Investing is a great way to build wealth and secure your financial future. Many factors determine the value of your investments over time, such as the initial investment amount, rate of return, frequency of contributions, and time horizon.

When considering what your investments will be worth after 30 years, it's essential to understand the power of compound interest. The longer your money is invested, the more potential it has to grow, and the impact of compounding returns becomes more significant.

Online investment calculators can help you estimate how your investments might perform over time by taking into account factors such as contribution amount, frequency, expected rate of return, and compounding frequency.

Additionally, your investment strategy may change as you progress through different life stages. Younger investors can typically tolerate more risk and benefit from a longer time horizon, while those closer to retirement may seek more stable, lower-risk investments.

Starting early, contributing regularly, and maximizing the benefits of compound interest by investing for the long term can help you build a substantial nest egg for the future.

| Characteristics | Values |

|---|---|

| How to calculate future value | The future value of an investment can be calculated using the 'Insert Function' under the Formula tab on an Excel sheet. The formula is: FV=1,00,000 x ((1+0.12)^10) |

| How to calculate future value of a series of investments | FV= I x (((1+r%)^n) -1)/r%) |

| How much to invest to become a millionaire | A 30-year-old making investments that yield a 3% yearly return would have to invest $1,400 per month for 35 years to reach $1 million. If they instead contribute to investments that give a 6% yearly return, they would have to invest $740 per month for 35 years to end up with $1 million. But if they choose investments that yield a 9% yearly return, they would need to invest $370 per month for 35 years to reach $1 million. |

| How much should you be investing in your 30s | Saving and investing 10-15% of your income is generally a safe bet. |

What You'll Learn

How to calculate the future value of your investment

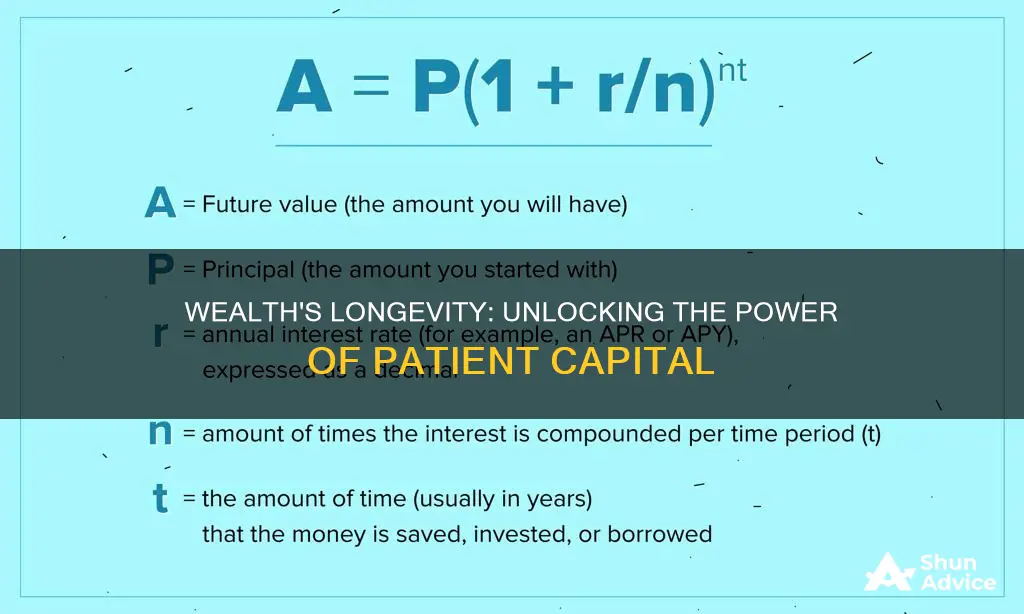

Calculating the future value of an investment is a basic financial calculation that can help you determine the value of an investment in the future. It is based on the principle of the time value of money, which states that money in hand today is worth more than money to be received in the future.

Identify the investment or asset amount:

To calculate the future value, you need to first know the amount of money you are investing or the present value. For example, let's say you plan to invest £1,000 in the stock market or a savings account.

Determine the interest rate:

The next step is to find out the interest rate offered on your investment and the length of time you plan to hold the investment. This could be a guaranteed interest rate offered by a bank, which could be simple interest or compounded interest. Simple interest is calculated on the initial investment amount, while compounded interest is applied to the cumulative balance over time.

Apply the interest rate to the length of your investment:

This step differs depending on whether your investment earns simple or compound interest.

- For simple interest, multiply the interest rate by the length of your investment, and add one to this value.

- For compound interest, add one to the interest rate, and raise that value to the power of the length of your investment.

Multiply the interest calculation by your initial investment amount:

This final step will give you the future value of your investment.

