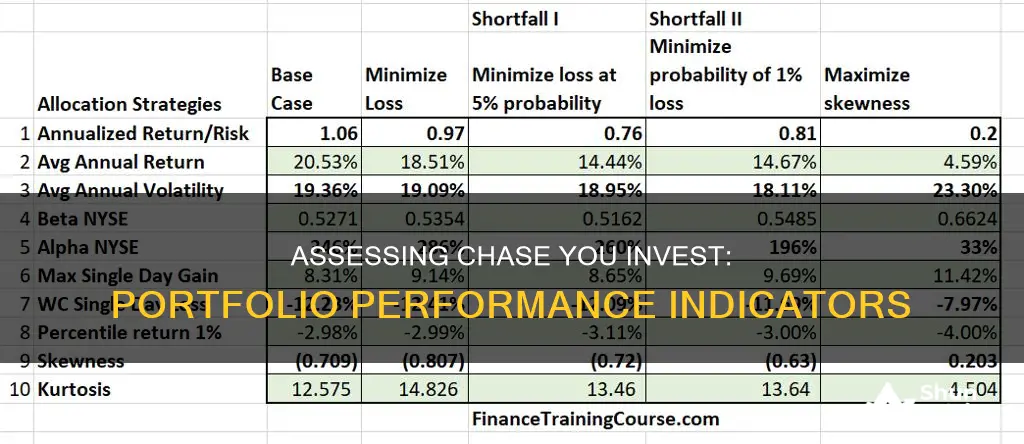

If you're looking to understand how your investments are performing, there are several key metrics to consider. Firstly, it's important to distinguish between absolute and relative performance. Absolute performance measures the change in your portfolio's value over a specific period, while relative performance compares your returns to the overall market. Current returns, which refer to the income generated by your portfolio in the form of dividends and interest, are also important, especially if you rely on this income for living expenses. Additionally, it's crucial to consider taxable income from investments, such as dividends, interest, and capital gains, as these may impact your overall portfolio performance. When evaluating your Chase investment portfolio, it's recommended to seek advice from financial professionals who can guide you through the various performance metrics and help you make informed decisions.

| Characteristics | Values |

|---|---|

| Account minimum | $1 |

| Account value | Current market value of your account in US dollars |

| Interest on uninvested cash | 0.01% APY |

| Investment options | Stocks, bonds, mutual funds, exchange-traded funds (ETFs), options, fixed income products |

| Trading options | Market, limit, stop, stop-limit |

| Trading times | 6 AM to 2 AM ET |

| Trading app | Available for iOS and Android |

| Customer support | Phone and in-person |

What You'll Learn

- Yield: A percentage of income earned from an investment over a specific period

- Absolute performance: A measure of portfolio increase or decrease over a period

- Relative performance: Compare your returns to the overall market

- Current returns: Income produced by the portfolio, comprised of dividends and interest

- Taxable income: Dividends, interest and capital gains are taxable

Yield: A percentage of income earned from an investment over a specific period

Yield is a measure of the income generated by an investment over a specific period, usually a year, expressed as a percentage. It is calculated by dividing the income earned from the investment by the investment's price. For example, if you earned $50 in interest on a $1,000 bond, the yield would be 5%.

Yield can be calculated for various types of investments, including bonds, stocks, and certificates of deposit (CDs).

For bonds, the yield is typically calculated by dividing the interest earned in a year by the bond's value. This calculation method is particularly relevant for bonds bought at the point of issue, where the yield is the same as the interest rate or coupon rate.

For stocks, the yield is calculated by dividing the dividend paid over a year by the stock's market price. It is important to note that if a stock does not pay a dividend, it will have no yield.

Yields on CDs are relatively straightforward, as the bank or financial institution will provide the interest rate and the annual percentage yield (APY).

When evaluating the performance of your investments, it is essential to consider yield as it provides insight into the income generated by your investments over a specific period.

The Cycle of Savings, Borrowing, and Investing: Understanding the Trio

You may want to see also

Absolute performance: A measure of portfolio increase or decrease over a period

Absolute percentage growth is a measure of the increase or decrease in the value of a portfolio over a given period. It is expressed in percentage terms and can be either positive or negative. This measure is useful for retail investors who are typically more concerned with absolute returns than relative returns.

Absolute percentage growth is calculated by measuring the gains or losses of a portfolio over a period, without reference to a benchmark or external yardstick of performance. It is important to note that this is different from relative growth, which measures performance against a benchmark or another asset.

For example, if a portfolio increases in value from $10,000 to $15,000 over a year, the absolute increase is $5,000, and the absolute percentage growth is 50%.

It is worth noting that past performance does not guarantee future returns, and that other factors such as market volatility, interest rates, and earnings growth patterns should be considered when evaluating investment portfolio performance. Additionally, risk is an important factor to consider when evaluating portfolio performance, as it provides context for the returns achieved.

Strategies for Evaluating Your Investment Portfolio

You may want to see also

Relative performance: Compare your returns to the overall market

When it comes to evaluating the performance of your investments, comparing your returns to the overall market is a good measure. This is known as relative performance. If your portfolio has increased by a certain percentage over a year, and the overall market by a lower percentage, then you have performed well. Likewise, if your portfolio is down by less than the overall market, you have also done well.

However, it is important to consider whether you built your portfolio to be more or less risky than the overall market. If you have made additions or withdrawals from your portfolio, this will also impact its performance relative to the market.

It is also important to select a comparison measure with characteristics similar to your portfolio. For example, if your stock portfolio is broadly diversified, the S&P 500 index is a good measure to use. This index measures the performance of the 500 largest publicly traded companies and is broad and often quoted. If your portfolio is made up of smaller companies, you may want to use the NASDAQ index or the Wilshire 5000 index, which include smaller companies and represent a larger base.

