CD (Certificate of Deposit) investments are a popular and accessible way for individuals to grow their savings. Setting up a CD investment involves opening an account with a financial institution and committing a fixed amount of money for a predetermined period. During this time, the funds earn interest, and the investor can choose from various terms, typically ranging from a few months to several years. Understanding how CD investments work, including the interest calculation methods and the benefits of long-term commitments, is essential for anyone looking to make the most of their savings and potentially earn a steady return.

What You'll Learn

- Understanding CD Investment Basics: A simple overview of how CDs work

- Interest Rates and Terms: How interest rates affect CD returns and maturity periods

- Early Withdrawal Penalties: Penalties for withdrawing funds before the CD term ends

- Tax Implications: Tax considerations for CD investors and potential benefits

- Comparison with Other Investment Options: Advantages of CDs over other savings vehicles

Understanding CD Investment Basics: A simple overview of how CDs work

A Certificate of Deposit (CD) is a time-bound deposit account offered by banks, which provides a higher interest rate compared to regular savings accounts. It is a secure and fixed-term investment option, making it an attractive choice for those seeking a stable return on their savings. When you invest in a CD, you essentially lend your money to the bank for a specified period, and in return, you earn interest. Here's a simple breakdown of how CDs work:

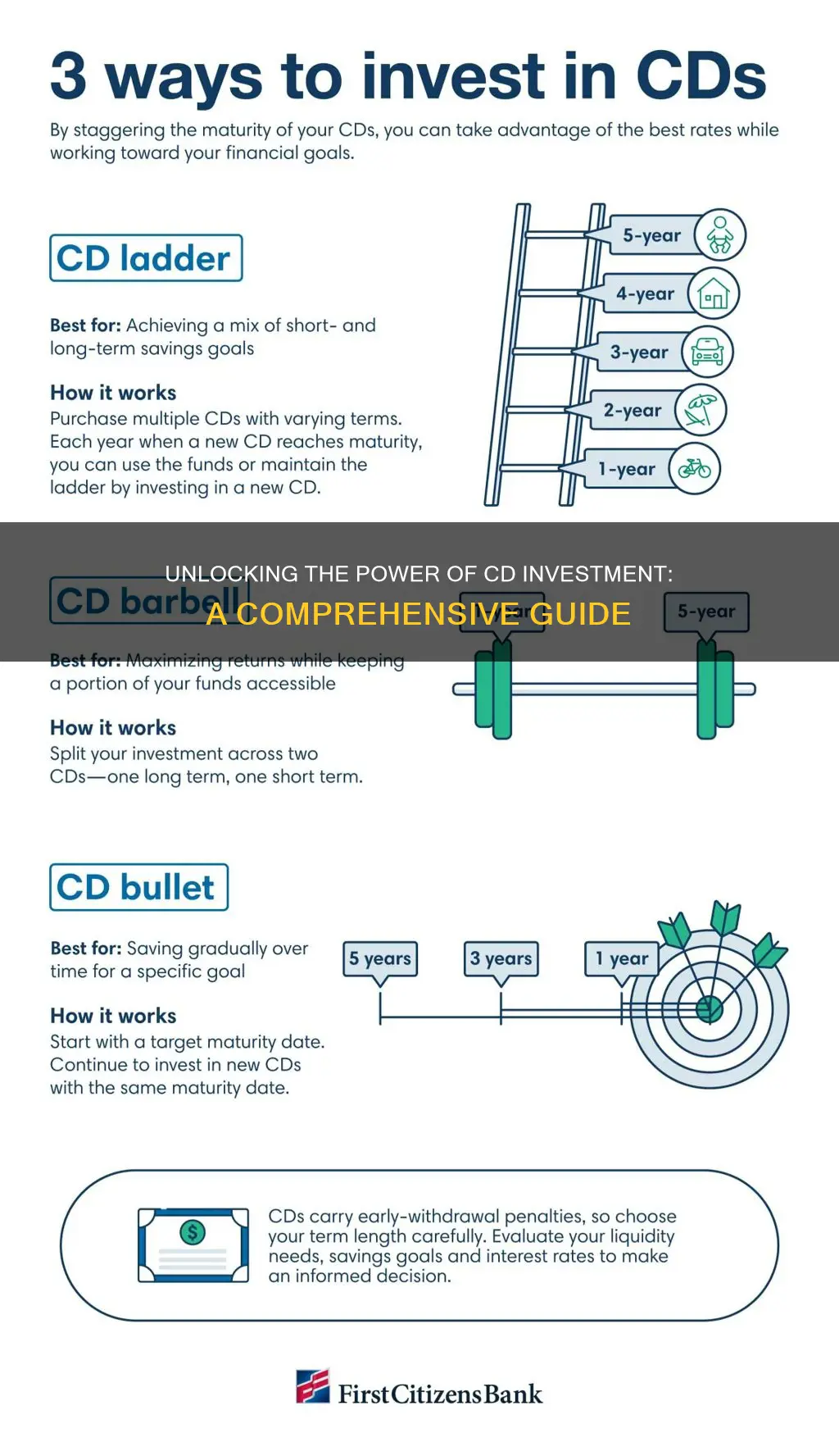

When you open a CD account, you agree to keep your money in the account for a predetermined period, known as the term or maturity period. This term can vary, ranging from a few months to several years. During this time, you typically cannot withdraw the funds without incurring penalties, which is a key feature that sets CDs apart from regular savings accounts. The longer the term, the higher the interest rate, as the bank has a longer period to earn interest on your investment.

The interest earned on a CD is usually calculated and paid out at maturity, which means you receive the entire amount you initially deposited, plus the accrued interest, when the term ends. Some CDs also offer the option to receive interest payments periodically, such as monthly or quarterly, which can be beneficial if you need access to the funds before maturity. It's important to note that early withdrawal penalties can be significant, so it's crucial to choose a term that aligns with your financial goals and needs.

