There are many reasons why an individual may choose to change their investment manager. While investing is considered a long-term activity, it is not uncommon for investors to consider changing their investment manager in the face of capital loss. However, this can be a risky move, potentially disrupting the cycle that enables a portfolio to weather storms over the long term.

Other reasons for switching investment managers include poor performance, high fees, strained communication, and stagnant advice. Individuals may also feel uncomfortable or undervalued in their interactions with their investment manager, or that their manager is talking down to them or evading their questions.

It is important to note that changing investment managers can be expensive, with costs potentially negating the gains of the change. Additionally, there may be financial ramifications, such as termination fees, tax implications, and additional costs associated with moving assets.

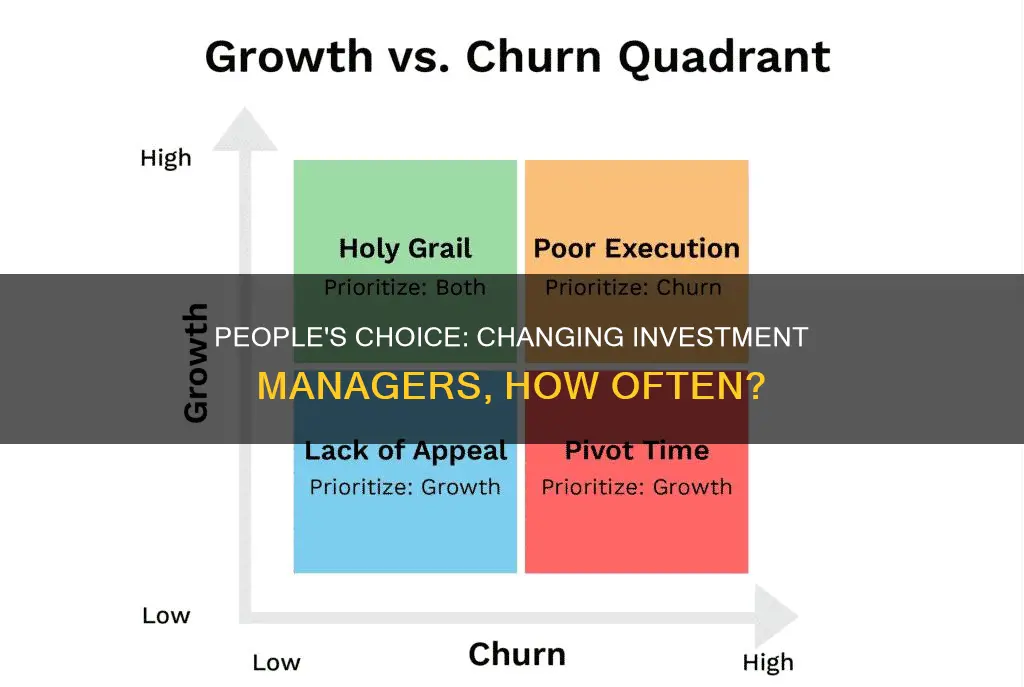

While there is no set frequency for how often people switch investment managers, it is typically done in response to significant life changes or a perception that the current manager is no longer suitable.

| Characteristics | Values |

|---|---|

| Reasons for changing investment managers | Poor performance, high fees, strained communication, stagnant advice, lack of transparency, high costs and fees, personality clash, under-performing portfolio, poor communication, advisor doesn't adapt to changing situation, advisor only calls to trade, advisor doesn't listen |

| How often people change investment managers | 60% of high net worth and ultra-high net worth investors have switched advisors at least once |

| Process of changing investment managers | Sign an agreement with the new advisor, notify the old advisor in writing, work with the new advisor on selling current holdings |

| Considerations before changing investment managers | Termination fee, tax implications of selling certain assets, surrender charges for some funds, capital gains taxes, withdrawal penalties |

Poor performance

When considering a change due to poor performance, it is crucial to assess your investment manager's performance relative to your goals and industry benchmarks. Confirm their understanding of your objectives and compare the behaviour of your investments to your original expectations. Market indices, such as the S&P 500 or FTSE 100, can provide a frame of reference, but specific market-based benchmarks are often more relevant to your portfolio. Conducting a peer-to-peer comparison can also help determine if your manager's performance is in line with others in the industry.

It is also essential to consider factors beyond investment returns, such as service, financial planning, communication, and advice beyond the portfolio. A consistent and transparent investment manager who understands your financial goals and designs a strategy to help you achieve them is crucial.

Furthermore, changing investment managers can be costly and may disrupt the long-term strategy of your portfolio. It is important to remember that markets are short-term animals, and poor performance may be temporary. Thus, it is advisable to maintain a suitably calibrated risk profile and stay the course through volatile periods.

In summary, while poor performance may be a valid reason to consider changing investment managers, it is important to conduct a thorough evaluation, consider the risks and costs of changing, and ensure that any new manager is appropriately evaluated and aligned with your goals and expectations.

Retirement Planning: Fisher's 500K Portfolio Breakdown

You may want to see also

High fees

Management fees are usually based on a percentage of assets under management (AUM). These fees can range from as low as 0.10% to more than 2% of AUM. The more actively managed a fund is, the higher the management fees tend to be. Actively-managed funds generally result in higher management fees than those that are more passively managed, and they don't necessarily see better returns.

