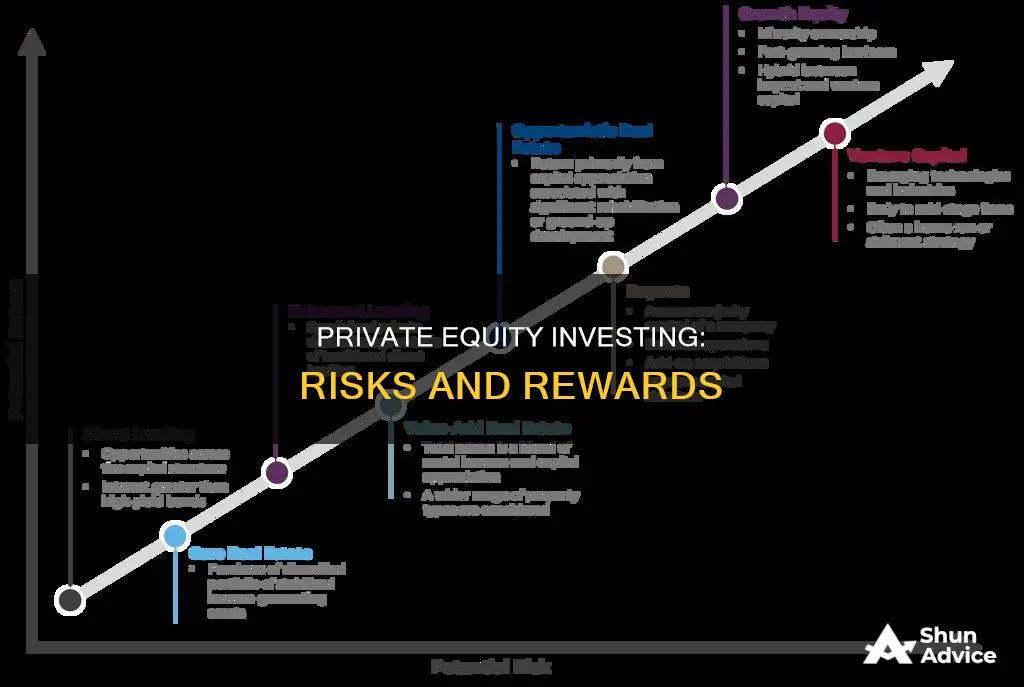

Private equity investing is an increasingly popular option for investors looking to diversify their portfolios, but it's important to be aware of the risks involved. Private equity investments are generally riskier than publicly traded securities due to their illiquid nature and the need to lock up capital for several years. There are several types of risks associated with private equity investing, including operational risk, funding risk, liquidity risk, market risk, and capital risk. Private equity investments are also subject to higher costs, such as due diligence, bank financing, and legal fees. While private equity can offer high returns, investors need to carefully consider the risks and seek financial advice before making any investment decisions.

What You'll Learn

Operational risk

The operations of a company should be one of the key elements to consider before investing in PE. It is important to evaluate the company's operational capabilities and ensure that its processes and systems are robust and up-to-date to mitigate the risk of loss.

In addition to the potential for IT system failures, insufficient manpower can also lead to inadequate processes and systems. This could include a lack of skilled employees or high employee turnover, which can impact the company's ability to effectively manage its operations and make sound decisions.

Outdated systems can also pose a significant risk to the smooth functioning of a company. This includes relying on legacy software or equipment that may be prone to malfunctions or cyber-security threats. It is crucial for investors to assess the company's ability to adapt to new technologies and stay ahead of the competition in terms of operational efficiency.

The impact of operational risk can be far-reaching and result in financial losses, damage to reputation, and decreased investor confidence. Therefore, it is essential for investors to conduct thorough due diligence and carefully evaluate the operational capabilities of the company before investing in PE.

Smartly Investing 15 Lac in India: A Beginner's Guide

You may want to see also

Funding risk

The unpredictable timing of cash flows poses funding risks to investors. Capital commitments are contractually binding, and defaulting on capital calls results in adverse economic consequences for the limited partner (LP) and the private equity fund.

