Investing in the S&P 500 index is a popular strategy for many investors seeking to gain exposure to the performance of the largest U.S. companies. The S&P 500 is a stock market index that tracks the stock performance of 500 large, publicly traded companies in the United States. While investing in the index can provide diversification and potentially strong returns, it's important to consider the risks involved. This paragraph will explore the safety and potential benefits of investing in the S&P 500 index, including the historical performance, the role of diversification, and the factors that can influence the index's volatility.

What You'll Learn

- Historical Performance: Track the S&P 500's long-term returns and volatility to gauge historical safety

- Market Cap Weighting: Understand how large companies impact the index's overall risk and stability

- Sector Diversification: Analyze the distribution of sectors within the index to assess risk exposure

- Dividend Yield: Evaluate the index's dividend yield as a potential safety net during market downturns

- Volatility and Risk: Compare the S&P 500's volatility to other indexes to determine its relative safety

Historical Performance: Track the S&P 500's long-term returns and volatility to gauge historical safety

To assess the safety of investing in the S&P 500, it's crucial to delve into its historical performance, specifically focusing on long-term returns and volatility. The S&P 500, a widely recognized stock market index, comprises 500 large-cap U.S. companies and serves as a benchmark for the overall U.S. stock market. Analyzing its historical data provides valuable insights into the potential risks and rewards associated with investing in this index.

Over the long term, the S&P 500 has demonstrated impressive performance, consistently outpacing inflation and delivering substantial returns to investors. Historical data reveals that the index has averaged an annual return of around 10% over the past several decades. This positive trend is further supported by the fact that the S&P 500 has experienced significant growth during both bull and bear markets, showcasing its resilience and ability to weather economic downturns. For instance, despite the global financial crisis of 2008, the index recovered and continued to show strong performance in the following years.

Volatility, a measure of the index's price fluctuations, is another critical aspect to consider. While the S&P 500 has demonstrated long-term stability, it has also experienced periods of heightened volatility. These volatile periods often coincide with significant economic events or market corrections. For example, the dot-com bubble burst in the early 2000s led to a sharp decline in the index, followed by a robust recovery. Understanding these volatile episodes is essential for investors to manage their risk exposure and make informed decisions.

By examining historical data, investors can identify patterns and trends that may help them make more informed choices. Long-term investors often view the S&P 500 as a safe haven due to its consistent performance and the diversification it offers across various sectors and industries. However, it's important to note that past performance does not guarantee future results, and market conditions can change. Therefore, investors should conduct thorough research and consider their risk tolerance before making investment decisions.

In summary, tracking the S&P 500's historical performance, including its long-term returns and volatility, provides a comprehensive understanding of the index's safety and potential risks. While the index has a strong track record of delivering positive returns, investors should remain vigilant and adapt their strategies based on current market conditions and their specific financial goals.

Well Fargo: Invest in Customer Service, Gain Customer Loyalty

You may want to see also

Market Cap Weighting: Understand how large companies impact the index's overall risk and stability

Market capitalization, or market cap, is a fundamental concept in investing, and it plays a significant role in understanding the dynamics of stock market indices, such as the S&P 500. Market cap weighting is a method used to calculate the value of an index by assigning weights to each constituent stock based on its market capitalization. This approach is widely used in index funds and exchange-traded funds (ETFs) that aim to replicate the performance of a specific market index.

In the context of the S&P 500, which comprises 500 large-cap U.S. companies, market cap weighting means that the index's performance is heavily influenced by the movements of the largest companies within it. These large-cap stocks typically have substantial market values, and their price fluctuations can significantly impact the overall index. For instance, if a few dominant companies in the S&P 500 experience a sharp decline, it could lead to a proportional drop in the index's value, making it more volatile.

The impact of market cap weighting on risk and stability is a critical consideration for investors. Here's how it works: Firstly, large companies with substantial market caps tend to have a more significant influence on the index's performance. This is because their stock prices carry more weight in the index calculation. As a result, the S&P 500 may be more sensitive to news and events affecting these dominant companies. For example, a major tech company's earnings report could have a more substantial impact on the index than a smaller company's similar announcement.

