Private equity secondaries are transactions in which an investor buys an asset later in its investment cycle. The market for private equity secondaries is growing, with a record volume of deals in 2021. Private equity secondaries are also referred to as continuation transactions because they involve the purchase of existing interests or assets from primary private equity fund investors. This provides liquidity for sellers and the potential for faster returns and lower risk for buyers. However, investing in private equity secondaries is high risk and there is no guarantee of returns.

| Characteristics | Values |

|---|---|

| Type of transaction | Transactions in which an investor buys an asset later in its investment cycle |

| Type of market | Secondary market |

| Type of investment | Alternative investment |

| Type of asset | Private equity |

| Type of buyer | Institutional or individual investor |

| Type of seller | Primary private equity fund investor |

| Total market volume in 2021 | $132 billion |

| Benefits to sellers | Liquidity, higher and faster returns, risk mitigation |

| Benefits to buyers | Discounted access, enhanced transparency, faster return of capital, shorter duration, portfolio diversification, reduced uncertainty, pricing efficiency, J-curve mitigation, liquidity |

| Types of transactions | LP secondary transactions, GP-led transactions, direct secondary transactions |

| Types of funds | Primary funds, secondary funds, secondaries funds |

What You'll Learn

Liquidity and faster returns

The private equity secondary market has grown steadily since the turn of the century, with its benefits becoming increasingly difficult to ignore. Liquidity and faster returns are among the most attractive of these benefits.

Liquidity

Private equity secondaries have become increasingly popular for allocators due to their ability to provide liquidity. The secondary market provides liquidity for existing investors, allowing them to sell their stakes and create a stream of cash that can be deployed into new investment priorities or to satisfy an urgent need for capital.

Faster Returns

Private equity secondaries offer faster returns due to a shortened J-curve. The J-curve depicts an initial loss followed by a large gain. By investing in a private equity secondary fund, buyers benefit from a reduced time until cash is returned. This is because secondary investors are purchasing assets further along in their investment cycle, meaning they have less time to wait before seeing returns on their investment.

In addition to faster returns, private equity secondaries can also offer discounted access to assets, enhanced transparency into the underlying portfolio or assets, and the potential for lower fees.

Savings vs Investments: Where Should Your Money Go?

You may want to see also

Blind pool risk

In contrast, private equity secondaries involve purchasing pre-existing assets or portfolios from another investor. This limits the blind pool risk as secondary investors know exactly what they are investing in. They can evaluate the performance of the assets and predict their future value potential. This increased transparency allows for more informed investment decisions and enhances an investor's ability to conduct due diligence.

The reduction of blind pool risk in private equity secondaries is advantageous for investors as it provides a clearer understanding of the underlying investments. However, it is important to note that private equity secondaries still carry significant risks. These investments are typically high-risk and illiquid, and investors may lose all their money. Therefore, thorough due diligence and a careful assessment of the underlying assets are crucial before considering investing in private equity secondaries.

To summarise, blind pool risk is a critical factor to consider when investing in private equity. While private equity secondaries offer more transparency and potentially lower blind pool risk compared to primary funds, investors should still approach these opportunities with caution due to the inherent risks associated with this type of investment.

Diverse Portfolios: Smart Investing for Long-Term Success

You may want to see also

J-curve mitigation

The J-curve is a common trend in private equity investments, where there is an initial loss followed by a dramatic gain. This is often observed in private equity firms that purchase struggling companies and attempt to turn them around. While the J-curve is an inevitable consequence of a company turnaround, there are strategies that can be employed to mitigate the initial loss and accelerate the time it takes to reach the gain.

Secondary Investments

Secondary investments are a type of private equity investment where an investor purchases an asset from another investor. These investments tend to be more mature, meaning they are faster to distribute back to shareholders. By investing in secondary funds, investors can enter at a later stage in the investment lifecycle, reducing the length and depth of the initial loss. This also means that cash is returned to investors more quickly, improving liquidity.

Co-Investments

Co-investments are direct investments made into a portfolio company, often alongside a general partner or private equity (PE) firm. Co-investments allow investors to skip the waiting period typically associated with traditional PE funds, as they join near the time of purchase. Additionally, co-investors can avoid many of the management fees charged by PE firms, resulting in a higher-than-average return. However, co-investments may be difficult for new firms to access, as they require an established relationship with an existing PE firm.

Diversification

Investing in companies that provide essential products and services for stable end markets can help to mitigate exposure to volatility. By targeting resilient businesses with a track record of success, investors can reduce the impact of economic headwinds on their portfolio. This strategy can be particularly effective in a down cycle or challenging macroeconomic environment.

