Managers play a crucial role in planning significant investments in long-term projects, such as purchasing new equipment or introducing new products. This process, known as capital budgeting, involves evaluating potential major projects to ensure that investments are aligned with the company's strategic goals and resources are used efficiently. It is essential for managers to conduct a thorough investment project management process, which includes several stages: from initiating the project to planning, implementation, operation, and eventually closing the project. This complex undertaking requires expertise in financial analysis, such as discounted cash flow analysis, payback analysis, and throughput analysis, to determine the potential returns and feasibility of the investment. Effective project management ensures timely and cost-effective outcomes, mitigates risks, and keeps all stakeholders satisfied and united toward a common goal.

| Characteristics | Values |

|---|---|

| Project Selection | Managers use capital budgeting techniques to select projects that will yield the best return. |

| Capital Budgeting Techniques | Payback period, internal rate of return, net present value, and discounted cash flow analysis. |

| Strategic Alignment | Projects are chosen to align with business goals and ensure resources are used wisely. |

| Risk Management | Managers identify and quantify risks, developing contingency plans. |

| Resource Management | Managers ensure the right people are doing the right things at the right time. |

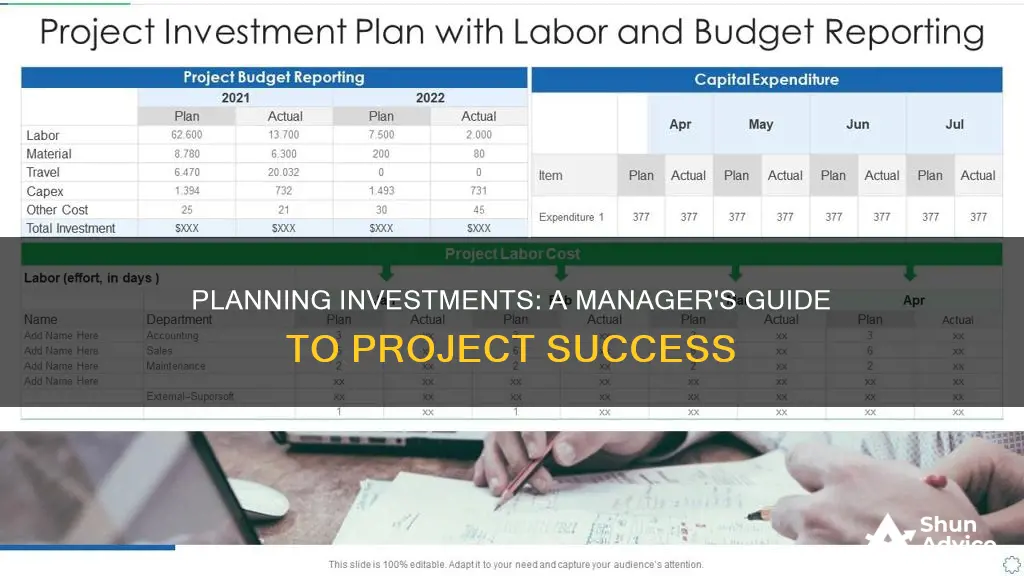

| Project Tracking and Reporting | Managers oversee progress and report on the project's status. |

| Decision-Making | Managers have the expertise to make informed decisions and help with problem-solving. |

| Continuous Improvement | Managers learn from past projects, identifying successes and failures to improve future projects. |

| Collaboration | Managers foster collaboration and encourage teamwork, especially in remote work settings. |

| Client and Stakeholder Satisfaction | Managers manage client expectations and ensure stakeholders are satisfied with project results. |

What You'll Learn

Discounted cash flow analysis

Discounted cash flow (DCF) analysis is a crucial tool for managers when planning significant investments in projects. It is a valuation method that estimates the value of an investment based on its expected future cash flows. By using a discounted cash flow calculation, managers can make informed decisions about allocating resources to projects that will bring the most value to the company.

DCF analysis involves assessing the initial cash outflow required for a project and the subsequent cash inflows in the form of revenue and other future outflows, such as maintenance and operational costs. These cash flows, except for the initial outflow, are discounted back to the present date to determine the net present value (NPV). The discounting is done because, in the future, currencies often become devalued due to inflation. Therefore, a dollar today is worth more than a dollar tomorrow as it can be invested to generate revenue.