Secondly, market cap weighting can contribute to the overall stability of the index. Since the largest companies often have diverse business models and strong market positions, they may be less susceptible to specific risks. These companies usually have a more significant influence on the index, which can act as a buffer against the volatility of smaller, more specialized firms. This dynamic can make the S&P 500 a more stable investment option, especially during periods of market turbulence.

However, it's essential to recognize that market cap weighting also has its limitations. The approach may not accurately reflect the overall market's health, as it heavily relies on the performance of a select few companies. This concentration of power among large-cap stocks can lead to potential risks. If these dominant companies underperform or face significant challenges, the entire index could be impacted, making it less representative of the broader market.

In summary, market cap weighting is a critical aspect of understanding the S&P 500's performance and its implications for investors. It highlights the influence of large companies on the index's overall risk and stability. While this weighting method provides a comprehensive view of the market's largest components, investors should also consider the potential drawbacks, such as the impact of a few dominant stocks on the index's volatility.

Invest Wisely: Maximizing Small Finances for Smart Returns

You may want to see also

Sector Diversification: Analyze the distribution of sectors within the index to assess risk exposure

When considering the safety of investing in the S&P 500 Index, sector diversification is a critical aspect to analyze. The S&P 500 is a stock market index that tracks the performance of 500 large-cap U.S. companies across various sectors. Understanding the distribution of these sectors within the index is essential for assessing the overall risk exposure of an investment.

The S&P 500 Index is composed of multiple sectors, each representing a specific industry or group of industries. These sectors include Technology, Financials, Healthcare, Consumer Discretionary, and many more. By examining the weight or representation of each sector within the index, investors can gain insights into the potential risks and opportunities associated with different industries. For instance, if a significant portion of the index is allocated to the Technology sector, any downturn in this sector could have a substantial impact on the overall performance of the S&P 500.

To assess risk exposure, investors should analyze the historical performance and volatility of each sector. Some sectors, like Technology, are known for their high growth potential but may also be more susceptible to market fluctuations. On the other hand, sectors like Utilities or Consumer Staples often provide more stable returns and can act as a hedge during market downturns. By diversifying investments across these sectors, investors can potentially mitigate risks and create a more balanced portfolio.

Additionally, understanding the correlation between sectors is crucial. Sectors that are highly correlated may move in similar directions, either positively or negatively. For example, the Financials and Real Estate sectors often exhibit strong positive correlations, as both are influenced by economic conditions and interest rates. By identifying these correlations, investors can make informed decisions about sector allocation and further enhance their risk management strategies.

In summary, sector diversification is a key factor in evaluating the safety of investing in the S&P 500 Index. Analyzing the distribution of sectors, their historical performance, volatility, and correlations can help investors make informed choices. A well-diversified portfolio across various sectors can potentially reduce risk and provide a more stable investment experience. It is recommended to regularly review and adjust sector allocations to adapt to changing market conditions and ensure a balanced approach to investing.

Is Automation a Safe Investment? Unlocking the Risks and Rewards

You may want to see also

Dividend Yield: Evaluate the index's dividend yield as a potential safety net during market downturns

When considering the safety of investing in the S&P 500 Index, it's crucial to examine various aspects, including the index's dividend yield, which can serve as a crucial safety net during market downturns. Dividend yield is a financial ratio that indicates the annual dividend payment per share relative to the stock's current price. For the S&P 500, this yield is calculated by dividing the total annual dividend payments by the index's current market value.

A higher dividend yield suggests that the index's constituent companies are returning a more significant portion of their profits to shareholders. This can be particularly attractive during market slumps as it provides investors with a steady income stream, potentially offsetting losses in other areas of the portfolio. For instance, if the S&P 500's dividend yield is 2%, an investor would receive $2 in dividends for every $100 invested, even if the stock price declines. This income can be reinvested or used to cover essential expenses, providing a sense of financial security.

