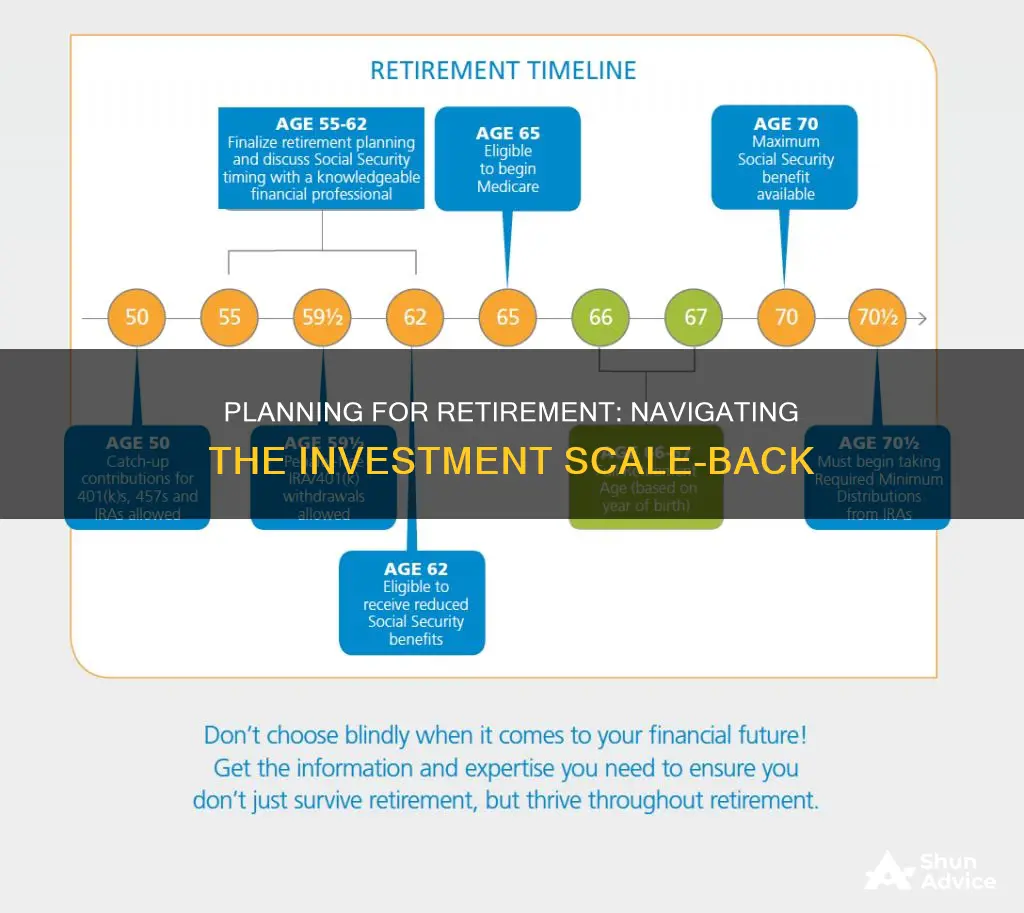

When it comes to scaling back investments before retirement, timing is crucial. While there is no one-size-fits-all approach, it's generally recommended to adopt a more conservative strategy as retirement approaches. This means reducing risk and preserving wealth to ensure a consistent income during retirement years.

For those in their 20s and 30s, investing aggressively in the stock market is common, as there is ample time to recover from any market downturns. However, as people enter their 50s and approach retirement, a shift towards more stable, lower-risk investments like bonds and cash is often advised. This ensures that a sudden market crash doesn't significantly deplete retirement funds.

Additionally, diversifying one's portfolio and rebalancing it periodically are important strategies to protect retirement savings. Seeking professional advice and considering one's risk tolerance, goals, and time horizon are also key components of effective retirement planning.

| Characteristics | Values |

|---|---|

| Time to scale back investments before retirement | 10-15 years |

| Suggested savings benchmark by age 35 | 1-1.5 times current salary |

| Suggested savings benchmark by age 50 | 3.5-6 times salary |

| Suggested savings benchmark by age 60 | 6-11 times salary |

| Suggested percentage of income to save for retirement | 15% |

| Suggested percentage of monthly income to contribute monthly | 10% |

| Suggested percentage of pre-retirement income for monthly budget in retirement | 70% |

| Suggested rate of return before retirement | 6% |

| Suggested rate of return during retirement | 5% |

| Suggested annual income increase | 2% |

| Suggested life expectancy | 95 |

What You'll Learn

How to reduce investment risk before retirement

As you approach retirement, you may want to scale back your investments and take a more conservative approach to reduce investment risk. Here are some strategies to help you achieve that:

Diversify Your Portfolio

Diversifying your portfolio is crucial to minimising investment risk. This involves spreading your assets across multiple types of investments, such as stocks, bonds, mutual funds, exchange-traded funds (ETFs), and even cash. By doing so, you can protect your retirement savings in case of an economic downturn. The allocation of your portfolio depends on your proximity to retirement. For example, younger investors in their 20s can afford to have a more stock-weighted portfolio, while those closer to retirement age should opt for a more balanced distribution between stocks and lower-risk assets like bonds.

Rebalance Your Portfolio Regularly

Over time, some investments will perform better than others, changing the percentage of each asset in your portfolio and potentially exposing you to more risk. Therefore, it's important to rebalance your portfolio at least once a year (some financial advisors recommend doing this quarterly) to bring it back in line with your original investment targets. An easy way to ensure your portfolio is continually rebalanced is to invest in a target-date fund, which automatically adjusts its investments to safer assets as your retirement date approaches.

Don't Panic and Withdraw Money Too Early

It's important to resist the urge to panic and withdraw your money during market lows. Withdrawing money early from a 401(k) can result in hefty tax penalties. Even those nearing retirement age may rebound from a market crash in time for their first withdrawal, as seen in the case study of the coronavirus-fuelled crash in 2020, where the market recovered to record highs within eight months.

Keep Some Cash on Hand

Having cash reserves can help you cover unexpected expenses during retirement, especially if you're on a fixed income. Financial professionals recommend having enough cash or cash equivalents to cover living expenses for three to five years. This can also help mitigate the "sequence of returns risk", where withdrawing money early in retirement during market downturns can permanently diminish your retirement portfolio's longevity.

Consult a Financial Advisor

A financial advisor can help you create a comprehensive plan that considers your specific circumstances, such as your goals, risk tolerance, and time horizon. They can also assist in rebalancing your portfolio and ensuring your asset allocation is appropriate for your situation.

Other Considerations

- Your age and life stage: The general rule of thumb for determining the percentage of your portfolio that should be invested in stocks is to subtract your age from 110. However, this may not account for your personal circumstances, so it's important to seek advice if needed.

- Your risk tolerance: Younger investors tend to be more risk-tolerant, while older investors may be more risk-averse as they have less time to recover from losses.

- Your income and savings: It's important to save consistently for retirement throughout your working life, increasing your savings rate as you earn more.

- Your retirement income and expenses: Consider your expected income from sources like Social Security, pensions, or passive income, as well as your anticipated expenses during retirement.

- Market conditions: Keep a close eye on market conditions and be prepared to adjust your investments accordingly.

Remember, reducing investment risk as you approach retirement is a gradual process, and you don't have to make drastic changes all at once. By diversifying your portfolio, regularly rebalancing, and seeking professional advice when needed, you can ensure your retirement savings are protected.

Sports Fandom: Why the Obsession?

You may want to see also

The importance of a diversified portfolio

The topic of how many years to scale back investments before retirement is an important one, and a key consideration is the diversification of your portfolio. Here are some insights into why a diversified portfolio is vital:

Protecting Your Capital

Diversification is a fundamental concept in investing, and it involves spreading your investments across different asset classes, industries, and geographic regions. The core idea is to reduce the overall risk of your investment portfolio. By not putting all your eggs in one basket, you lower the chances of a single negative event wiping out your investments. For example, if you only invest in airline stocks, an industry-wide issue like a pilots' strike could cause all your stocks to drop in value. However, if you also invest in railway stocks, they might increase in value as passengers seek alternative modes of transportation.

Reducing Risk

The main benefit of diversification is risk reduction. By investing in a variety of assets, you decrease the likelihood of all your investments being affected by the same market events. Different assets react differently to economic conditions. For instance, if the Federal Reserve raises interest rates, equity markets may still perform well, but bond prices tend to fall. A diversified portfolio aims to include assets with low correlations to balance out these fluctuations. While diversification doesn't guarantee against losses, it's a crucial component of reaching long-term financial goals while minimising risk.

Better Opportunities and Returns

Diversification can also lead to better opportunities and higher risk-adjusted returns. By diversifying across sectors, companies, asset classes, time frames, and borders, you increase your exposure to different investment opportunities. This approach can result in discovering high-performing investments that you might have otherwise missed. Additionally, diversifying can make investing more enjoyable, as it involves researching new industries and comparing companies.

