Cryptocurrency is a highly volatile and speculative investment. It is recommended that investors allocate no more than 5% of their portfolio to crypto assets, with some experts suggesting up to 20% depending on risk tolerance and beliefs about crypto.

Diversification is a common strategy to manage risk, but it may not be as effective in the crypto market due to the high correlation between most cryptocurrencies. Most coins tend to move in tandem, so a diversified portfolio of cryptos might not provide the expected risk reduction.

When deciding how many different cryptos to invest in, it's essential to consider factors such as your risk tolerance, investment goals, and the time you can dedicate to research and monitoring. Active traders who can dedicate time to daily, weekly, or monthly trades may be able to diversify more effectively.

It's also crucial to understand the technology behind cryptocurrencies and conduct thorough research before investing. Major crypto assets like Bitcoin and Ethereum have demonstrated more resilience than newer or smaller-cap coins, so it's generally recommended to stick to the major cryptocurrencies.

Additionally, it's important to only invest what you can afford to lose, as the crypto market is subject to extreme volatility.

| Characteristics | Values |

|---|---|

| Number of cryptocurrencies to invest in | 3-5 is a common recommendation, but it depends on your risk tolerance and how much research you've done |

| Diversification | Holding multiple cryptocurrencies can limit your upside and increase fees, but it can also protect you from significant losses |

| Active vs. passive investing | If you're an active trader, diversification is less important since you're making moves more frequently |

| Crypto market maturity | The crypto market is still immature, so diversification may not provide the same benefits as in more mature markets |

| Correlation among cryptos | Most cryptocurrencies are highly correlated, so a diversified portfolio of cryptos may not actually be diversified |

| Tax consequences | Buying and selling cryptocurrencies can trigger taxable events, so be mindful of the tax implications of your trades |

| Bitcoin as a benchmark | Measure the performance of your crypto investments against Bitcoin, as it is the oldest and largest digital asset |

| Crypto allocation | Most experts recommend that cryptocurrencies make up no more than 5% of your total portfolio |

| Volatility | Cryptocurrencies tend to be highly volatile, so be prepared for significant price swings |

What You'll Learn

Diversification and risk management

Diversification:

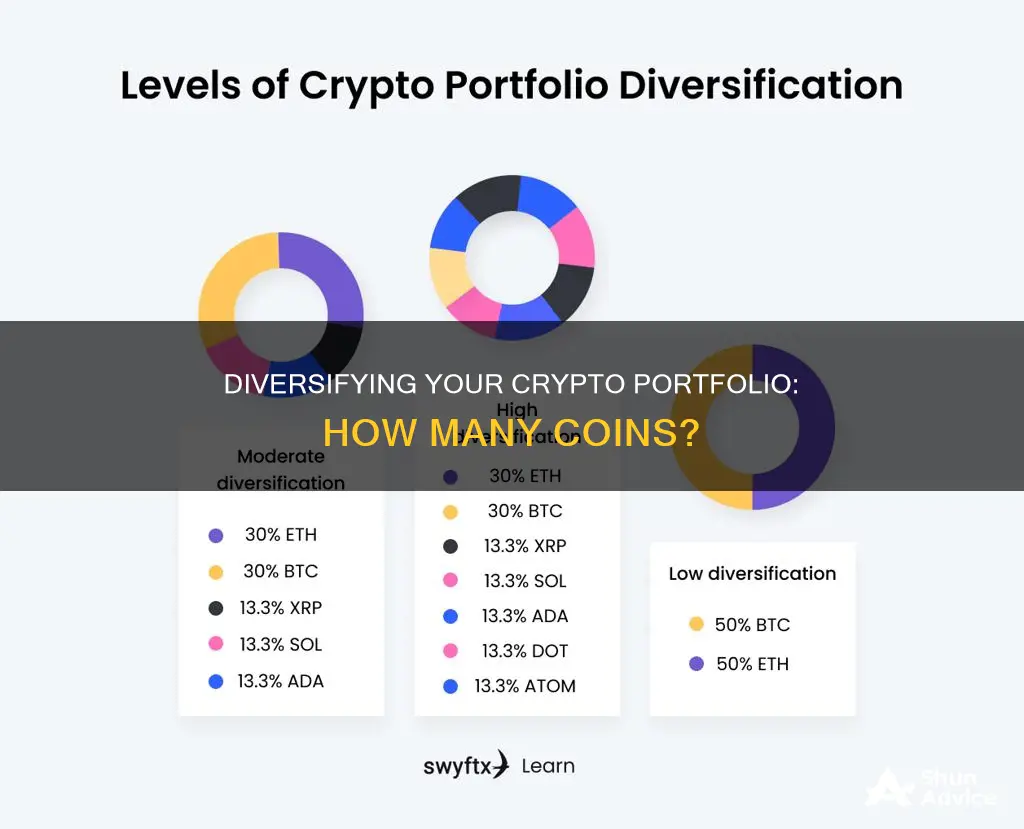

- Basic Principle: Diversification is the practice of spreading your investments across multiple assets to reduce risk. In the context of cryptocurrencies, this means investing in multiple coins rather than putting all your money into one coin.

