The Thrift Savings Plan (TSP) is a retirement investment program for federal employees and uniformed service members. It is a defined-contribution plan that offers participants tax advantages similar to those of a 401(k) plan. The TSP offers a range of investment options, including six funds and a mutual fund window, allowing participants to build a diversified portfolio to meet their retirement goals. Understanding the different funds available and their associated risks and returns is crucial for making informed investment decisions.

| Characteristics | Values |

|---|---|

| Type of plan | Defined-contribution (DC) plan |

| Who is eligible | Federal employees and members of the military |

| Tax benefits | Same as a 401(k) |

| Matching contributions | Yes, up to 5% |

| Contribution limit (2023) | $22,500 |

| Contribution limit (2024) | $23,000 |

| Catch-up contributions | $7,500 for those aged 50 or older |

| Investment options | Six funds and a mutual fund option |

| Funds | G Fund, F Fund, C Fund, S Fund, I Fund, L Fund |

| Fund managers | Blackrock Capital Advisers and State Street Global Advisors |

| Fund fees | Low, around 0.05% |

| Withdrawal options | Monthly, quarterly, annually |

What You'll Learn

Traditional vs Roth TSP investing

The Thrift Savings Plan (TSP) is an investment account that government employees, including military members, receive as a benefit. Federal employees have the option to contribute to a TSP as part of their retirement savings strategy. One of the key decisions they need to make is whether to contribute to a traditional TSP or a Roth TSP.

Traditional TSP

With a traditional TSP, you contribute pre-tax dollars, which lowers your taxable income for the year. This means you pay less in taxes now, but you'll have to pay taxes on your withdrawals during retirement. Traditional TSPs are subject to required minimum distributions (RMDs), which means you must take a certain amount of money out of your account each year after a certain age.

Roth TSP

With a Roth TSP, contributions are made with after-tax dollars, meaning you pay taxes on the money upfront. However, your retirement withdrawals are tax-free, provided you meet certain requirements. Roth TSPs are not subject to RMDs, so you can keep your contributions and earnings in your account for as long as you want.

The decision between a traditional TSP and a Roth TSP depends on your individual circumstances and future expectations for taxes and income. If you expect your taxes to be higher in the future or believe that tax rates will increase, a Roth TSP may be a better choice. On the other hand, if you want to reduce your current taxable income and pay taxes on withdrawals during retirement, a traditional TSP may be more advantageous.

In some cases, it may make sense to use both traditional and Roth TSP accounts to benefit from tax diversification and adapt to changing tax rates and other factors.

Amaravati: Invest Now or Never?

You may want to see also

How to enrol in the TSP

Enrolling in the Thrift Savings Plan (TSP)

The Thrift Savings Plan (TSP) is a retirement savings and investment plan for federal employees and members of the military. It is one of the largest retirement plans in the world, with more than 6.8 million participants.

Civilian employees of the US federal government are automatically enrolled in the TSP, but military service members are not. To enrol, service members need to:

- Know about the program.

- Log in to the TSP website.

- Select a contribution percentage.

The TSP is similar to a 401(k) plan. You can choose to have contributions taken directly from your paycheck, and you can invest that money in a variety of different funds. The TSP offers the same tax benefits as a 401(k), and many agencies offer matching contributions of up to 5%.

The TSP has two basic options for investing:

- Traditional TSP: You make contributions with pre-tax dollars, and pay taxes on withdrawals in retirement.

- Roth TSP: You pay taxes on contributions now, and then make tax-free withdrawals in retirement.

The government will automatically contribute 1% of your basic pay to your TSP, even if you don't put in any of your own money. You are also automatically enrolled to contribute 3% of your basic pay each month, but you can change or stop this at any time. After two years of service, the government will match your contributions up to an additional 4%.

You can choose to invest your TSP money in a variety of investment options, including government-backed US Treasury bills, emerging markets, corporate bonds, and stocks.

The Sweet Taste of Success: Will Hershey's Roundhill Investments

You may want to see also

Choosing the best TSP funds

Understanding the Different TSP Funds

The Thrift Savings Plan (TSP) offers five core individual funds with different investment strategies:

- Government Securities Investment (G) Fund: This fund invests in low-risk, low-yield government bonds and guarantees principal protection. It is intended for conservative investors and has historically provided the lowest returns among the core funds.

- Fixed Income Index Investment (F) Fund: This fund invests in a range of debt instruments, including treasury securities, corporate bonds, and asset-backed securities. It offers slightly higher risk and returns compared to the G Fund.

- Common Stock Index Investment (C) Fund: This fund invests in the Standard and Poor's 500 Index, comprising 500 large and mid-cap companies. It is the most conservative of the three stock funds and has posted higher returns over time.

