Equity investments are a type of investment fund that pools money from investors to buy shares of a company on the stock market. These shares are typically traded on a stock exchange. The main benefit of equity investment is the possibility of increasing the value of the principal amount invested, which comes in the form of capital gains and dividends. Equity funds are often classified based on their investment strategy, with two main categories: actively managed funds and passive funds. Actively managed funds have portfolio managers who actively research, analyse and select stocks with the goal of outperforming a benchmark index. On the other hand, passive funds, such as index funds, aim to replicate the performance of a specific market index. Equity funds can also be classified based on the size of the companies they invest in, with large-cap, mid-cap and small-cap funds focusing on large, medium and small market capitalisations, respectively.

| Characteristics | Values |

|---|---|

| Definition | An equity investment is money that is invested in a company by purchasing shares of that company in the stock market. |

| Purpose | Investors purchase shares of a company with the expectation that they’ll rise in value in the form of capital gains, and/or generate capital dividends. |

| Benefits | The main benefit from an equity investment is the possibility to increase the value of the principal amount invested. This comes in the form of capital gains and dividends. |

| Types | Actively managed funds, passively managed funds, growth funds, value funds, blend equity funds, sector funds, geographically focused funds, large-cap funds, mid-cap funds, small-cap funds |

| Risks | Market risk, credit risk, foreign currency risk, liquidity risk, political risk, economic concentration risk, inflation risk |

What You'll Learn

Equity as ownership interest

Equity is an important concept in finance, and it is often referred to as shareholders' equity (or owners' equity for privately held companies). It represents the amount of money that would be returned to a company's shareholders if all of the assets were liquidated and the company's debts were paid off. Equity is also used to describe the degree of ownership in a business entity. The concept is based on the premise that equity is equal to ownership.

Equity interest can refer to partnership interests in a partnership company, membership interests in a limited liability company, or shares or stock interests in a corporation, including preferred and common stocks. For example, if an investor owns 25% of a business, they own 25% equity interest in that company.

Shareholders obtain equity interest when they purchase shares of stock in a business, and the number of shares they buy relative to the total number of outstanding shares determines their ownership interest. Shareholders with a higher percentage of equity interest may have a higher level of motivation to work towards the business's success.

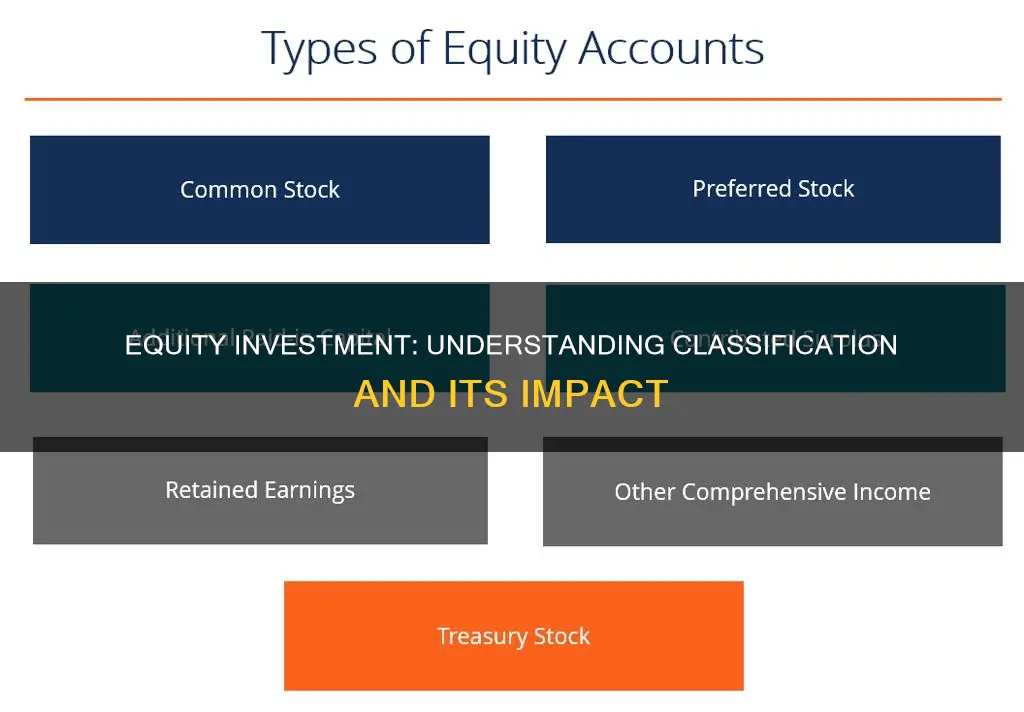

Equity can also be classified as common or preferred stock. Common stock is generally sold on stock exchanges, and its price and dividend payments change according to market forces and other success factors. Owning common stock gives the shareholder proportional ownership of the business and voting rights to choose the board of directors, but no powers over the running of the company. On the other hand, preferred stock refers to an equity interest with a fixed dividend value for life. The price of preferred stock depends on the credit rating or financial status of the business and the dividend amount, rather than the profitability of the company.

