Robin Speziale, a graduate of the University of Waterloo, is the author of Market Masters, which chronicles his journey to building a $300,000 stock portfolio before turning 30. Speziale, who grew up in a middle-class family, started saving from a young age and investing in stocks from the age of 18. He attributes his success to emulating successful rich people, earning and saving, understanding compound interest, investing in stocks, capitalising on crises, refining his investing skill, and sticking to his investment strategy.

| Characteristics | Values |

|---|---|

| Age when decided to be rich | 12 years old |

| Age when opened first bank account | 8 years old |

| Age when started investing in bonds | 14 years old |

| Age when opened first brokerage account | 18 years old |

| Age when portfolio reached $250,000 | 28 years old |

| Age when portfolio reached $300,000 | 29 years old |

| Age when published Market Masters | 30 years old |

| Age when portfolio is predicted to reach $1,000,000 | 35 years old |

| Number of books read about investing | 50 |

| Number of top investors met with | 28 |

| Number of books recommended | 10 |

| Number of steps in wealth-building journey | 8 |

What You'll Learn

Study successful investors

If you want to make money by investing in stocks, it makes sense to study successful stock investors. As Isaac Newton said:

> "If I have seen further than others, it is by standing upon the shoulders of giants."

From the age of 12 to 20, Robin Speziale read around 50 books on the topic of investing. Here are some of the most important investing books for him:

- The Intelligent Investor by Benjamin Graham: This book introduced Speziale to value investing and the essential concepts of "Margin of Safety", "Mr Market", and "Intrinsic Value". Warren Buffett called it "the best book on investing ever written".

- Common Stocks and Uncommon Profits by Philip Fisher: This book opened Speziale's eyes to growth stocks. After reading it, he started paying more for stakes in higher-quality, faster-growing companies.

- One Up On Wall Street by Peter Lynch: This book taught Speziale the importance of "buying what you know", which has saved him from investing in many "dog-stocks". It also inspired him to invest in "tenbaggers".

- Market Wizards by Jack D. Schwager: This book introduced Speziale to some of America's top traders and explained their investment frameworks (why and how they buy), which has been invaluable to him.

- Buffettology by Mary Buffett and David Clark: This is one of the few books that successfully explains how Warren Buffett invests in stocks.

- The Money Masters by John Train: A fun classic that shares winning strategies from some of the world's best investors.

Speziale also studied Forbes' list of the 500 Richest People in the World and Canadian Business' Richest Canadians. This helped him realise that he could become rich by earning money, saving it, and investing in stocks, just like many rich people before him.

Gross Saving and Investment: Understanding the Basics

You may want to see also

Earn and save money when young

Robin Speziale, the author of 'Market Masters', started his wealth-building journey at the age of 12. He opened his first bank account at eight years old and took on a job as a paperboy at 12, depositing each paycheck into his savings account. By the time he was 14, his savings had grown to around $5,000.

Speziale started investing in stocks at 18, after opening his first brokerage account. He invested $10,000, evenly distributed across five stocks, owning a $2,000 stake in each company. He continued to earn money through co-op job placements and bought more stocks, growing his portfolio.

Speziale recommends earning and saving money from a young age. He advises young people to take on jobs, such as delivering newspapers, and to deposit the money into a savings account. This allows for the accumulation of a substantial sum to invest in the future.

Investing Life Savings: Strategies for Long-Term Financial Growth

You may want to see also

Understand how to compound money

Understanding how to compound money is a crucial step in building a substantial investment portfolio. Here are some instructive and focused paragraphs on this topic, drawn from the story of how an individual built a 300k investment portfolio before turning 30:

Understanding the Power of Compound Interest

Compound interest is like magic. The earlier you start investing, the longer your money will compound and work for you. This means that even a small amount of money can grow significantly over time due to the power of compound interest. Starting early and allowing your investments to compound is a crucial step in building wealth.

Investing in Bonds to Generate Interest

When the individual turned 14, their savings account had reached $5,000. They wanted to invest in stocks but were not yet eligible for a brokerage account due to their age. As a solution, they started investing in bonds from their local bank. They purchased Canadian Savings Bonds and safely stored them in a wooden box under their bed, knowing that these bonds would generate interest on the principal amount.

