Investing your savings is a great way to grow your wealth and achieve financial independence. However, it's important to distinguish between saving and investing. Saving involves setting funds aside in safe, liquid accounts, while investing involves using your money to buy assets like stocks, bonds, or real estate, with the hope of earning a return. Before investing, it's crucial to have a solid financial foundation, including a budget you're comfortable with and an emergency fund.

When it comes to how often you should invest your savings, the answer depends on your financial goals and time horizon. Short-term financial goals, such as building an emergency fund or saving for an upcoming expense, typically require a more conservative approach with lower-risk investments like treasury bills, certificates of deposit, or money market funds. Medium-term goals, such as saving for a wedding or a new car, may involve a mix of conservative and growth-oriented investments. For long-term goals like retirement, investing in higher-risk/higher-reward assets, such as growth stocks and real estate, is often recommended to outpace inflation and achieve substantial growth.

It's important to remember that investing carries risks, and the value of your investments can go up or down. Seeking advice from a financial professional can help you make informed decisions about how often and where to invest your savings based on your specific circumstances and goals.

| Characteristics | Values |

|---|---|

| Savings vs. Investments | Saving money should come before investing. Savings provide the capital to feed your investments. |

| Investment Options | Stocks, ETFs, real estate, starting a business, the stock market, art, bonds, mutual funds, index funds, robo-advisors, brokerage accounts, retirement accounts |

| Investment Goals | Short-term, medium-term, long-term |

| Investment Accounts | Online savings or money market account, CDs, short-term bond funds, equity (stock) index funds, equity exchange-traded funds, brokerage accounts, retirement accounts |

| Investment Strategies | Risk tolerance, portfolio size, overall financial position, drive and determination, time horizon |

| Savings Strategies | Create a spending plan, lock in a %age of your income, invest according to your risk profile, save consistently, pay yourself first |

What You'll Learn

How much should I save before investing?

Before investing, it is recommended that you have at least three to six months' worth of living expenses saved. This will help you cover unexpected costs, such as job loss or medical bills, and ensure you have financial security. It is also a good idea to be comfortable with your budget and be free of any high-interest debt, especially credit card debt.

The amount you should save before investing depends on your individual circumstances, but aiming for at least six months' income in an emergency fund is a common recommendation from financial advisors. This will provide a buffer and ensure you have sufficient time to adjust if your financial situation changes.

You should also consider your risk tolerance and investment timeframe when deciding how much to save before investing. If you are cautious and dislike taking risks, you may want to save a more substantial emergency fund before investing. Additionally, if you need the money within the next five years, keeping it in a savings account rather than investing it may be the better option.

While it is important to have a financial cushion, remember that keeping too much money in a savings account can also be detrimental. Savings accounts often have low-interest rates, and if the interest rate is lower than the inflation rate, your money will lose value in real terms. Therefore, it is essential to balance saving with investing to ensure your money grows over time.

Once you have a sufficient emergency fund in place and have addressed any high-interest debt, you can start investing. Investing is a great way to make your money work for you and build wealth over time. Remember to do your research, understand the risks involved, and seek professional advice if needed.

Retirement Investing: Navigating the Kiplinger Way

You may want to see also

What are the best investment options for short-term goals?

When it comes to investing your savings, it's important to distinguish between saving and investing. Saving money involves setting funds aside in safe, liquid accounts, whereas investing involves buying an asset like stocks in hopes of earning a return. Saving money should almost always come before investing money.

Short-term investments are financial assets that can be easily converted to cash within a short period, ranging from a few days to 3-5 years. They are highly liquid assets specifically designed to provide a safe and temporary place to invest excess cash.

- Savings accounts are one of the better places to hold your money if you'll need it soon. You can easily transfer money to a checking account in an emergency, and you'll earn a small amount of interest.

- Money market accounts have a maturity limit of around 91 days, no lock-in period, high liquidity, and low risk. They offer secure capital and attractive short-term returns.

- Treasury securities or treasury bills are another good short-term investment offering high liquidity, safety, and satisfying returns. Their maturity dates vary from 91 days to 365 days.

- Liquid funds, also known as money market funds, are a type of debt fund that allows instant redemption up to a specific limit, and you can earn better returns than a savings account. They are considered very safe, but the returns are lower compared to other investment options.

- Short-term funds invest in securities that mature in 1-3 years. They are a little riskier but aim to safeguard capital and provide modest capital appreciation.

- Fixed deposits are very popular as a short-term investment option. The investor deposits a lump sum for a fixed tenure, and the deposited amount earns a return at a predetermined interest rate.

- Recurring deposits are a type of secured investment where you invest a fixed amount monthly instead of a lump sum. They usually have a minimum tenure of 6 months and a maximum of 10 years.

- National Savings Certificates are 5-year postal investments that offer tax benefits and assured returns.

- Equity mutual funds, also known as arbitrage funds, are more tax-efficient if held for more than a year and give approximately 8% interest post-tax.

