As of July 2024, the best-performing investment trusts include those specialising in Japan, the US, and Europe. Tech is also back as a winning sector, with semiconductor stocks in particular driving returns.

Some of the most popular investment trusts in 2024 include JPMorgan Global Growth & Income, NextEnergy Solar Fund, Polar Capital Technology, Pershing Square Holdings, and The Renewables Infrastructure Group.

When considering which investment trust to buy now, it's important to keep in mind that past performance is not a reliable indicator of future returns. It's also crucial to understand the risks involved, as the value of investments can go down as well as up.

| Characteristics | Values |

|---|---|

| Top-performing investment trusts as of July 2024 | Seraphim Space Investment Trust, Foresight Sustainable Forestry, GRIT Investment Trust, Manchester & London, Baker Steel Resources, Schiehallion Fund, Allianz Technology Trust, Tufton Oceanic Assets |

| Top-performing investment trusts in the past year | Intuitive Invts Group, Seraphim Space Investment Trust, Manchester & London Invt Trust, Schiehallion Fund, CATCo Reinsurance Opps C, Allianz Technology Trust, Polar Capital Technology, Pershing Square Holdings, abrdn New India Investment Trust |

| Top-performing investment trusts in the past three years | Doric Nimrod Air Two, Literacy Capital PLC, Amedeo Air Four Plus, Riverstone Energy, Doric Nimrod Air Three, Rockwood Strategic, Dunedin Enterprise, Ashoka India Equity Investment |

| Top-performing investment trusts in the past seven years | Allianz Technology Trust, Pershing Square Holdings, Polar Capital Technology Trust, Oakley Capital Invts, Dunedin Enterprise, JPMorgan American Invt Trust |

| Most popular investment trusts in July 2024 | Scottish Mortgage Investment Trust, JP Morgan Global Growth & Income, Greencoat UK Wind, Allianz Technology Trust, Hicl Infrastructure, Polar Capital Technology Trust, 3I Group, City Of London Investment Trust, Nextenergy Solar Fund, Supermarket Income Reit |

| Most popular investment trusts in June 2024 | JPMorgan Global Growth & Income, NextEnergy Solar Fund, Polar Capital Technology, Pershing Square Holdings, The Renewables Infrastructure Group |

| Most popular investment trusts in May 2024 | JPMorgan Global Growth & Income, NextEnergy Solar Fund, BlackRock World Mining, F&C Investment Trust, Pershing Square Holdings |

| Most popular investment trusts in April 2024 | JPMorgan Global Growth & Income, BlackRock World Mining, F&C Investment Trust, Pershing Square Holdings, Polar Capital Technology |

| Most popular investment trusts in March 2024 | JPMorgan Global Growth & Income, Polar Capital Technology, India Capital Growth, F&C Investment Trust, Pershing Square Holdings |

| Most popular investment trusts in February 2024 | JPMorgan Global Growth & Income, Polar Capital Technology, Pershing Square Holdings, BlackRock World Mining, India Capital Growth |

| Most popular investment trusts in January 2024 | L&G Global Technology Index, Vanguard LifeStrategy 80% Equity, Royal London Short Term Market, Vanguard US Equity Index, HSBC FTSE All-World Index |

| Investment trusts to buy at a discount | Murray International Trust, Fidelity Special Values, Bankers Investment Trust, Personal Assets Trust |

| Investment trusts with strong long-term performance | JPMorgan American (JAM), Scottish Mortgage Trust (SMT), Fidelity Special Values |