Setting up a CD investment is relatively straightforward. You start by finding a financial institution that offers competitive CD rates. Compare different banks and credit unions to find the best terms and interest rates that suit your investment goals. Once you've chosen a provider, you'll need to decide on the term length, typically ranging from 6 months to 5 years or more. After opening the account, you deposit your funds, and the bank will confirm the interest rate and maturity date.

CDs are considered low-risk investments, making them an excellent choice for conservative investors who want to grow their savings without the volatility associated with stocks or bonds. They provide a guaranteed return, making them a stable investment option for those who prefer a more predictable financial strategy. Additionally, CDs are insured by the FDIC (Federal Deposit Insurance Corporation) up to $250,000 per depositor, ensuring the safety of your investment.

Unveiling the Secrets: How Investment in BPI Trade Works

You may want to see also

Interest Rates and Terms: How interest rates affect CD returns and maturity periods

Interest rates play a pivotal role in determining the returns and overall structure of Certificate of Deposit (CD) investments. When you deposit funds into a CD, you essentially lend your money to a financial institution, typically a bank or credit union, for a fixed period. During this time, the bank agrees to pay you a predetermined interest rate, which is a crucial factor in the overall profitability of your investment.

The relationship between interest rates and CD returns is straightforward: higher interest rates generally lead to higher returns for CD investors. When interest rates rise, the bank has to offer more attractive rates to encourage people to deposit their money. As a result, investors can earn more interest on their CDs. For instance, if you invest $1,000 in a 1-year CD with a 5% interest rate, you'll earn $50 in interest, making your total return $1,050. Conversely, during periods of low or falling interest rates, CD returns may be lower, as banks can offer fewer incentives to attract deposits.

Maturity periods, or the length of time for which you agree to keep your funds in the CD, are also significantly influenced by interest rates. Longer maturity periods often result in higher interest rates, as the bank can earn more interest on your money over an extended period. This higher rate of return is a trade-off for the investor, who agrees to keep their funds locked in for a more extended duration. For example, a 2-year CD might offer a slightly higher interest rate than a 1-year CD to compensate for the longer commitment.