During economic downturns, investors often seek stable sources of income to weather the storm. The S&P 500's dividend yield can offer this stability, especially when compared to other asset classes. Historically, dividend-paying stocks have demonstrated resilience during market corrections, as companies with strong dividend policies tend to have robust balance sheets and a commitment to shareholder returns. This can be a significant advantage for investors looking to protect their capital and generate consistent income.

However, it's essential to note that not all companies within the S&P 500 pay dividends, and the dividend yield can fluctuate based on market conditions and individual company performance. Investors should also consider the quality of the dividends, as some companies may cut dividends during economic crises, impacting the overall yield. Diversification within the index is key, ensuring that investors benefit from the overall strength of the S&P 500 while managing potential risks.

In summary, the S&P 500's dividend yield is a critical factor in assessing the safety of investments during market downturns. It provides a potential safety net by offering a steady income stream, which can be particularly valuable when other asset classes may be experiencing significant losses. Investors should carefully evaluate the dividend policies of individual companies within the index and consider the overall diversification of their portfolio to maximize the benefits of dividend yield while mitigating risks.

Invest Your Savings: Safe Strategies for Beginners

You may want to see also

Volatility and Risk: Compare the S&P 500's volatility to other indexes to determine its relative safety

The S&P 500 is a widely followed stock market index that tracks the performance of 500 large-cap U.S. companies. It is often considered a benchmark for the overall health of the U.S. stock market and is used by investors to gauge the market's performance and volatility. When evaluating the safety of investing in the S&P 500, understanding its volatility relative to other indexes is crucial.

Volatility is a measure of how much an investment's value fluctuates over time. It is typically expressed as a percentage and indicates the risk associated with an investment. The S&P 500, being a broad market index, has historically demonstrated moderate to high volatility. This volatility is primarily driven by the diverse range of companies it includes, each with its own set of risks and market influences. During periods of economic uncertainty or market downturns, the S&P 500's volatility tends to increase, as the index reflects the overall market sentiment and performance.

To put this into perspective, let's compare the S&P 500's volatility to other well-known indexes. The Russell 2000, for instance, is a smaller-cap index consisting of 2,000 U.S. companies. It generally exhibits higher volatility than the S&P 500 due to its smaller and more specialized market cap range. On the other hand, the Dow Jones Industrial Average (DJIA) is a more focused index, comprising 30 large, publicly owned companies. The DJIA's volatility is often considered lower than that of the S&P 500, as it represents a more limited segment of the market.

However, it's important to note that volatility is not solely indicative of risk. While the S&P 500's volatility may be higher than some other indexes, it also offers diversification across various sectors and industries. This diversification can act as a risk mitigation strategy, as different sectors may perform differently during various market conditions. Additionally, historical data and market analysis can provide insights into the S&P 500's long-term performance and its ability to recover from volatile periods.

In summary, when assessing the safety of investing in the S&P 500, it is essential to consider its volatility in the context of other indexes. While the S&P 500 may exhibit moderate to high volatility, it also provides a diversified investment opportunity. Investors should conduct thorough research, consider their risk tolerance, and consult with financial advisors to make informed decisions regarding their investment strategies.

Pistols for Profit: Smart Investment Choices

You may want to see also

Frequently asked questions

The 500 Index, also known as the S&P 500 Index, is a stock market index that tracks the performance of 500 large-cap U.S. companies. It is widely considered a benchmark for the overall U.S. stock market and is used to measure the performance of the 500 largest publicly traded companies in the United States.

The S&P 500 Index is calculated using a market-capitalization-weighted method. This means that companies with larger market capitalizations (the total value of their outstanding shares) have a greater impact on the index's performance. The index is calculated by summing the market value of all 500 stocks and then dividing by a divisor to ensure the index value is accurate over time.

Investing in the 500 Index can be considered a relatively safe strategy due to the index's broad diversification across various sectors and industries. The S&P 500 includes companies from multiple sectors, including technology, healthcare, finance, and consumer goods, which helps to mitigate the risk associated with individual stocks. However, like any investment, there are still risks involved, such as market volatility and economic downturns.

