The concept of wahed investment, a term often used in Islamic finance, refers to a structured approach to investing that adheres to the principles of sharia law. This method involves a unique investment strategy where the primary focus is on creating a balanced and ethical financial portfolio. It emphasizes the importance of ethical and socially responsible investing, ensuring that the investment process is transparent and free from speculative or risky elements. The wahed investment model aims to provide a fair and sustainable way of managing financial assets, offering an alternative to conventional investment practices. By following this approach, investors can contribute to the growth of the economy while maintaining their commitment to Islamic values and ethical standards.

What You'll Learn

- Investment Structure: How are funds allocated to different assets

- Risk Management: What strategies are used to mitigate investment risks

- Performance Tracking: How is the fund's performance measured and reported

- Transparency: What level of transparency is provided to investors

- Withdrawal Process: How and when can investors withdraw their funds

Investment Structure: How are funds allocated to different assets?

The concept of wahed investment, which translates to "single unit" in Arabic, refers to a structured investment approach where a single fund or portfolio is designed to invest in various assets to achieve a specific financial goal. This strategy aims to provide investors with a diversified and balanced approach to wealth management. When it comes to the investment structure, the allocation of funds to different assets is a critical aspect that determines the overall performance and risk profile of the investment.

In wahed investment, the allocation process involves a careful selection and distribution of assets, such as stocks, bonds, real estate, or alternative investments. The primary objective is to create a well-diversified portfolio that minimizes risk while maximizing potential returns. Asset allocation is typically based on an investor's risk tolerance, investment goals, and time horizon. For instance, a conservative investor might allocate a larger portion of their funds to bonds and fixed-income securities, while a more aggressive investor may focus on stocks and equity investments.

The allocation strategy can vary depending on the investment manager's philosophy and the specific fund's objectives. Some investment structures employ a static approach, where the asset allocation remains fixed throughout the investment period. This method is suitable for investors who prefer a consistent strategy and are willing to accept potential underperformance during market downturns. On the other hand, dynamic allocation is used, which involves regular adjustments to the asset mix based on market conditions and performance. This approach allows for more flexibility and the ability to capitalize on emerging opportunities.

Investment managers use various tools and models to determine the optimal asset allocation. These may include historical performance analysis, risk assessment frameworks, and quantitative models that consider market trends, economic indicators, and individual asset characteristics. By employing these methods, managers can make informed decisions about how to allocate funds across different asset classes. It is essential for investors to understand the investment structure and the underlying allocation strategy to align their financial goals and risk preferences.

In summary, wahed investment focuses on creating a diversified portfolio by allocating funds across various assets. The investment structure plays a vital role in determining the risk and return characteristics of the investment. Investors should be aware of the allocation strategy employed by the investment manager to ensure that their financial objectives are met while managing risk effectively. Understanding the allocation process empowers investors to make informed decisions and build a robust investment strategy.

Investing: Separating Fact from Fiction

You may want to see also

Risk Management: What strategies are used to mitigate investment risks?

When it comes to risk management in investments, especially in the context of wahed investments, a structured approach is essential to navigate the potential pitfalls and ensure long-term success. Here are some strategies employed to mitigate investment risks:

Diversification: One of the fundamental principles of risk management is diversification. This strategy involves spreading investments across various asset classes, sectors, and geographic regions. By diversifying, investors can reduce the impact of any single investment's performance on their overall portfolio. For instance, a wahed investment fund might allocate a portion of its assets to stocks, bonds, real estate, and alternative investments, ensuring that the risk is not concentrated in one area. This approach helps in managing both market and specific risks associated with individual assets.

Risk Assessment and Analysis: Before making any investment decision, a thorough risk assessment is crucial. This process involves identifying and analyzing potential risks associated with the investment. For wahed investments, this could include market risk, credit risk, liquidity risk, and operational risk. For example, market risk analysis might involve studying historical market trends, volatility, and potential external factors that could impact the investment. By understanding these risks, investors can make informed decisions and implement appropriate mitigation measures.

Risk Mitigation Techniques: Several techniques are employed to manage and reduce investment risks. One common strategy is the use of hedging, which involves taking offsetting positions to protect against potential losses. For instance, an investor might use options or futures contracts to hedge against market downturns. Additionally, investors can employ risk-reducing strategies like setting stop-loss orders to limit potential losses or using derivatives to manage specific risks. In the context of wahed investments, these techniques can be tailored to suit the fund's investment objectives and risk tolerance.

Regular Review and Monitoring: Effective risk management requires continuous monitoring and review of investments. Investors should regularly assess the performance of their wahed investment portfolio and compare it against predefined risk metrics and benchmarks. This process helps in identifying any deviations from the expected risk profile and allows for prompt action. For instance, if a particular investment is underperforming and posing a higher risk, investors can consider rebalancing the portfolio or adjusting the investment strategy.

Risk Management Framework: Establishing a comprehensive risk management framework is vital for wahed investments. This framework should outline the processes, policies, and procedures for identifying, assessing, and managing risks. It includes defining risk tolerance levels, setting risk limits, and implementing internal controls. By having a structured approach, investors can ensure that risk management is an integral part of the investment process, leading to more informed and strategic decision-making.