It's important to note that the impact of interest rates on CD returns and maturity periods can vary depending on market conditions and the specific bank's policies. During economic downturns or periods of low inflation, central banks often lower interest rates to stimulate the economy. This can lead to lower CD returns, especially for longer-term investments. On the other hand, in a rising interest rate environment, investors might benefit from higher returns, but they may also face the challenge of locking in funds for extended periods, which could limit their flexibility to access the money when needed.

Understanding the interplay between interest rates and CD terms is essential for investors to make informed decisions. By keeping an eye on market trends and economic indicators, investors can strategically choose the right CD maturity periods and interest rates to maximize their returns while managing their liquidity needs effectively. This knowledge empowers investors to navigate the CD market with confidence and make the most of their investment opportunities.

Investing Insights: Understanding Buying Power and Its Impact on Your Portfolio

You may want to see also

Early Withdrawal Penalties: Penalties for withdrawing funds before the CD term ends

When it comes to certificates of deposit (CDs), one of the key considerations for investors is understanding the potential penalties associated with early withdrawals. Early withdrawal penalties are fees or charges imposed by financial institutions when an investor takes out funds from a CD before the designated term has expired. These penalties are designed to protect the bank's interests and ensure that investors commit to the agreed-upon term, which allows the bank to maintain a stable source of funds for lending purposes.

The penalty for early withdrawal typically varies depending on the financial institution and the specific CD product. It is often expressed as a percentage of the principal amount withdrawn. For instance, a bank might charge a penalty of 1% of the withdrawn amount if the CD term is for one year and the investor decides to withdraw funds after six months. This penalty discourages premature withdrawals and encourages investors to keep their funds in the CD for the entire term to benefit from the higher interest rates.

The calculation of the penalty is usually straightforward. It is calculated as a fixed percentage of the total amount withdrawn. For example, if an investor has a $5,000 CD with a 1% early withdrawal penalty, and they withdraw $1,000 after only 6 months, the penalty would be 1% of $1,000, which is $10. This penalty is deducted from the withdrawn amount, so the investor receives $990. The penalty percentage can vary, but it is often higher for shorter-term CDs, as the bank's risk is greater when funds are withdrawn early.

It's important for investors to carefully review the terms and conditions of their CD agreement to understand the specific penalty structure. Some banks may offer a flat fee instead of a percentage, which could be a fixed amount or a percentage of the total deposit. Additionally, certain financial institutions might waive the penalty in specific circumstances, such as when the account holder is facing a financial emergency or if the withdrawal is for a significant life event, like a first home purchase.

In summary, early withdrawal penalties are a crucial aspect of CD investments, as they can significantly impact the overall returns. Investors should be aware of these penalties and plan their financial strategies accordingly. By understanding the potential fees, individuals can make informed decisions about when and how to access their funds, ensuring they maximize the benefits of their CD investments while minimizing any financial losses due to early withdrawals.

Unraveling the Secrets: A Guide to How Investors Work

You may want to see also

Tax Implications: Tax considerations for CD investors and potential benefits

When it comes to Certificate of Deposit (CD) investments, understanding the tax implications is crucial for investors to make informed decisions and optimize their financial strategies. CDs are time deposits offered by financial institutions, typically with higher interest rates than regular savings accounts. While CDs offer a safe and relatively stable investment option, the tax treatment of these investments can vary, and investors should be aware of the potential tax benefits and considerations.

One of the primary tax considerations for CD investors is the interest earned on the investment. In most jurisdictions, interest income from CDs is taxable. The tax treatment of CD interest can vary depending on the country and the specific tax laws. In many cases, the interest earned is subject to income tax, and investors may need to report it on their tax returns. The tax rate applied to CD interest income can vary based on the investor's overall income and the tax brackets they fall into.

