How much of your salary should you put towards retirement? Well, that depends on a number of factors, including your age, your income, your expenses, and your retirement goals.

According to sources, a good rule of thumb is to save around 15% of your pre-tax income each year for retirement, including any employer contributions. This is based on research suggesting that most people will need between 55% and 80% of their pre-retirement income to maintain their lifestyle after retiring.

However, this may vary depending on your personal circumstances. For example, if you plan to retire early, you will likely need to save more than 15% per year. On the other hand, if you have a pension or other sources of income during retirement, you may be able to save less.

It's also important to start saving early and take advantage of compound interest. Even if you can only save a small amount, the earlier you start, the more time your savings have to grow.

| Characteristics | Values |

|---|---|

| How much to save for retirement | At least 15% of pre-tax income each year, including any employer match |

| How much money will you need in retirement | Enough to replace 75-80% of your pre-retirement income |

| When to start saving for retirement | As early as possible, ideally from age 25 |

| How to save for retirement | Use tax-advantaged accounts such as 401(k)s, IRAs, and Roth IRAs |

| How to maximise savings | Take advantage of employer matching contributions |

What You'll Learn

How much should I save each year?

It is recommended that you save at least 15% of your pre-tax income each year for retirement. This includes any employer match. This guideline is based on research which indicates that most people would need to contribute this amount from an assumed starting age of 25 through to retirement age (usually assumed to be 67) to support a replacement annual income rate equal to 45% of pre-retirement income. This assumes no pension income and that you will live for 30 years in retirement.

However, the amount you should save each year depends on a variety of factors, including when you plan to retire, your desired retirement lifestyle, when you started saving, and how much you've already saved. For example, if you don't plan to work until 67, you will likely need to save more than 15% a year.

If you are unable to save 15% of your income, it is still beneficial to save whatever you can. Even small amounts invested early in your career can grow substantially over time.

- Make the most of tax-advantaged savings accounts like traditional 401(k)s and IRAs.

- Take the 1% challenge: increase your savings by 1% per year.

- If you are 50 or older, make the most of catch-up contributions to your retirement savings plans.

- Review your risk tolerance and investment strategy with an eye toward capital preservation as you near retirement.

- Consider using online retirement savings calculators to help you reach your goals.

Smart Places to Invest $2K Right Now

You may want to see also

What will my savings cover?

The answer to this question depends on a number of factors, including your annual salary, your expenses, and your lifestyle.

As a general rule, most financial advisors recommend that your annual retirement income should be around 75% to 80% of your pre-retirement income. This is based on the assumption that you will need less income during retirement due to lower taxes and reduced spending. However, this may vary depending on your individual circumstances, such as whether you will still have a mortgage or other debts, and what your healthcare costs will be.

To estimate how much you will need to save for retirement, you can use the "replacement rate" method. This involves calculating what percentage of your pre-retirement income you will need to replace with income from various retirement resources, such as 401(k) accounts, part-time work, and Social Security. For example, if you made $100,000 per year before retirement and need $75,000 per year during retirement, your replacement rate is 75%.

Another rule of thumb is to aim for a retirement savings fund that is equal to a multiple of your annual salary. For example, by age 35, you should aim to save one to one-and-a-half times your current salary, and by age 50, you should aim for three-and-a-half to six times your salary. By the time you retire, you should ideally have savings equivalent to 10 times your annual salary.

It's also important to consider the impact of time and compounding on your retirement savings. The earlier you start saving, the more time your investments will have to grow. Even small amounts invested early in your career can add up to substantial sums by the time you retire.

In addition to your savings, you will also likely receive income from Social Security during retirement. You may also have other sources of income, such as a pension or part-time work.

By taking into account all these factors and creating a detailed retirement plan, you can ensure that your savings will cover your expenses and maintain your desired standard of living during retirement.

Who Invests in Schools?

You may want to see also

How much do I need to save?

How much you need to save for retirement depends on your current income and the lifestyle you want to have when you retire.

Rules of Thumb

There are a few rules of thumb that are often used as quick estimates for how much to save for retirement. Many retirement experts recommend saving the equivalent of 10 times your pre-retirement salary. This is based on the assumption that you will need around 80% of your pre-retirement annual income to live comfortably. Another common rule is to budget for at least 70% of your pre-retirement income during retirement.

Percentages

Another way to estimate how much you need to save is by percentage. Fidelity Investments suggests saving 15% of your gross salary starting in your 20s and continuing throughout your working life. This should include savings across various retirement accounts, as well as any employer contributions. Saving 15% of your income annually is a good target for many people, but higher earners may need to save more than this.

