Investment banking is a demanding profession, and the working hours of investment bankers in the US can vary significantly. Typically, investment bankers in the US work long hours, often exceeding 60 hours per week, especially during busy periods or when dealing with high-profile deals. These extended hours are a result of the fast-paced nature of the industry, where deadlines are tight, and clients demand rapid responses. The culture of long hours is deeply ingrained in the industry, and many investment bankers report working late nights and weekends as a regular part of their job. However, this demanding work schedule can also lead to high salaries and significant financial rewards for those who can manage the long hours and maintain a healthy work-life balance.

| Characteristics | Values |

|---|---|

| Average Workweek | 60-70 hours |

| Typical Hours | 8:00 AM - 8:00 PM, 5-7 days a week |

| Overtime | Common, especially during busy periods |

| Flexibility | Limited, due to high-pressure environment and client demands |

| Work-Life Balance | Challenging, often requiring long hours and weekends |

| Stress Level | High, with intense competition and demanding clients |

| Physical Demands | Sedentary, primarily involving desk work |

| Mental Demands | High, requiring strong analytical and communication skills |

| Career Progression | Fast-paced, with potential for rapid advancement |

| Education | Typically a bachelor's degree in finance, economics, or related field |

| Experience | Entry-level positions often require 0-2 years of experience |

| Salary | Competitive, with base salary and performance-based bonuses |

| Job Security | Moderate, with potential for high turnover due to demanding nature |

What You'll Learn

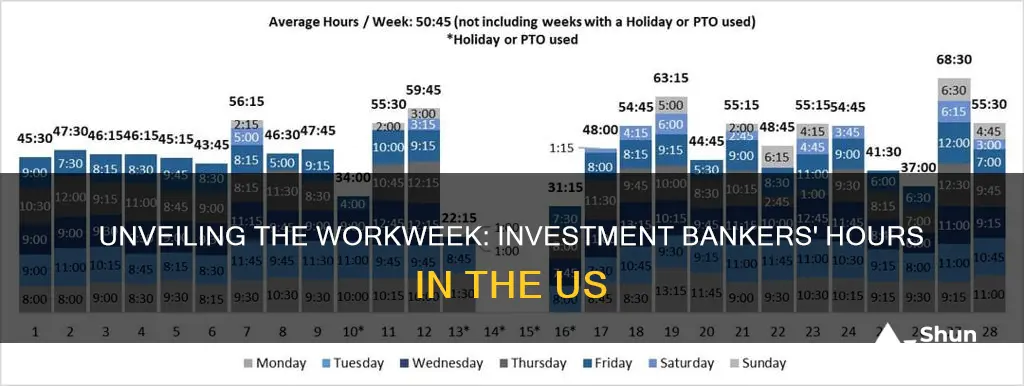

- Average Workweek: Investment bankers in the US typically work 50-60 hours per week

- Industry Norms: Long hours are common, with some firms promoting a 24/7 culture

- Compensation Structure: High earnings often justify extended work hours

- Work-Life Balance: Achieving balance is challenging due to demanding job nature

- Regulatory Changes: Recent regulations aim to limit excessive work hours

Average Workweek: Investment bankers in the US typically work 50-60 hours per week

The demanding nature of investment banking has long been a topic of interest, especially regarding the work hours of professionals in this field. In the United States, investment bankers are renowned for their long workweeks, often exceeding the standard 40-hour workweek. On average, investment bankers in the US can expect to work anywhere between 50 to 60 hours per week, and sometimes even more. This demanding schedule is a significant aspect of the profession and has become somewhat of a norm within the industry.

The high-pressure environment and the need to meet deadlines, secure deals, and maintain a competitive edge contribute to the extended work hours. Investment bankers often juggle multiple projects simultaneously, requiring them to dedicate significant time and effort to each task. This can lead to a blurring of boundaries between work and personal life, as the job demands constant attention and quick decision-making.

Long workweeks are not unique to investment banking but are a reflection of the industry's culture and the nature of the work. The fast-paced, results-driven environment often requires bankers to be readily available and responsive, especially during critical deal-making stages. This can result in a sense of urgency and a need to work extra hours to ensure projects stay on track.

Despite the challenges, many investment bankers find the field rewarding and exciting. The high earning potential, intellectual stimulation, and the opportunity to work with diverse clients can make the long hours worthwhile. However, it is essential to maintain a healthy work-life balance, and some firms are now implementing initiatives to support employee well-being and promote sustainable work practices.

Understanding the average workweek of investment bankers provides insight into the industry's demands and expectations. It highlights the dedication and commitment required to succeed in this field, while also emphasizing the need for a supportive work environment that values employee health and productivity.

