Coinbase is a cryptocurrency exchange where users can buy and sell popular coins such as Bitcoin, Ethereum, and Solana. It is one of the most popular cryptocurrency exchanges, with tens of millions of users, and is considered an easy way for new crypto investors to get started. However, to use Coinbase, you must be at least 18 years old. This is because most crypto platforms, including Coinbase, impose a minimum age restriction of 18 to purchase crypto. While there are no laws prohibiting minors from investing in cryptocurrencies, the lack of regulation in the crypto industry means that teens should only invest what they are willing to lose.

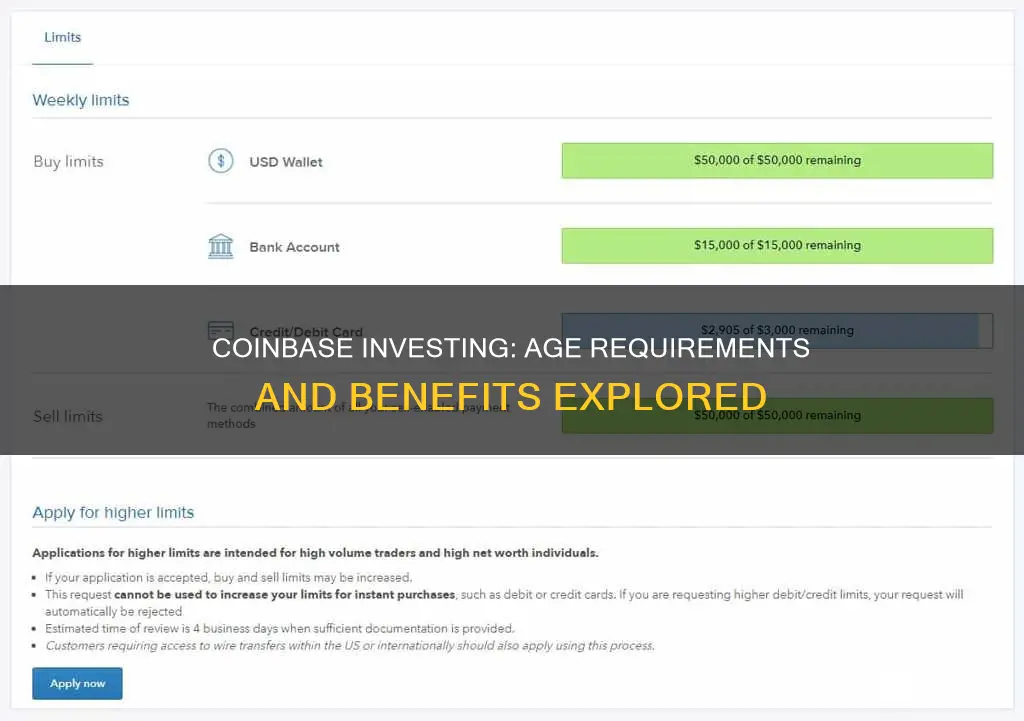

| Characteristics | Values |

|---|---|

| Minimum age to invest in Coinbase | 18 years old |

| Account requirements | Government-issued photo ID, a computer or smartphone with internet access, a phone number for SMS verification, the latest version of your internet browser |

| Payment methods | Bank account, debit card, PayPal, Apple Pay, wire transfer |

What You'll Learn

- Coinbase requires users to be 18 or older

- Crypto is volatile, so teens shouldn't invest more than they can lose

- Crypto wallets can be self-controlled or part of a regulated exchange

- Teens can invest in crypto via custodial accounts or decentralised exchanges

- Crypto is a decentralised, ultra-secure digital currency

Coinbase requires users to be 18 or older

Coinbase is a cryptocurrency exchange where users can buy popular coins like Bitcoin, Ethereum, and Solana. It is one of the easiest ways to buy cryptocurrency, which has helped fuel its explosion in popularity. However, Coinbase requires users to be 18 or older to access its services. This age restriction is in place to protect young people from the risks associated with investing in cryptocurrencies, which are highly volatile and subject to extreme price fluctuations.

Coinbase's website states that "As of July 25, 2017, you must be 18 or older to access Coinbase services." This policy change was implemented to ensure that underage users do not access Coinbase's platform, which can be risky for them. While there are no laws forbidding minors from investing in cryptocurrencies, Coinbase, as a responsible platform, chooses to impose this age restriction for the protection of young individuals.