Long-Term Wealth Building

A diversified portfolio is critical to building long-term wealth. As Ric Edelman, founder of Edelman Financial Engines, notes, there's more to investing than just stocks and bonds. By diversifying across asset classes, you lower your risk of losing a significant amount of money at once, as ideally, they will balance each other out. Historical performance shows that no single asset class consistently outperforms the others year after year. By investing in a variety of assets, you increase the chances of capturing the returns of the best-performing investments over time.

Preservation and Distribution

As you approach retirement, the focus of your portfolio should shift from growth and accumulation to preservation and distribution. Instead of taking unnecessary risks, it's essential to adopt a preservation mindset to ensure your hard-earned money lasts throughout your retirement years. This typically involves adding safer investments to your portfolio, such as annuities, bonds, bond funds, certificates of deposit (CDs), and cash.

In conclusion, a diversified portfolio is crucial as you scale back your investments before retirement. It helps protect your capital, reduce risk, enhance opportunities, and build long-term wealth. By diversifying your investments, you can feel more confident that your financial goals are on track, even amidst market fluctuations.

Crypto Investors: How Many?

You may want to see also

How to rebalance your portfolio

As you approach retirement, you'll want to rebalance your portfolio to ensure that your investments are in line with your risk tolerance and financial goals. Here are some detailed instructions on how to rebalance your portfolio:

Determine your risk tolerance

Before making any changes to your portfolio, it's important to assess your risk tolerance. This will help you understand how much risk you are comfortable taking on. A general rule of thumb is to subtract your age from 110; the result is the percentage of your portfolio that should be invested in stocks. However, a more comprehensive approach would be to consider your financial goals, time horizon, and other factors in addition to your age.

Assess your current portfolio

Take stock of your current investments and how they are allocated across different asset classes, such as stocks, bonds, cash, and alternative investments. You can use a risk tolerance questionnaire or work with a financial advisor to get a qualified analysis of your portfolio and determine if your current allocation aligns with your risk tolerance and financial goals.

Adjust your asset allocation

Based on your risk tolerance and financial goals, make adjustments to your portfolio to ensure it is properly diversified. If you are approaching retirement, consider adding safer investments such as bonds, annuities, certificates of deposit (CDs), and cash to your portfolio. The goal is to preserve your capital and generate consistent income rather than focusing solely on aggressive growth.

Consider target-date funds

If you want a more hands-off approach to rebalancing your portfolio, consider investing in target-date funds. These are funds that automatically adjust their asset allocation over time, becoming more conservative as you get closer to the target retirement date. This can help take the emotion out of investing and ensure that your portfolio is appropriately diversified at each stage of your life.

Monitor and rebalance regularly

Rebalancing your portfolio is not a one-time event. It's important to regularly monitor your investments and make adjustments as needed. You may want to rebalance at least once a year or even once a quarter, depending on market conditions and your financial goals. Remember that rebalancing does not mean making drastic changes; it's about bringing your portfolio back in line with your original investing strategy and risk tolerance.

Seek professional advice

If you are unsure about how to rebalance your portfolio or want more personalized advice, consider consulting a financial advisor or planner. They can provide guidance based on your specific circumstances and help you make more informed decisions about your investments.

LetGo: Why Venture Capitalist Investments?

You may want to see also

The benefits of keeping cash reserves

While it is important to invest for retirement, it is also important to keep some of your money as cash reserves. Cash reserves are highly liquid funds that are kept in case of emergencies or unexpected financial needs. Here are some benefits of keeping cash reserves:

Protects Against Market Downturns

As you approach retirement, it is recommended to shift your investment strategy from aggressive to conservative. This means moving from high-risk, high-reward investments like stocks to safer options like bonds, annuities, and cash. Keeping cash reserves ensures that you have a buffer to fall back on if the market takes a downturn, protecting your retirement funds.

Provides Financial Stability

Cash reserves can help you maintain financial stability by covering unexpected short-term costs. This is especially important if you have regular expenses, such as mortgage payments or medical bills, that need to be paid regardless of market conditions. Having cash reserves ensures that you can cover these expenses without having to sell off your investments at a loss.

Avoids Debt

A well-managed cash reserve can help you avoid credit card debt or the need to take on additional loans. For example, if you have an emergency expense, you can use your cash reserves to cover it without incurring high-interest credit card debt. This is beneficial as it prevents you from paying additional costs in the form of interest.