- Limitations: Diversification can limit your potential gains. In a hypothetical scenario, if you hold only one cryptocurrency and it increases 100x, your portfolio gains 100x. However, with a diversified portfolio of 20 or 30 coins, it is highly unlikely that all of them will increase 100x simultaneously.

- Crypto-Specific Considerations: Cryptocurrencies, especially during the 2017 boom, tended to move in tandem. This correlation means that a diversified portfolio of cryptos might not provide the same level of risk reduction as a diversified portfolio of stocks, for example. As the crypto market matures, diversification within the asset class may become more effective.

Risk Management:

- Volatility: Cryptocurrencies are known for their high volatility. This means that their prices can fluctuate drastically in a short period. It's essential to be comfortable with this volatility and only invest what you can afford to lose.

- Allocation: Most financial experts recommend allocating no more than 5% of your total portfolio to cryptocurrencies due to their high risk and volatility. This allocation provides a balance between potential gains and risk management.

- Dollar-Cost Averaging: Consider using this strategy by making small, recurring purchases of cryptocurrencies on a set schedule. This approach helps to reduce the impact of volatility and avoids the need to time the market.

- Major Cryptocurrencies: Larger and more established cryptocurrencies like Bitcoin and Ethereum have demonstrated greater resilience compared to newer or smaller coins. While they may offer lower potential returns, they are generally considered safer investments in the crypto space.

- Research and Due Diligence: It's crucial to research and understand the fundamentals of the cryptocurrencies you invest in. Assess real-world adoption potential, technical specifications, the development team, community engagement, and competitors.

- Long-Term Perspective: Cryptocurrencies are a new and volatile asset class. Maintaining a long-term perspective, focusing on potential profits over years or decades, can help you navigate the inherent volatility.

Klever Coin: A Smart Investment Decision?

You may want to see also

Crypto correlation

When considering how many different cryptocurrencies to invest in, it's important to understand the concept of crypto correlation. Most cryptocurrencies are highly correlated with each other, meaning that their prices tend to move in tandem. This correlation is due to the relatively small size of the crypto market compared to traditional financial markets, as well as the interconnected nature of the blockchain technology that underlies all cryptocurrencies.

During the 2017 crypto boom, for example, most major coins followed a similar trajectory, with their prices rising and falling together. This high correlation means that diversifying your portfolio across many different cryptocurrencies may not provide the same benefits as diversifying across different asset classes, such as stocks or bonds. In other words, holding a variety of different cryptos may not protect you from losses during a market downturn, as the prices of most coins are likely to be correlated.

However, it's worth noting that the crypto market is still in its early stages of development, and as it matures, the correlation between different coins may change. Additionally, some coins, such as stablecoins, are designed to have a lower correlation with the broader crypto market, as they are pegged to the value of traditional currencies like the US dollar.

So, when deciding how many different cryptos to invest in, it's important to consider the level of correlation between coins. While diversifying across a small number of cryptos may provide some benefits, it's unlikely to provide the same level of protection as diversifying across uncorrelated asset classes. Therefore, it's generally recommended that cryptocurrencies make up a relatively small portion of your overall investment portfolio, typically less than 5%.

The Ultimate Bitcoin Investment Guide

You may want to see also

Lessons from the 2017 crypto boom

The year 2017 was a significant one for cryptocurrencies, as they became an acknowledged part of the global financial system. Bitcoin, the most well-known cryptocurrency, saw a massive surge in value, reaching a high point of over $10,000, reflecting a broader boom in the crypto market. However, this boom also highlighted several important lessons for investors and the industry as a whole:

Be Wary of Market Manipulation:

Research has indicated that the 2017 crypto boom, particularly the rise in Bitcoin prices, was partly driven by coordinated price manipulation using another cryptocurrency, Tether. This highlights the importance of being vigilant and understanding the underlying factors influencing crypto prices.

The Need for Regulation:

The crypto market's rapid growth and volatility have attracted increased regulatory attention. While some countries have banned or restricted certain crypto activities, others have sought to clarify rules and enforce existing regulations. This underscores the importance of staying informed about regulatory developments, as they can significantly impact the market.