The age restriction on Coinbase means that users must be at least 18 years old to create an account. The account creation process requires users to provide a government-issued photo ID, such as a driver's license or state ID, which helps verify their age. Additionally, users must have a computer or smartphone with internet access and a phone number for SMS verification. These requirements ensure that only eligible individuals can access Coinbase's services.

It is important to note that Coinbase is not the only platform with age restrictions. Most major crypto exchanges and platforms have similar policies in place. They require users to be at least 18 years old, and some even have a minimum age of 21. These platforms often have Know Your Customer (KYC) guidelines, which help ensure that only eligible and verified individuals can access their services.

While the age restriction on Coinbase may be inconvenient for younger individuals interested in cryptocurrencies, it is essential to understand the risks associated with this type of investing. Cryptocurrencies are highly volatile, and their value can fluctuate significantly. Investing in cryptocurrencies carries a high risk of losing some or all of your investment. Therefore, it is crucial for individuals to understand these risks before investing and to only invest what they are willing to lose.

Akita Coin: A Wise Investment Decision?

You may want to see also

Crypto is volatile, so teens shouldn't invest more than they can lose

Age Requirements for Investing in Crypto on Coinbase

To buy cryptocurrency on Coinbase, you must be at least 18 years old. Coinbase's website states that:

> "As of July 25, 2017, you must be 18 or older to access Coinbase services. Underage Coinbase users who opened accounts under our old policy will be notified of this change and will be given ample opportunity to remove funds from their accounts before the accounts are closed."

Crypto is a highly volatile asset class, which means that prices can fluctuate wildly and investors can experience significant losses. As a result, teens should only invest what they are willing to lose. Here are some reasons why:

- Speculative Nature of Crypto: Cryptocurrencies are highly speculative, meaning their prices can be extremely volatile. This volatility can lead to wide losses if the market moves against your position.

- "No "Real" Money: Cryptocurrency is based on the perception of value. Its worth comes from people's willingness to assign value to it. This means that if people lose faith in a particular cryptocurrency, its value could drop significantly.

- Regulatory Uncertainty: The crypto industry currently operates with relative freedom from regulation. However, there is a risk that governments may impose restrictions or even ban certain cryptocurrencies. Such actions could negatively impact the value of crypto investments.

- Scams and Hacks: Scams and hacks are prevalent in the crypto space, and investors could lose money due to fraudulent activities or security breaches.

- Fees: Crypto transactions often come with fees, and these can be higher than those associated with traditional investments such as stocks, bonds, or mutual funds.

Given these risks, teens should approach crypto investing with caution. While it can be a valuable learning experience and a way to gain exposure to new technologies, it is essential to understand the volatile nature of crypto and invest accordingly. As Brian Kelly, founder and CEO of BKCM, LLC, advises, allocate a small portion of your investment funds (5% or less) to crypto to balance the risk. This way, if crypto investments don't perform as expected, the impact on your overall portfolio remains manageable.

Black Coin: A Smart Investment Decision?

You may want to see also

Crypto wallets can be self-controlled or part of a regulated exchange

To invest in Coinbase, you must be 18 or older. Coinbase is a type of custodial wallet, where the exchange 'keeps custody' of your private key and, therefore, your digital assets.

Crypto wallets, on the other hand, can be self-controlled, or self-custodial. These wallets are usually the best type because they allow you to exercise full control of your digital asset storage and are not tied to any single exchange or other institution. Self-custodial wallets are more secure and less subject to the whims of exchanges or government regulators.

However, the trade-off is that you are solely responsible for managing and remembering your private key. If you lose your key, you could lose your funds permanently. While there are backup solutions, such as recovery phrases, there is always a chance you will forget your key and recovery phrase and be unable to access your wallet.

Custodial wallets are convenient, but they are less secure than self-custodial wallets. Entrusting the management of your wallet to a third party, such as an exchange, can make your assets a target for hackers. If the exchange is hacked, your private key and funds could be stolen.

Decentralized exchanges (DEX) are self-custodial, meaning the exchange lets you control your keys and digital currency. Centralized exchanges (CEX), on the other hand, are custodial and comply with regulatory authorities, and need licenses to operate. Both types of exchanges can leave you vulnerable to cybercrime.

