Asset allocation is a vital investment strategy that can help you balance risk and reward. It involves dividing your investment portfolio among different asset classes, such as stocks, bonds, cash, real estate, and derivatives. The right mix of assets will depend on your financial goals, risk tolerance, and investment time horizon. For example, younger investors might opt for more stocks for growth, while those nearing retirement may favour bonds and cash for stability. There is no one-size-fits-all approach, so it's essential to tailor your asset allocation to your personal circumstances.

| Characteristics | Values |

|---|---|

| Purpose | Balance risk and return |

| Investment Types | Stocks, bonds, cash, real estate, derivatives, commodities, futures, options, mutual funds, exchange-traded funds, cryptocurrencies |

| Investor Considerations | Risk tolerance, investment objectives, time horizon, available money, age, financial goals, life events |

| Models | Conservative, moderately conservative, moderately aggressive, aggressive, very aggressive, income, balanced, growth |

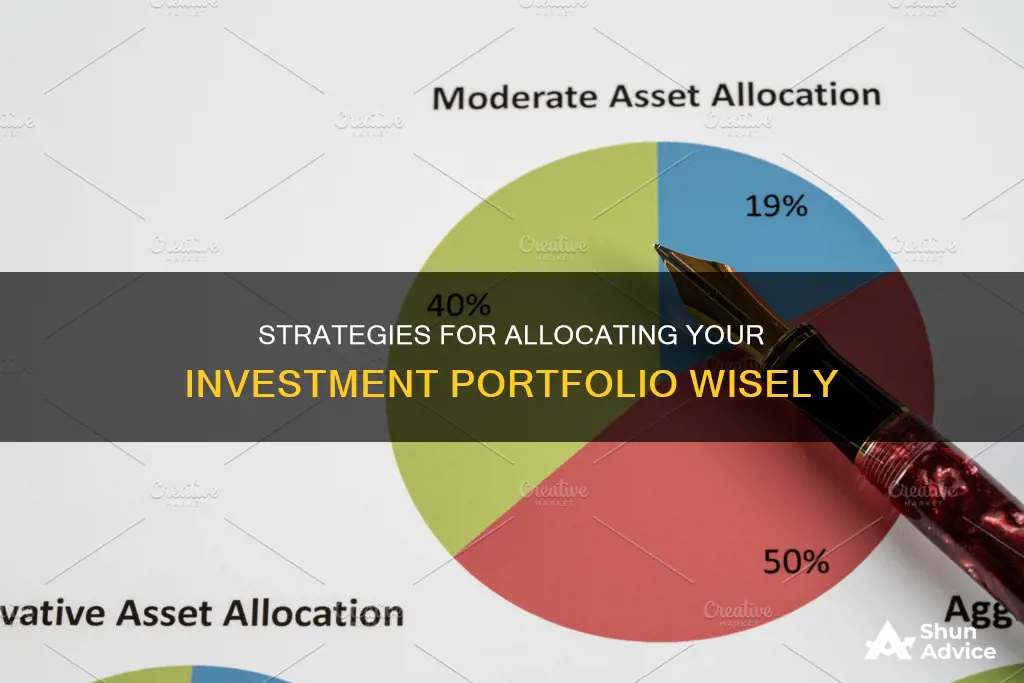

| Common Allocations | 60/40 (60% equity/40% debt), 60/30/10 (60% equity, 30% debt, 10% alternatives) |

What You'll Learn

Stocks, bonds, and cash

Stocks

Stocks, also known as equities, typically make up the majority of an investment portfolio, especially for younger investors or those with a higher risk tolerance. Stocks offer the potential for higher returns over the long term but come with more volatility and risk. If you're saving for retirement and are many years away from retiring, investing heavily in stocks can be a good option as you have time to ride out market turbulence. The percentage of stocks in your portfolio can vary based on your comfort with risk. For example, a growth portfolio, suitable for long-term retirement investors, typically consists of 70% to 100% stocks.