For example, if you invest £1,000 in a savings account with 5% simple annual interest for five years:

Future value = £1,000 x (1 + (0.05 x 5)) = £1,250

If the same £1,000 is invested in a savings account with 5% compounded annual interest for five years:

Future value = £1,000 x ((1 + 0.05)^5) = £1,276.28

As you can see, compound interest can increase your investment more quickly over the same period because it adds interest to the balance each year.

It is important to note that the future value calculation assumes a stable and continuous growth rate, and it does not account for fluctuations in the market, such as interest rate changes or inflation. Therefore, while it is a useful tool, it may not always provide an accurate prediction of your investment's future value.

The Fisher Investments 500K Retirement Portfolio: What's Inside?

You may want to see also

How much to invest to become a millionaire

The amount of money you need to invest to become a millionaire depends on several factors, such as the rate of return, your monthly contribution, and the time you have to reach your goal.

If you're looking to become a millionaire in 30 years, here's an example of how much you'd need to invest each month, based on different rates of return:

- With a 3% yearly return, you would need to invest around $1,400 to $1,750 per month.

- For a 6% yearly return, you would need to invest approximately $740 to $1,050 per month.

- To achieve a 9% yearly return, which is more aggressive, you would need to invest around $370 to $590 per month.

These estimates assume a retirement age of 65 and a consistent monthly contribution over 30 years. The sooner you start investing, the better, as compound interest has more time to grow your money.

It's important to note that becoming a millionaire takes time and discipline. It's not a "get-rich-quick" scheme but rather a long-term strategy. Additionally, it's crucial to manage your expenses and avoid unnecessary spending to maximize your savings.

While investing, consider diversifying your portfolio with stocks, bonds, ETFs, and index funds. Seeking advice from a qualified financial advisor can also help you make informed decisions and create a personalized plan to reach your financial goals.

Who Invests in Precious Metals?

You may want to see also

How to invest at every age

Investing at any age can be a daunting task, but it's important to remember that there is no one-size-fits-all approach. Your investment strategy should evolve as you progress through life, and it's crucial to understand the risks and rewards associated with different types of investments. Here is a guide on how to invest at every age:

In Your 20s

This is the time to be aggressive with your investments and take on more risk. You can afford to assume more investment risk because you have time to recover from market downturns. Focus on paying off any student loans or credit card debt, and start building an emergency fund. Consider investing in growth assets, such as stocks, which are expected to gain value in the future. You can also look into your employer's 401(k) plan or open a traditional or Roth individual retirement account (IRA).

In Your 30s

Your priorities might shift towards mortgage payments, starting a family, or saving for your children's education. As your income increases, consider increasing your investments. You can still withstand a moderate amount of risk, but allocate a bit more to conservative assets like bonds. Aim to contribute 10-15% of your income and eliminate any debt to free up money for investments.

In Your 40s

Retirement planning should be a top priority in your 40s. Your risk tolerance starts to shift, so while you can still place some funds in aggressive investments, be diligent in researching solid track records of returns. You may also want to start allocating more of your portfolio to lower-risk bonds and fixed investments. Consider maxing out your retirement accounts and contributing to a health savings account (HSA) to prepare for the future.

In Your 50s

As retirement approaches, adopt a more conservative approach to investing. Scale back on higher-risk assets and focus on safer options. Create a detailed retirement plan, including your desired retirement age and the amount of money you'll need to live comfortably. If you need to catch up on savings, you can contribute additional funds to your 401(k) as employees over 50 are allowed to do so.

In Your 60s

By this age, you should ideally have around 11 times your ending salary saved. Take stock of your financial situation and consider downsizing your lifestyle to save more for retirement. A conservative allocation of 50% stocks and 50% bonds may be more comfortable at this stage.

In Your 70s and Beyond

Even after retiring, continue investing to protect against inflation. T. Rowe Price suggests holding up to 20% cash, 30-50% stocks, and 40-60% bonds. Remember that you must begin taking required minimum distributions (RMDs) from tax-advantaged retirement accounts at age 72.

Remember, investing is a long-term endeavour, and it's crucial to tailor your strategy to your unique goals, risk tolerance, and financial situation. Consult a financial advisor to help you create a comprehensive plan that evolves with you over time.

Tata Steel: Invest Now?

You may want to see also

How to calculate return on investment

Return on Investment (ROI) is a crucial financial metric used to evaluate the efficiency and profitability of an investment or to compare the efficiency of several different investments. ROI is usually expressed as a percentage and can be calculated using a specific formula.