Diversification is Key:

Diversifying your crypto investments across multiple assets can help manage risk and volatility. While some investors choose to focus solely on major cryptocurrencies like Bitcoin and Ethereum, others opt for a mix of established and newer projects with unique value propositions. Diversification can provide exposure to potential gains while limiting the impact of losses.

Don't Neglect the Fundamentals:

It's crucial to research and understand the fundamentals of any crypto investment. This includes assessing real-world adoption potential, reviewing technical specifications, evaluating the development team, and studying competitors. Avoid assets driven solely by speculation and hype, and favour projects with strong fundamentals and unique capabilities.

Be Skeptical and Do Your Own Research:

The crypto space is prone to scams, fraud, and charlatan leaders. It's essential to be skeptical and conduct thorough research before investing. Don't fall prey to the fear of missing out or get caught up in hype cycles. Understand the technology, study the whitepapers, and make informed decisions based on your own research and risk tolerance.

Long-Term Outlook:

Approach crypto investing with a long-term outlook and avoid short-term speculation. The crypto market is highly volatile, and prices can fluctuate significantly. By adopting a long-term perspective, you can better navigate price swings and focus on the broader trends and potential of the technology.

Understand the Risks:

Crypto investing carries substantial risks, and it's important to be aware of them. Only invest what you can afford to lose, and consider limiting your crypto exposure to a small portion of your overall portfolio (typically recommended at less than 5%). Stay informed about legal cases, regulatory changes, and governance updates, as these can significantly impact the market.

The Importance of Security:

Safely storing your crypto in secure wallets or with trusted custodial services is essential. Explore options like hardware wallets, software wallets, or trusted custodians to protect your investments from hacks, fraud, or loss. Additionally, maintain strong security practices, such as using complex and unique passwords and securely storing recovery phrases.

Crypto is Part of a Broader Financial Landscape:

While crypto has unique characteristics, it also interacts with traditional financial markets and regulations. Understand how crypto fits into the broader financial landscape, including its relationship with banks, financial institutions, and existing financial products. This can help you make more informed investment decisions.

The Role of Influencers and Celebrities:

Celebrities and influencers have played a significant role in promoting certain cryptocurrencies and ICOs (Initial Coin Offerings). However, it's important to remember that endorsements don't always reflect the quality or legitimacy of a project. Always do your own research and don't invest solely based on celebrity endorsements.

In conclusion, the 2017 crypto boom offers valuable lessons for investors and the industry. By heeding these lessons, investors can make more informed decisions, manage risk effectively, and navigate the volatile yet potentially rewarding world of cryptocurrencies.

The Future of Pepe Coin: Where to Invest?

You may want to see also

Crypto portfolio composition

Diversification

Diversification is a basic investment principle that involves 'not putting all your eggs in one basket'. In other words, you don't want to risk losing everything by investing in a single asset. However, diversification has a cost: it limits your potential gains and increases management fees and complexity.

When it comes to cryptocurrencies, an important thing to note is that most cryptos are highly correlated, meaning their prices tend to move in tandem. This means that a portfolio of many different cryptos may not be truly diversified.

Number of Cryptos

There is no one-size-fits-all answer to how many different cryptos you should invest in. It depends on various factors, including your risk tolerance, investment strategy, and the amount of capital you have available.

Some people advocate for investing in only a few cryptos that you truly believe in and understand, while others suggest diversifying across a larger number of assets to reduce risk.

- Risk tolerance: If you have a low-risk tolerance, consider sticking to well-established cryptos like Bitcoin and Ethereum. If you're more risk-tolerant, you might allocate a small portion of your portfolio to newer, smaller-cap coins with higher potential returns.

- Capital: If you have a limited amount of capital to invest, spreading it across too many cryptos can dilute your purchasing power and make it difficult to accumulate significant holdings. In this case, you may want to focus on a smaller number of cryptos.

- Time and expertise: Diversification requires more time and effort to manage and research multiple assets. If you don't have the time or expertise to monitor and evaluate a large number of cryptos, consider focusing on a smaller set.

- Active vs. passive investing: If you're an active trader who regularly buys and sells cryptos, diversification may not be as important since you're making frequent trades. On the other hand, if you're a long-term holder, diversification can help protect you from the high volatility of the crypto market.

- Percentage allocation: Most financial experts recommend that cryptocurrencies make up no more than 5% of your total portfolio. This limit helps manage risk and volatility. Within this allocation, you can further decide how to distribute your capital across different cryptos.

Crypto Selection

When selecting which cryptos to include in your portfolio, consider the following factors:

- Fundamentals: Research the fundamentals of the crypto, including its real-world adoption potential, technical specifications, development team, community engagement, and competitors. Favour cryptos with unique value propositions, competent teams, and widespread adoption potential.