Investment Losses: Can TurboTax Carry Them Over for You?

You may want to see also

Performance Tracking: How is the fund's performance measured and reported?

Performance tracking is a critical aspect of managing investment funds, especially in the context of Wahed Investment, a digital investment platform. It involves a systematic process to measure, analyze, and report the financial performance of the funds under management. This process is essential for investors to understand how their money is being invested and to make informed decisions about their investments. Here's a detailed look at how fund performance is measured and reported:

Performance Measurement:

- Wahed Investment employs various metrics and tools to gauge the performance of its funds. One of the primary methods is the calculation of the Net Asset Value (NAV) per share. The NAV represents the net value of the fund's assets after deducting liabilities. It is calculated daily and provides a clear picture of the fund's performance over time.

- Another crucial metric is the Total Return, which includes both capital gains and income generated from the fund's investments. This metric gives investors an idea of the overall growth and profitability of their investments.

- Performance is also measured through the comparison of the fund's returns against relevant benchmarks. Benchmarks are carefully selected indices or portfolios that represent the market or a specific segment of the market in which the fund operates. By comparing the fund's performance to these benchmarks, investors can assess how well the fund is performing relative to its peers.

Performance Reporting:

- Regular performance reports are generated to keep investors informed. These reports typically include a summary of the fund's performance over a specific period, often a month or a quarter. They provide a snapshot of the fund's NAV, total returns, and any significant events or changes during the reporting period.

- Detailed performance reports may also include a breakdown of the fund's holdings, showing the percentage of the portfolio invested in different asset classes, sectors, or individual securities. This level of detail allows investors to understand the fund's investment strategy and the distribution of their assets.

- Additionally, Wahed Investment might provide investors with personalized reports, tailored to their investment goals and risk profiles. These reports could highlight the performance of the fund in relation to the investor's specific objectives, making it easier for them to assess the alignment of their investments with their financial plans.

The performance tracking process is a transparent and structured approach to managing investment funds. It ensures that investors have access to accurate and timely information, enabling them to make strategic decisions regarding their investments. By employing various performance metrics and providing comprehensive reports, Wahed Investment aims to deliver a clear understanding of fund performance, fostering trust and confidence among its investors.

Unveiling the Midas Touch: A Guide to Midas Investments

You may want to see also

Transparency: What level of transparency is provided to investors?

When it comes to Wahed Investment, transparency is a key aspect that investors should be aware of. The level of transparency provided by Wahed can greatly impact an investor's decision to participate in their investment offerings. Here's an overview of what investors can expect in terms of transparency:

Wahed Investment aims to provide a high level of transparency to its investors, ensuring they have access to relevant information. They believe that informed investors can make better decisions. As such, they offer detailed reports and disclosures to keep investors well-informed. These reports typically include performance updates, market analysis, and any relevant news or events that may affect the investment. By providing these insights, Wahed allows investors to understand the factors influencing their investments.

One of the ways Wahed maintains transparency is by offering clear and concise documentation. Their investment products are accompanied by comprehensive prospectuses or offering documents that outline the investment's structure, risks, and potential returns. These documents are designed to be easily understandable, ensuring investors can make informed choices. Additionally, Wahed may provide regular updates and notifications to investors, keeping them informed about any changes or developments related to their investments.

Another aspect of transparency is the availability of customer support and communication channels. Wahed Investment should have a dedicated team to address investor inquiries and provide clarification on any concerns. This ensures that investors can seek information and receive timely responses, fostering a sense of trust and confidence in the investment process.

Furthermore, Wahed's website and online platforms can offer a wealth of information. These platforms may include educational resources, FAQs, and detailed investment insights. By providing such resources, investors can gain a deeper understanding of the investment strategies and the market dynamics at play. This level of transparency empowers investors to make more informed decisions and manage their investments effectively.

In summary, Wahed Investment strives to maintain transparency by offering detailed reports, clear documentation, and accessible communication channels. These measures ensure that investors are well-informed and can make confident decisions regarding their investments. It is essential for investors to review and understand the transparency practices of any investment firm to ensure a positive and successful investment journey.

Strategizing for Retirement: Adapting Investment Plans for a Secure Future

You may want to see also

Withdrawal Process: How and when can investors withdraw their funds?

The withdrawal process for Wahed Investment is designed to be straightforward and efficient, allowing investors to access their funds when needed. Here's an overview of how and when investors can withdraw their investments:

Withdrawal Options:

- Investors have the flexibility to withdraw their funds at any time. The platform offers a seamless withdrawal process, ensuring investors can access their capital promptly.

- When initiating a withdrawal, investors can choose between different methods. The primary options include bank transfers and electronic fund transfers to the investor's designated account.

- Wahed Investment prioritizes security and transparency. Before processing a withdrawal, investors may be required to provide additional verification steps, such as identity proof and fund source confirmation, to ensure the security of their funds.

Withdrawal Timeline:

- The withdrawal process typically begins once the investor submits the request. Investors can expect a swift response, with most withdrawals processed within 2-3 business days.