- Fixed maturity plans have a lock-in period of a minimum of 3 years and are more tax-efficient than fixed deposits, with better returns.

- Corporate fixed deposits are offered by non-banking financial companies and have a higher rate of return than FDs or debt mutual funds, but they are also considered riskier.

- Stocks & derivatives are always considered high-risk investments but offer ample opportunities to make high profits and exit in the short term.

When choosing an investment option for your short-term goals, focus on safety, liquidity, and return potential.

Retirement Planning: When Do People Start?

You may want to see also

What are the best investment options for long-term goals?

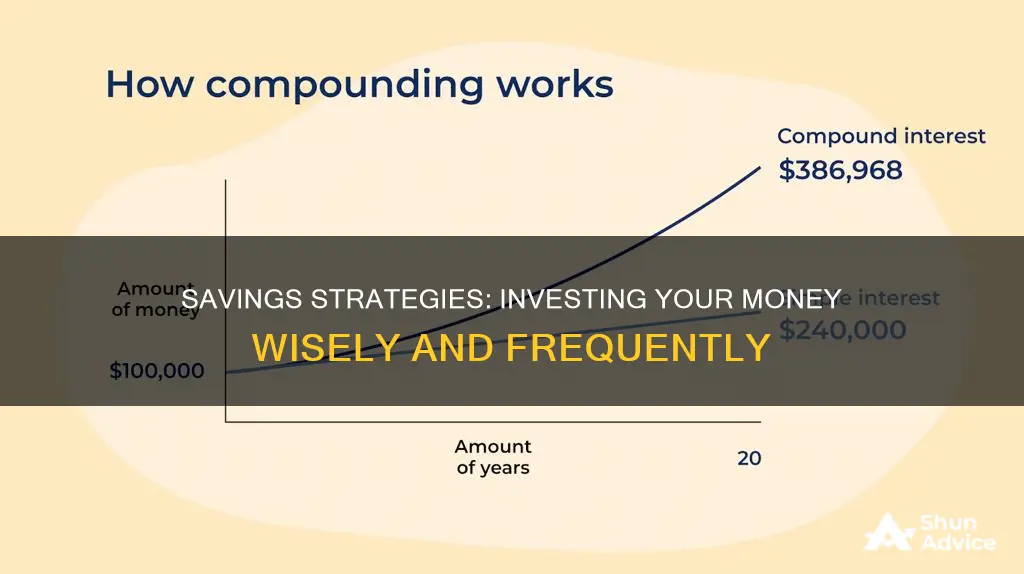

Investing is essential if you want your savings to grow over time. While keeping money in a savings account is safe, the interest you'll earn won't be enough to keep up with inflation over the years. In contrast, investing in the stock market delivers compound returns that not only keep up with inflation but also outpace it.

Tax-Advantaged Retirement Accounts

Retirement accounts, such as individual retirement accounts (IRAs) or workplace retirement plans like 401(k)s, offer valuable tax benefits. They provide tax-free growth while funds remain in the account, saving you a significant amount on capital gains taxes. With traditional accounts, you generally deduct contributions from your taxes the year you make them and then pay income taxes on withdrawals after age 59 1/2. On the other hand, Roth accounts are funded with after-tax money, and withdrawals are tax-free.

529 Plans for Educational Expenses

529 plans are ideal if you're saving for educational expenses. You can start one even before your children are born and invite family members to contribute. These plans offer tax-free growth, and your child won't owe taxes on the money as long as it's used for qualified educational expenses. Additionally, depending on your state, you may receive a break on your state income taxes if you invest using its plan.

Taxable Brokerage Account

If you're investing for a long-term goal outside of retirement or education, consider a taxable investment account. With online brokerage accounts, you have the flexibility to decide how and when to invest your money. While most financial experts recommend investing primarily in low-cost index funds, you might also choose to allocate a small portion of your portfolio to individual stocks or more speculative investments like cryptocurrency.

Real Estate

Real estate has long been considered one of the best long-term investments. It requires a significant amount of money to get started, and there are high commissions involved. However, investing in real estate can be attractive because you can borrow money from a bank to finance most of the investment and pay it back over time. Additionally, there are numerous tax laws that benefit property owners.

Robo-Advisor Portfolio

Robo-advisors are a good option if you don't want to actively manage your investments. These platforms use algorithms to select and manage investments based on your goals, time horizon, and risk tolerance. They typically invest in low-cost exchange-traded funds (ETFs) and charge an annual management fee, which is often around 0.25%.

It's important to note that the best investment options depend on your individual circumstances, including your financial situation, risk tolerance, and specific long-term goals.

The Great Debate: Paying Off Bills vs. Investing – Which Should You Choose?

You may want to see also

How do I create a spending plan?