Working and Saving During High School

Throughout high school, the individual worked various odd jobs, including mechanic shop janitor, meat department clerk, and Best Buy associate. They saved money from each paycheck and continued to buy more bonds, compounding their money and growing their savings. This disciplined approach to saving and investing laid the foundation for their future portfolio.

Participating in a Stock Market Challenge

During high school, the individual also had the opportunity to practice investing in the stock market through a stock market challenge organized by Investors of Tomorrow. They put their amateur investing skills to the test and won 1st place nationwide. This experience provided valuable insights and reinforced their interest in investing.

Transitioning to Investing in Stocks

At the age of 18, the individual opened their first brokerage account and began investing in stocks. They cashed out their bonds, amounting to $10,000, and invested this money evenly into five different stocks, owning a $2,000 stake in each company. This marked the beginning of their journey as a stock investor, following in the footsteps of their idols, Benjamin Graham, Philip Fisher, Peter Lynch, and Warren Buffett.

The Magic of Compounding Returns

By investing in stocks, the individual could compound their returns through both capital appreciation (stock price increases) and dividend income (quarterly dividends from companies). As they continued to earn money through university co-op job placements and bought more stocks, their portfolio grew steadily. This is a classic example of how compounding returns can accelerate wealth creation over time.

The Impact of the Financial Crisis

In 2008, when the individual was 21 years old, the global financial crisis hit, causing stock markets to collapse. Their stock portfolio suffered a significant decline, but instead of panicking and selling, they capitalized on the crisis. They invested all their savings into their existing stock holdings, buying quality stocks at discounted prices. This move paid off as their stocks rebounded and pushed above pre-crisis highs in the following years.

The Benefits of Long-Term Investing

The power of compounding is evident in the individual's investment journey. By the time they were 25, their stock portfolio had grown to about $125,000. They realized that they could further accelerate wealth creation by focusing on compounding returns. This involved refining their investment strategy, selecting stocks with strong growth potential, and consistently reinvesting their dividends.

The Advantage of a Larger Capital Base

As the individual's portfolio grew, they noticed the exponential impact of compounding returns. For example, a 10% return on a $300,000 portfolio would result in a $330,000 portfolio the following year, without any additional capital investments. This demonstrates the advantage of having a larger capital base, where even modest returns can lead to significant growth.

In summary, understanding how to compound money is essential for building a substantial investment portfolio. It involves harnessing the power of compound interest, investing early, reinvesting dividends, and staying disciplined during market downturns. By following these principles, anyone can work towards achieving their financial goals and building wealth over time.

Solow Model: Investment Savings Strategy for Long-Term Growth

You may want to see also

Invest in stocks for the long run

By the time Robin Speziale was 18, he had already saved up $10,000 from bonds and a part-time job. He was now ready to invest in stocks.

Speziale says, "By investing in stocks I could compound returns through both capital appreciation (i.e., stock price goes up) and dividend income (i.e., quarterly dividends from companies)". He invested his $10,000 evenly into five stocks, owning a $2,000 stake in each company.

He chose to invest in stocks because that was how his idols, Benjamin Graham, Philip Fisher, Peter Lynch, and Warren Buffett, got rich. He earned more money through co-op job placements and bought more stocks, and his portfolio grew and grew.

Then the 2008 financial crisis happened, and Speziale's portfolio took a 50% hit. But he didn't sell. Instead, he invested all his savings into his existing stock holdings. He bought quality stocks at a 50% discount.

Speziale says, "I simply learned from Benjamin Graham, the father of value investing, that economies and markets operate in cycles. Therefore, an investor could capitalize on manic markets, rather than become fearful and flee."

Indeed, 2009 was a great year to be a value investor. Speziale would make a similar move in February 2016 to capitalize on a bear market in Canadian stocks, where the TSX declined by almost 25% from its high in September 2014.

He knew that historically, the TSX had declined by 28% on average during bear markets, lasting nine months, while the average bull market had advanced by 124%, lasting 50 months. So he was confident that his investments would pay off in the long run.

And they did. By the time he graduated from the University of Waterloo in 2010, his stock portfolio had grown to about $50,000. This was a turning point for Speziale as the magic of compounding started to take effect.