What You'll Learn

Investment trusts vs funds

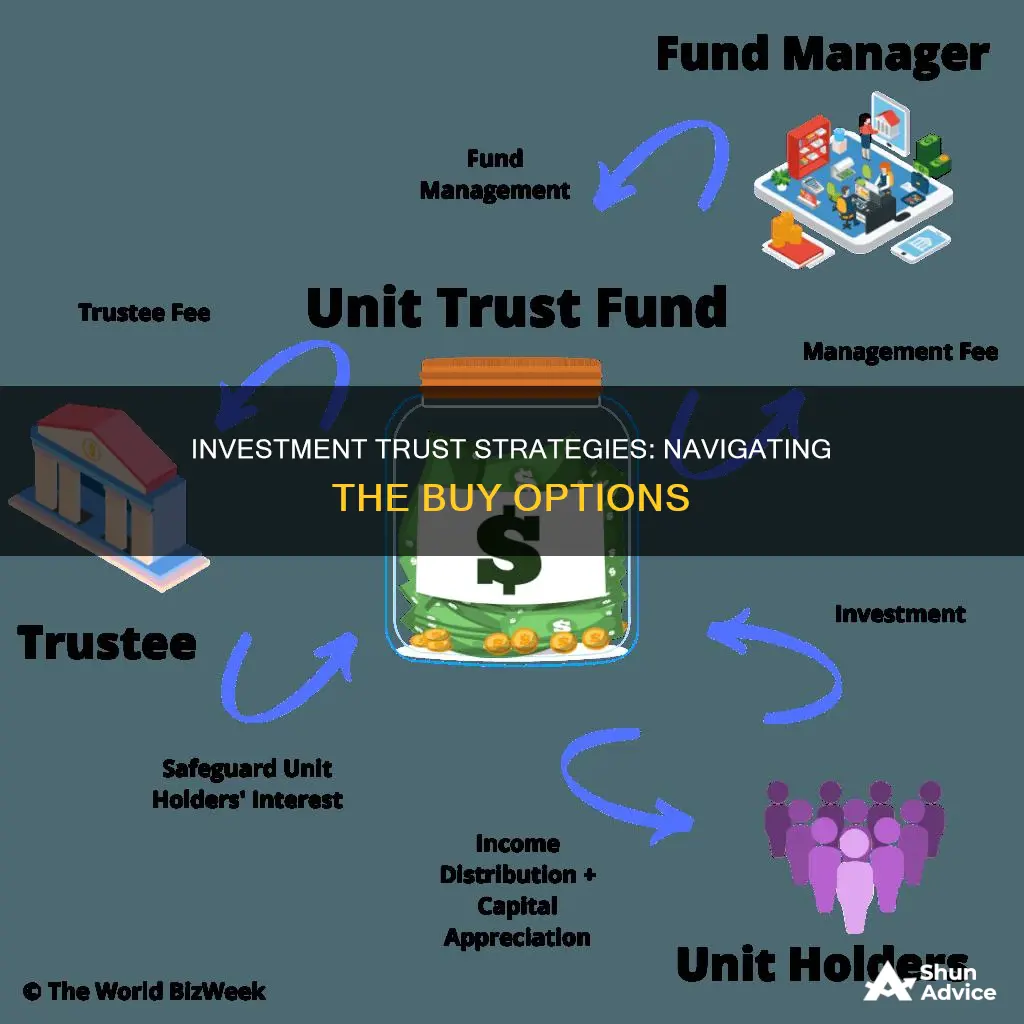

Investment trusts and funds share a lot of similarities. Both enable investors to pool their money with that of others, giving them exposure to a wide range of assets through a single vehicle. However, there are some key differences to be aware of when deciding whether to invest in an investment trust or a fund.

Structure

Funds are typically structured as 'open-ended', meaning there is no limit on the number of units that can be issued at any one time. Investors buy and sell units directly from and to the fund manager. Investment trusts, on the other hand, are 'closed-ended funds'. They issue a fixed number of non-redeemable shares, which are traded among investors on a recognised stock exchange.

Management

Funds and fund managers are essentially the same entity, whereas investment trusts are companies with a board of directors that supervise the activities of the fund managers. The board of directors is responsible for choosing the investment manager and ensuring they perform well and comply with the objectives of the trust.

Investment strategy

Funds are bound by specific investment rules, whereas investment trusts are not, giving fund managers more flexibility. Investment trusts can also borrow money to invest, which is known as 'gearing'. This offers fund managers the opportunity to take advantage of a long-term view or react swiftly to a particular asset.

Liquidity

Open-ended funds can experience inflows and outflows of investors' funds, which can cause difficulties during volatile markets. Investment trusts, being closed-ended, do not have this problem as they are not required to cater to inflows and outflows of investors' funds. This makes investment trusts better suited to less liquid investments, such as property, infrastructure, wind farms, private equity or timber.

Pricing

The price of units in a fund is directly linked to the value of the underlying assets, whereas the share price of an investment trust is dependent on the performance of the underlying assets and supply and demand for the shares. This means that investment trusts can trade at a discount or premium to the value of their underlying assets.

Income

Investment funds are required to distribute all the income generated by the underlying assets to unitholders. Investment trusts, however, can reserve up to 15% of the income earned by the underlying assets each year to build a safety net for leaner years. This allows them to provide a smoother income journey for investors and a more reliable dividend stream.

Charges

Ongoing management charges for funds are typically between 0.75% and 1.5% per annum for actively managed funds, and less than 0.5% for passive funds. Investment trust charges vary, with some being almost as cheap as passive funds, and larger trusts being subject to very low management charges. However, investment trusts are usually treated like shares and may incur a commission of around £8-12 to buy and sell, whereas this is often free for funds.