Seizes Opportunities

While cash reserves are primarily for emergencies, they can also be used to seize opportunities. For instance, if a company decides to purchase new equipment or expand its operations, it can use its cash reserves to finance these short-term expenses. This allows for quick growth and can be more financially advantageous than taking on credit.

Peace of Mind

Finally, keeping cash reserves can provide peace of mind. Knowing that you have a financial buffer to fall back on can reduce stress and worry, especially if you are approaching retirement or are already retired. It ensures that you have the funds to cover essential expenses, even during market downturns or economic slowdowns.

In summary, while investing is important for growing your wealth, keeping cash reserves is also crucial for financial stability and peace of mind. By maintaining a balance between investing and saving, you can ensure that you are prepared for both expected and unexpected expenses, giving you a more secure financial future.

Investments: Votes and Voice

You may want to see also

How to continue contributing to your 401(k) during market volatility

When it comes to retirement planning, it's important to consider how market volatility can impact your 401(k) and what strategies you can employ to continue contributing effectively. Here are some instructive guidelines on how to navigate this complex process:

Maintain a Disciplined Investment Strategy

It's crucial to stick to your investment plan during volatile market conditions. Avoid making impulsive decisions, such as selling stocks during a downturn or reducing contributions when your 401(k) is performing well. Remember that markets fluctuate, and staying the course can position you to benefit from the eventual recovery.

Diversify Your Portfolio

Diversification is a powerful tool to mitigate risk. Spread your investments across different asset classes, such as stocks, bonds, cash, and other investment vehicles. Diversification helps protect your portfolio from being overly exposed to any single market segment.

Adjust Your Asset Allocation

As you approach retirement, gradually shift your asset allocation towards more conservative investments. Reduce your exposure to riskier assets, such as small-cap stocks, and increase your holdings in fixed-income and cash investments. This helps safeguard your portfolio from significant losses during market downturns.

Consult a Financial Advisor

Engaging the services of a qualified financial advisor can be invaluable. They can assist in determining the appropriate asset allocation for your age, investment objectives, and risk tolerance. A financial advisor can provide personalized guidance on how to adjust your portfolio as you near retirement.

Be Strategic with Withdrawals

Early withdrawals from your 401(k) can incur significant IRS tax penalties. Generally, it's advisable to wait until you're at least 59½ years old to make withdrawals. Additionally, consider setting a disciplined withdrawal plan, aiming to withdraw no more than 3% to 5% of your funds in the first year of retirement, with subsequent adjustments to keep pace with inflation.

Take Advantage of Employer Matching

If your employer offers matching contributions to your 401(k), be sure to contribute at least enough to maximize this benefit. This is essentially "free money" and can significantly boost your retirement savings over time.

Stay Calm and Avoid Emotional Decisions

It's important to make investment decisions with a level head, avoiding emotional impulses. Market volatility can induce fear or greed, leading to hasty choices. Stay informed, but don't let short-term fluctuations dictate your long-term strategy.

Keep an Eye on the Long Term

Market volatility is inevitable, but it's important to maintain a long-term perspective. Remember that historically, the stock market has trended upward over time. Focus on your investment goals and stick to a well-thought-out plan to navigate the ups and downs.

By following these guidelines and adapting them to your personal circumstances, you can continue contributing to your 401(k) effectively during market volatility and enhance your overall retirement planning.

Gamestop: The People's Stock

You may want to see also

Frequently asked questions

It is recommended that you start scaling back your investments 10 to 15 years before retirement. This will allow you to shift to a more conservative and stable portfolio, reducing the risk of loss.

While there is no one-size-fits-all answer, a common benchmark is to aim for a retirement savings goal that is a multiple of your annual salary, with the range increasing as you get older. For example, by age 35, aim for one to one-and-a-half times your salary, and by age 60, aim for six to 11 times your salary.

It is generally recommended to save between 10% and 15% of your pre-tax income each month for retirement. This can include contributions to your 401(k), IRA, and other retirement accounts.

Here are a few strategies to protect your retirement savings:

- Don't panic and withdraw your money too early, as this can result in tax penalties.

- Diversify your portfolio by investing in a mix of stocks, bonds, and cash to reduce risk.

- Rebalance your portfolio periodically to ensure it aligns with your risk tolerance and investment targets.

- Keep some cash reserves to cover unexpected expenses and mitigate sequence-of-returns risk.