As he entered a full-time career and earned a bigger paycheck, he could invest more money into the stock market and further grow his portfolio.

Understanding Investment Strategies: Model Portfolios Explained

You may want to see also

Capitalise on crises in the market

Robin Speziale's 8-step wealth-building journey, which helped him build a $300,000 stock portfolio before turning 30, included learning to capitalise on crises in the market.

In 2008, Speziale was 21 years old when the financial crisis hit, causing economies around the world to enter a recession and stock markets to collapse. His stock portfolio suffered a 50% decline, and the financial press was full of doom and gloom, urging people to sell. However, Speziale did the opposite. He invested all his savings into his existing stock holdings, despite his fear.

Speziale's move paid off. His stocks soon rebounded, pushing above pre-financial crisis highs in the following years. He had bought quality stocks at a 50% discount.

Speziale's strategy was inspired by Benjamin Graham, the father of value investing, who taught that economies and markets operate in cycles. Therefore, investors should capitalise on manic markets, buying stocks at low prices, rather than becoming fearful and fleeing.

Warren Buffett's famous quote sums up this strategy: "Be fearful when others are greedy and greedy when others are fearful."

Speziale applied this strategy again in February 2016, capitalising on a bear market in Canadian stocks where the TSX declined by almost 25% from its high in September 2014. He knew that historically, bear markets on the TSX had declined by 28% on average, lasting 9 months, while bull markets had advanced by 124% on average, lasting 50 months. Therefore, he was confident that taking on risk during bear markets would eventually be rewarded in the long run.

In summary, to capitalise on crises in the market, investors should:

- Study successful investors like Benjamin Graham and Warren Buffett, and understand their strategies for navigating market crises.

- Be contrarian and buy quality stocks when prices are low, rather than selling out of fear.

- Understand that markets operate in cycles, and take a long-term view, knowing that bear markets are typically shorter and less severe than bull markets.

Betterment: Savings or Investment?

You may want to see also

Frequently asked questions

The first steps are to study successful investors, earn and save money, and understand how to compound money.

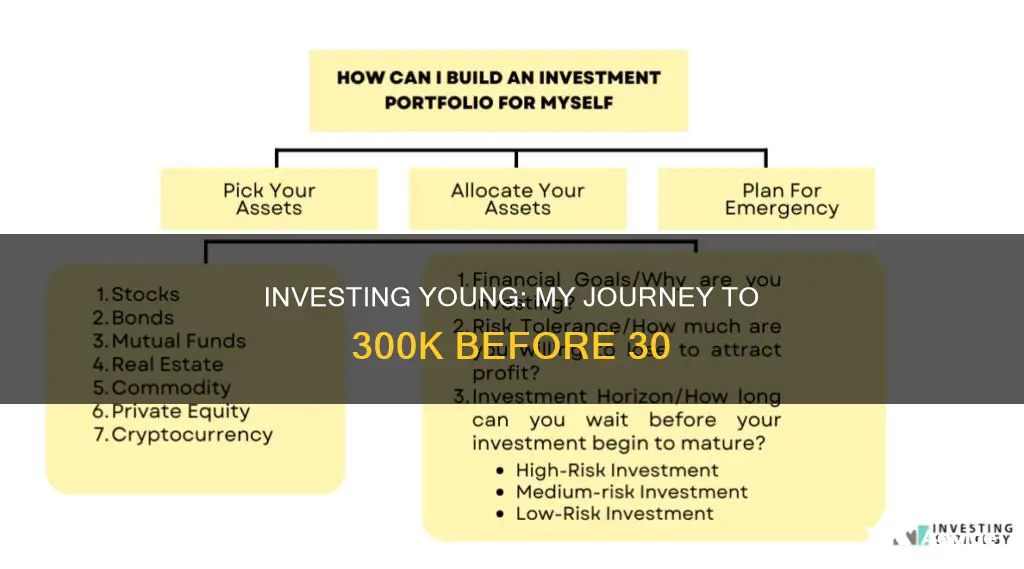

Some good investment options include stocks, bonds, and real estate.

Some tips include diversifying your portfolio, working with a professional, educating yourself, and considering your risk tolerance and time horizon.