Some have argued that the crypto markets are already under the control of the people who use them. The participants of this space are the ones who take charge of it, and its decentralized nature gives power back to the individual. While there may be ways to influence and steer the industry, crypto and blockchain technology are built with anti-control measures, such as distributed and decentralized voting and peer-to-peer data transmission.

Pundi X Coin: A Smart Investment Decision?

You may want to see also

Teens can invest in crypto via custodial accounts or decentralised exchanges

Teens and Crypto Investing: What You Need to Know

The Legal Landscape:

There is no minimum age requirement to own cryptocurrency, and people of any age can legally invest in it. However, many US-based crypto platforms, including Coinbase, impose a minimum age restriction of 18 years. This means that teens under 18 cannot directly sign up for a crypto wallet or exchange and purchase crypto independently.

Methods for Teen Crypto Investing:

Custodial Accounts:

A custodial account is an adult-managed investment account that allows a parent or guardian to open and control an account on behalf of a minor. While the adult makes investment decisions, the assets legally belong to the child. EarlyBird and UNest are examples of platforms that offer custodial accounts with crypto investing options.

Decentralized Exchanges:

Decentralized crypto exchanges are unregulated and process transactions directly on the blockchain. Since they are not subject to age restrictions, teens can connect their digital wallets and trade cryptocurrencies without parental involvement. However, these exchanges are highly risky, and fiat currency cannot be exchanged for crypto.

Additional Considerations:

Crypto investing, in general, is considered high-risk and speculative due to its volatile nature and regulatory uncertainty. Therefore, teens and their parents should carefully evaluate the risks and ensure that any investment aligns with their risk tolerance and financial goals. It is recommended that teens invest only a small amount of money that they are comfortable losing.

Furthermore, teens interested in crypto investing should prioritize improving their financial literacy and understanding the technology behind cryptocurrencies, such as blockchain, before diving into the market. This foundational knowledge will enable them to make more informed decisions and navigate the complex world of crypto with greater confidence.

Should You Invest in Ripple Coin?

You may want to see also

Crypto is a decentralised, ultra-secure digital currency

Crypto: A Decentralised, Ultra-Secure Digital Currency

Crypto, or cryptocurrency, is a digital currency that uses blockchain technology to ensure all transactions are secure. It is a decentralised peer-to-peer network, meaning it does not rely on any central authority, such as a government or bank, to uphold or maintain it. This makes it theoretically immune to government interference or manipulation.

Each individual coin is stored in a digital ledger, which is a computerized database using strong cryptography to secure transaction records, control the creation of additional coins, and verify the transfer of coin ownership. This cryptography makes it nearly impossible to counterfeit or double-spend.

The first cryptocurrency was Bitcoin, which was first released as open-source software in 2009. As of June 2023, there were more than 25,000 other cryptocurrencies in the marketplace, with more being added all the time.

Crypto has no physical form and is not issued by a central authority. It is typically controlled in a decentralised way, with each cryptocurrency working through distributed ledger technology, usually a blockchain.

Crypto has grown to become its own asset class, although it is not considered a currency in the traditional sense and varying legal treatments have been applied to it in various jurisdictions.

Investing in Crypto on Coinbase

Coinbase is a popular platform for buying and selling crypto. However, it does impose a minimum age restriction, requiring users to be at least 18 years old to get involved in purchasing crypto.

There are ways to get around this age restriction, such as using bitcoin ATMs or other methods. However, it is important to understand the risks and implications of putting your money into a volatile investment before getting involved in crypto.

Coinbase: A Smart Investment Move?

You may want to see also

Frequently asked questions

Yes, Coinbase requires users to be at least 18 years old. This is in line with other crypto platforms and exchanges, which often impose a similar minimum age restriction.

Crypto investing is considered high-risk and mostly unregulated, so the age restriction helps ensure that investors are aware of the risks involved and are old enough to take responsibility for any losses.

No, Coinbase does not allow users under 18 to access its services, even with parental permission. However, parents can create a Coinbase account and purchase cryptocurrencies on behalf of their children.

Investing in cryptocurrency is risky due to its volatile nature and regulatory uncertainty. Coinbase, in particular, has been sued by the Securities and Exchange Commission for allegedly operating illegally and offering unregistered securities. Additionally, Coinbase users have reported incidents of their accounts being drained overnight, highlighting the potential for fraud and hacks.