The efficient market hypothesis (EMH) suggests that no active investor can consistently beat the market over long periods except by chance, as stock prices fully reflect all available information and expectations. Nobel laureate William Sharpe's research supports this, showing that "After costs, the return on the average actively-managed dollar will be less than the return on the average passively-managed dollar for any time period."

Additionally, high fees charged by active investment managers may not always be worth it, as index funds are now available at very low fees. Actively managed funds have to work harder to beat their benchmarks, and higher fees cover the greater costs required to evaluate and pick securities. However, this does not always translate into better returns.

In summary, high fees can significantly impact investment returns over time, and investors should carefully consider whether the benefits of active investment management outweigh the costs.

Building an Australian Investment Portfolio: Strategies for Success

You may want to see also

Poor communication

Lack of Transparency

A lack of transparency from investment managers can lead to mistrust and uncertainty for clients. If clients are not provided with clear and frequent updates on their investments, they may feel that their manager is hiding something or not being honest about the performance of their portfolio. This can lead to a breakdown in trust and may cause clients to question the competence of their investment manager.

Inconsistent Communication

Inconsistent communication can take many forms, such as long periods of silence followed by sudden bursts of communication, or a failure to communicate via the client's preferred methods. For example, if a client prefers email communication but their investment manager insists on phone calls, this can create a sense of disconnect and frustration. Consistent and clear communication is crucial for maintaining a positive relationship with clients.

Inaccessibility

Investment managers who are difficult to reach or unresponsive to client inquiries can create a sense of frustration and dissatisfaction. Clients want to feel that their investment manager is accessible and willing to address their concerns. Establishing regular "office hours" or designated times for client check-ins can help ensure that managers are available to their clients and actively listening to their needs.

Failure to Adapt to Client Needs

A good investment manager should understand that client needs and goals can change over time and be able to adapt their strategies accordingly. If a manager fails to recognize these changes or is unwilling to adjust their approach, it can lead to disagreements and dissatisfaction on the part of the client. Regular debrief sessions and comprehensive client goal-setting can help investment managers stay aligned with their clients' needs and expectations.

Personality Clash

While this may not seem like a direct result of poor communication, a personality clash often stems from a breakdown in communication and a failure to understand the client's needs and preferences. If a client feels they are not on the same page as their investment manager or that their manager does not "mesh" with them, it can lead to a breakdown in trust and a desire to switch to a different manager.

In conclusion, poor communication can have significant negative consequences for investment managers, leading to a loss of clients and a damaged reputation. By focusing on clear, consistent, and transparent communication, investment managers can improve client relationships and retain their business.

Diversified Investment Portfolios: Strategies for Optimal Returns

You may want to see also

Stagnant advice

As an investor, it is natural to wonder about your next move in such a situation. However, it is important to remember that changing investment managers can be inherently risky. Terminating an investment manager can disrupt the cycle that enables your portfolio to weather storms over the long term. It can also be an expensive move that negates the gains of a change, with costs estimated at around 3-4%.

That being said, it is still important to assess your investment manager's performance. Here are some ways to do so:

- Confirm their understanding of your objectives. The best managers take the time to thoroughly understand your objectives so they can orient your investments accordingly.

- Measure performance against industry benchmarks. Market indices like the S&P 500 or FTSE 100 can provide a frame of reference, although they may not be useful as a direct measurement tool.

- Conduct a peer-to-peer comparison. Consider what you could have achieved elsewhere.

Remember, consistency is one valuable predictor of future investment manager performance. While it is important to stay informed and make changes when necessary, investing is a marathon, not a sprint.

Understanding Portfolio Investment: Definition and Key Concepts

You may want to see also

Lack of transparency

- Not receiving regular updates or reports on your investment portfolio's performance.

- Difficulty obtaining answers to questions about your investments, including simple queries.

- Lack of clarity around investment strategies and decisions, with the manager failing to explain their approach or rationale.

- Uncertainty about fees and costs associated with the investment management service.

- Inability to understand the tax implications of the investment decisions being made on your behalf.

To address these issues, it is essential to establish clear communication channels with your investment manager and set expectations for reporting and updates. It is your right to understand how your money is being managed and to receive timely and accurate information about your investments. If your investment manager is unable or unwilling to provide this level of transparency, it may be a sign that it's time to consider switching to a new manager who can offer a higher level of transparency and communication.

Additionally, you can take a proactive approach by conducting thorough research before choosing an investment manager. Read reviews, talk to other investors, and ask for recommendations. During your initial interactions with prospective investment managers, pay attention to their level of transparency and communication style. Ask questions about their reporting processes, fee structures, and tax considerations to gauge their level of openness and responsiveness. By being diligent upfront, you can increase the likelihood of establishing a trusting and transparent relationship with your investment manager.

Building a Socially Responsible Investment Portfolio: Doing Well by Doing Good

You may want to see also

Frequently asked questions

There is no one-size-fits-all answer to this question. It depends on a variety of factors, including the performance of your investments, the level of trust and communication between you and your manager, and any relevant financial and tax implications.

Some red flags that indicate it may be time to change your investment manager include: poor performance, high fees, strained communication, stagnant advice, and a lack of transparency. Additionally, if you find yourself frequently second-guessing their decisions or seeking financial advice elsewhere, it might be time to consider a change.

Changing investment managers can be a major decision with potential financial ramifications. It may result in termination fees, tax implications, and surrender charges for certain funds. Additionally, there is a risk of disrupting the ebb and flow cycle that enables your portfolio to weather storms over the long term. Therefore, it is crucial to carefully consider the pros and cons before making any changes.