Benchmarks by Age

The following are some benchmarks for how much you should have saved for retirement by certain ages, according to T. Rowe Price and Fidelity:

- By age 30: Save at least 1 times your current salary.

- By age 35: Save 1 to 1.5 times your current salary.

- By age 40: Save 3 times your current salary.

- By age 50: Save 3.5 to 6 times your current salary.

- By age 60: Save 6 to 11 times your current salary.

- By age 67: Save 10 times your current salary.

Online Calculators

Online retirement savings calculators can also be a useful tool to help you understand how much you need to save and how changing savings and withdrawal rates can impact your retirement nest egg.

GME: Invest Now?

You may want to see also

How can I make my savings last?

It's important to make steady progress toward saving for retirement, no matter your age. Here are some ways to make your savings last:

Withdrawals

It is recommended that you withdraw between 3% and 5% of your total savings in the first year of retirement. This amount can be adjusted for inflation in subsequent years. For instance, if the inflation rate was 3% in the first year, you would increase your withdrawal amount by $3000 (assuming a starting withdrawal amount of $100,000) in the second year. This withdrawal strategy gives you a good chance of making your savings last throughout retirement.

Emergency funds

It is recommended that you have an emergency fund that can cover three to six months' worth of living expenses. This fund can be invested in a high-yield online savings account.

Retirement savings

It is important to contribute to your retirement savings as early as possible. The earlier you start, the more time your investments have to grow and recover from any market downturns. If you are enrolled in an employer-sponsored retirement plan, make sure you are contributing at least enough to get your full company match. If you don't have access to a company plan, consider opening a Roth or traditional IRA.

Additional savings

Once you are comfortable with the balance in your emergency fund, consider investing additional money in a brokerage account. Brokerage accounts can earn higher returns than savings accounts and are useful for medium-term goals like a home down payment or other pre-retirement goals.

Educational savings

If you are starting a family, consider opening an educational savings account like a 529 plan to pay for your children's educational expenses. This will help you avoid tapping into your retirement savings to pay for college.

Debt

The longer you carry debt, the more you pay in interest and the less you will have available to save. Focus on paying down debt while also continuing to save for retirement.