The DCF formula is as follows:

> DCF = CF1 / (1 + r) ^ 1 + CF2 / (1 + r) ^ 2 + ... + CFn / (1 + r) ^ n

Where:

- DCF is the sum of all future discounted cash flows expected from the investment.

- CF1, CF2, ..., CFn are the cash flows for each year, with CF1 being the cash flow for the first year, CF2 for the second year, and so on.

- R is the discount rate in decimal form, representing the target rate of return expected from the investment.

By applying this formula, managers can determine the maximum amount they should invest in a project to achieve their desired rate of return. It allows them to compare different investment opportunities and select the one with the highest NPV, indicating the most profitable option.

DCF analysis is particularly useful when evaluating projects with different timelines. For example, consider two projects: Project A, which involves an initial investment followed by a growing income stream until the product becomes obsolete, and Project B, which also requires an initial investment but has no sales until it is sold in five years for a large payoff. Even though Project B brings in a higher total cash flow, Project A may be chosen due to the earlier timing of its expected cash flows, resulting in a higher NPV.

However, it's important to acknowledge the limitations of DCF analysis. It relies on estimates of future cash flows, which may prove inaccurate due to unforeseen economic changes, market demand, technological advancements, competition, and other factors. Therefore, DCF analysis should be used in conjunction with other valuation methods and financial metrics to make well-informed investment decisions.

The Perfect Investment Portfolio: Strategies for Success

You may want to see also

Payback analysis

When planning significant investments in projects, managers need to consider the potential risks and returns involved. One method of capital budgeting that can be used to assess the viability of a project is payback analysis. This is a mathematical method used to determine how long it may take to start, complete, and pay for a capital project. It is a simple and quick way to give managers a "back-of-the-envelope" understanding of the real value of a proposed project.

The payback period is an important metric for investors, as it helps them determine how long it will take to recover the initial costs associated with an investment. Generally, a shorter payback period is more desirable as it indicates a less risky investment. However, it is important to note that payback analysis does not account for the time value of money, the effects of inflation, or the complexity of investments with unequal cash flow over time.

To address these limitations, investors can use alternative methods such as net present value (NPV) and internal rate of return (IRR) in conjunction with payback analysis. These methods factor in the time value of money, opportunity costs, and more detailed information to provide a more accurate assessment of the scope of the project.

By using payback analysis, investors can make logical and informed decisions regarding capital projects and their deadlines. It helps to highlight risks, determine short-term liquidity, and identify projects with the biggest return on investment (ROI). Additionally, payback analysis can be applied to both short- and long-term projects, providing a useful tool for financial planning and analysis.

Savings Strategies: Where to Invest for Maximum Returns

You may want to see also

Throughput analysis

The goal of throughput analysis is to identify and minimize the weakest links in the production process. By maximising throughput and removing inefficiencies, companies can increase revenue.

Managers can make several types of assumptions about capacity when analysing throughput. Theoretical capacity assumes production will operate continuously without interruptions, but this is not a realistic assumption as machines need maintenance and employees take time off. Practical capacity, which accounts for repairs, wait times, and holidays, is a more realistic assumption.

A company's throughput also depends on how well it manages its supply chain. If supplies are not available as an input to production, this will negatively impact throughput.

To calculate throughput, the following formula can be used:

> Throughput = Inventory / Time Spent in Production

Managers can increase throughput by deploying real-time monitoring and data analysis of production processes, using standardised checklists, and introducing a bit of competition among workers using a scorecard.

In summary, throughput analysis is a valuable tool for managers to assess significant investments in projects by identifying bottlenecks and maximising the efficiency of the production process.

Strategies to Optimize Your Investment Portfolio

You may want to see also

Risk management

Risk Identification

The first step is to identify potential risks that may impact the project's timeline, performance, or budget. This includes brainstorming with the team, stakeholders, and clients to gather their insights and concerns. It is crucial to involve individuals with relevant experience and knowledge of historical data to identify potential risks accurately.

Risk Assessment and Analysis

Once the risks have been identified, the next step is to assess and analyze their potential impact and likelihood. This involves determining the severity of each risk, which can be done through a risk matrix or similar tools. The analysis also involves understanding the organization's risk threshold and tolerance to decide which risks to prioritize.

