A significant number of Americans invest in the stock market each year. In 2023, 61% of adults in the United States invested in the stock market, a figure that has remained steady over the years but is still below pre-Great Recession levels. This equates to about 158 million Americans. Stock ownership is highly correlated with income, with 87% of upper-income Americans investing in the stock market compared to 25% of lower-income Americans.

| Characteristics | Values |

|---|---|

| Percentage of Americans who own stock | 61% |

| Percentage of American families that hold stock | 58% |

| Percentage of American families that directly hold stock | 21% |

| Percentage of upper-income Americans who own stock | 87% |

| Percentage of lower-income Americans who own stock | 25% |

| Percentage of middle-income Americans who own stock | 65% |

| Percentage of non-Hispanic white households that own stock | 61% |

| Percentage of non-Hispanic black households that own stock | 31% |

| Percentage of Hispanic households that own stock | 28% |

What You'll Learn

Stock ownership by wealth level

While over half of Americans own stocks, stock ownership is heavily concentrated among the wealthiest Americans. According to Gallup, 61% of Americans own stocks, a figure that has risen since 2021 and is now at its highest since 2008. However, stock ownership is strongly correlated with wealth, and the top 1% of Americans own a disproportionate share of stocks.

The top 1% of Americans hold almost half of all stocks, with a value of $19.73 trillion. This is in stark contrast to the bottom 50% of Americans, who hold just 1% of stocks, worth $41 billion. Expanding to the top 10% of Americans, this group owns 86.9% of stocks, worth $34.7 trillion.

The Federal Reserve reported the median value of stock ownership by income group for 2016: the bottom 20% own $5,800, the 20th-40th percentile own $10,000, the 40th to 60th percentile own $15,500, the 60th to 80th percentile own $31,700, the 80th to 89th percentile own $82,000, and the top 10% own $365,000.

Baby boomers hold the largest share of stocks by generation, with 54% of stocks, valued at $21.58 trillion. This is followed by Gen Xers, who own 20.9% of stocks, and millennials, who own 7.3%.

Stock ownership is also dramatically split along racial lines, with white Americans owning 88.8% of stocks, while Black Americans own 0.7% and Hispanic Americans 0.6%.

The concentration of stock ownership among the wealthy has hit an all-time high, with the top 10% of Americans holding about 93% of stock market wealth. This has been driven in part by the ultra-wealthy moving their money out of traditional public equities markets and into private capital markets.

The disparity in stock ownership contributes to the wider wealth inequality in the United States, with the top 1% of households holding 32.3% of the country's wealth, while the bottom 50% hold just 2.6%.

The Evolution of Investing: A Glimpse into the Future of Finance

You may want to see also

Stock ownership by generation

Stock ownership is strongly correlated with age, and older generations tend to have a larger share of stock ownership. Here is a breakdown of stock ownership by generation:

- Baby Boomers: Baby boomers hold the largest share of stocks at 54% of stocks, valued at $21.58 trillion. This is not surprising, as they have had more time to build wealth and see their investments grow.

- Gen X: Gen Xers own 20.9% of stocks, worth $8.36 trillion.

- Millennials: Millennials own 7.3% of stocks, worth $2.9 trillion. Millennials' ownership has increased, and they currently own more stocks compared to older generations when they were the same age.

- Gen Z: The Federal Reserve does not report stock ownership numbers for Gen Z. However, according to a survey by The Motley Fool, 37% of Gen Z respondents own individual stocks, and 36% have a retirement account.

Millennials and Gen Z have easier and cheaper access to the stock market and other investments than previous generations due to the rise of commission-free trading and user-friendly mobile investing apps. Millennials' stock ownership has jumped, but they still only own about 2.5% of the market. As millennials enter their peak earnings years, their share of stock ownership is expected to continue rising.

Depression-Era Investments: Where Money Went

You may want to see also

Stock ownership by race

Stock ownership in the US is highly dependent on race, which is also correlated with income and wealth. According to a USAFacts analysis of the Federal Reserve's Survey of Consumer Finances from 2019, 61% of white, non-Hispanic families owned stocks in 2019, compared to only 34% of Black and 24% of Hispanic families. When measured by value, 24% of white, non-Hispanic family assets were in stocks, compared to 13% for Blacks and 10% for Hispanics.