Understanding Investment Management: Strategies for Success

You may want to see also

Liquidity risk

The illiquid nature of private equity investments also means that investors may be forced to sell illiquid assets to meet their financial commitments if they are faced with inadequate funding. This is known as funding risk, which is closely related to liquidity risk.

Additionally, the lack of an active market for the underlying investments makes it difficult to estimate when the investment can be realised and at what valuation. The European Private Equity and Venture Capital Association has identified liquidity risk as one of the four main categories of risk that investors in private equity funds face. The illiquidity of LP interests exposes investors to risks when selling such interests, as there may not be a secondary market for such sales. LP interests are also usually sold at a discount to the reported NAV.

Given the long-term and illiquid nature of private equity investments, investors should carefully consider the potential liquidity risk before committing their capital.

Assessing Chase You Invest: Portfolio Performance Indicators

You may want to see also

Market risk

Private equity investments are subject to changes in long-term interest rates, exchange rates, and other market risks. The infrequent valuations, typically conducted quarterly, and the subjective nature of assessments make it challenging to estimate the investment's realisation value. However, the market prices of publicly listed equities at the time of sale of a portfolio company will ultimately impact the realisation value.

Broad equity market exposure, geographical and sector exposure, foreign exchange rates, commodity prices, and interest rates are all factors that contribute to market risk in private equity. Unlike public markets, where prices fluctuate constantly, private equity investments rely on isolated valuations, making it challenging to exit investments or accurately assess their value.

The capital at risk in private equity includes the net asset value of the unrealised portfolio and future undrawn commitments. In a worst-case scenario, all portfolio companies could experience a decline in value, potentially dropping to zero. Market risk is closely related to capital risk, where the uncertainty of unrealised gains or losses influences the possibility of realised losses at the end of a fund's life.

To summarise, market risk in private equity investing arises from macroeconomic factors and the fluctuation of tangential markets. It is characterised by long-term interest rate changes, exchange rate variations, and other market-specific factors. The infrequent and subjective nature of valuations adds complexity to assessing the realisation value of investments.

Public Investment in India: Understanding Government Spending

You may want to see also

Capital risk

The capital at risk is equal to the net asset value of the unrealised portfolio, plus any future undrawn commitments. In theory, there is a risk that all portfolio companies could experience a decline in their current value, potentially dropping to zero. This risk is heightened in private equity investments due to their illiquid nature and the long-term commitment required from investors, typically between five to ten years.

To mitigate capital risk, investors can consider diversifying their portfolios by investing in a range of companies across different sectors and industries. Additionally, seeking advice from financial professionals and conducting thorough due diligence on private equity firms and their fund managers is essential.

Berkshire Hathaway: Investing Guide for Indians

You may want to see also

Frequently asked questions

There are several risks associated with private equity investing, including:

- Operational risk: the risk of loss due to inadequate processes and systems, such as outdated IT systems or insufficient manpower.

- Funding risk: the risk that investors are unable to provide funds for investments, leading to a potential need to sell illiquid assets to meet commitments.

- Liquidity risk: the difficulty in liquidating a position due to the private nature of the investments and the long-term commitment, typically between 5 to 10 years.

- Market risk: exposure to fluctuations in foreign exchange rates, interest rates, and other economic factors that can impact the value of investments.

- Capital risk: the possibility of losing the investor's capital, which is influenced by market uncertainties, fund manager capabilities, and the performance of the underlying companies.

Private equity investments are generally considered riskier than publicly traded securities due to their illiquid nature and lack of publicly quoted prices. They are subject to higher costs, including due diligence, bank financing, legal fees, and management fees. However, private equity can also provide higher potential returns and is a great option for diversifying an investment portfolio.

Before investing in private equity, it is essential to carefully consider the following:

- Portfolio diversification: Evaluate whether adding private equity will add value to your portfolio or increase concentration risk.

- Fees: Private equity fees tend to be higher than other investments, so consider if the potential returns will outweigh the accumulated fees.

- Investment history: Research the historical performance of the specific private equity investments you're considering. Look for patterns of growth and returns over the last few years.

- Industry-specific risks: Different sectors carry varying levels of risk. For example, investing in the technology industry may require a closer examination of operational risks.