- Small Capitalization Stock Index Investment (S) Fund: The S Fund holds securities of smaller and less established companies, offering higher growth potential than the C Fund but with greater risk.

- International Stock Index Investment (I) Fund: This fund invests in securities of larger, more established companies in 21 developed countries outside the US. It is considered high-risk and has historically posted higher returns than the C Fund.

Evaluating Risk and Returns

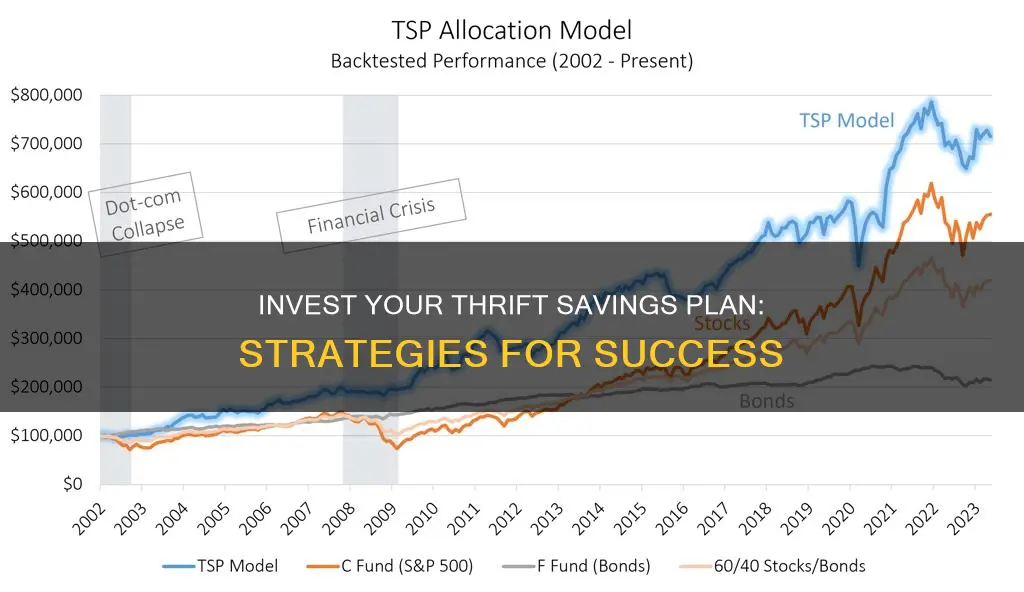

When choosing TSP funds, it is essential to consider your risk tolerance and investment goals. The G and F Funds are low-risk but have lower growth potential. The C, S, and I Funds offer higher potential returns but come with higher risk. Diversifying your portfolio across these funds can help balance risk and returns.

Allocation Strategies

There are different allocation strategies you can consider based on your risk appetite and investment horizon:

- An 80-10-10 allocation to the C, S, and I Funds, respectively, is a common approach that focuses primarily on the C Fund while also providing exposure to the other two funds.

- A more balanced approach is the 60-20-20 allocation, distributing your investments evenly across the C, S, and I Funds.

- If you are younger and comfortable with higher risk, consider allocating a larger portion to the S and I Funds, which have higher growth potential.

- The TSP also offers Lifecycle (L) Funds, which automatically adjust their asset allocation based on your age and target retirement date. These funds become more conservative as you get closer to retirement. However, some investors prefer to have more control over their investments and avoid L Funds.

Monitoring and Adjusting Your Portfolio

Remember to regularly monitor the performance of your chosen TSP funds and adjust your allocation as needed. You can also seek advice from a financial advisor or investment professional to ensure your TSP investments align with your overall financial goals and risk tolerance.

Unlocking Private Equity: Investors' Perspective

You may want to see also

How much to contribute

The amount you can contribute to your Thrift Savings Plan (TSP) depends on various factors, including your age, income, financial goals, and risk tolerance. Here is a detailed guide to help you determine how much to contribute to your TSP.

Minimum Contribution Recommendations

It is recommended that you contribute at least 5% of your basic pay or income to your TSP. This is because the US government provides a matching contribution of up to 5% for Blended Retirement System (BRS) participants. By contributing less than 5%, you are essentially turning down free money. Since October 1, 2020, the automatic enrolment percentage for TSPs has been 5%, so if you enrolled on or after this date, you are likely already contributing 5%. However, if you enrolled earlier or chose a lower percentage, you may need to increase your contribution.

Maximum Contribution Limits

The Internal Revenue Code determines the maximum TSP contribution amount each year. This limit was $19,500 in 2021 and increased to $20,500 in 2022. If you are aged 50 or older, you can set aside an additional $6,500 in catch-up savings. For military service members in combat zones, the maximum contribution was $58,000 in 2021 and increased to $61,000 in 2022.