These disparities are also evident in the Health and Retirement Study, which found that at every income quartile and education level, the percentage of Black and Hispanic households who own risky, higher-yielding assets is considerably smaller than that of white households. For example, about 36% of white households report stock ownership, with a mean value of $24,933. In contrast, less than 10% of Black or Hispanic households own stocks, resulting in a much lower mean stock holding of $3,387 for Black and $1,608 for Hispanic households.

The racial wealth gap is significant, with white households owning at least five times the wealth of minority households, while white household earnings are only twice as much. This gap is influenced by differences in saving behaviour and choice of assets, with minority households having lower participation in financial markets and preferring safer investments such as real estate and insurance.

Recent initiatives, such as "relationship-development teams" by investment firms and encouragement from religious leaders and financial advisers in the Hispanic community, aim to increase financial opportunities for minority households and narrow the racial wealth divide.

Fisher Investments Pay Periods: Unveiling the Mystery

You may want to see also

Americans' best investment options

According to a recent Gallup survey, about 158 million Americans, or 61% of U.S. adults, invest in stocks. This figure has been steadily increasing over the years, but it is still below the levels before the Great Recession, which peaked in 2007-2008 at 65%.

When it comes to the best investment options for Americans, there are several avenues to consider, depending on factors such as risk tolerance, time horizon, financial situation, and investment goals. Here are some of the top investment options for Americans:

- High-yield savings accounts: These accounts offer higher interest rates compared to traditional bank savings accounts. They are suitable for short-term savings or emergency funds, and it's recommended to keep three to six months' worth of living expenses in such an account.

- Certificates of Deposit (CDs): CDs are federally insured savings accounts that offer fixed interest rates for a defined period, usually one, three, or five years. They are a good option if you want to save for a specific goal and don't need immediate access to your money.

- Bonds: Bonds offer a relatively safe form of fixed income. Government bonds, such as Treasury bills, notes, and bonds, are considered very low-risk as they are backed by the US government. Corporate bonds, on the other hand, offer potentially higher yields but carry a higher risk as they are not government-backed.

- Mutual funds: Mutual funds pool money from multiple investors to invest in stocks, bonds, or other assets. They are a good option for diversification and are suitable for long-term goals like retirement.

- Index funds: These are a type of mutual fund that aims to replicate the performance of a specific stock market index, such as the S&P 500 or Nasdaq-100. They are more cost-effective than actively managed funds and are suitable for long-term investors.

- Dividend stock funds: Dividend stocks are stocks that pay out a portion of the company's profits to shareholders, usually on a quarterly basis. Dividend stock funds reduce risk by diversifying your portfolio and are suitable for investors seeking regular income.

- Value stock funds: These funds invest in stocks that are bargain-priced compared to the broader market. They tend to perform better when interest rates rise, and many of them also pay dividends.

- Real Estate Investment Trusts (REITs): REITs are a way to invest in real estate without directly managing properties. They pay out dividends and can offer capital appreciation over time.

- S&P 500 index funds: These funds are based on a diverse range of large American companies and provide broad exposure to the stock market. They are suitable for beginning investors or those seeking a well-diversified investment.

- Rental housing: Investing in rental properties can be lucrative if you are willing to manage them yourself. It requires a long-term commitment and the ability to deal with tenants and property maintenance.

It's important to remember that investing carries risks, and it's essential to consider your financial situation, goals, and risk tolerance before making any investment decisions.

Young Investors: Excited or Apprehensive?

You may want to see also

Americans' stock ownership history

Stock ownership in the United States has historically been limited to a small fraction of the population. However, this began to change in the 1980s, with the proportion of stockholders increasing rapidly from 13% in 1980 to 52% in 1998. This growth can be attributed to various factors, including new pension laws that shifted employees' pensions to 401(k) plans, the emergence of mutual funds, the deregulation of brokerage commissions, and the increasing wealth of Americans.