Investment Influx: Output Demand Shift

You may want to see also

Investment trust discounts

Investment trusts are publicly traded companies listed on the London Stock Exchange. Investors buy shares in the trust to gain exposure to a portfolio of pooled assets. The return investors get from investment trusts is determined by the value of the trust's shares, which can move independently of the value of the assets in the trust. This means that a trust's shares will trade at either a premium or a discount.

The fundamental reason for a trust trading at a discount is that there are more sellers than buyers. This may be due to weak sentiment, with investors thinking the asset value will decrease. If an area is very unfashionable, owners of shares will need to offer their shares at a discounted price to attract potential buyers.

Discounts may also widen because of trust-specific problems, such as a change of manager, or the perception that a manager has lost their edge. Some assets may only be valued a few times a year and so may not be immediately reflected in the net asset value. This might happen with private equity or commercial property assets, and this gap will often be reflected in the discount or premium.

A wide discount can provide an opportunity to buy assets at less than their current value. If a trust is trading at a discount, investors are paying less than the value of the investments. This can be particularly useful for income investors, who can pick up a long-term income stream at a discount.

However, there are no guarantees that a discount will close. Some trusts trade at a long-term discount. Investors need to look at a trust's historic average discount to determine if the discount is unusually wide or within its normal range.

A wide discount can also be a sign of distress, indicating that investors believe the asset price is about to drop. This is common among trusts where the underlying assets are not traded daily, such as property or infrastructure.

Managing discounts

Some trust managers will look to manage the discount, either by buying back shares to reduce a discount or issuing shares to reduce a premium. This is individual to each trust, and the policy will be stated in the trust's documents.

Young Investors: Start Now to Retire a Millionaire

You may want to see also

Investment trust popularity

Investment trusts are publicly listed companies that invest in other companies. They are a type of fund that pools together assets into a portfolio, allowing investors to buy shares in the trust to gain exposure to those assets. The return on investment trusts is determined by the value of the trust's shares, which can fluctuate independently of the value of the assets in the trust. This means that investment trusts can trade at either a premium or a discount.

Some of the most popular investment trusts among customers of various platforms include:

- JPMorgan Global Growth & Income

- NextEnergy Solar Fund

- Polar Capital Technology

- Pershing Square Holdings

- The Renewables Infrastructure Group

- BlackRock World Mining

- F&C Investment Trust

- India Capital Growth

- L&G Global Technology Index

- Vanguard LifeStrategy 80% Equity

- Royal London Short Term Market

- Vanguard US Equity Index

- Vanguard FTSE Global All Cap Index

- Vanguard LifeStrategy 60% Equity

- Gresham House Energy Storage

- CATCo Reinsurance Opportunities

- Augmentum Fintech

- Allianz Technology Trust

- Tritax EuroBox Euro

- Manchester & London

- Harmony Energy Income Trust

- JPMorgan American

- Fidelity Special Values

- Bankers Investment Trust

- Personal Assets Trust

- Scottish Mortgage Investment Trust

- JP Morgan Japanese

- Personal Assets

- JP Morgan Emerging Markets

- Fidelity China Special Situations

- JPMorgan China Growth & Income

- Abrdn Japan Investment Trust

- Abrdn New India Investment Trust

- Intuitive Investments Group

- Seraphim Space Investment Trust

- Schiehallion Fund

- Allianz Technology Trust

- Polar Capital Technology

- Pershing Square Holdings

- Abrdn New India Investment Trust

- Doric Nimrod Air Two

- Literacy Capital

- Amedeo Air Four Plus

- Riverstone Energy

- Doric Nimrod Air Three

- Rockwood Strategic

- Dunedin Enterprise

- Ashoka India Equity Investment

- Allianz Technology Trust

- Polar Capital Technology Trust

- Pershing Square Holdings

- Oakley Capital Investments

- Dunedin Enterprise

- JPMorgan American Investment Trust

- JPMorgan Emerging Markets

- Personal Assets Trust

- Polar Capital Technology

- Schroder AsiaPacific

- Sts Global Income and Growth Trust

- Worldwide Healthcare

- Scottish Mortgage

- City of London

- Securities Trust of Scotland

- Temple Bar

- Abrdn UK Smaller Companies Growth

- Baillie Gifford Japan

- Baillie Gifford US Growth

- JPMorgan Emerging Markets

- JPMorgan Global Emerging Markets Income

- Schroders AsiaPacific

- Sts Global Income and Growth Trust

- Worldwide Healthcare

When considering the popularity of investment trusts, it is important to remember that investment goals, risk appetite, and time horizon should be central to any investment decision. While investment trusts can provide diversification and access to a wide range of assets, they also carry risks, and their share prices can be volatile.