Determining Your Ideal Contribution Amount

While contributing the minimum of 5% is advisable to take advantage of the government match, most financial advisors recommend saving far more than this, depending on your financial situation. One common suggestion is to save at least 15% of your income for retirement. To determine the ideal contribution amount for your specific circumstances, it is best to consult a financial advisor, who can help you evaluate your TSP choices within the context of a holistic retirement plan. They will consider factors such as your financial goals, risk tolerance, and other sources of retirement income.

Adjusting Your Contributions

Remember that you can change your TSP contribution amount as needed. If you are in the Blended Retirement System (BRS), it is particularly important to ensure you are contributing at least 5% of your basic pay to maximise the government match. Increasing your contribution rate earlier in your career will also reduce the need to "catch up" when you are closer to retirement age. You can use the TSP calculator to determine the specific dollar amount to be deducted each pay period to maximise your contributions without exceeding the annual limit.

Investments: Best Bets for Today

You may want to see also

Understanding withdrawal options

There are two types of TSP withdrawals for active federal civilian workers and members of the uniformed services: financial hardship and age-based.

Financial Hardship Withdrawals

To qualify for a financial hardship withdrawal, you must meet at least one of the following criteria:

- Recurring negative monthly cash flow

- Unpaid medical expenses (including household improvements for medical care) not covered by insurance

- Unpaid personal casualty loss(es) not covered by insurance

- Unpaid legal expenses for separation or divorce from your spouse

- Losses due to a major disaster declared by the Federal Emergency Management Agency

Other requirements include:

- A minimum withdrawal amount of $1,000

- Withdrawing only your own contributions and any earnings accrued from these contributions

- Withdrawing from the account associated with your active employment at the time; if both your uniformed services and civilian TSP accounts are associated with your active employment, you can make a financial hardship withdrawal from each account

Consequences of financial hardship withdrawals:

- Subject to federal income tax and, in some cases, state income tax

- If you are younger than 59½, you may have to pay a 10% early withdrawal penalty tax

- Any tax-exempt or Roth contributions included in the withdrawal, as well as qualified Roth earnings, are not subject to federal income tax

Age-Based Withdrawals

Age-based withdrawals, also known as age-59½ in-service withdrawals, are available to individuals aged 59½ or older. The key points to note about these withdrawals are:

- You can only withdraw funds in which you are vested, i.e., funds you are entitled to keep, based on your years of service

- The minimum withdrawal amount is $1,000, or the entire vested account balance if less than $1,000

- You can make up to four age-59½ withdrawals per calendar year from the account associated with your active employment; if both your civilian and uniformed services TSP accounts are associated with your active employment, you can make age-59½ withdrawals from each account

Consequences of age-59½ withdrawals:

- 20% federal income tax on the taxable portion of the withdrawal unless rolled over into an IRA or eligible employer plan; the actual tax owed depends on overall taxable income

- No early withdrawal penalty

Withdrawals in Retirement

Once you have retired, you have four options for taking withdrawals:

- Partial distribution of a specified amount

- Total distribution: your TSP account balance will become zero, and you cannot move money back into the TSP from other eligible plans

- Annuity purchase: you can use your TSP account to purchase a life annuity through an outside vendor, such as Metropolitan Life Insurance Company. This option is irreversible

- Installments (automatic withdrawals)

These options can be used individually or in combination, but withdrawals and distributions cannot be reversed once processed. Therefore, it is crucial to understand the chosen option, its tax implications, and its effect on your TSP account.

Required Minimum Distributions (RMDs)

The IRS mandates that you take a portion of your traditional TSP account, known as a Required Minimum Distribution (RMD), when you reach a certain age (currently 73) and are separated from service. The TSP calculates the RMD amount based on your age, traditional balance from the previous year, and the IRS's Uniform Lifetime Table. Distributions from your Roth account do not count toward satisfying your RMD.

Mortgage or Market: Navigating Your Finances in a Recession

You may want to see also

Frequently asked questions

The Thrift Savings Plan (TSP) is a tax-advantaged retirement savings plan for federal employees and military service members. It functions similarly to a 401(k) plan, offering a variety of investment funds and the option of automatic payroll contributions.

The TSP offers six core investment funds: the Government Securities Investment (G) Fund, Fixed-Income Index Investment (F) Fund, Common-Stock Index Investment (C) Fund, Small-Capitalization Stock Index Investment (S) Fund, International-Stock Index Investment (I) Fund, and Lifecycle (L) Funds.

It is recommended to consult a financial advisor to determine the best investment strategy for your TSP, taking into account your risk tolerance, financial situation, and retirement goals. Diversifying your investments across multiple funds can help balance risk and growth potential.

The contribution limit for the TSP is $22,500 for 2023 and $23,000 for 2024. Individuals aged 50 and above can make additional catch-up contributions of up to $7,500 in either year.