Smart investments can have a positive impact on the economy. They can help to increase the quality and quantity of factors of production, leading to a boost in aggregate demand and a positive multiplier effect. This can result in increased output, decreased unemployment, and stable prices. Additionally, smart investments can help individuals create an additional source of income, provide long-term financial security, and generate meaningful returns. By investing in diversified portfolios, individuals can also reduce their risk of losing money over time.

What You'll Learn

Inflation and cost of living

Inflation and the cost of living are closely related concepts, but they are not the same. Inflation is the overarching phenomenon that describes the increase in the price of goods and services, or the decrease in the buying power of a unit of currency. The cost of living, on the other hand, is a more specific metric that represents the average cost of an accepted standard of living, including food, housing, transportation, taxes, and healthcare.

Inflation and the subsequent increase in the cost of living can have a significant impact on individuals' financial situations and their purchasing behaviour. As the cost of living rises, people's returns on investments or savings do not go as far. This is especially challenging for retirees who rely mostly on their profits or savings to pay their bills. To compensate, consumers may buy less, switch to cheaper substitutes, look harder for bargains, or postpone significant purchases.

The impact of inflation on the cost of living is relative and depends on an individual's income and spending habits. While inflation affects everyone, it tends to hit middle-class and lower-income households harder. Low-income households are more vulnerable to rising food and energy prices, which make up a larger share of their overall spending.

During periods of high inflation, central banks such as the Federal Reserve in the US or the Bank of England in the UK may intervene to curb rising costs. They do so by raising interest rates, which has a domino effect on other loan rates, including mortgage rates. While this strategy can help slow down inflation, it also leads to higher borrowing costs for households and can result in a slowdown in the housing market as consumers are squeezed out of the market.

To protect their money from the eroding effects of inflation, investors can consider various investment strategies. Financial advisors suggest avoiding long-term bonds or certificates of deposits during periods when interest rates are expected to rise, as doing so could lead to missing out on higher rates later. Instead, investors may want to focus on short to intermediate-term bonds. Additionally, investors may want to be cautious about investing in growth stocks, as these companies tend to expect higher earnings in the future, and inflation reduces the value of those future cash flows.

To hedge against inflation, financial advisors recommend investing in value stocks, real estate, gold, or even cryptocurrencies. Value stocks are companies trading below average rates and are often in industries like financial or consumer staples sectors that are less vulnerable to inflation. Real estate can also be a good investment during inflationary periods, as property values tend to increase, and landlords can pass on rent increases to their tenants. Gold and cryptocurrencies are attractive options during inflation because they are not directly tied to the value of traditional currencies and can preserve their worth even as the buying power of cash decreases. However, it is important to remember that gold and cryptocurrencies are highly volatile assets and should only make up a small portion of an investment portfolio.

Cash or Invest: The Great Car Buying Dilemma

You may want to see also

Long-term financial security

Diversify Your Portfolio

Diversification is a key strategy for long-term financial security. By spreading your investments across various asset classes, such as stocks, bonds, real estate, and alternative investments, you reduce the risk associated with putting "all your eggs in one basket." Diversification helps protect your portfolio from adverse market cycles and volatility, allowing you to generate good returns and preserve your wealth over time.

Take Calculated Risks

Achieving long-term financial security often requires taking calculated risks. This means investing adventurously, especially when you have a long time horizon. While it's important to be mindful of risks, don't let fear of short-term fluctuations prevent you from making investments that could pay off in the long run.

Think Long-Term

When investing for the long term, it's crucial to focus on your long-term financial goals rather than getting caught up in short-term market movements. Remember that market downturns and volatility are normal and can present opportunities for those with a long-term perspective.

Invest in a Mix of Asset Classes

Different asset classes perform differently during economic slowdowns and periods of inflation. For example, during economic slowdowns, some investors turn to fixed-income options like bonds, fixed deposits, and debt schemes. On the other hand, real estate and gold are often seen as hedges against inflation, as their values tend to increase during periods of rising prices.

Emergency and Retirement Funds

Building an emergency fund is crucial for long-term financial security. It helps you avoid turning to high-interest credit cards or loans when unexpected expenses arise. Additionally, contributing to a retirement account ensures that you have savings to provide income when you are no longer working.

Pay Down Debt

Focusing on paying down debt, especially high-interest credit card debt, is an important part of long-term financial planning. The faster you reduce your debt, the more money you'll have available to invest in your future goals.

Prioritize and Plan

Identify your short- and long-term financial goals, quantify them, and prioritize them. Understand your risk tolerance and investment horizon, and create a financial plan that aligns with your goals and circumstances. Regularly review and adjust your plan as needed to stay on track.

