its business, and provide a buffer against future challenges. Conversely, negative cash flow may signal financial troubles or indicate investments in assets, research, or future growth. A company's cash flow statement details its sources and use of cash, including cash flow from operations, investing, and financing activities. This statement is a valuable tool for investors, analysts, and companies themselves to assess financial health, stability, and growth potential.

| Characteristics | Values |

|---|---|

| Cash flow type | Operating activities, investing activities, financing activities |

| Cash flow analysis | Helps determine a company's working capital and financial health |

| Positive cash flow | Indicates a company's liquid assets are increasing |

| Negative cash flow | May indicate financial trouble, but not always |

| Cash flow sources | Sales, loans, investors |

| Cash flow uses | Operating expenses, debt, reinvesting in business, paying dividends |

| Cash flow statement | Reports sources and use of cash over a specific period |

| Cash flow calculation | Total cash inflow minus total cash outflow |

| Cash flow and profit | Cash flow refers to money flowing in and out, profit is what remains after expenses |

| Free cash flow | Money left after operating and capital expenses, can be used as company chooses |

| Cash flow and financial statements | Cash flow statement is one of three financial statements, along with balance sheet and income statement |

| Cash flow and business health | Positive cash flow over multiple quarters indicates efficient operations and potential for growth |

What You'll Learn

Cash flow from investing activities

Types of Investing Activities

Investing activities can include:

- The purchase of physical assets, such as property, plant, and equipment (PP&E), also known as capital expenditures.

- Proceeds from the sale of PP&E.

- Acquisitions of other businesses or companies.

- Proceeds from the sale of other businesses (divestitures).

- Purchases of marketable securities (e.g. stocks, bonds, etc.).

- Proceeds from the sale of marketable securities.

- Collection of loans and insurance proceeds.

Importance of Cash Flow from Investing Activities

Calculating Cash Flow from Investing Activities

To calculate the cash flow from investing activities, the sum of the following items would be added together to arrive at the annual figure:

- Capital expenditures (CapEx)

- Purchase of investments

- Spending on acquisitions

- Proceeds from the sale of investments

How Much Cash Should You Keep in Your Investment Portfolio?

You may want to see also

Cash flow from financing activities

Financing activities include transactions involving debt, equity, and dividends. This includes issuing equity or stock, borrowing debt from a creditor or bank, and issuing bonds. It also includes negative cash flow activities such as retiring debt, and making dividend payments and stock repurchases.

The CFF formula is as follows:

> CFF = CED − (CD + RP)

> Where:

> CED = Cash inflows from issuing equity or debt

> CD = Cash paid as dividends

> RP = Repurchase of debt and equity

CFF provides investors with insight into a company's financial strength and how well its capital structure is managed. A positive CFF indicates that more money is flowing into the company than out, increasing its assets. However, this could be a warning sign if the company is already in debt. Conversely, a negative CFF could be a good sign, as it may indicate that the company is servicing or retiring debt, or making dividend payments.

Overall, the cash flow statement provides an account of the cash used in operations, including financing and investing. It is an important tool for investors and analysts to determine if a business is on sound financial footing.

Selling Investments on Cash App: A Step-by-Step Guide

You may want to see also

Cash flow from operations

Analysts pay close attention to this section of the cash flow statement as it indicates the viability of the business. To remain solvent, a company's cash flow from operations should be net positive over time. This means that a company's operations must generate positive cash inflows.

The cash flow from operations can be calculated using the direct or indirect method. The direct method involves determining all types of cash transactions, including cash receipts, cash payments, cash expenses, interest, and taxes. The formula for the direct method is:

> Cash Flow from Operations = Cash Receipts - Cash Payments - Cash Expenses - Cash Interest - Cash Taxes

The indirect method starts with net income and adjusts it according to changes in the balance sheet. The formula for the indirect method is:

> Cash Flow from Operations = Net Income + Gains & Losses from financing & investments + Non-cash charges + changes in operating accounts

The International Financial Reporting Standards defines operating cash flow as cash generated from operations, less taxation and interest paid.

Cash-Rich Investments: Strategies for Financial Freedom

You may want to see also

Net cash flow

The formula for net cash flow is:

This can be simplified to:

Weighing the Benefits: Cashing in on Investments

You may want to see also

Discounted cash flow

DCF can be used to help investors decide whether to acquire a company or buy securities. It can also assist business owners and managers in making capital budgeting or operating expenditure decisions.

DCF analysis helps determine the value of an investment based on its future cash flows. The present value of expected future cash flows is calculated using a projected discount rate.

If the DCF is higher than the current cost of the investment, the opportunity could result in positive returns and may be worthwhile.

The formula for DCF is:

> DCF = CF1 / (1 + r)¹ + CF2 / (1 + r)² + CFn / (1 + r)n

Where:

- CF1 = The cash flow for year one

- CF2 = The cash flow for year two

- CFn = The cash flow for additional years

- R = The discount rate

The discount rate in DCF analysis is the interest rate used when calculating the net present value (NPV) of the investment. It represents the time value of money from the present to the future.

DCF analysis is widely used in investment finance, real estate development, corporate financial management, and patent valuation. It has been used in some form since money was first lent at interest in ancient times.

DCF valuation is differentiated from the accounting book value, which is based on the amount paid for the asset. DCF analysis gained popularity as a valuation method for stocks following the stock market crash of 1929.

There are several methods for calculating DCF, including:

- Flows to equity approach (FTE)

- Adjusted present value approach (APV)

- Weighted average cost of capital approach (WACC)

- Total cash flow approach (TCF)

DCF analysis provides a reasonable projection of whether a proposed investment is worthwhile. It can be applied to a variety of investments and capital projects where future cash flows can be reasonably estimated.

Strategies for Forecasting Cash Flow from Investing Activities

You may want to see also

Frequently asked questions

Cash flow is the movement of money into and out of a company over a certain period of time. If the company's inflows of cash are greater than the outflows, the cash flow is positive. If the outflows are greater, it is negative.

Net cash flow is calculated by subtracting total cash outflow from total cash inflow.

There are three types of cash flow: cash flow from operations, cash flow from investing, and cash flow from financing.

Cash flow from investing (CFI) reports the cash generated or spent on investment-related activities over a specific period. This includes purchases of physical assets, investments in securities, or sales of securities or assets.