Uncorking the Secrets: Navigating the World of Wine as an Investment

You may want to see also

Industry Norms: Long hours are common, with some firms promoting a 24/7 culture

The investment banking industry in the United States is renowned for its demanding work culture, where long hours and a relentless pace are often the norm. This is a well-established industry practice, with many firms promoting a 24/7 work environment, expecting employees to be available and responsive at all times. The pressure to meet deadlines, secure deals, and maintain a high level of productivity can lead to extended work hours, often requiring bankers to work beyond the traditional 9-to-5 schedule.

In the fast-paced world of investment banking, the expectation is that employees will dedicate significant time and effort to their work. This includes late nights, weekends, and even holidays, especially during peak periods or when dealing with high-profile clients. The culture often emphasizes the importance of being 'always on', where bankers are expected to be accessible and responsive, ensuring that clients' needs are met promptly.

This demanding work culture has become a defining characteristic of the industry, with some firms actively fostering a 24/7 atmosphere. The pressure to perform and maintain a competitive edge can lead to a sense of urgency, where long hours are not just common but also expected. As a result, many investment bankers adopt a lifestyle that prioritizes work, often at the expense of personal time and well-being.

However, it's important to note that this industry norm has its critics. Some argue that the long hours can lead to burnout, fatigue, and a negative impact on personal relationships and overall health. The culture of overwork can also create a competitive environment where employees feel pressured to keep up, potentially leading to increased stress and a decline in work-life balance.

Despite the challenges, the 24/7 culture persists, and many investment bankers embrace the demands of the job, driven by the desire to succeed and the potential for high rewards. The industry's reputation for long hours is well-established, and while it may be demanding, it also offers opportunities for professional growth and financial success.

Small Investments, Big Returns: Strategies to Attract Investors with Modest Capital

You may want to see also

Compensation Structure: High earnings often justify extended work hours

The investment banking industry is renowned for its demanding work culture, and the compensation structure plays a significant role in justifying the extended hours that professionals in this field often endure. Investment bankers in the US typically work long hours, and their compensation reflects the high-pressure nature of their jobs. The industry is highly competitive, and top performers are rewarded with substantial earnings, which can include base salaries, bonuses, and commissions.

Base salaries for investment bankers are generally competitive and often higher compared to other financial sectors. These salaries are designed to attract and retain talent in a market where skilled professionals are in high demand. However, the real incentive for extended work hours lies in the potential for significant bonuses and commissions. Bonuses are a substantial part of the overall compensation package and are often based on individual performance, team success, and the overall profitability of the firm. High-performing investment bankers can earn substantial bonuses, sometimes even exceeding their base salary, especially during peak periods or after successful deals.

The culture of long work hours is deeply ingrained in the industry, and it is often seen as a sign of dedication and commitment. Investment bankers are expected to be available outside regular working hours, responding to urgent client needs or market shifts. This expectation can lead to a blurring of boundaries between work and personal life, with professionals often sacrificing leisure time to meet deadlines and deliver results. The high-pressure environment and the potential for significant financial rewards make the extended work hours seem justified to many, as they believe their efforts contribute to the success of the firm and their own career advancement.

However, the long hours can also take a toll on physical and mental health, leading to increased stress, burnout, and a higher risk of lifestyle-related illnesses. The industry's culture is now being re-evaluated by many, with a growing emphasis on work-life balance and employee well-being. Some firms are implementing initiatives to address the issue, such as flexible work arrangements, wellness programs, and regular performance reviews to ensure a sustainable work environment.

In summary, the compensation structure in investment banking, which includes high base salaries, substantial bonuses, and commissions, justifies the extended work hours that professionals in this field often experience. While the industry demands dedication and long hours, there is an increasing awareness of the need for a healthier work-life balance, and many firms are now taking steps to address this issue while maintaining the high standards expected in this competitive sector.

Amazon's Potential Embrace of Dogecoin: A Crypto Revolution?

You may want to see also

Work-Life Balance: Achieving balance is challenging due to demanding job nature

The fast-paced and high-pressure environment of investment banking often requires long hours, making work-life balance a significant challenge for professionals in this field. Investment bankers in the US frequently work more than 50 hours per week, and some even report working upwards of 80 hours or more in a typical week. This demanding nature of the job can lead to a blurring of boundaries between work and personal life, making it difficult to disconnect and recharge.

One of the primary reasons for the extended work hours is the nature of the job itself. Investment banking involves a high level of responsibility and often requires quick decision-making, especially during critical deals or market events. The pressure to deliver results and meet deadlines can lead to a culture of long workdays and a tendency to work beyond standard hours. Additionally, the competitive nature of the industry and the desire to climb the career ladder can further exacerbate the issue, as individuals may feel the need to put in extra hours to stand out and prove their dedication.