One potential benefit for CD investors is the possibility of tax-free interest. In some countries, certain types of CDs, such as those issued by credit unions or specific government-sponsored programs, may offer tax-free interest. These programs are designed to provide savings opportunities to specific groups, such as members of a particular profession or individuals in certain income brackets. Investors who qualify for these programs can benefit from tax-free interest, allowing their money to grow without the burden of income tax.

Additionally, CD investors should consider the impact of compounding interest on their tax obligations. As interest accrues and compounds over time, the total interest earned can grow significantly. This growth may result in higher tax liabilities, especially if the investor's overall income is already substantial. It is essential to plan and consider the tax implications of compounding interest to ensure that the investment strategy aligns with the investor's tax situation.

Furthermore, investors should be aware of the potential tax benefits of CD investments, especially in retirement planning. CDs can be a valuable component of a retirement portfolio due to their fixed-term nature and relatively stable returns. By investing in CDs, individuals can take advantage of tax-deferred growth, allowing their savings to accumulate without immediate tax consequences. This strategy can be particularly beneficial for those approaching retirement age, as it provides a means to grow savings while minimizing current tax obligations.

Robinhood Investing: A Beginner's Guide to Trading on the Platform

You may want to see also

Comparison with Other Investment Options: Advantages of CDs over other savings vehicles

When comparing certificates of deposit (CDs) to other investment options, it's clear that CDs offer several advantages for those seeking a safe and stable way to grow their savings. One of the primary benefits is the guaranteed return, which is a stark contrast to the volatility often associated with stocks and bonds. With a CD, you know exactly how much you'll earn over the term of the investment, providing a sense of security that is hard to find elsewhere. This predictability is especially appealing to risk-averse investors who prefer a more conservative approach to growing their wealth.

In contrast, traditional savings accounts typically offer lower interest rates, and while they provide some level of liquidity, the returns are often insufficient to keep pace with inflation. This makes CDs an attractive alternative, as they can offer higher interest rates, sometimes significantly so, especially for longer-term commitments. For instance, a 5-year CD might provide a more substantial return than a 1-year CD, and even more so compared to a regular savings account.

Another advantage of CDs is their fixed maturity date, which means you know exactly when your investment will mature and you can access your funds. This predictability is a significant benefit over other investment vehicles, such as mutual funds or exchange-traded funds (ETFs), which can fluctuate in value and may not provide the same level of liquidity. With a CD, you can plan your finances with greater certainty, knowing that your money will be available at a specific time without the risk of market downturns affecting your principal.

Furthermore, CDs are generally considered low-risk investments, making them ideal for those who want to preserve their capital while still earning a reasonable return. This is particularly important for retirement planning or other long-term financial goals where capital preservation is a priority. In a low-interest-rate environment, CDs can offer a much-needed boost to savings, helping investors maintain the purchasing power of their money over time.

In summary, CDs provide a compelling investment option for those seeking a safe, stable, and predictable return. Their advantages over other savings vehicles, such as higher interest rates, guaranteed returns, and fixed maturity dates, make them a valuable tool for anyone looking to grow their wealth in a controlled and secure manner. Understanding these benefits can help investors make more informed decisions about their financial future.

CDs: Worthwhile Investment?

You may want to see also

Frequently asked questions

A CD is a time deposit account offered by banks, where you deposit a fixed amount of money for a specified period, earning a guaranteed interest rate. It's a low-risk investment option, providing a safe and secure way to grow your savings over time.

Setting up a CD investment is straightforward. You can start by researching different banks and their CD offerings. Compare interest rates, terms (maturity periods), and any associated fees. Once you've chosen a suitable CD, you'll need to open an account, typically by providing personal information, funding the account, and selecting the desired term.

While CDs are generally considered low-risk, there are a few considerations. Early withdrawal penalties may apply if you withdraw funds before the maturity date. Additionally, the interest rate offered might be lower compared to other investment options. It's important to understand the terms and conditions to make an informed decision.

Yes, you can typically withdraw funds from a CD before the maturity date, but it may incur penalties. The penalty amount varies depending on the bank and the term of the CD. It's advisable to review the terms and conditions to understand the potential costs and any restrictions on early withdrawals.