Private equity has become a major component of the alternative investment universe, attracting investors with the prospect of improving the risk and reward characteristics of their portfolios. Private equity funds are typically operated by firms on behalf of institutional and accredited investors, who are often required to commit significant capital for years. The funds tend to be most popular when stock prices are high and interest rates are low. Private equity investments are usually made in mature companies, which are then overhauled to increase their value before being sold again. This buying to sell strategy is rarely employed by public companies, which tend to buy to keep. Private equity funds can also provide investors with access to companies in industries that are not commonly publicly traded, such as healthcare.

What You'll Learn

- Private equity offers higher absolute returns and improves portfolio diversification

- Private equity managers are true stock pickers

- Private equity investing offers exposure to smaller companies

- Private equity managers have access to legitimate inside information

- Private equity allows investors to back entrepreneurs

Private equity offers higher absolute returns and improves portfolio diversification

Private equity is an attractive investment option for high-net-worth individuals and institutional investors because of its potential for high returns. Private equity firms buy companies, often those that have been undermanaged or undervalued, and overhaul them to increase their value before selling them again for a maximum return. This "buying to sell" strategy is rarely employed by public companies, which usually "buy to keep".

Private equity firms produced average annual returns of 10.48% over a 20-year period ending on June 30, 2020. During that same time frame, the Russell 2000 Index, a performance-tracking metric for small companies, averaged 6.69% per year, while the S&P 500 returned 5.91%. Private equity outperformed venture capital too, which averaged 5.06% per year between 2000 and 2020.

However, when compared over other time frames, private equity returns can be less impressive. For example, venture capital was the top performer between 2010 and 2020, with an average annual return of 15.15%. And while private equity returns outperformed their public market equivalents between 1994 and 2005, they did not do so much thereafter. The average alpha fell from 8.9% to 1.5% per annum.

Private equity's high absolute returns and low volatility would provide attractive diversification benefits to a traditional equity-bond portfolio. Private equity funds represent equity positions in corporates, and so the low volatility of the US Private Equity Index compared to the S&P 500 is likely to be artificial, the product of smoothed valuations. However, private equity returns are not directly comparable to public market returns, and so researchers have created public market equivalent returns, which invest in public markets by mimicking private equity cash flows.

REITs: Recession-Proof Investment?

You may want to see also

Private equity managers are true stock pickers

Private equity firms have a specific strategy that sets them apart from public companies: buying to sell. This strategy involves acquiring companies that are undervalued or under-managed, making operational and financial changes to increase their value, and then selling them for a maximum return. This approach is rarely employed by public companies, which typically buy to keep. By focusing on buying to sell, private equity managers can make significant returns on their investments, even if it means taking on more debt to finance acquisitions.

Private equity managers have the freedom to make bold decisions without the pressure of meeting analysts' earnings estimates or pleasing public shareholders every quarter. This allows them to take a longer-term view and make major changes to the companies they acquire, such as cost-cutting measures or restructuring. They may also bring their own management team or retain prior managers to execute an agreed-upon plan. Private equity managers are incentivized to make these changes as they have a limited time to add value before exiting the investment.

The success of private equity firms relies heavily on their ability to identify and acquire undervalued or under-managed companies, and then increase their value through strategic interventions. This makes private equity managers true stock pickers who play a crucial role in generating high returns for their investors.

Why People Avoid Investing

You may want to see also

Private equity investing offers exposure to smaller companies

Private equity firms can provide expertise that a company's prior management may lack. For example, they can help a company develop an e-commerce strategy, adopt new technology, or enter new markets. Private equity ownership can also allow a company's management to take a longer-term view and focus on the bigger picture rather than short-term earnings estimates.

Private equity investing in smaller companies can be risky, as these companies may have limited transparency and varying levels of risk. Mature companies may provide transparency on earnings and operations data, while early-stage startups have very little of this information. This makes investing in an unproven startup inherently more risky than investing in a growth-stage company with established revenue and market share.

Additionally, private equity investing typically requires a significant capital commitment for years, so access to such investments is usually limited to institutions and high-net-worth individuals. The minimum investment in private equity funds is typically $25 million, although it can sometimes be as low as $250,000 or even $25,000.

The NFT Investment Craze: Why?