Bonds

Bonds are considered a lower-risk investment compared to stocks. They provide stability to your portfolio and reduce volatility. However, they generally offer lower expected returns. As you get closer to retirement or if you have a lower risk tolerance, allocating a larger portion of your portfolio to bonds is often recommended. For example, a balanced portfolio might allocate 40% to 60% to stocks, while the rest is in bonds.

Cash

Cash and cash equivalents, such as savings and money market accounts, provide liquidity, portfolio stability, and emergency funds. While cash doesn't offer the same return potential as stocks or bonds, it plays a crucial role in your portfolio. A general guideline is to maintain cash and cash equivalents in the range of 2% to 10% of your portfolio. However, this may vary depending on your financial goals, risk tolerance, and current life stage. For retirees, having a larger cash position can provide peace of mind and ensure sufficient liquid reserves during economic downturns. Additionally, if you're planning a significant expense in the next few years, such as buying a home or paying for education, setting aside extra cash in advance is advisable.

Rules of Thumb

There are a few rules of thumb to consider when allocating your portfolio:

- Rule of 100: This rule suggests subtracting your age from 100 to determine the percentage of your portfolio that should be in stocks. For example, if you're 60, this rule advises holding 40% in stocks.

- Rule of 110: Similar to the Rule of 100, but you subtract your age from 110. This rule evolved as people are generally living longer.

- 3-5 Year Rule: Any money you anticipate needing within the next 3-5 years should be kept in cash, short-term bonds, or a diversified bond fund.

Asset Allocation Funds

If you want a simpler approach to portfolio management, consider asset allocation funds, which are mutual funds or exchange-traded funds (ETFs) that invest in a mix of stocks, bonds, and other asset classes. These funds periodically adjust their allocations based on market conditions and investment strategies. Target-date retirement funds are a popular type of asset allocation fund that gradually shifts towards more conservative investments as you get closer to retirement.

Remember, there is no one-size-fits-all approach to allocating your portfolio among stocks, bonds, and cash. It's essential to consider your financial goals, risk tolerance, time horizon, and age to create a portfolio that aligns with your unique circumstances.

Savings and Investments: Two Sides of the Same Coin

You may want to see also

Risk and return

The risk-return trade-off is a key concept. While it's tempting to seek the highest possible return, simply choosing the riskiest assets is not a prudent strategy. For instance, during the stock market crashes of 1929, 1981, 1987, and the global financial crisis of 2007-2009, investing solely in stocks with the highest potential return would have been ill-advised. Successful investors can weigh the relationship between risk and return, accepting that their returns may sometimes be beaten by other investors or funds.

The level of risk an investor can tolerate depends on their financial goals, time horizon, and personal circumstances. An investor with a long time horizon and a high-risk tolerance may feel comfortable with a high-risk, high-return portfolio. Conversely, those with shorter time horizons and lower risk tolerance may prefer low-risk, low-return allocations.

An investor's age is also a critical factor in determining their risk tolerance. Younger investors typically favour more stocks for growth, while older investors approaching retirement may shift to safer assets like bonds and cash. A common rule of thumb is the "100 minus age" rule, which suggests that the percentage of a portfolio allocated to stocks should be 100 minus the investor's age. For example, a 30-year-old would invest 70% in stocks and 30% in bonds.

Additionally, it's important to remember that asset allocation is not a one-time decision. Regular portfolio reviews and adjustments are necessary to adapt to changing financial needs and goals.

Savings and Investments: Planning for Your Future

You may want to see also

Asset allocation models

Income Portfolio

This model focuses on generating a steady stream of income for investors, making it suitable for those in or nearing retirement. It typically consists of 70% to 100% bonds, with the remaining portion in dividend-paying stocks. The goal is to provide a stable income stream while preserving capital.