Chinese Investors: Where They Put Their Money

You may want to see also

Investment trust diversification

Investment trusts pool together assets into a portfolio, and investors can buy shares in the trust to gain exposure to them. However, unlike traditional funds, the return investors get from investment trusts is determined by the value of the trust's shares, which can move independently of the value of the assets in the trust.

Diversification is a common investment strategy that involves purchasing various types of investments to reduce the risk of market volatility. It is a component of asset allocation, which refers to how much of a portfolio is invested in various asset classes.

The three most common asset classes are stocks, bonds, and cash (or cash equivalents). To achieve diversification, investors blend dissimilar assets (like stocks and bonds) so that their portfolio is not overly exposed to a single asset class or market sector.

- Diversification by asset class: The three primary general asset classes in an investment portfolio are stocks, bonds, and cash. Stocks offer the highest long-term gains but are volatile, especially in a cooling economy. Bonds are income generators with modest returns but typically underperform during an economic expansion. Cash has low risk and low returns and can be used to buffer volatility or unexpected expenses.

- Diversification within assets: Investors can further diversify by considering factors such as industry, company size, creditworthiness, geography, investment strategy, and style (growth vs. value).

- Diversification beyond asset class: Diversification can extend beyond traditional asset classes to include alternative investments such as pensions, annuities, insurance, precious metals, and cryptocurrency. These asset classes often have a lower correlation with the stock market and can aid in diversification.

When deciding which investment trust to buy now, it's important to consider your investment goals and risk tolerance. While diversification is a useful strategy for reducing risk, it's essential to remember that it cannot eliminate risk entirely. Market risk and asset-specific risks are two types of risks that investments carry.

- JPMorgan Global Growth & Income: This trust has been a popular choice among investors, appearing as one of the most purchased investment trusts in multiple months.

- NextEnergy Solar Fund: This fund focuses on the solar energy sector, providing exposure to renewable energy investments.

- Polar Capital Technology: This trust invests in the technology sector, offering a way to gain exposure to tech companies.

- Pershing Square Holdings: This trust has appeared on the list of most purchased investment trusts in multiple months, indicating its popularity among investors.

- The Renewables Infrastructure Group: This trust focuses on infrastructure related to renewable energy, providing another option for investing in the green energy sector.

Investments of Passion: Collectibles

You may want to see also

Investment trust performance

When considering which investment trust to buy now, it is important to look at investment trust performance. Investment trusts are publicly-listed companies that invest in other companies, pooling assets into a portfolio that investors can buy shares in. The return on investment trusts is determined by the value of the trust's shares, which can move independently of the value of the assets in the trust. This means that a trust's share price can trade at a premium or a discount.

As of July 2023, Japan, US, and European trusts were at the top of the leaderboard for the year, while Asia-Pacific trusts were the bottom performers. The top-performing investment trusts in 2023 so far include abrdn Japan Investment Trust (AJIT), JP Morgan American (JAM), and Fidelity Special Values. These trusts have strong track records and count Nvidia as one of their top holdings, which has seen a nearly 200% rise in its share price this year.

When looking at investment trust performance, it is important to consider the investment goals and appetite for risk. Investment trusts can be riskier than other types of collective investments, and it is generally recommended to hold them for the long term. Additionally, the performance of the underlying investments (net asset value) and the share price should both be taken into account when evaluating investment trusts.

Some well-established investment trusts that have been running for several decades and are over £1 billion in size include Murray International Trust, Fidelity Special Values, Bankers Investment Trust, and Personal Assets Trust. These trusts have strong records of consecutive increases in cash payments and dividends, offering attractive valuations for long-term investors.

The best-performing investment trusts as of July 2024 include Intuitive Invts Group, Seraphim Space Investment Trust Ord, Manchester & London Invt Trust, and Schiehallion Fund Ord. These trusts have delivered strong returns over the past year, three years, and seven years.

Dream Car or Investment: Where Should Your Money Go?

You may want to see also

Frequently asked questions

This depends on your investment goals and appetite for risk. Investment trusts can be tricky to understand, and there are a lot of options to choose from. It is recommended that you hold them for the long term and do your research before investing.

Some popular investment trusts include JPMorgan Global Growth & Income, NextEnergy Solar Fund, Polar Capital Technology, Pershing Square Holdings, and The Renewables Infrastructure Group.

Some top-performing investment trusts include Intuitive Invts Group, Seraphim Space Investment Trust, Manchester & London Invt Trust, Schiehallion Fund, and CATCo Reinsurance Opps C.

Some well-established investment trusts include Murray International Trust (established in 1907), Fidelity Special Values (established in 1984), and Bankers Investment Trust (established in 1888).

Some things to consider when choosing an investment trust include the investment philosophy, process, people involved, price, performance, and size of the trust. It is also important to understand how gearing and discounts and premiums can influence the price of investment trusts.