A spending plan is an informal document used to determine the cash flow of an individual or household. It is similar to a budget, outlining where income is earned and where expenses are incurred. Here are the steps to create a spending plan:

Collect the Necessary Documents and Information:

Gather three months' worth of pay stubs, bank statements, bills, loan statements, insurance premiums, and any other relevant financial documents. This comprehensive collection will provide an accurate picture of your financial situation.

Calculate Your Income:

Determine your total monthly income, including all sources such as salary, investments, child support, alimony, or Social Security. If you are self-employed or have variable income, use the lowest monthly income from the past year as a baseline and account for self-employment taxes.

Track Your Expenses:

Analyse your spending patterns by categorising expenses. Start with essential categories like housing (rent or mortgage, insurance, utilities), food (groceries, eating out), and transportation (car loan, gas, public transportation). Then, include medical, social, and discretionary spending. Don't forget to track savings and investments as well.

Set Your Financial Goals:

Reflect on your spending and saving patterns. Are they aligned with your values and priorities? Identify any areas where you are uncomfortable with the level of debt or any specific goals you want to achieve, such as home ownership.

Make a Plan to Achieve Your Financial Goals:

If you want to save more, consider ways to reduce spending or increase your income. Look for areas in your budget where you can cut back, such as eating out or subscription services. Alternatively, explore options to boost your income, such as asking for a raise or taking on a part-time job.

Stick to Your Plan:

Set up automatic savings to make saving effortless. Regularly review and adjust your plan as life changes occur, such as marriage, having a child, or a change in your career. Stay motivated by tracking your progress and celebrating your successes along the way.

Ready to Invest? Here's What You Need to Know

You may want to see also

How do I invest according to my risk profile?

Investing is essential if you want your savings to grow over time. While keeping money in a savings account might seem like a safe option, the interest you'll earn is unlikely to keep up with inflation. In contrast, investing in the stock market can deliver compound returns that not only keep up with inflation but also outpace it.

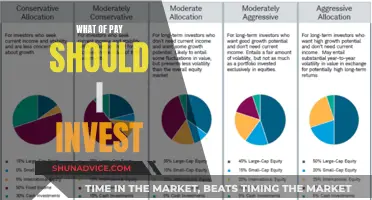

However, investing is risky in the short term, and it's important to understand your risk profile before you begin. A risk profile is an evaluation of an individual's willingness and ability to take risks. It is important for determining a proper investment asset allocation for a portfolio.

- Age and financial responsibilities: If you are a young professional with minimal responsibilities, you may be able to put more money into riskier investments. However, if you have family dependents, you may want to consider investments that offer both returns and protection.

- Professional profile: Your income is another important factor when assessing your risk tolerance. If you have a high income, you may be more willing to take on higher risks. Additionally, the stability of your income depends on the industry you work in. For example, if you work in a start-up, you may not want to be as aggressive in your investments as someone working in a stable and established company.

- Family wealth: If you have family wealth, you can afford to take on more risk by investing in riskier instruments like equity. However, if losing that wealth would cause financial strain, you should opt for capital protection instead and invest in more conservative instruments like debt funds and balanced funds.

- Current investment portfolio: If you have previously invested in very safe instruments, you may want to consider taking on more risk to increase your potential returns. Adopting a goal-based investing strategy can help you make changes to your portfolio. For long-term goals, you can take on more risk by investing in equity-related investments. For short-term goals, consider liquid investments or fixed-income options.

- Understanding of the equity market: High-risk equity investments require a good understanding of the market. If you are an aggressive investor, consider investing in market-linked instruments like unit-linked insurance plans (ULIPs), which can provide the dual benefit of market-linked returns and insurance protection.

Once you understand your risk profile, you can create an investment plan that aligns with your goals and risk tolerance. Remember, investing always carries some level of risk, and it's important to do your research before committing your money.

Renting: A Cost or an Investment?

You may want to see also

Frequently asked questions

This depends on your financial situation and goals. As a general rule, you should only invest your savings when you have a stable financial foundation. This means being comfortable with your budget, being free of high-interest debt, and having an emergency fund saved up. Once you have these basics covered, you can start investing your savings to grow your wealth over time.

The amount you invest depends on your financial goals and risk tolerance. It's recommended to invest a portion of your income consistently, even if it's a small amount. Most financial planners advise saving between 10% to 15% of your annual income.

For short-term financial goals (less than 3 years), consider low-risk options such as high-yield savings accounts, money market accounts, or certificates of deposit (CDs). These options offer liquidity and FDIC insurance but may have relatively low-interest rates.

For medium-term financial goals (3 to 10 years), you can consider a mix of conservative and growth-oriented investments. This may include interest-bearing assets, fixed-income investments, and growth and income equities.

For long-term financial goals (10+ years), focus on investments with higher risk/reward potential, such as growth stocks, real estate, and equity (stock) index funds. These investments offer the potential for substantial growth over the long term, outpacing inflation.

Remember, it's essential to assess your financial situation, goals, and risk tolerance before deciding how often and how much to invest your savings.