Maintaining a healthy work-life balance is crucial for overall well-being and long-term success. However, the demanding job nature of investment banking can make this a significant challenge. Long work hours can lead to increased stress, burnout, and a higher risk of physical and mental health issues. It can also impact personal relationships and leave little time for leisure activities, hobbies, or quality time with family and friends.

To address this challenge, investment bankers can take several steps to improve their work-life balance. Firstly, setting clear boundaries and communicating them to colleagues and clients is essential. This may involve establishing specific work hours and ensuring that personal time is protected. Prioritizing self-care is also vital; this can include regular exercise, healthy eating habits, and adequate sleep to maintain energy levels and focus.

Additionally, learning to delegate tasks and seeking support when needed is crucial. Investment bankers should not hesitate to rely on their team members or mentors to share the workload, allowing for a more manageable schedule. Time management techniques, such as creating structured daily plans and prioritizing tasks, can also help individuals stay organized and reduce the need for excessive overtime. Finally, regularly reviewing and reassessing one's work-life balance can help identify areas for improvement and ensure that personal well-being remains a priority.

Planning for the Longevity of Your Retirement Investments

You may want to see also

Regulatory Changes: Recent regulations aim to limit excessive work hours

The investment banking industry has long been associated with demanding work cultures and long hours, often pushing employees to their limits. However, recent regulatory changes in the United States are aimed at addressing this issue and promoting a healthier work-life balance for investment bankers. These regulations are a response to growing concerns about the negative impact of excessive work hours on employee well-being, productivity, and the overall stability of the financial sector.

One of the key regulatory measures introduced is the establishment of maximum workweek limits. The U.S. Department of Labor's Fair Labor Standards Act (FLSA) has been amended to set a standard workweek of 40 hours, with a maximum of 10 hours of overtime per week. This means that investment bankers and other financial professionals are now legally entitled to a reasonable work-life balance, ensuring they do not consistently work beyond this limit. The regulation also mandates that employers provide adequate rest periods and prevent "call-back" work, ensuring that employees are not on-call indefinitely without proper compensation.

These changes have been welcomed by labor advocates and employee representatives, who argue that they will help reduce burnout and improve overall job satisfaction. By setting clear boundaries, the regulations aim to prevent the development of a toxic work culture where long hours are glorified and employees feel pressured to sacrifice personal time for career advancement. This shift in approach is particularly significant in an industry where the traditional expectation of working late nights and weekends has been deeply ingrained.

The impact of these regulations is already being felt in the industry. Many investment banks and financial firms are reevaluating their work policies and practices to comply with the new standards. Some companies are implementing flexible work arrangements, such as compressed workweeks or remote work options, to accommodate employees' needs while still meeting business demands. Others are focusing on improving productivity through better time management and process optimization, ensuring that work can be completed within the standard 40-hour week.

Despite some initial concerns about the potential impact on productivity and competitiveness, many industry players believe that these regulatory changes will ultimately benefit the industry as a whole. By promoting a healthier and more sustainable work environment, investment banks may attract and retain top talent, leading to improved performance and innovation. Additionally, the regulations encourage a more balanced approach to work, allowing employees to manage their personal and professional lives more effectively, which can result in increased job satisfaction and reduced turnover rates.

Unleash Your Wealth: Understanding Acorn's Investment Strategy

You may want to see also

Frequently asked questions

Investment banking hours can vary significantly, but it is common for bankers to work long hours, often exceeding 60 hours per week. The job demands a high level of dedication and can involve irregular work patterns, including early mornings, late nights, and weekends.

No, the work hours can differ based on the specific role, the stage of a project, and the firm's culture. Analysts and associates often face longer hours, especially during deal-making periods, while managing directors and partners might have more flexible schedules. Some firms promote a healthier work-life balance, while others are known for their intense and demanding culture.

Compensation packages in investment banking are generally competitive and include base salaries, bonuses, and benefits. The industry is known for offering lucrative rewards, and the potential for high earnings is a significant attraction. However, the trade-off is often a demanding work environment and a significant time commitment.

Achieving a healthy work-life balance in investment banking can be challenging. Many bankers prioritize their careers and often make personal sacrifices. Strategies to manage this include setting clear boundaries, delegating tasks, and utilizing time management techniques. Some firms also offer wellness programs and flexible work arrangements to support employee well-being.

The investment banking industry has faced scrutiny over working hours, leading to some regulatory changes. In the US, the Dodd-Frank Act introduced rules to limit working hours and provide rest periods for certain financial professionals. Additionally, industry self-regulation and initiatives by financial institutions aim to improve work-life balance and employee satisfaction.