For fixed-income investments, you may want to compare the returns of long-term US government bonds. This information can usually be found in many quarterly and annual reports issued by market commentators.

Vanguard Portfolio Analysis: Outside Investments Included?

You may want to see also

Current returns: Income produced by the portfolio, comprised of dividends and interest

To understand the current returns of a portfolio, it is important to look at the income generated by the portfolio, which includes dividends and interest. This is an essential aspect of portfolio performance and can provide insights into the effectiveness of your investment strategy.

Dividends are payments made by companies to their shareholders, typically from their profits. They can contribute to the total return of an investment and are often sought by income-focused investors. Dividends can be consistent or rising, and they are usually considered a sign of financial health for a company. It is important to note that high dividends do not always indicate the success of a company and can sometimes be issued to retain shareholders. Therefore, it is essential to consider contextual information when evaluating dividends.

Interest, on the other hand, is the amount charged by a lender to a borrower for the use of an asset, typically expressed as a percentage of the principal amount. In the context of a portfolio, interest can be earned through various investments, such as bonds or fixed-income products.

To calculate the current returns of a portfolio, you can follow these steps:

- Identify the individual assets or investments in your portfolio.

- Calculate the total income generated by each asset, including dividends and interest.

- Determine the weight or proportion of each asset in your portfolio. This can be done by dividing the value of each asset by the total value of your portfolio.

- Multiply the income generated by each asset by its weight in the portfolio.

- Sum up the weighted income amounts for all the assets to get the total current return of your portfolio.

It is important to note that the calculation of current returns may vary depending on the specific investments and their characteristics. Additionally, factors such as market conditions, economic indicators, and investor sentiment can influence the expected returns of your portfolio.

By understanding the current returns of your portfolio, you can gain valuable insights into the performance of your investments and make more informed decisions about your investment strategy.

Building a Robust Investment Portfolio: Where to Start?

You may want to see also

Taxable income: Dividends, interest and capital gains are taxable

When it comes to your portfolio's performance, it's important to understand the tax implications of your investments. Here's a detailed overview of how taxable income from dividends, interest, and capital gains is treated:

Dividends

Dividends are regular payments made by a company to its shareholders from its earnings. They are typically paid out quarterly, but some companies may distribute them more or less frequently. There are two types of dividends for tax purposes: ordinary dividends and qualified dividends. Ordinary dividends are taxed at ordinary income tax rates, which can go up to 37%. On the other hand, qualified dividends, which are typically paid by a US corporation or a qualifying foreign entity, are taxed at lower capital gains tax rates ranging from 0% to 20%. The specific rate depends on your taxable income and filing status. For example, if you're a single filer with an income of $47,025 or less for the 2024 tax year, your qualified dividend won't be taxed at all. If your income is higher, the tax rate increases to 15% or 20% depending on the amount. It's important to note that you must include dividend income on your tax return, even if you reinvest it to purchase more shares.

Interest

Interest income is generally taxed at ordinary income tax rates. For example, if you receive $50 in interest income from a $1,000 certificate of deposit, you will pay taxes on that amount along with your other income. However, some types of interest income, such as interest from municipal bonds, may be exempt from federal and state taxes. Interest earned on US Treasury bonds, notes, and certain other government securities is taxed as ordinary income at the federal level but is usually not taxed at the state level. Additionally, taxpayers with investment income and modified adjusted gross income above certain thresholds may be subject to the Net Investment Income Tax (NIIT), which is a 3.8% tax on specific investment income types.

Capital Gains

Capital gains occur when an asset increases in value between the time it is purchased and the time it is sold. The tax treatment of capital gains depends on how long the asset was held. Short-term capital gains, for assets held for one year or less, are taxed at ordinary income rates, which can go up to 37%. Long-term capital gains, for assets held for more than one year, are typically taxed at lower rates ranging from 0% to 20%. The specific rate depends on your income level and filing status. For instance, in 2024, if your income is $518,900 or less, the long-term capital gains tax rate is 15%. If your income exceeds this amount, the rate increases to 20%. It's important to note that capital losses can be used to offset capital gains in a given tax year, reducing the amount of tax owed.

Reporting and Considerations

It's important to accurately report your investment income on your tax return. You will typically receive IRS forms such as 1099-DIV for dividends, 1099-INT for interest income, and 1099-B for capital gains and losses. These forms provide details about the type and amount of income received. Additionally, if you received more than $1,500 in interest income and/or ordinary dividends in a year, you must report it using Schedule B. Even if you earn less than this amount, you still need to include it on your tax return.

While we've provided an overview of how taxable income from dividends, interest, and capital gains is treated, it's important to consult official sources and tax professionals for the most up-to-date and comprehensive information. Tax laws and regulations can be complex and may change over time.

Savings, Investments, and the Economy's Vital Balance

You may want to see also

Frequently asked questions

Absolute performance is a measure of how much your portfolio has increased or decreased over a given period. For example, if you started with $50,000 at the beginning of the year and ended with $60,000, your portfolio increased by 20%. However, this does not account for additions or withdrawals, or how your portfolio compares to the overall market. Relative performance is a better measure, comparing your return to the overall market.

The rate of return is the total money you make or lose on an investment. To find your total return, add the change in value (up or down) to all the income you collected from that investment in interest or dividends. To find the percentage return, divide the change in value plus income by the amount you invested.

Yield is a measure of the income generated by an investment over a specific period (usually a year), divided by the investment's price, and expressed as a percentage. For stocks, yield is calculated by dividing the dividend by the stock's market price. For bonds, the yield is the same as the interest rate or coupon rate.