You may want to see also

Private equity managers have access to legitimate inside information

Private equity firms tend to focus on mature companies rather than startups, and they often invest in companies that are undervalued or under-managed, where there is a one-time opportunity to increase the business's value. By the time a private equity firm acquires a company, it already has a plan in place to increase the investment's worth, which may include cost-cutting, restructuring, or leveraging debt to increase returns.

The private equity industry has grown rapidly, especially during periods of high stock prices and low-interest rates. The success of private equity firms is often attributed to their aggressive use of debt, focus on cash flow and margins, freedom from public company regulations, and hefty incentives for operating managers. However, private equity firms have also faced criticism for their rapid changes to acquired companies, which can be difficult for employees and communities.

Overall, private equity managers have access to legitimate inside information through their active involvement in the market and their management of portfolio companies, which gives them an advantage in making investment decisions.

Club Members: Cramer's Investing Army

You may want to see also

Private equity allows investors to back entrepreneurs

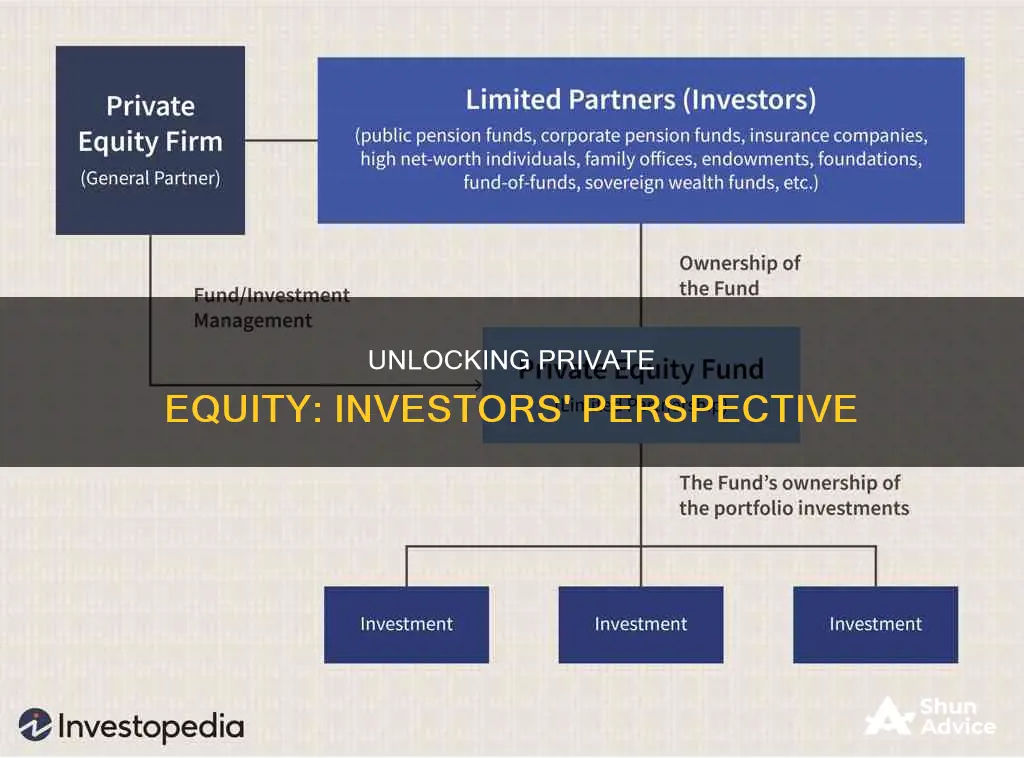

Private equity firms raise capital from institutional investors, such as hedge funds, pension funds, and high-net-worth individuals, to establish investment funds. These funds are then used to acquire companies, typically through buyouts, where the private equity firm acquires the entire company. This provides the financial backing that entrepreneurs need to grow their businesses and realize their vision.

The private equity firm's goal is to increase the company's value before exiting the investment. This can be achieved through various strategies, such as margin expansion, free cash flow generation, and valuation multiple expansion. By backing entrepreneurs with capital and expertise, private equity firms can help them scale their businesses and maximize their potential.

Private equity firms also have the advantage of freedom from public company regulations and the ability to take on debt to finance acquisitions. This allows them to pursue aggressive growth strategies and generate higher returns on investment compared to public companies.

Overall, private equity provides investors with an opportunity to back entrepreneurs by offering financial support, operational improvements, and strategic guidance to help them grow their businesses and maximize their value.

Investments: Top Ten Picks

You may want to see also