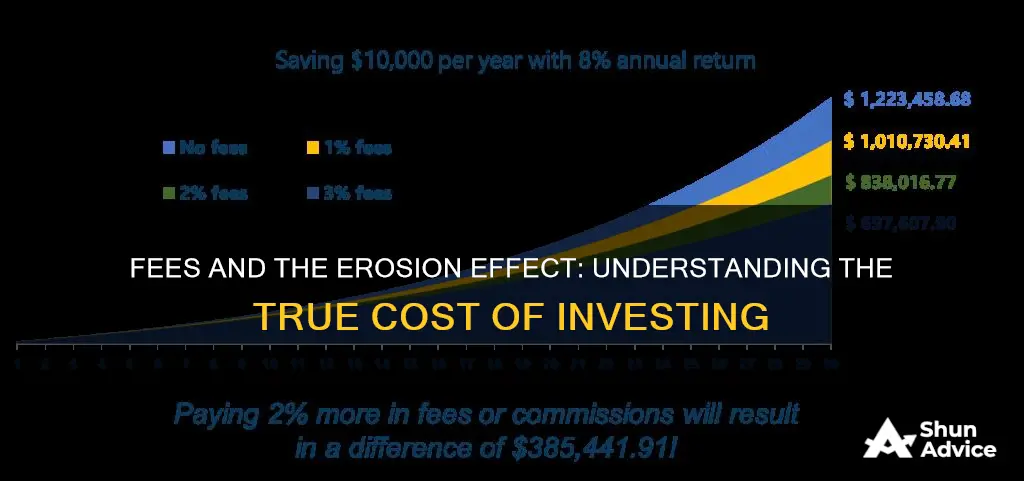

Fees can have a significant impact on your investments. While they may seem small, over time, they can substantially reduce your wealth. Fees that appear insignificant can consume almost one-third of your final portfolio balance over 45 years. For example, an annual fee of 1% on a portfolio worth £10,000 would result in fees of approximately $480,000.

There are two main types of fees: transaction fees and ongoing fees. Transaction fees are charged each time you buy, sell or exchange an investment, while ongoing fees are regular charges such as an annual account maintenance fee. Both types of fees will reduce the overall amount of your investment portfolio.

It is important to understand the fees you are paying and to ask questions about them. You should also consider how to reduce or eliminate fees, such as by purchasing an investment directly without using an investment professional.

What You'll Learn

Transaction fees

For example, if your expense ratio is 1% and transaction fees are another 1.5%, equalling a total of 2.5% of your portfolio taken away, those transaction fees are actually more than your expense ratio, especially when considering the average lifetime of your portfolio.

Let's assume you open an account with no fees with an initial investment of $10,000, with an 8% annual rate of return, compounded every year for 45 years. At age 65, your portfolio would be worth $319,204.49. Now, let's take this exact same setup, except this time you pay the "small" annual fee of 2.5%. With this one change, at age 65, your portfolio would then only consist of $111,265.54. With the 2.5% annual fee over the lifetime of the investment, that is a loss of 65% of your potential earnings.

To avoid transaction fees, consider minimising the number of transactions you enter into and lumping transactions together to potentially minimise the per-transaction charges. In addition, consider seeking brokers that offer free trades for select types of contracts.

Market Volatility: Should You Invest Now?

You may want to see also

Ongoing fees

Some examples of ongoing fees include:

- Investment advisory fees: Charged by investment advisers to manage your investment portfolio, usually as an ongoing annual fee based on the value of your portfolio.

- Annual operating expenses: Mutual funds and exchange-traded funds (ETFs) incur expenses and costs that are often passed on to investors in the form of annual ongoing fees, such as management fees, distribution fees and other expenses. These fees are typically identified as a percentage of the fund's assets, known as the expense ratio.

- 401(k) fees: Participants in 401(k) plans may be charged operating and administration expenses, in addition to the annual operating expenses of the mutual fund investments held in the plan.

- Annual variable annuity fees: Variable annuity investments may charge fees for administration, insurance, and optional features, in addition to the annual operating expenses of any underlying mutual funds or other investments.

It is important to understand the fees associated with your investment account and to ask questions about them. Be sure to review your statements and compare fees across different financial institutions to make informed decisions about your investments.

Retirement Investments: Strategies for a Secure Future

You may want to see also

Investment platform fees

- Dealing charges: These are levied when you buy or sell shares and funds, and the cost depends on the type of investment and account.

- Trading fees: You'll owe these fees anytime you sell or buy an investment. The amount may vary depending on the asset and the number of trades.

- Fund management fees: These annual fees cover the fund manager's costs and can range from 0.10% to around 0.80% or more, depending on the type of fund.