By the end of the 20th century, more than half of Americans had some form of investment in the stock market. This number continued to grow, and between 2001 and 2008, an average of 62% of Americans owned stock. However, the global financial crisis of 2007-2009 had a significant impact on stock ownership in the country. The percentage of Americans investing in the stock market fell, with a low of 52% reported in 2013 and 2016.

In recent years, stock ownership in the United States has been on the rise again. In 2023, Gallup reported that 61% of Americans owned stock, the highest since 2008. This increase in stock ownership can be attributed to various factors, including the strong market performance and the increasing popularity of neobrokers, which have made stock trading more accessible to investors.

While stock ownership in the United States has historically been unequal, with the wealthiest 1% holding a significant portion of stocks, the recent increase in stock ownership has been more evenly distributed. In 2022, 58% of American families held stock, with 21% holding stocks directly. This reflects a growing trend of Americans investing in the stock market, either through workplace retirement plans or individual accounts.

Investing for Early Retirement: Strategies to Reach Financial Freedom

You may want to see also

Frequently asked questions

Around 61% of Americans, or about 158 million people, invest in the stock market each year.

The percentage of Americans investing in the stock market has been steadily increasing since 2013, when it was at a low of 52%. The number of Americans investing in the stock market has now returned to pre-2008 levels.

Stock ownership varies considerably across demographic groups. While 88% of those with incomes above $100,000 own stocks, only about one-in-five of those with incomes below $35,000 have assets in the stock market. Additionally, 61% of non-Hispanic white households own stocks, compared to 31% of non-Hispanic black households and 28% of Hispanic households.

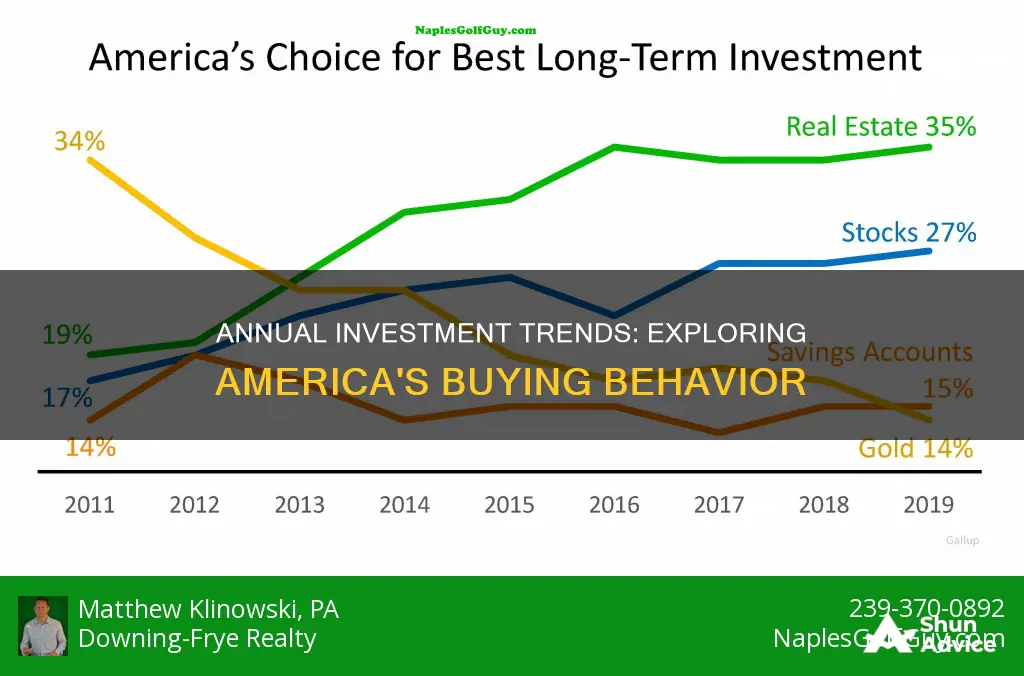

Real estate is typically ranked as the best investment for the long term, with 36% of Americans choosing it as the top option. This is followed by stocks or mutual funds (22%), gold (18%), and savings accounts or CDs (13%).