Seek Professional Advice

Consider consulting a certified financial planner or adviser, especially if you're new to investing. They can provide personalized advice based on your goals, risk tolerance, and time horizon. However, always do your research, ask questions, and understand the costs and risks associated with any investment.

Military Personnel: Investing for the Future

You may want to see also

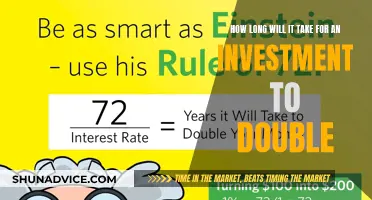

Compounding interest

The power of compounding helps a sum of money grow faster than if just simple interest were calculated on the principal alone. The higher the number of compounding periods, the greater the compound interest growth will be. For example, a $100,000 deposit receiving 5% simple annual interest would earn $50,000 in total interest over 10 years. However, if the same deposit had a monthly compound interest rate of 5%, the interest would add up to about $64,700.

For investors, compounding interest can be utilised through brokerage accounts' dividend reinvestment plans (DRIPs). Assets that pay dividends, such as dividend stocks or mutual funds, allow investors to reinvest those dividends to purchase more shares of the asset. This enables interest to grow on a larger investment.

Retirement Investments: Where Do Seniors Put Their Money?

You may want to see also

Risk management

Identify and Analyse Risks

Before investing, it is essential to identify and understand the potential risks associated with a particular investment decision. Risks can come from various sources, such as market volatility, interest rate changes, or the financial health of the company you are investing in. Conduct thorough research and analysis to identify these risks and their potential impact on your investment.

Diversification

Diversifying your investment portfolio is a powerful risk management strategy. By spreading your investments across different assets, industries, and geographic locations, you can reduce the impact of a single negative event. Diversification helps protect your portfolio from adverse market cycles and volatility, preserving your wealth.

Avoid High-Risk Schemes

Be cautious of investment schemes that promise high returns with little or no risk. These schemes often present unrealistic expectations and may lead to significant losses. Endorsements from celebrities or influencers should not be the sole basis for your investment decisions. Conduct your own research and carefully evaluate the risks before investing.

Timing and Long-Term Goals

Consider your investment timeframe and long-term financial goals. If you need access to your funds in the near future, investing in volatile assets like stocks may not be advisable, as you may not have sufficient time to recover from potential losses. Align your investments with your financial objectives and risk tolerance.

Due Diligence and Fraud Prevention

Practise due diligence by asking questions, reading documents carefully, and understanding the costs and charges associated with your investments. Be cautious of fraud and ensure that the firms or entities you deal with are authorised and regulated. Stay informed about the companies you invest in by following their financial statements, announcements, and news.

Professional Advice

If you need assistance, consider seeking advice from a professional financial adviser. They can provide guidance tailored to your specific circumstances, risk tolerance, and investment goals. Remember that investing involves risk, and even with careful risk management, losses can still occur.

Analyzing Investment Opportunities: Strategies for Success

You may want to see also

Economic growth

Additionally, investment should increase the quality and quantity of factors of production, shifting the production possibility frontier outwards and increasing the economy's long-run aggregate supply. This means that the economy can produce more goods and services, leading to economic growth.

Smart investing involves making the right choices to meet your specific needs and achieve your future financial goals. It can provide an additional source of income, long-term financial security, and sufficient post-retirement wealth. Here are some ways to invest smartly:

- Start investing early and consistently. The earlier you start, the more time your money has to grow.

- Build a diverse portfolio to help with risk management and avert financial losses in volatile markets.

- Understand the power of compound interest. Reinvesting interest yields can generate larger sums of money over time.

- Avoid chasing the highest return. Smart investing focuses on low-risk, steady investments over a long period.

- Build a risk appetite by understanding your risk tolerance and how much financial loss you can sustain.

- Track your investments regularly to nurture and manage your portfolio effectively.

- Avoid herd mentality and make investment decisions based on your financial goals, risk tolerance, and personal circumstances.

By investing smartly, you can contribute to economic growth through increased aggregate demand, improved production efficiency, and reduced unemployment.

Crypto Investments: Legal or Not?

You may want to see also

Frequently asked questions

Smart investing can increase the quality and quantity of production factors, leading to a positive multiplier effect on the demand side. On the supply side, it can boost long-run aggregate supply and reduce unemployment.

Smart investing helps individuals create an additional source of income, provides long-term financial security, and assists in building sufficient wealth for retirement.

Smart investing involves starting early, making consistent investments, building a diverse portfolio, and reinvesting compound interest over time.

By investing in stocks, bonds, and other assets, individuals can stay ahead of inflation as their money's value increases.

While smart investing can reduce the risk of loss, there is always a chance that the value of an investment may fall. It is important to carefully consider investment decisions and be aware of potential risks.