- Transfer fees: These fees apply if you transfer funds from your account or make a wire transfer.

- Paper statement fees: You can avoid these fees by opting for electronic statements and notifications instead of paper statements.

- Account closing or transfer fees: Most platforms charge a fee for closing or transferring your account.

When choosing an investment platform, it's important to consider the total cost, not just the potential for profit. Some platforms may offer lower fees but provide fewer features or services. It's also essential to read the fine print and understand all the potential fees before signing up. Additionally, the cheapest platform for you may depend on factors such as the amount you have to invest, the type of investments you want to hold, and how often you trade.

The Ethical Retirement Conundrum: Navigating a Moral Minefield

You may want to see also

Fund management fees

Investment management fees are fees charged by investment managers for managing investments on behalf of clients. These fees cover the cost of managing and administering an investment portfolio and can vary depending on the number of assets being managed and the investment manager's fee structure.

Types of Fund Management Fees

Percentage of Assets Under Management (AUM)

Many investment managers charge a fee based on a percentage of the total assets under management. This fee structure aligns the manager's incentives with the investor's, as the manager earns more when the portfolio value increases.

Tiered Fee Structures

In some cases, investment managers may offer tiered fee structures, where the percentage fee decreases as the assets under management increase. This approach can provide a discount for investors with larger portfolios.

Performance-Based Fees

Performance-based fees, also known as incentive fees, are charged based on the investment manager's ability to outperform a predetermined benchmark or return target.

Flat Retainer Fee

Some investment managers charge a flat retainer fee for their services, irrespective of the portfolio size or performance. This fee structure can provide predictability and transparency for investors.

Per-Hour Consulting Fees

Investment managers may also charge an hourly rate for specific consulting services, such as financial planning or portfolio analysis.

Impact of Fund Management Fees on Investment Returns

Fees can have a significant impact on long-term investment returns due to their compounding effect. High fees can erode investment gains over time, making it essential for investors to minimize costs whenever possible. For example, consider a £10,000 investment held for 30 years: with a 2% fee, the investor would receive a net return of 3% and would end up with just over £24,270. However, with a fee of just 0.5% and the same net return of 3%, the investment would be worth around £37,450—a difference of £13,180.

Minimizing Fund Management Fees

To minimize costs, investors can consider the following strategies:

- Investing in low-cost passive funds, such as index funds or exchange-traded funds (ETFs), which have lower management fees than actively managed funds.

- Negotiating fees, particularly for high-net-worth clients or institutional investors.

- Diversifying investments across different fee structures, such as a combination of active and passive funds, to balance risk, return, and cost.

- Using robo-advisors, which typically require lower minimum investments and charge lower fees.

Note Investing: Exploring the Payment Methods

You may want to see also

Annual account fees

To minimise the impact of annual account fees, it is important to be mindful of the following:

- Compare fees: When choosing a financial institution, compare the annual account fees charged by different institutions. Some institutions may offer options to waive or reduce these fees, such as by enrolling in paperless statements or meeting certain account balance requirements.

- Long-term impact: Understand the cumulative impact of annual account fees over time. Even small fees can compound and reduce your overall investment returns. Consider the potential long-term value of your investments and choose institutions with competitive fee structures.

- Evaluate overall cost: Consider the overall cost of the investment, including all associated fees. While a low annual account fee may seem attractive, other fees such as transaction fees or advisory fees could add up to a significant amount. Look for institutions that offer a balance of competitive fees and quality services.

- Ask questions: Don't be afraid to ask your financial institution for clarification on their fee structure. Understand what fees you will be charged, when they will be incurred, and what value you are gaining in return. This will help you make informed decisions about your investments.

- Shop around: Don't settle for the first institution you find. Take the time to research and compare multiple institutions to find the best combination of fees and services that align with your investment goals and risk tolerance.

Remember, annual account fees are just one component of the overall costs associated with investing. It is important to consider all fees and their potential impact on your investments to make informed decisions.

The Power of Early Retirement Investing: Why Starting Now Pays Off

You may want to see also

Frequently asked questions

Fees typically come in two types: transaction fees and ongoing fees. Transaction fees are charged each time you buy, sell or exchange an investment, while ongoing fees are charges incurred regularly, such as an annual account maintenance fee.

Both transaction fees and ongoing fees will reduce the overall amount of your investment portfolio. Over time, even small ongoing fees can have a big impact.

If your fees seem too high, you can ask questions and consider following up in writing if you are not satisfied. In some cases, fees are negotiable, so you can talk to your investment professional about reducing them. You can also shop around and consider moving to a new firm, but be sure to think about any tax consequences and fees for closing or transferring your account.