Single-Asset Secondaries

Single-asset secondaries, or continuation funds, are a type of general partner-led secondary transaction. This model allows for greater flexibility, as general partners can hold their most promising assets longer and have additional exit options. Single-asset secondaries can help to unlock potential value by providing access to additional capital and time to execute a value-creation plan. They also mitigate unwanted broader portfolio risk by providing exposure to a single asset rather than multiple assets at the portfolio level.

Savings and Investment: Autonomy and its Economic Impact

You may want to see also

Portfolio diversification

Private equity secondaries can be a great way to diversify your investment portfolio. Diversification is essential to long-term investment success. Holdings comprised of varying asset types can reduce overall investment portfolio volatility, protect against inflation, and even improve returns.

Access to a Range of Assets

Investing in private equity secondaries gives you access to a broad range of assets at different stages of their life cycle, across sectors and geographies. This diversification can reduce overall portfolio risk.

Lower Risk

Private equity secondaries can also help to mitigate 'blind pool risk'. Blind pool risk refers to the fact that limited partners commit capital to a portfolio that is yet to be constructed, creating a "blind pool" of capital. In the case of secondaries, investors are putting their money into companies that are already known, allowing them to analyse the performance so far and calculate the future value potential of the underlying companies.

Higher and Faster Returns

Private equity secondaries can provide higher and faster returns for investors. Investors can often buy private equity secondaries at a significant discount, creating the opportunity for superior returns when they come to sell. Additionally, investing in secondaries can mean investors don’t have to wait as long to see their cash returned, which is known as 'J curve mitigation'.

Liquidity

The private equity secondary market offers liquidity, which is especially useful given that primary private equity investments are typically illiquid and subject to long lock-up periods. The secondary market allows private equity investors to sell their stakes to unlock cash that can then be invested elsewhere or used for immediate cash needs.

Compliance and Regulatory Benefits

In some circumstances, private equity secondaries can also be useful as a compliance tool. For example, banks that invest in private equity are required to keep a certain amount of capital in reserve to cover any potential losses. By using the secondary market, banks can sell some of their private equity positions and meet the required amount of capital cover.

Visualizing Your Investment Portfolio: A Graphical Guide

You may want to see also

Pricing efficiency

The private equity secondary market is known for its complexity and lack of established trading platforms. This means that the transfer of interests in private equity funds can be labour-intensive. The illiquid nature of private equity assets adds to the complexity, as they are typically intended as long-term investments for buy-and-hold investors.

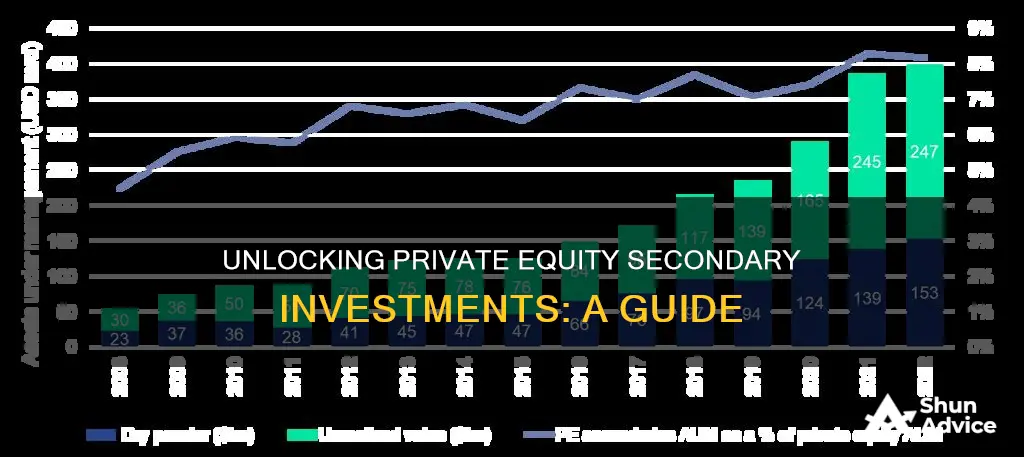

However, despite the challenges, the private equity secondary market has been growing in volume and maturity. In 2022, the market accounted for US$108 billion in volume. This growth has been driven by strong demand for private equity exposure and an increasing number of market participants, including dedicated secondary investment firms and institutional investors.

In recent years, the market has become more efficient, with assets trading at or above their estimated fair values. This improvement in pricing efficiency has attracted more buyers and increased overall market activity.

Additionally, the private equity secondary market has evolved with the emergence of non-traditional secondary strategies, such as preferred capital, which allows limited partners and general partners to raise additional capital while maintaining ownership of their portfolios.

Overall, pricing efficiency in the private equity secondary market is a complex and dynamic aspect of this evolving investment landscape.

Investment Philosophy: Portfolio Diversification Strategies Explained

You may want to see also