ROI is calculated by subtracting the initial cost of the investment from its final value, then dividing this new number by the cost of the investment, and finally multiplying it by 100. The formula for ROI is typically written as:

ROI = (Net Profit / Cost of Investment) x 100

In project management, the formula is written similarly but with slightly different terms:

ROI = [(Financial Value - Project Cost) / Project Cost] x 100

Alternatively, ROI can be calculated by dividing the gain from an investment by the cost of the investment. This basic formula is as follows:

ROI = Gain from Investment / Cost of Investment

It is important to note that ROI does not take into account the holding period or passage of time, which can be a limitation when comparing investment alternatives. To address this, annualized ROI can be calculated, which considers the length of time the investment is held.

Additionally, ROI calculations can be adjusted for risk to provide a more nuanced understanding of an investment's potential. Metrics such as risk-adjusted return on capital (RAROC) help to facilitate more informed decisions by accounting for the investment's risk profile.

When interpreting ROI calculations, it is important to keep in mind that a positive ROI indicates that the investment is profitable, while a negative ROI means that the investment is generating a loss.

The Bucket List: Unraveling the Bucket Approach for Retirement Planning

You may want to see also

How to invest in your 30s

Investing in your 30s can be a great way to build wealth and save for the future. Here are some detailed tips to help you get started:

Solidify a financial plan

It's important to have a solid financial plan in place, outlining your short- and long-term goals. This includes planning for unexpected costs, such as hospitalisation, job loss, home repairs, or other emergencies. Experts recommend having at least three to six months' worth of expenses saved up for such situations.

Get your employer's retirement plan match

Contribute to any workplace retirement plan offered by your employer, especially if they provide matching contributions. This is essentially "free money" that can boost your savings. Make sure you understand the vesting requirements, as some employers may require you to work for a certain period before their contributions are vested.

Contribute to an IRA

Consider opening an Individual Retirement Account (IRA) to diversify your investment portfolio and reduce your taxable income. A Roth IRA, in particular, offers tax-free withdrawals during retirement, and you can also withdraw contributions at any time without penalty.

Maximise your retirement savings

The earlier you start saving for retirement, the more time your money has to compound and grow. Try to maximise your contributions to take advantage of the power of compound interest. A good rule of thumb is to save 10-15% of your income for retirement.

Stick with stocks for long-term goals

Investing in stocks through exchange-traded funds (ETFs) and mutual funds can be a good option in your 30s, as you still have time to ride out market volatility and make up for any losses. This strategy requires a higher risk tolerance, but the potential for higher returns over the long term makes it worthwhile.

Build wealth by purchasing a home

If you're currently renting, consider investing in a home. While homeownership is not for everyone, it can help you build equity and save for the future. Keep in mind the total cost of ownership, including property taxes and maintenance.

Take calculated risks

With a longer time horizon, you can afford to take on more investment risk in your 30s. Consider investing 70-80% of your long-term savings in stocks and stock mutual funds, as these tend to offer higher average returns over time.

Seek inexpensive diversification

Diversify your investments by using index and exchange-traded funds, which track specific indices like the S&P 500. These funds offer a wide assortment of stocks and tend to have lower fees. You can further diversify by investing in international stocks, small and medium US companies, and bond funds.

Prioritise your financial goals

While retirement is an important goal, don't forget about other financial milestones. These could include saving for a child's education, a down payment on a home, or even personal goals like a vacation or surgery. Prioritise retirement savings, but find ways to divert money towards other goals as well.

Consult a financial advisor or robo-advisor

If you feel overwhelmed or unsure about creating a financial plan, consider consulting a fee-only financial planner. Alternatively, a robo-advisor—a computer algorithm that manages your investments for a small annual fee—can be a more affordable option.

Remember, investing in your 30s is a great step towards financial security and building wealth. It's never too late to start, and with a well-thought-out plan, you can make the most of your investments.

The Dividend Dilemma: Exploring Investment Options

You may want to see also

Frequently asked questions

This depends on the rate of return and how much you can contribute each month. For a 3% yearly return, you would need to invest $1,400 per month for 30 years. For a 6% yearly return, you would need to invest $740 per month, and for a 9% yearly return, you would need to invest $370 per month.

You can use the formula FV = PV x ((1+r%)^n), where FV is the future value, PV is the present value, r is the rate of return, and n is the time period of the investment in years.

You should consider your risk tolerance, investment time frame, contribution amount and frequency, and expected rate of return. It's also important to diversify your investments across different asset classes, such as stocks, bonds, and mutual funds.

Compound interest is when the interest earned on an investment starts earning interest itself. The longer your investment horizon, the more time compound interest has to grow your money.

A good rule of thumb is to save and invest 10-15% of your income for retirement. This will allow your money to compound over time and grow towards your financial goals.