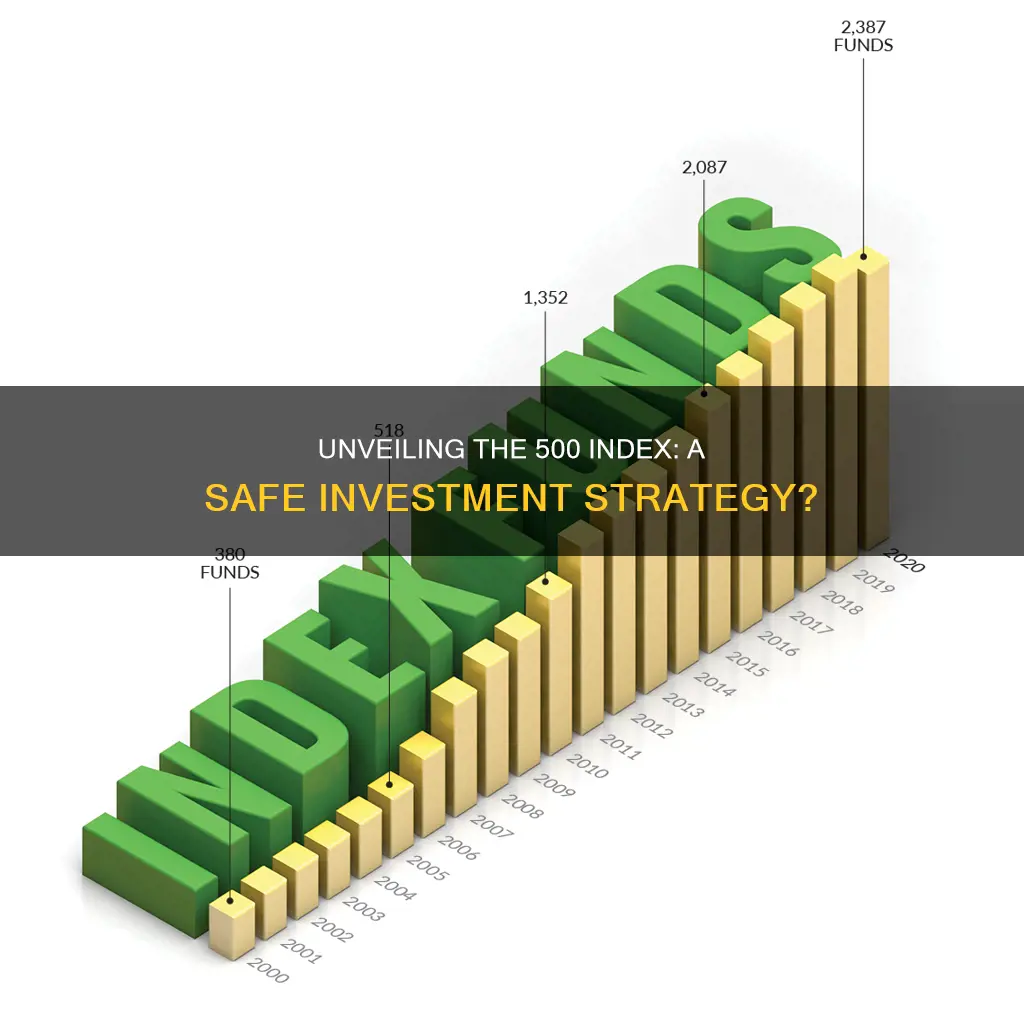

Investing in the 500 Index offers several advantages. Firstly, it provides exposure to a large and diverse group of companies, reducing the impact of individual stock performance. Secondly, the index has historically shown strong long-term performance, often outpacing other asset classes. Additionally, investing in the S&P 500 can be a cost-effective way to gain market exposure, as it is a widely followed index with numerous investment products available, such as index funds and exchange-traded funds (ETFs).