- Major cryptos: Large, established cryptos like Bitcoin and Ethereum have weathered multiple market cycles and tend to be more resilient than newer, smaller coins. They also have larger market capitalizations and are tied to a range of financial products.

- Use case: Consider the use case and utility of the crypto. For example, Bitcoin is widely seen as a store of value, while Ethereum enables smart contracts and decentralised applications.

- Tax implications: Keep in mind the tax consequences of trading cryptos. In many jurisdictions, each time you buy or sell a crypto, it is a taxable event, and you need to report capital gains and losses.

- Personal beliefs: Invest in cryptos that align with your beliefs and risk tolerance. Consider why you're buying crypto and your plans for any gains.

Portfolio Management

Once you've decided on the number and types of cryptos in your portfolio, it's important to manage it effectively:

- Long-term perspective: Focus on the potential for profits over the long term, rather than getting caught up in short-term price swings.

- Rebalancing: Periodically reevaluate your positions and rebalance your portfolio based on your evolving views of the market.

- Dollar-cost averaging: Consider using a dollar-cost averaging strategy, where you buy a fixed amount of crypto at regular intervals, regardless of the market price. This helps to reduce the impact of volatility and removes the emotion from buying decisions.

- Tracking: Tracking your crypto portfolio can be challenging, but it's important to monitor your investments and adjust as needed based on your entry and exit criteria.

In conclusion, the composition of your crypto portfolio depends on various factors, including your risk tolerance, investment strategy, and capital. Diversification can help manage risk, but it's important to recognise the limitations of diversification in the highly correlated crypto market. Always invest in cryptos that you've researched and understand, and remember to keep a long-term perspective.

Burger Coin: A Smart Investment Decision?

You may want to see also

Timing and long-term perspective

As with any investment, timing is key when investing in cryptocurrencies. The crypto market is notoriously volatile, and prices can fluctuate wildly in a short space of time. Therefore, it is essential to do your research and carefully consider the timing of your investments.

One strategy to consider is dollar-cost averaging, which involves making small, regular purchases of cryptocurrencies at set intervals, such as weekly or monthly. This approach helps to reduce the impact of volatility and removes the need to try and time the market perfectly.

It is also important to take a long-term perspective when investing in cryptocurrencies. The crypto market is still relatively new and immature, and it may take time for your investments to pay off. As such, it is generally recommended to hold cryptocurrencies for at least one year, if not longer, to ride out the short-term price swings and give your investments the best chance of success.

While the potential for high returns may be tempting, it is crucial to remember that cryptocurrencies are a high-risk asset class. As such, it is generally recommended that cryptocurrencies make up no more than 5% of your total investment portfolio. This allows you to benefit from the potential upside while limiting your exposure to risk.

When deciding how many different cryptocurrencies to invest in, it is important to consider the benefits of diversification. By spreading your investments across multiple assets, you can reduce the risk of losing everything if one coin performs poorly. However, diversification also has its drawbacks. Firstly, it can limit your upside as you are not putting all your eggs in one basket. Secondly, it can be more costly and time-consuming to manage multiple investments.

In the context of cryptocurrencies, diversification may not provide the expected benefits due to the high correlation between most crypto assets. This means that the prices of different coins tend to move in tandem, so even a diversified portfolio of cryptos may still be subject to significant volatility. Therefore, when deciding how many cryptos to invest in, it is crucial to carefully research and select only the assets you truly believe in, rather than trying to own everything.

Link Coin: A Smart Investment Decision?

You may want to see also

Frequently asked questions

This depends on your risk tolerance and beliefs about crypto. Most experts agree that cryptocurrencies should make up no more than 5% of your portfolio. Some experts, such as Aaron Samsonoff, chief strategy officer and co-founder of InvestDEFY, allow for allocations as high as 20%.

It's important to remember that cryptocurrencies are a high-risk asset class. Diversification is a good strategy to mitigate risk, but it may not work for crypto since most coins tend to move in tandem. Therefore, a "diversified" portfolio of cryptos might not actually be diversified.

Bitcoin is the oldest and largest digital asset in crypto market dominance and is often recommended as a starting point for investors. Ethereum is the second-largest cryptocurrency by market cap and is also a popular choice. Other popular cryptocurrencies include Binance Coin, Cardano, Dogecoin, and Tether.

It's important to take a long-term perspective when investing in crypto, as it is a new and volatile asset class. Many experts recommend using a dollar-cost averaging strategy, where you buy or sell a fixed dollar amount regardless of market movements. Additionally, it's crucial to do your own research and only invest what you can afford to lose.