Investment strategy

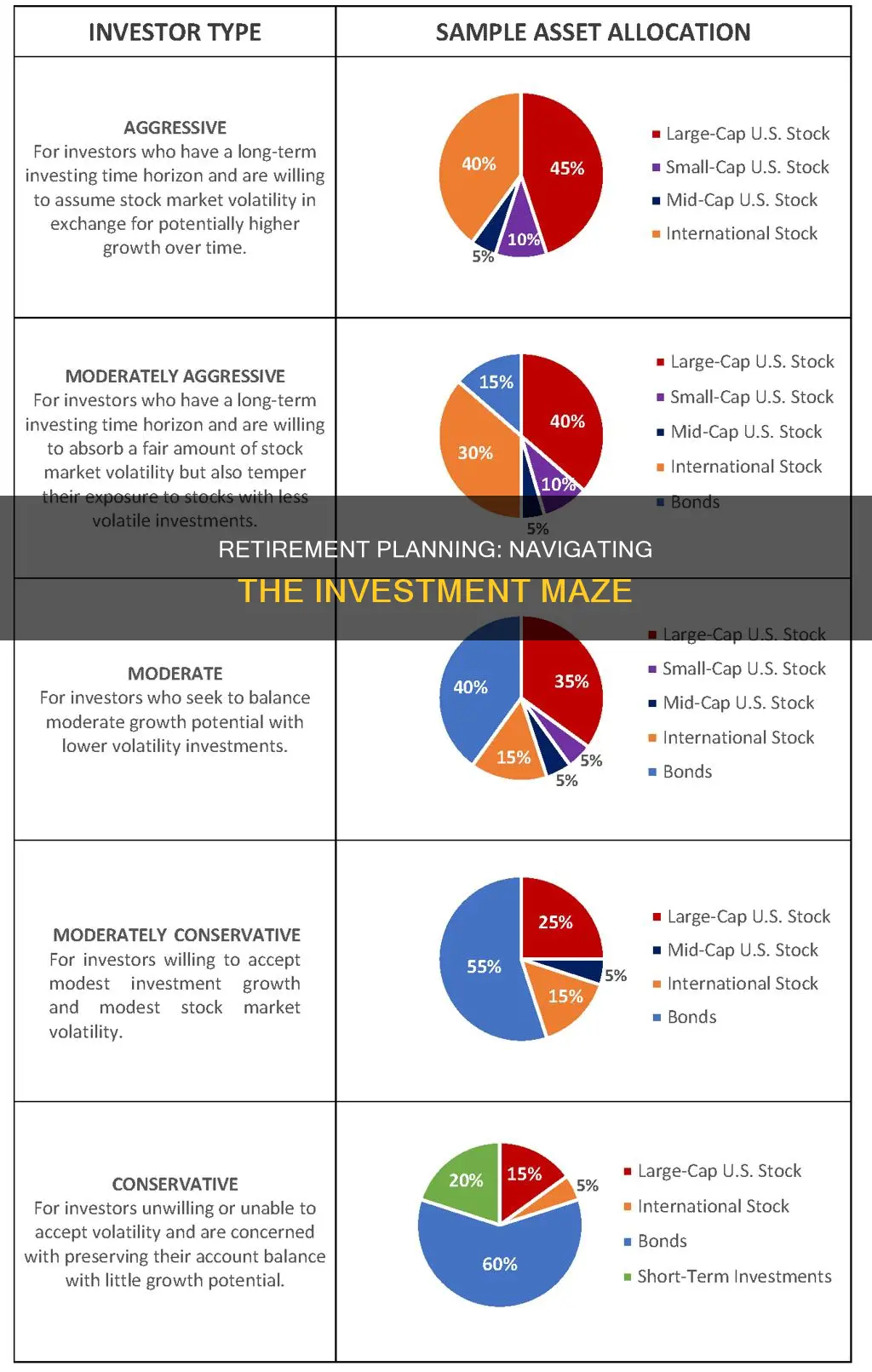

The mix of investments you choose will impact how much you can withdraw without running out of money. Portfolios with more stocks have historically provided more growth over the long term but have also experienced bigger price swings. If you need a high level of confidence that your savings will last throughout retirement, consider a more conservative portfolio.

Guaranteed income

Some products, like annuities, guarantee a stream of income for life. While investing always involves risk, annuities can eliminate the risk of outliving your savings. Income annuities can be a good way to cover essential expenses, while sustainable withdrawals from savings can be used for more flexible expenses.

Timeline

The number of years you plan to be in retirement will impact how much you can withdraw. Generally, the longer your retirement lasts, the lower the sustainable withdrawal rate.

Flexibility

A rigid withdrawal plan may not align with your actual spending needs in retirement. You may have additional expenses some years due to planned or unplanned events. Being flexible with your spending and adjusting your withdrawals accordingly will give you the security of knowing you can "overspend" in certain years.

Expenses

If the annual withdrawals you need exceed what you can safely withdraw, and you are unable to reduce your expenses, you may risk running out of money during retirement. In this case, you could consider working part-time, downsizing your home, or buying an annuity to cover essential expenses.

Kodak Stock: Buy or Pass?

You may want to see also

When should I start saving?

When it comes to saving for retirement, the general consensus is that the earlier, the better. Financial experts advise that you should start saving for retirement as soon as you can, and ideally, you would begin in your 20s when you first leave school and start earning a regular paycheck.

The main reason for starting early is that it gives your money more time to grow. Each year's gains can generate their own gains the following year, thanks to a powerful wealth-building phenomenon known as compounding. For example, if you start saving for retirement at 25, putting aside $3,000 a year for 10 years and then stopping, by the time you reach 65, your $30,000 investment will have grown to more than $338,000, assuming a 7% annual return. However, if you wait until you're 35 and then save $3,000 a year for 30 years, you'll only have about $303,000 by the time you're 65.

While it is ideal to start saving in your 20s, it can be a challenge, as you may be paying off student loans or managing other financial commitments. However, even saving a small amount can make a huge difference in your future, and it's important to remember that you don't need to figure everything out right now. The most important thing is to get started and make steady progress toward your retirement savings goal.

If you're not sure where to start, consider these steps:

- Find the right kind of account for your savings, such as a 401(k) or an IRA.

- Choose the investments for your account, keeping in mind that higher-risk investments like stocks usually provide the opportunity for the highest rate of return.

- Open your account and set up automated contributions from each paycheck if possible.

- Increase your savings over time, aiming to save at least 10%-15% of your income annually for retirement.

Remember, the longer you wait to start saving for retirement, the more you'll need to invest each month, and the harder it will be to catch up. So, while it may seem like retirement is a long way off, the best time to start saving is now.

Shiba Inu: Invest or Avoid?

You may want to see also