Managing External Municipal Investment Managers: Strategies for Success

You may want to see also

Equity funds

Passively managed funds, on the other hand, include index funds, which aim to replicate the performance of a specific market index. Passive fund managers do not attempt to outperform the market; instead, they track the index as closely as possible. Because passive funds require less active management, they generally have lower fees and taxes than actively managed funds.

Alternative Investment Management: Exploring Non-Traditional Strategies

You may want to see also

Equity securities

Additionally, equity securities can be classified based on their investment strategy. Growth funds invest in companies expected to have rapid earnings growth, while value funds focus on stocks considered undervalued. Blend equity funds invest in a mix of both growth and value stocks.

Millennial Money: Strategies for Smart Investment Management

You may want to see also

Equity accounting

The equity method requires the investing company to record the investee's profits or losses in proportion to its percentage of ownership. The initial investment amount is recorded as an asset on the investing company's balance sheet, and any profit increases the investment value, while losses decrease it. The investee company will record its profit or loss for the period in its own income statement, and the investing company will recognise its share of this, according to its percentage of ownership.

The equity method also makes periodic adjustments to the value of the asset on the investor's balance sheet. This is because the investor has a controlling interest in the investee. The requirements for the equity method are set out in U.S. GAAP and IFRS rules, although there is specific guidance in U.S. GAAP that does not exist in the IFRS.

The biggest consideration under equity accounting is the level of investor influence over the operating and financial decisions of the investee. When an investor acquires 20% or more of the voting stock, it is presumed that they can exert significant influence over the investee. Conversely, when ownership is less than 20%, it is presumed that the investor does not exert significant influence unless it can be demonstrated.

The equity method is used to record the profits earned by a company through its investment in another company. It is generally used when a company holds significant influence over the company it is investing in. The investment is recorded at historical cost, and adjustments are made based on the investor's percentage ownership in net income, loss, and dividend payouts. Net income increases the value on the investor's income statement, while loss and dividend payouts decrease it.

Viewing Your Acorns Investment Portfolio: A Simple Guide

You may want to see also

Equity investing

An equity investment is money that is invested in a company by purchasing shares of that company in the stock market. These shares are typically traded on a stock exchange. Equity investors purchase shares with the expectation that they will rise in value, generating capital gains, and/or pay dividends. If an equity investment rises in value, the investor would receive the monetary difference if they sold their shares, or if the company's assets are liquidated and all its obligations are met.

There are two primary categories of equity funds: actively managed funds and passive funds. Actively managed funds have portfolio managers who actively research, analyse and select stocks with the goal of outperforming a benchmark index, such as the S&P 500. They use their expertise and various strategies to decide whether to buy, hold or sell stocks within the fund's portfolio. The success of an actively managed fund largely depends on the fund manager's skill and decision-making ability. Because of the more hands-on approach, actively managed funds typically charge higher fees than passive funds.

Passive funds, on the other hand, include index funds, which aim to replicate the performance of a specific market index. For example, an S&P 500 index fund seeks to mirror the returns of the S&P 500 by holding the same stocks in the same proportions as the index itself. Passive fund managers do not attempt to outperform the market; instead, they track the index as closely as possible. Because passive funds require less active management, they generally have lower fees and taxes than actively managed funds.

Equity funds are also classified based on their investment strategy, with two main categories: growth funds and value funds. Growth funds invest in stocks of companies expected to have more rapid earnings growth, often characterised by higher price-to-earnings (P/E) ratios. Value funds, on the other hand, buy stocks that are considered undervalued based on fundamental analysis and often have lower P/E ratios, higher dividends, and lower price-to-book ratios.

Group Investment Management: Strategies for Success

You may want to see also

Frequently asked questions

An equity investment is money that is invested in a company by purchasing shares of that company in the stock market. These shares are typically traded on a stock exchange.

Equity investments are classified as either trading securities, available-for-sale securities, or, in the case of debt investments, held-to-maturity securities. The classification is based on the intent of the company regarding how long they plan to hold each investment.

The cost method records the acquisition costs in an asset account called "Equity Investments". Acquisition costs include commissions and fees paid to acquire the stock.

The equity method is used when the investor can significantly influence the operating and financial policies or decisions of the company they have invested in. The investor adjusts the value of their equity investment for dividends received and the corporation's earnings or losses.

The main benefit of equity investments is the possibility to increase the value of the principal amount invested, which comes in the form of capital gains and dividends. Equity investments can also strengthen a portfolio's asset allocation by adding diversification.