- However, it's important to note that the timeline may vary depending on the chosen withdrawal method and the investor's bank or financial institution. Electronic transfers, for instance, might be faster than traditional bank wire transfers.

- In some cases, especially during peak periods or for complex verification processes, the withdrawal might take a little longer. Investors will be informed of any potential delays during the withdrawal request process.

Fees and Considerations:

- Wahed Investment may charge a small fee for withdrawals, which is standard practice in the industry. The fee structure is transparent and communicated to investors beforehand.

- Investors should be aware of any applicable fees and potential tax implications associated with withdrawals. It is advisable to review the platform's fee schedule and tax guidelines to understand the financial aspects of the withdrawal process.

- The platform aims to provide a cost-effective and efficient service, ensuring that investors can access their funds without excessive charges.

Security and Support:

- Wahed Investment takes security seriously and employs various measures to protect investors' funds during the withdrawal process. This includes encryption technologies and secure data transmission protocols.

- In case of any queries or concerns regarding withdrawals, investors can reach out to the platform's customer support team. The support team is available to assist with any issues and provide guidance throughout the withdrawal procedure.

By offering a transparent and efficient withdrawal process, Wahed Investment ensures that investors can manage their investments with ease and confidence. The platform's focus on security and investor support further enhances the overall investment experience.

Savings vs. Investing: Understanding the Key Differences

You may want to see also

Frequently asked questions

The Wahed Investment Model is a unique approach to investing that focuses on Islamic finance principles. It aims to provide a sharia-compliant alternative to traditional investment methods, ensuring that the investment process adheres to Islamic law. This model offers a structured way to invest while avoiding any interest-based transactions, making it an attractive option for those seeking ethical and socially responsible investment opportunities.

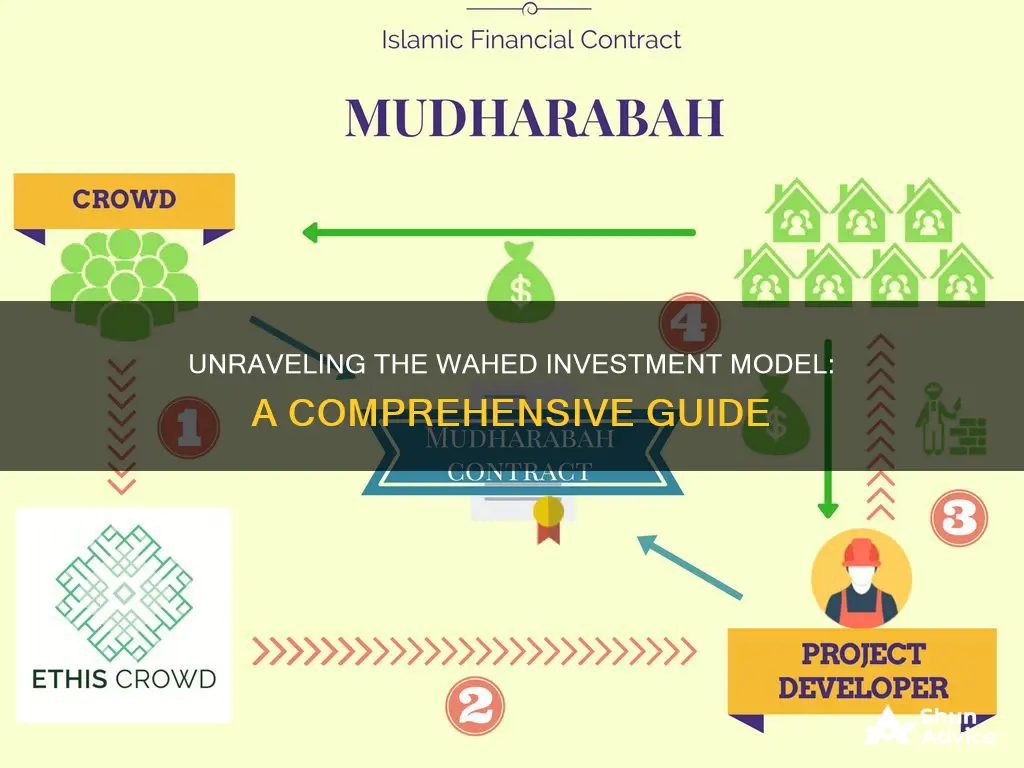

The model operates by employing various strategies to avoid conventional financial instruments. It primarily invests in assets that generate returns through profit-sharing or rental income, such as real estate, business ventures, and equity shares. By focusing on these avenues, the model ensures that the investment process aligns with the principles of Islamic finance, promoting fairness and transparency.

Investing with Wahed offers several advantages. Firstly, it provides access to a diverse range of investment opportunities, allowing investors to build a well-rounded portfolio. The model's emphasis on ethical and socially conscious practices can appeal to those who prioritize sustainability and transparency. Additionally, Wahed's approach may offer potential risk mitigation, as it avoids speculative investments and focuses on tangible assets, providing a more stable investment environment.