Risk Response and Mitigation

After assessing the risks, the team should develop a risk response plan, outlining measures to prevent risks from occurring or reducing their impact. This includes selecting appropriate risk management tools, such as a risk register, risk assessment matrix, or Monte Carlo simulations.

Risk Ownership and Monitoring

Each identified risk should be assigned an owner, who is responsible for monitoring and managing it. The risk management plan should also include concrete details on how the team will continually monitor risks throughout the project and respond to them effectively.

Risk Reporting and Communication

The risk management plan should define the formats and channels for documenting and reporting risk-related information to the project team and organizational leaders. Transparent and frequent communication ensures that everyone is aware of the risks and can contribute to the risk management process.

To streamline the risk management process, organizations can utilize templates and tools specifically designed for this purpose. These templates provide a structured framework to identify, assess, and respond to risks effectively. They may include sections for risk identification, risk assessment, risk mitigation, risk tracking, and reporting.

By following these steps and utilizing appropriate tools, managers can effectively address risks when planning significant investments in projects. It enables them to anticipate and mitigate potential issues, increasing the chances of project success and reducing potential losses.

Adjusting Your Investment Portfolio: Strategies for Success

You may want to see also

Resource allocation

Types of Resources

- Labour: This involves delegating tasks according to the skills, qualifications, and experience of employees, as well as external services or contingent staff like IT or marketing agencies.

- Equipment: This includes any machines, tools, hardware, or software used to create products, provide services, or complete business tasks, such as excavators, bulldozers, and CAD software for a construction company.

- Space: Companies require physical facilities or headquarters to complete work, develop products, and offer services, which they may lease or purchase.

- Materials: This covers any physical supplies, including raw materials (steel, oil, lumber), inventory, and office supplies like computers, stationery, and furniture.

- Money: Budgeting and fund allocation to different departments, allowing them to purchase resources, pay salaries, and make investments.

Steps for Effective Resource Allocation

- Develop a Comprehensive Project Plan: Outline the project idea, goals, team composition, and divide it into focus areas, phases, and tasks. This forms the foundation for resource requirement estimation and timeline creation.

- Establish Resource Requirements: Determine the human and non-human resource needs for each project component. Identify the required skills, competencies, equipment specifications, and budget for each project or phase.

- Source Resources and Funding: Utilise software to identify the availability of internal and external resources. Make decisions to hire new employees, rent equipment, or acquire other necessary support, factoring the associated costs into the overall financial plan.

- Allocate Resources According to the Plan: Ensure business leaders are aware of the resources available and monitor their usage and performance. Be prepared to replace or reallocate resources as needed, especially for high-priority projects.

Common Challenges in Resource Allocation

- Outdated Software: Using outdated software for resource management can lead to inefficiencies and miscommunications. Cloud-based software enables real-time updates and improvements in collaboration.

- Changes in Project Scope: Adaptability is crucial when dealing with unexpected changes in project scope, scale, and resource strains. Regularly update the resource and project schedule, employing creative problem-solving for effective reallocation.

- Mismanagement of Employee Talents: Properly managing and assigning tasks according to employee talents and skill levels is essential for fostering engagement and interest. Ensure experienced employees have responsibilities that match their expertise, while junior employees work on beginner tasks.

- Changes in Resource Availability: Create backup plans to address unexpected changes in human or non-human resource availability due to sickness, equipment malfunctions, or other issues.

- Lack of Communication: Effective communication ensures everyone involved has access to resource plans and requirements, reducing the chances of misallocation and improving project success.

Positive Impacts of Effective Resource Allocation

- Enhanced Productivity: Proper resource allocation leads to improved productivity, with team members feeling supported and valued, having clear guidelines and sufficient tools to execute their tasks.

- Cost Minimisation: Planning resource allocation helps identify the best resources at optimal prices, increasing profitability and return on investment.

- Timely Project Completion: Organising resource availability at the beginning of a project supports timely completion, leading to client satisfaction and enhanced brand awareness.

- Improved Products and Services: Access to the right resources enables companies to develop high-quality, competitive products and services, fostering innovation.

- Optimised Employee Skill Sets: Assigning team members to diverse projects helps build their skills and develop them professionally, optimising their contribution to the company's objectives.

- Improved Employee Productivity: Providing employees with the necessary resources and opportunities enhances their engagement and performance, leading to higher productivity and efficient collaboration.

Betterment: Savings or Investment?

You may want to see also