Balanced Portfolio

A balanced portfolio aims to strike a balance between growth and income. It typically invests 40% to 60% in stocks and the remaining in bonds. This model is suitable for investors seeking to reduce potential volatility and are comfortable with short-term price fluctuations. It is often chosen by investors with a mid- to long-range investment time horizon.

Growth Portfolio

The growth portfolio is designed for long-term capital appreciation and is commonly recommended for long-term retirement investors. It consists of 70% to 100% stocks, with a focus on capital appreciation. This model can experience large short-term price fluctuations and is suitable for investors with a high-risk tolerance and a long-term investment horizon.

It's important to note that these models can be further customized based on individual needs and risk tolerance. Additionally, investors can choose from various investment vehicles, such as mutual funds or exchange-traded funds (ETFs), to implement these asset allocation models.

Who Runs Berkshire's Investment Portfolio?

You may want to see also

Diversification

For example, if you invest all your money in one company and it goes bankrupt, you lose everything. However, if you split your investment between two companies, you reduce the odds of losing money by half. Investing in four companies further reduces the risk.

You can diversify across different asset classes such as fixed income, equity, and gold. Within these broad categories, there are further subtypes. For instance, within fixed income, you have risk-free assets like bank fixed deposits and government savings schemes, and within equity, you have large-cap, mid-cap, and small-cap stocks.

Mutual funds are a great way to diversify your portfolio. They pool money from different investors and invest in various securities, providing instant diversification with a small investment.

It is important to note that diversification does not guarantee profit or protect against losses. It is about managing risk and ensuring your portfolio is not overly exposed to any single investment or asset class.

The right diversification strategy depends on your financial goals, risk tolerance, time horizon, and investment experience. It is important to regularly review and adjust your portfolio to ensure it remains aligned with your changing needs and goals.

Invest or Save? Where Should Your Money Go?

You may want to see also

Time horizon

The time horizon will dictate the types of investment products that are most suitable for your goals. Generally, the longer the time horizon, the more aggressive or riskier the investment strategy can be. This is because there is a greater ability to recover from any market downturns that may happen along the way.

Short-Term Investment Horizon

A short-term horizon refers to investments that are expected to last for fewer than five years. For investors with a short-term horizon, the priority is preserving the principal amount and ensuring liquidity. Suitable investment options include cash, money market funds, savings accounts, certificates of deposit, short-term corporate bonds, and Treasury bills. These investments carry relatively little risk and can be easily converted to cash.

Medium-Term Investment Horizon

A medium-term horizon typically lasts between three and ten years. Investors with this time horizon can afford to take on moderate levels of risk. A mix of stocks and bonds is appropriate, with the allocation depending on individual risk tolerance. Medium-term investment goals include saving for a child's education, a down payment on a home, or marriage.

Long-Term Investment Horizon

A long-term horizon is for investments that are expected to last for ten or more years. Long-term investors can assume significantly more risk in exchange for higher potential returns. Their asset allocation should be tilted heavily towards equities, with some fixed-income assets for diversification. Retirement savings is the most common type of long-term investment.

It's important to note that the time horizon is not just dictated by the investment goal but also by individual factors such as age, income, and lifestyle. Additionally, as the investment horizon shortens, investors should adjust their portfolio by reducing risk and preserving gains.

Saving and Investment: Understanding the Fundamentals

You may want to see also

Frequently asked questions

Asset allocation is the process of dividing an investment portfolio among different asset classes, such as stocks, bonds, and cash, based on an investor's financial goals, risk tolerance, and time horizon.

Asset allocation impacts a portfolio by influencing its performance, risk level, and resilience to market volatility. A portfolio with a higher allocation to stocks tends to be more volatile, while a portfolio with a higher allocation to bonds and cash tends to be more stable.

Choosing an asset allocation depends on factors such as your financial goals, risk tolerance, investment time horizon, and personal preferences. It is important to consider your age, investment objectives, and the amount of money you have to invest. Younger investors might favor more stocks for growth, while those nearing retirement may opt for more bonds and cash for stability.